Asia is shaping to close the week out on modestly positive footing, with BHP Billiton (NYSE:BHP) indicated to open up 2% and ClearBridge American Energy (NYSE:CBA) closer to 0.5%, given the moves in the American Depository Receipt (ADR). Certainly this was not the case through European trade with our call for the ASX 200 a lowly 5096 (or 1% lower), but US traders have come and turned things around with S&P 500 rallying 1.4% from its intraday low of 2050. SPI futures (September contract) have rallied in appreciation, as has AUD/USD, USD/JPY and other risk assets, with the exception of oil, which is still 2.9% lower from yesterday’s ASX 200 close.

We still need to see the ASX 200 close 5312 to avoid a third consecutive week of losses and that clearly isn’t going to happen.

It’s hard to see traders buying the open with any conviction given next week’s event risk, but we could see some brave souls who see a ‘remain’ vote in the UK referendum tempted by adding selective risk to portfolios. I suspect any upside in the index should be contained 5175. This is a highly risky strategy as next Friday promises to be utter madness and as such as we have heard from the BoJ, Federal Reserve and Swiss National Bank overnight assuring participants that they will provide liquidity should it dry up on the day.

What I am genuinely interested in though was the five basis point drop in five-year US inflation expectations overnight to 1.51% and the lowest levels since early March. We see a further dovish twist from the Fed and yet inflation expectations keep falling. The Fed will not like that one bit, although we have seen a slight move higher in nominal US treasuries. Inflation expectations (measured through the bond market) continue to be part of the holy trinity of Fed influences, the others being the UK referendum and the labour market.

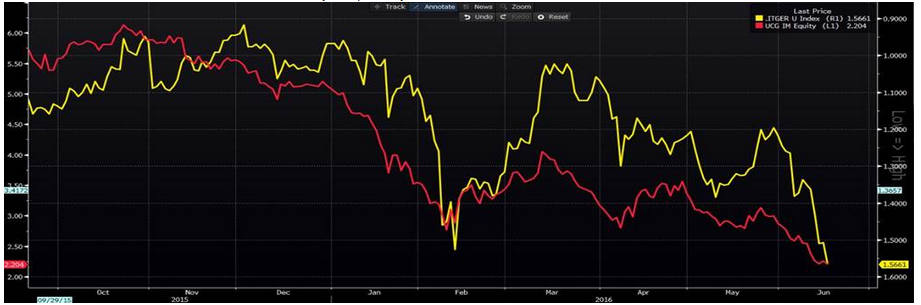

Traders would be wise to start to pay greater focus on the European banking sector, where both investment and sub-investment grade credit default swaps (CDS) are once again on the move higher and worryingly eyeing the January highs. Bond yield spreads between Southern European countries and German debt are widening and this is a huge negative for European banking system. We need to remember just how exposed European banks are to their domestic bonds (given their exposure on the balance sheet), so if yields rise the markets perception of the asset quality deteriorates. Names like Deutsche (NYSE:DB) and Unicredit (MI:CRDI) (see Bloomberg chart below) will become central to sentiment in all markets if we see a vote to ‘Brexit’ and the hugely over -leveraged European banking system could be in trouble. It’s this issue above all others that would be keeping my awake as a consideration for the vote.

On the other hand if we see a vote to ‘remain’ then these spreads will come in nicely and European markets will absolutely fly. Long Stoxx 50, short S&P 500 will be very compelling trade for traders who are happy to take the macro out of the equation somewhat, given the Stoxx50/S&P 500 ratio has run so far so fast, as we can see from the chart and the line of best fit. Everyone will be focused on FTSE and rightly GBP, but for me the most interesting dynamic will be what happens to European yield spreads and the knock on effect to the banking system.