Once a scarce asset available to a tiny community of miners and enthusiasts now has become one of the most favourite subjects at the dinner table and social media. Bitcoin and other cryptocurrencies are 21st-century investment representing the accessibility of information ensured by the digital age and technologies. While it is still a controversial question whether Bitcoin is an investment or speculation, it is clear that the price of this asset is extremely volatile. Certain factors clearly have an impact on the price of Bitcoin, such as regulations and hacker attacks; other factors are there to be discovered.

Meanwhile, it is useful to take a look on different events that have already taken place in connection to Bitcoin, such as hard forks, as well as looking for similar scenarios in the history, such as Dot-com bubble in the late 1990s. Below is the first part of an overview of factors that influence the price of Bitcoin and other characteristics that help us to determine the further development of this asset. The next part will be more technical looking deeper in the events influencing BTC/USD.

Forces of Bitcoin

The Bitcoin price is a practical indicator of Bitcoin’s real-world value, relative to other assets and currencies. While many factors affect the Bitcoin price in varying periods, user base, developer activity, and global adoption have been the three key factors behind the long-term increase in the price of Bitcoin for the past eight years.

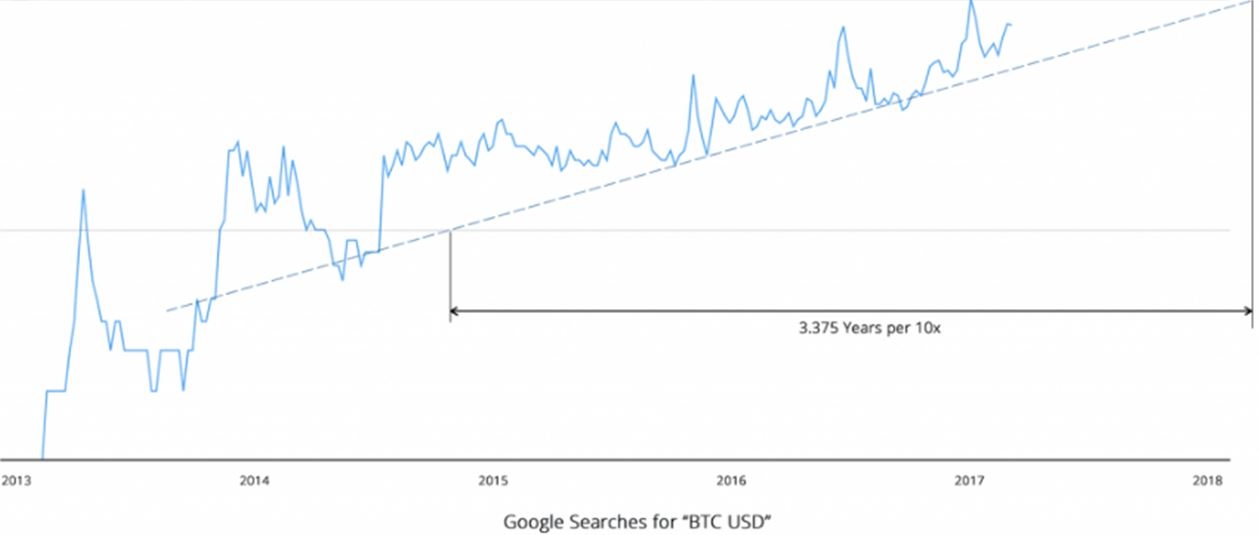

As an increasing number of users start to use Bitcoin, the demand for the cryptocurrency and speculation around the cryptocurrency market will further rise at a rapid rate. It is reported that 26 years from now if the user base of Bitcoin continues to grow at this pace, nearly everyone in the world will use Bitcoin. The number of Bitcoin users double every 12 months:

Analyst forecasts

Not only cryptocurrency enthusiasts have boosted the popularity of Bitcoin. There are numerous analysts forecasting mind-blowing value for Bitcoin and extreme profits for those holding them:

- Bitcoin will hit USD100,000 in 10 years with 10% of USD5 trillion average daily volume in the foreign exchange and USD1.75 trillion market capitalization. /Key Van-Petersen from Saxo Bank;

- Bitcoin will hit USD100,000 in 2021 according to Moore’s Law (golden rule of digital technology);

- Bitcoin will reach USD5 trillion market cap in next 10 years /Aaron Lasher, Breadwallet.

Meanwhile, there are as many if not more negative forecasts for the future of Bitcoin and other cryptocurrencies. For example, Mr. Roubini, often called by a nickname Dr. Doom, has expressed his opinion about Bitcoin on Bloomberg: “biggest bubble in human history” and forecasts that it will hit zero4. Indeed, it is fascinating to compare the development of the Bitcoin price with the general bubble phases.

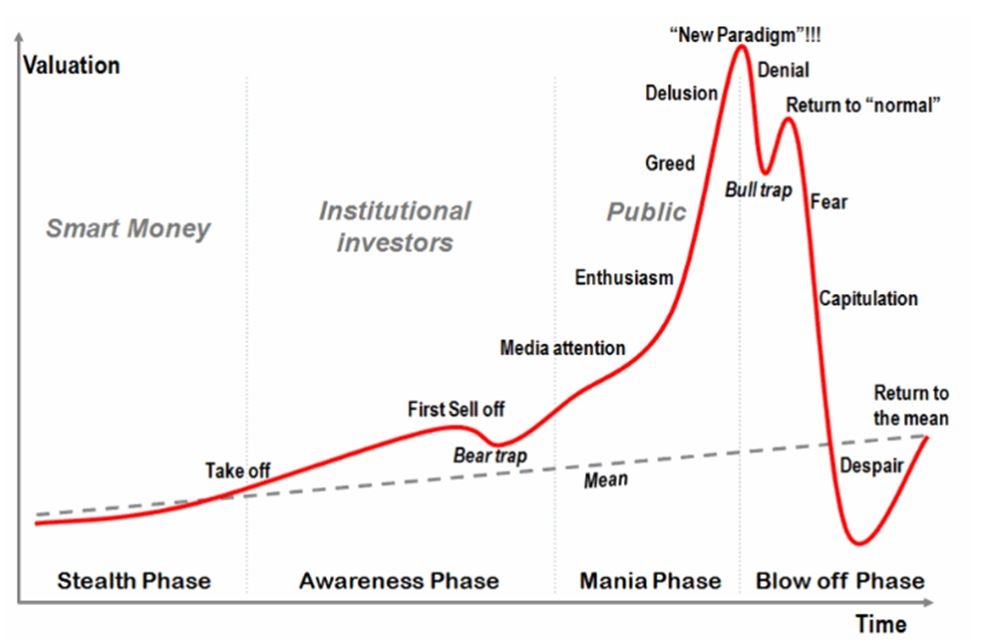

A possible scenario (general bubble phases):

Some time ago we already prepared an analysis of Bitcoin and wondered in which stage of a bubble timeline could at-that-time Bitcoin be:

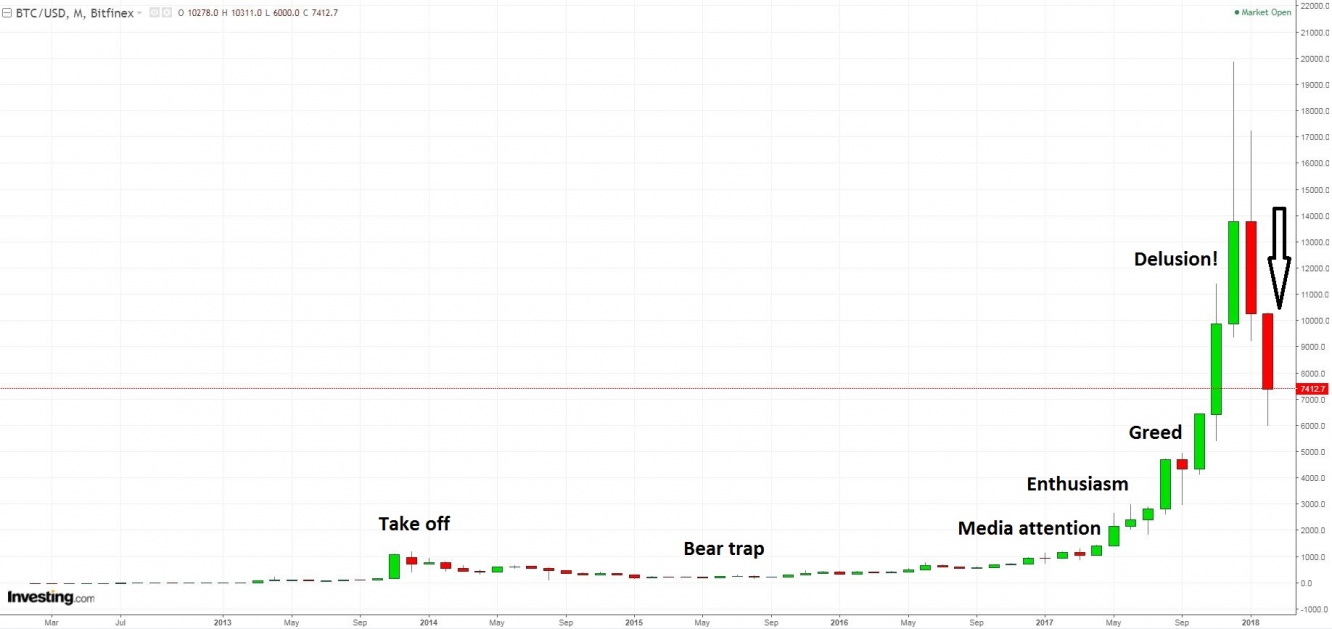

Surely, a lot has happened since then and we can update our graph:

As you can see, BTC/USD price graph could be used in books as a perfect real-life example of a bubble time-lapse. In fact, I don’t know if there has been anything closer to the theory as this. Right now, the question is, in which phase are those that are trading Bitcoin and possibly other cryptocurrencies – do they feel denial, fear or maybe they are already close to capitulation? In any case, if the Bitcoin follows general bubble phases also after the collapse, we may wait for it to return to the mean, which could be around 400 USD and grow at an approximate rate of 50USD per year.

Let’s now turn to history for some answers.

Crypto bubble vs Dot-com bubble

When looking into the history and searching for similar market movements, we can spot a Dot-com bubble taking place approximately between 1995 to 2001 when numerous internet companies were founded and failed within short period of time leading to a bubble in stock market: on March 10, 2000, NASDAQ Composite peaked to all-time high and continued with a sharp decline losing 78% of its value. Below are main similarities and differences between Crypto and Dot-com bubbles:

Similarities:

- Large amount of IPOs and ICOs;

- Rise in both – demand and supply;

- Huge hype in media;

- Extremely optimistic forecasts.

Differences:

- Dot-com companies had earnings, profits, CFs, expenses, employees, etc. Meanwhile, cryptocurrencies have none of these;

- Companies are paying dividends while it is illegal to pay dividends for cryptocurrencies.

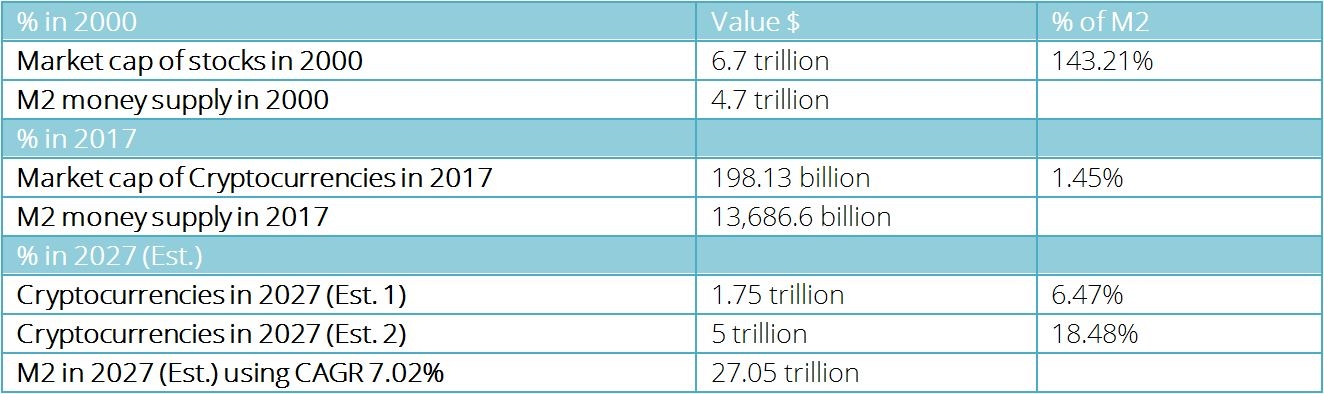

If we assume that there is such thing as Crypto bubble and compare it to Dot-com bubble, we can take market capitalization of tech companies before the bubble burst and calculate the % of money supply and do the same with cryptocurrencies.

Value of all stocks on Nasdaq on March 10, 2000, was $6.7 trillion. At that time, M2 Money supply in the US was $4.6784 trillion, this means that the value of all stocks on Nasdaq at that time was 143.21% of the US money supply.

The value of all cryptocurrencies on November 7, 2017, was $198.13 billion. Currently, M2 Money supply in the US is $13,686.6 billion (updated on November 2, 2017). This means that market capitalization of all cryptocurrencies is only 1.45% from the total US money supply.

If we take a look on some of the estimates regarding the potential Bitcoin market capitalization in 10 years, even reaching $5 trillion, it would be less than one-fifth of the total US money supply or almost 8 times less than % relation between the market capitalization of stocks and money supply in 2000.

If we take a look at dot-com bubble, there were some quality companies who survived and currently are very successful. It means that also if and when the Crypto bubble bursts, most likely cryptocurrencies will lose a large part of the market cap but they won’t totally disappear.