The re-open of the S&P 500 futures today has been a low-key affair, although we still see the momentum in broad equity markets still titled to the upside.

When you see the key price-maker central banks, that being the Fed, the ECB and the PBoC, shift its communication full circle to support equity markets, or in the case of the PBoC, allowing the credit taps to be turned to the maximum - this is a green light for the bulls, and the bears will run for the hills. The question, we hear quite prominently here is whether to chase this rally in equities, and put money to work after an 18% rally, or wait for a pullback to buy.

Recall, only back in December the ‘buy the dip’ mantra in equity markets was supposed to be dead in the water, but perhaps this is no longer the case with so much cash on the sidelines and the trend very much on the up. Apparently, this is a market that once again has faith that central banks are here to bail us all out in times of strife.

That said, we are not out of the woods, and the risk of a ‘buy the rumor, sell the fact’ scenario playing out in the trade talks builds by the day and the market has priced in a decent outcome that if it doesn't shape up volatility will ramp up. But, at this juncture, the idea of better liquidity conditions excites equity traders and investors. So, whether we are talking about a new Target Long-Term Refinancing Operation, and ultra-cheap loans to European banks, set to be announced in the 7 March meeting. Or, the Fed providing a terminal level of its balance sheet, perhaps in the May or June meeting that signals an early end to its Quantitative Tightening (‘QT’) program, the equity market likes what it hears, and we see volatility sellers across asset classes.

Commodities are also finding buyers, with U.S. crude closing above the 38.2% retracement of the October to December sell-off at $55.55 and eyeing a test of the 100-day MA at $57.45. Copper is pushing to the top of its multi-month range at $2.83 p/lb and again, traders are asking whether this time is different or do we fade the metal here? And, should we see a close through this technical ceiling, is Dr Copper telling us the world is a happy place, or at least less bad? One to watch, but this is a function of China turning on the credit taps again, and I do not see the data that supports the notion prices should be headed higher. Of course, we need to remember that economic data lags credit.

One important aspect here is the moves in the S&P 500 relative to the U.S. interest rate market. I have looked at euro/dollar futures (orange line), where we can see 4bp hikes priced in between March and December 2019, where the correlation has broken down and, if the correlation was still present, should be pricing a full hike here. If I look further down the rates curve, we still see 15bp of cuts through 2020. Hardly a market that screams of green shoots, which is a similar story in the bond markets.

Then, of course, we have gold. In U.S. dollar terms, the price needs a break of $1326, or we run the risk of a double-top. However, the continuation target given the completion of the bull flag is seen at $1355/60. In EUR terms of gold (see chart below) is flying, and the trend is a thing of beauty. As always, it's great to see gold heading higher in a full suite of currencies, where we then tend to pick the weakest currency to execute the order.

Equities are finding all the love

We have to look at the set-ups in so many equity markets to see the love for equity. I had been looking at the China A50 last week, and this is a whisker away from my target set last week of 11,980. China is up 15% YTD and flying, although, despite the CSI 300 index up 0.6% today breadth is not brilliant with 52% of stocks lower.

Focus on the ASX 200

Here, in Australia, the ASX 200 has been consolidating into 6110 and every time price pokes its head above the precipice we see supply coming back into stocks and the Aussie SPI futures. Value traded through the ASX 200 has been upbeat today and some 15% above the 30-day average, with financials putting in 27 index points. Energy has worked reasonably well, with a gain of 0.3%, and just like crude, there is a strong underlying trend in the price, and the sector sits near the highest levels since October.

All eyes on BHP’s numbers tomorrow, although they report 30 minutes after the ASX 200 close, and right on the Aussie SPI close. It’s a fitting backdrop to report in though, and, as we have seen from the 50% of index who have reported thus far, the index is moving higher despite what could be considered an uninspiring earning season. On Bloomberg’s consensus estimates, we see 50% of the index having reported numbers, with a mere 42% beating earnings estimates, while 52% have topped sales estimates. The average surprise on EPS has been a miss of 9.9%, with zero earnings growth in the period. So, pretty average numbers, but a rising tide lifts all boats and recall, this is a world where yield is working like a dream, especially in the FX market where ‘carry’ is sought above other factors.

Todays’ RBA minutes were not really a surprise, and we saw the formal shift to a neutral setting. After an initial sell-off in the front end of the Aussie yield curve, which led to a small pop in AUD/USD, we have seen better sellers emerge. We can see 22bp of cuts priced into the swap’s markets over the coming 12 months, but AUD/USD looks heavy ahead of Thursday’s (6 am AEST) event risk in the shape of the FOMC minutes.

In Europe, we see good interest to trade the German DAX (GER30 - see below), with the index testing a confluence of resistance levels. How price behaves into horizontal and trend resistance into 11,380 to 11,490 is key, because a close through here and this index will trend higher and the notion of FOMO will take hold, and we should see a fairly punchy move into 11,800. Of course, the index has its eyes on China-U.S. trade, as have we all, but it’s interesting that EC president Juncker has detailed to Stuttgarter Zeitung that Trump gave him his word that there would not be any tariffs on European cars, for the time being.

One suspects while autos will trade on the notion that Junker’s comments become a more permanent reality, if the banks are genuinely going have access to TLTRO liquidity then EU banks should be the beneficiaries here. Below we can see the daily chart of EU Stoxx 50 bank index, so the battle lines are drawn.

If we dare to focus on economics again, at 9 pm tonight, we get the German ZEW survey on expectations and current situation survey. The latter is expected to print 20 (from 27.6), so expectations are for another decent drop. The issue here is that a weak number (relative to expectations) will likely weigh on the EUR, but lift EU stocks, as it merely increases the prospect of more cheap loans.

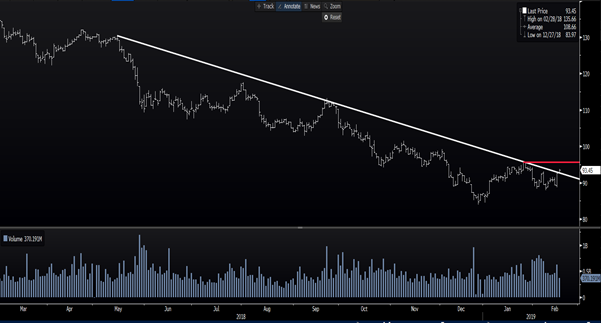

GBP not reacting to mad politics in the U.K.

In FX markets, there has been some interest to short the GBP, but nothing too punchy from Asia-based clients and we see price eyeing a re-test of the channel breakout. There could be some focus on Brexit negotiations, with Brexit secretary Steven Barclay heading to Brussels with Attorney-General Geoffrey Cox. All the while we watch the implosion of the Labour party resulting in a rising chance of general election. GBP remains a tough currency to do anything with, but a move through 1.2956 would be bullish, especially where we can see two-month risk reversals showing options traders have been big buyers of put vols over call vols.