Pick your favorite casino vice – craps, roulette, black jack – each of these games involves a little bit of skill and luck to leave the table with more money than you started with. Nevertheless, every gambler knows that overstaying your welcome will lead to tragic results.

Put simply, over a long enough time frame, the house always wins.

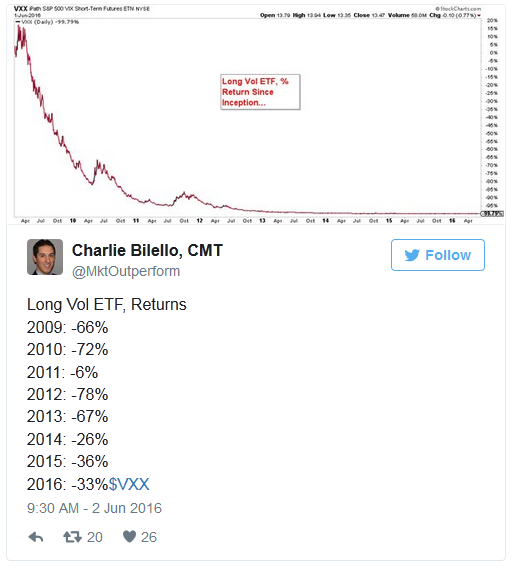

This same philosophy can also be applied to funds that track volatility futures. These indexes can experience sharp rallies that quicken the pulse and dilate your pupils, but they also have led to consistent wealth destruction over the last seven years.

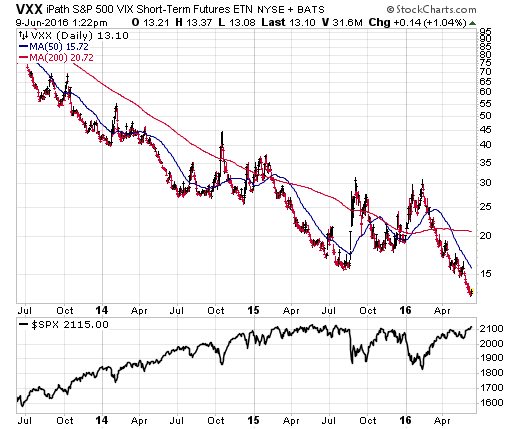

Charlie Bilello, Director of Research at Pension Partners, recently posted the following data set for the iPath S&P 500 VIX Short Term Futures ETN (NYSE:VXX). This exchange-traded note is the largest and most well-known fund that tracks an index of long volatility futures.

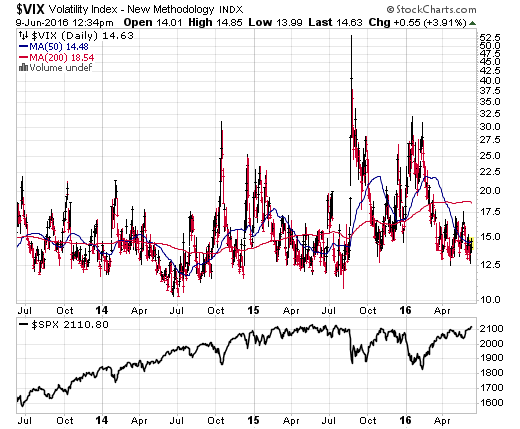

The CBOE VIX Volatility Index was created as a way to measure fear and greed in the marketplace through the calculation of options activity. As a pure index, this works relatively smoothly to gauge the overall positioning of investors as they seek to add or reduce risk through their exposure to stocks via the options market. Volatility tends to expand when stocks drop and contract when they rally.

However, that same philosophy runs into a variety of problems when applied to a tradeable investment vehicle such as VXX. Because it invests in futures contracts, VXX is subject to a myriad of structural issues that include time decay, contango, contract roll, and fees.

You almost need to be a math genius to truly understand the underlying risks and daily price fluctuations that drive this fund. That level of complexity is far outside my skillset and works against my personal philosophy of keeping portfolio management simple.

The crazy thing is that despite all of these issues, VXX is beloved by traders with a gamblers zealotry for striking it big. Yahoo (NASDAQ:YHOO) Finance lists average three-month daily trading volume at 66 million shares. According to the fund company website, VXX currently has $1.54 billion in total assets. That’s a lot of conviction in a product that has been a consistent headache for the majority of investors that have tried using it.

Can you make money in VXX? Absolutely. You have to get in, get out, and move on with a little bit of skill and a whole lot of luck.

The impulse to bet against the market and succeed in these funds is a strong pull. However, it should be tempered with the knowledge that timing the market is hard enough without trying to deal with intricate forces that work against volatility funds under the best of circumstances.

For those who wish to hedge a portion of their portfolio and have been considering a volatility fund for this process, I would perhaps suggest an inverse stock fund instead. An ETF like the ProShares Short S&P 500 ETF (NYSE:SH) is a vehicle that is easier to understand and allows you the flexibility to reduce your direct exposure to a drop in other long positions. There are inverse ETFs that track the Nasdaq 100, Russell 2000 and international indexes as well.

Another strategy is to move to cash and wait out a perceived drop instead. That way, if you are wrong, you don’t compound your mistakes by losing money as the market rallies higher. The only thing you lose by being in cash is opportunity.

Knowing what you own and why you own it is an important component of any successful portfolio management plan. That is why I have learned to stay far away from volatility funds for myself and my clients.

Disclosure : FMD Capital Management, its executives, and/or its clients June hold positions in the ETFs, mutual funds or any investment asset mentioned in this article. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities.