It promises to be a huge day for markets, and it’s fitting that we see a flat open for the ASX 200 and Nikkei. In theory we should gain a real sense of how traders aggregate a 50 basis point cut from the PBoC, the potential for CNY to be fixed weaker for a sixth consecutive day, a further contraction in Chinese manufacturing, and the March RBA statement.

One should also keep in mind the strong potential for a Trump win in the Republican nomination in today's ‘Super Tuesday’ primaries. Markets are under-pricing this possibility, and while Hillary Clinton will presumably win a head-to head race to the White House, nothing is certain here.

Price action in the various US equity markets is certainly not going to provide any conviction for local traders, with a nose dive in the latter stages of trade and a really ugly looking tape. Inflows into fixed income markets have been a key talking point, with very poor eurozone inflation numbers. One questions how the European Central Bank (ECB) can meet the excessive easing demands of the market, given the market is pricing in 16 basis points of cuts to the deposit rate in the upcoming meeting. EUR/USD has been sold and should continue to fall from here in my opinion.

China is the lead for Asia though, and judging by the initial 2% spike in the China A50 futures (the largest 50 mainland companies traded on the Singapore futures exchange) we should see some upside in the Chinese equity markets. Looking at both the iShares China Large-Cap ETF (N:FXI) and Deutsche X-trackers Harvest CSI 300 China A-Shares ETF (N:ASHR), traded on the NYSE, neither have seen speculator gains, although that would be due to playing catch up as CSI 300 closed down 2.4% yesterday. AUD/USD has moved modestly higher to $0.7170 (session high), and the days where China's easing policy and increased liquidity cause the AUD to react with gusto are well and truly behind us.

The 50 basis points (bp) cut to the required reserve ratio should increase liquidity in China by Rmb600 to Rmb700 billion, and one could make the call that it is probably a bit sooner than analysts had expected. However, it is interesting given the recent spike in the January credit data and ahead of Monday's FX reserves for February. Clearly the PBoC are less concerned with the current level of the currency or future capital outflows, preferring a forceful message that along with the massive injections through its different lending facilities, it is there to support the economy. This in itself is a positive, but it is fighting fires and shouldn’t be taken as a strong risk on signal in my opinion.

Keep an eye on China PMI at 12:00 AEST, with expectations this should remain in contractionary territory at 49.4.

The CNY ‘fix’ (12:15 AEST) could be a major catalyst today, and another weakening of the currency could cause a sell-off in the ASX 200 into the afternoon.

It’s a huge day locally for data, with the Q4 balance of payments at 11:30, and importantly, we get the contribution that net exports provide to tomorrow's Q4 GDP print. Poor inventory and company profit data yesterday suggest some downside risk to the current 0.5% qoq call, so less than 30bp contribution from exports and we should see AUD/USD under some pressure.

The RBA statement at 14:30 AEST should be largely unchanged from the February statement, given AUD/USD and the trade-weighted AUD are essentially flat from the prior meeting, while iron ore and Brent are 15% and 5% higher respectively. With inflation no longer ‘consistent with target over the next couple of years’, a hugely disappointing 16/17 Capex intension, the lowest wage growth in 20 years, and tepid January employment data, it’s hard to see the bank portray an upbeat picture. The fact that the swaps market is pricing in 42bp of cuts over the coming 12 months reflects this fairly well.

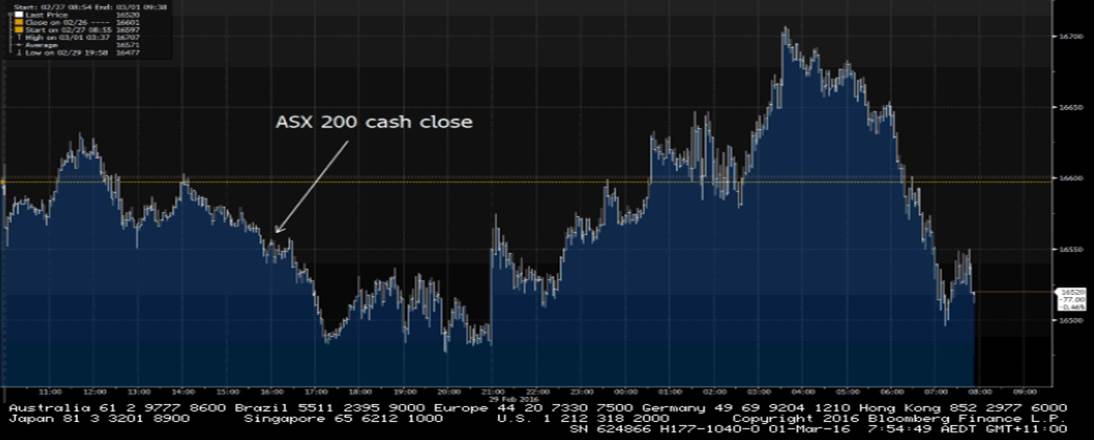

We are calling for a flat open, but I would not be surprised to see selling from the unwind of the open. N:BHP should open 2% higher after being taken off negative credit watch – investors are rewarding BHP management for its more flexible stance on capital management.