“It is a tale told by an idiot, full of sound and fury, signifying nothing.” – William Shakespeare, Macbeth

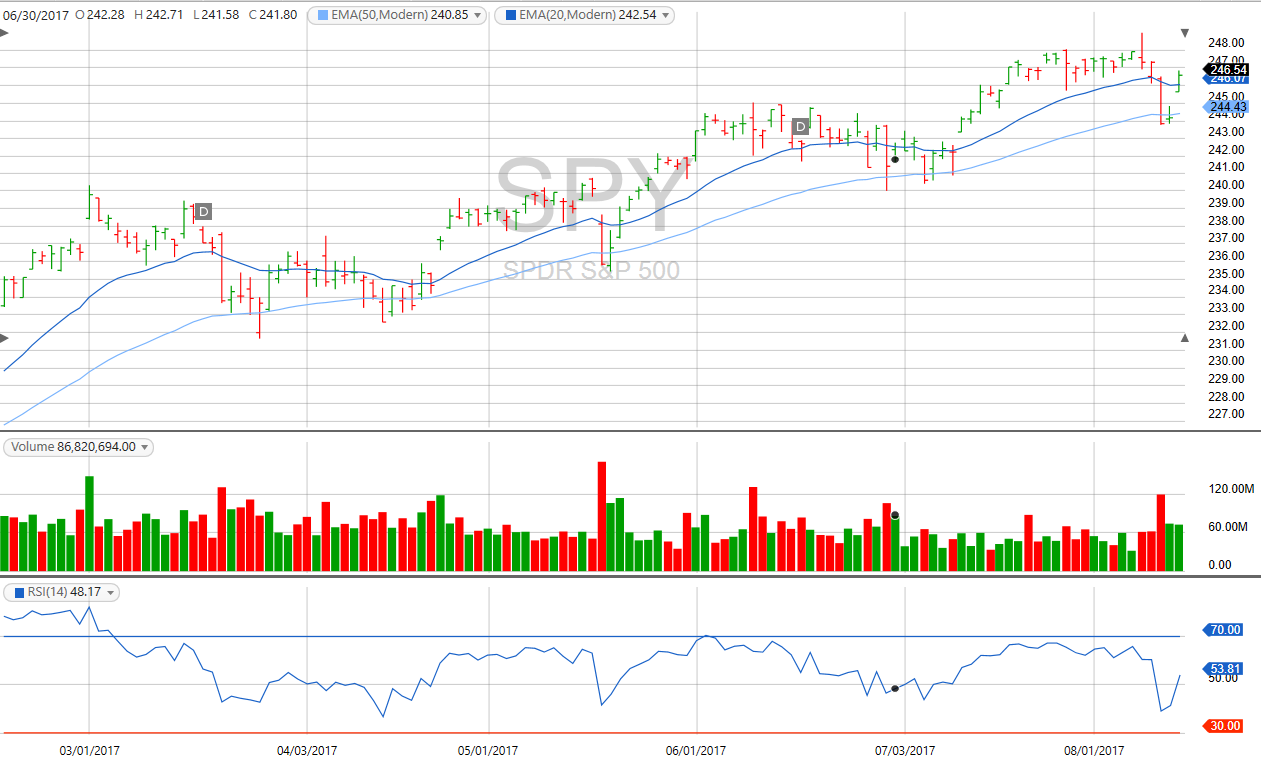

If you look at a chart like the one below, you might think that the week of August 4th was the boring one and the week of August 11th was the interesting one. You’d be wrong.

The path of the market in July followed a typical history – from the start of earnings season, or roughly the 10th of last month, to about the 27th, the S&P 500 rallied a bit more than 2%. A typical move over a typical time frame, earnings-wise. Also typical was the usual softening as the season wound down. The interesting part was that despite the fact that stocks are beating earnings by more than usual – supposedly the best in 13 years – stocks that beat aren’t moving the needle much, while stocks that disappoint get crushed. We haven’t had a scenario quite like that since the second quarter of 2000, says the Bloomberg article, and it’s probably for the same reason: valuations were already too high.

That the market sold off the following week wasn’t unusual either, though the worst week since March needed a bit of help to find its way down back to the 50-day average again. That help came in the form of the administration’s “fire and fury” bombast that made investors and traders alike a tad nervous about what might happen next. Stocks took a beating, though really about half of it can be attributed to the calendar and the usual profit-taking as earnings season winds down. Nearly all of the headlines, though, were focused on the war of words between two distinguished crackpots.

This prompted a spate of stories about how it’s always a mistake to sell threats of war or other political crises. The general theory is that we’ll get past it in the end, so don’t lose your nerve. Many wrote variations on the old Wall Street bromide that if the ICBMs are on the way, buy the stocks that everyone else is selling. If they land, it won’t matter, if they miss, you’ll make a killing (no pun intended).

Like most bromides, the buy-the-missile-news theory isn’t quite perfect – suppose, for example, that not all of the missiles miss but not all of the missiles land. Then those who sold first are going to look pretty smart for a long time. You might equally imagine that North Korea backs down from its four-missiles-near-Guam threat, but feels impelled to make some sort of gesture of defiance, just to keep the West at bay and show everyone how crazy-tough they are. Indeed, one might recall that the Japanese military consensus belief in 1941 was that the U.S. would of necessity conclude that with its Pacific fleet in ruins (after the Pearl Harbor attack), it should reach some sort of accommodation with the empire over Asian interests and the oil embargo of Japan.

People can miscalculate. If Kim Jong Un does, I don’t think anyone knows what the current administration would really do in return, nor how two major rivals that are much closer (Russia and China) might judge how best to manage the situation. It might come to pass that events fall far short of some World War III scenario yet still be messy (and bad for business) for quite some time.

You’d be wrong again if you thought that such thinking was anything close to the main preoccupation of traders. Nope, the real heart of the matter was whether or not the SPX could hold its test of the 50-day average, and on Friday the 11th it did. Ergo, look for quite a rebound if it starts to move back up again. If you look at the chart again, you’ll see that sometimes the bounce is in a session or two, sometimes it takes north of five, but once it starts to move, everyone piles in again.

Longer term the market is seriously asking for a beating and one will indeed come, sooner than most professionals think. That’s because most professionals are in too deep to contemplate the inevitable. Who wants to think about death?

Well, it depends on your horizon. If you’re going to need your money in the next few years, get out and stay out until the headlines are saying stocks may never rise again. If you’re a day trader, you’ll probably get it wrong too, despite what you firmly believe about your rock-solid ability to recognize the inevitable. Just be sure to do what the Vegas pit bosses tell you – never reach into your pocket for more money once you’ve lost your stake. If you’re under thirty, enjoy the rest of this season’s Game of Thrones episodes and stop worrying about the market. We’ll get past it. Right?

The Economic Beat

The August 4th week was a busy one for economic releases, highlighted by the jobs report but not revealing anything dramatic or that couldn’t be written off as a bit of monthly variation. The jobs report itself was something of a positive surprise with a headline gain of 209K jobs (seasonally adjusted, or SA), what with the consensus being stuck all year in a range of 175K-185K. One does get the feeling that the market has started to hold its collective breath on jobs every month – will this month be the turning point? – and so every time it isn’t, everyone feels emboldened to stay long and keep buying dips until next month’s report.

The report had some good points, though it ought to be acknowledged that some depend on quite a bit of seasonal adjustment. The unemployment rate fell to 4.3% even as the participation rate increased from 62.8% to 62.9%. Manufacturing payrolls took a big leap, from an original gain of 1,000 in June to a revised gain of 12,000 and a further gain of 16,000 in July. The “gain” may actually be due to seasonal tinkering, as the unadjusted data show very little difference from the June-July pattern of a year ago, one that was not followed by a manufacturing renaissance. It might also represent nothing more than another fracking bump.

Hourly earnings increased 0.3% for the month, but remained stuck at 2.5% year-on-year. The volatile household survey was even better on a monthly basis, at +349K, and while the monthly household numbers should be taken with a very large grain of salt, +349K isn’t going to get rubbed out.

Monthly variations are one thing, but jobs growth is slowing nonetheless. Year-year growth remains at multi-year lows. The ADP payroll report, as ever trying to catch up with BLS data (ADP tries to anticipate the BLS number, not provide a better guess) revised its initial June estimate from 158K all the way up to 191K private sector gains, very close to the BLS 194K revised estimate (231K including public sector). ADP’s July estimate was 178K vs. the BLS initial private-sector estimate of 205K, so there is still some work to be done on one side or the other.

The evidence for manufacturing is mixed. The Chicago survey slowed from 65.7 to 58.9, still a good number but a big change all the same and showing employment slowing even more. The Markit Economics July survey of manufacturing purchasing managers was virtually unchanged (53.3 vs. 53.2), while the better-known ISM version of the survey eased slightly to 56.3 from 57.8, the latter with a growth-contraction sector score of 15-3, a healthy number but average for a year that has seen abnormally high readings without any change in output growth rates.

The services version of the ISM survey showed one of its least optimistic readings since the election, dropping from 57.4% to 53.9%. However, the Markit survey of the service sector showed a slight rise for July, from 53.0 to 54.7. The steady, good-but-not-great readings from the Markit surveys all year have correlated well with the steady, good-but-not-great output measures this year, lending support to the notion that I and many others have suggested, namely that the ISM surveys this year have been more sentiment than science. The July drop in the ISM service number might not be any more related to real activity than the outsized positive readings from the first quarter.

The “first final” reading for factory orders in June showed a drop of 0.2% in the ex-transportation category, with the headline total of 3.0% overall being dramatically skewed by aircraft orders that are suspect in both timing and actual dollars. It doesn’t correlate with the increase in manufacturing employment shown by the Labor Department. Nor did June construction spending, sporting a 1.3% loss in its initial estimate from an upwardly revised 0.3% in May. That dropped the year-on-year rate to 1.6%, not exactly a barn-burner, though as always it needs be observed that the initial construction estimates for any given month are prone to large revisions. The Dallas Fed regional survey did show a big jump, from 12.3 to 22.3, reflecting the oil rally. The recent sell-off in oil may reverse that.

The personal income and spending report for June did not show an economy on fire. The first estimates showed that income was unchanged and that spending rose only 0.1% (both seasonally adjusted and annualized, or SAAR). Real disposable personal income eased to a 1.2% y/y rate from 1.4% in May (about average for the last four months), while y/y spending fell to a multi-month low of 2.4%. The following week reported a sharp drop in unit labor costs from quarter one (+5.4%) to quarter two (+0.6%), though it should be noted that it’s another number subject to big revisions.

In other areas, pending home sales reversed a 0.7% loss in May to a 1.5% gain in June, while international trade showed a narrowed deficit for June that will boost the next GDP revision.

The following week ending August 11th led off with an interesting statistic from the Federal Reserve’s Labor Market Conditions index, a number that has yet to achieve major market interest. It isn’t about to, either, as the Fed announced the complete discontinuation of the index. Though the Fed did not say so, I imagine it will be back to the drawing board for the research staff to come up with something that better models what’s going on with other measures.

The labor turnover report (JOLTS) for June showed openings increasing to a 4.0% rate, best in some time, while the hire rate at 4.1% was unchanged from both last month and last year. Wholesale sales in June, helped along by an increase in oil prices, are up 5.5% from a year ago (not seasonally adjusted, or NSA), a nice-looking number but in fact the slowest such gain since last November. Even so, the trailing-twelve-month number rose to a three-year high of 4.5%, also helped by favorable energy comparisons. Inventories rose, implying another upward revision to Q2 GDP and leaving the inventory-to-sales ratio unchanged at what is still a historically heavy 1.29.

The big news for the week of the 11th economically speaking, one that had nothing to do with the Korean war of words, might have been the easing in inflation rates. The producer price index (PPI) fell 0.1%, leaving the y/y total rate at 1.9% and the y/y core rate (ex-food and energy) at 1.8%. Consumer prices rose by only 0.1%, leaving the y/y rate unchanged at 1.7% and the core rate at 1.7%. The data generated a serious uptick in Fed policy speculation.

Next week will bring the retail sales report on Tuesday, along with the New York manufacturing survey, import-export prices and the homebuilder sentiment index. The last item will be followed the next day by housing starts, while the New York survey is followed by the Philadelphia survey on Thursday. The Fed itself will release its latest meeting minutes on Wednesday and the latest estimate of industrial production on Thursday.