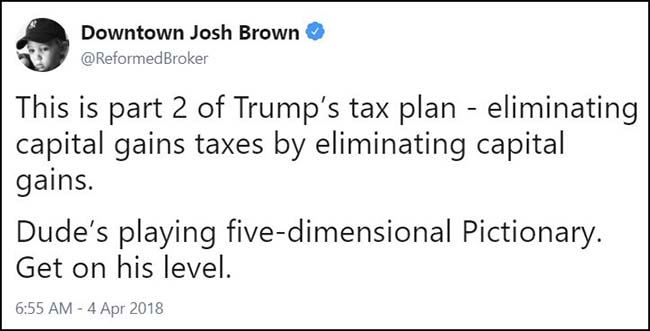

Trade wars have escalated and the White House is now preparing for negative impacts to the U.S. economy. Plans are being made to financially help farmers in the event of tariffs hitting grains. No word if equal plans are being set for displaced metal workers, auto workers, fruit and nut farmers, or even negatively affected investors. This is a mess, and while the White House talking heads say that this is all negotiating, the real impacts are being felt as U.S. steel and aluminum prices surge, and soybeans and hog fall. Meanwhile, supply chains are being disrupted as U.S. manufacturers pre-buy raw materials that could see 15-25% tariffs. This is not an efficient use of capital and I’d expect us all to hear data points about it on first quarter conference calls for the next month as earnings season begins.

Speaking of which, the numbers start rolling later this week and expectations are very high going into their earnings prints. While it is likely that many companies did well at the top line, most investors will be watching the cost side and resulting impact on margins. Top-line growth without incremental improvement in margins, combined with uncertainty surrounding the global trade war, could put a lid on stock prices and widen credit spreads. In addition to earnings fog, investors must factor in the new Syrian escalation and impact on U.S./Russia ties, Washington’s inquiries into Facebook (NASDAQ:FB) and internet data this week, and the slowdown in March nonfarm payrolls last week. Just too much fog for me. I would much rather have it all on the line at the Masters with a four foot putt in front of me than be fully invested in stocks today. And if this news flow keeps heading in the wrong direction, all investors will soon have plenty of extra time to work on their short game.

Trade wars send the S&P 500 to its third test of the 200-day moving average…

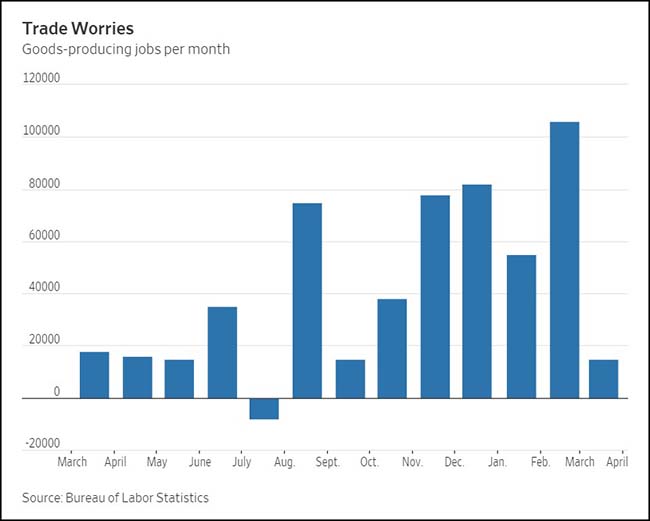

Did Friday’s weak jobs numbers show the first signs of the trade wars hitting recent economic data?

President Donald Trump began his trade tirade right at the start of March with tweets about putting tariffs on steel and aluminum, which he quickly followed with an announcement about the penalties. That set off a month of dueling threats and actual tariffs that has only gotten more heated.

Mr. Trump’s first actions sent stocks tumbling, setting up March to be a volatile and down month for the market and leading to the first quarterly decline in nine quarters.

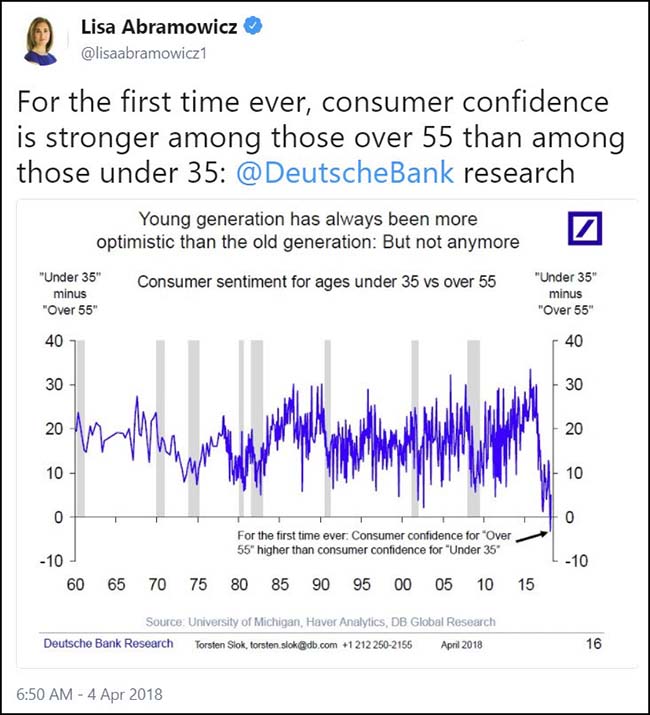

The combination of a trade dispute and a volatile stock market could make executives, who have been struggling to hire in a tight job market, a bit nervous. It wasn’t too long ago that executives were too worried about weak economic growth to hire more than absolutely necessary. Deutsche Bank) economist Torsten Slok says nervousness about trade was jarring to executives because of the strong, pro-business sentiment that prevailed until early this year.

The evidence for that is clearest in employment by goods producers, which was up just 15,000—compared with a gain of 106,000 in February—largely because of a 15,000-job decline in construction hiring. It is no coincidence that builders use lots of aluminum and steel, though they were also hit by weather. While goods producers are a smaller part of the economy than the service sector, they had been big drivers of job growth in recent months after choppy gains last year.

Advisers and business leaders don’t know who to talk to anymore inside the Executive Branch…

“If we do get into a trade war, even a small one, it will hamper growth. And you can see that in the stock market, people don’t like it,” said economist Art Laffer, an informal adviser to Trump who helped sell the president’s tax plan last year.

Business leaders don’t know how to read this new phase of “MAGAnomics,” and they don’t have the same sway over Trump’s inner circle of advisers as they did when former Goldman Sachs executive Gary Cohn and staff secretary Rob Porter, a more traditional Republican, had Trump’s ear.

Trump’s new inner circle of economic advisers often contradict one another, adding to the confusion. On Friday, Treasury Secretary Steven Mnuchin said there’s “potential” for a trade war, while new National Economic Council Director Larry Kudlow kept stressing that talks were underway and that the standoff was likely to end without tariffs going into effect.

Corporate executives, who only weeks ago thought they had successfully contained Trump’s impulses on immigration and trade, are now unsure what is coming next or what it will do to the economy. One look at the U.S. stock market tells the story: After surging nearly 19 percent last year, the Standard & Poor’s 500-stock index is in the red so far this year as investors fear a trade war between the world’s two biggest economies. The Dow Jones Industrial Average has fallen into a “correction.”

And as the volatility of decision making increases, some investors are selling out of the U.S…

For a growing number of global money managers, the risks of investing in the U.S. are too great right now given the political uncertainty. “At some point, you just bite the bullet and say, ‘I’m just going to get out of all my assets, all my exposures out of the U.S.,’” Nader Naeimi, a money manager at the $145 billion AMP Capital Investors in Sydney, told Bloomberg News. “That’s the No. 1 thing we’re thinking.”

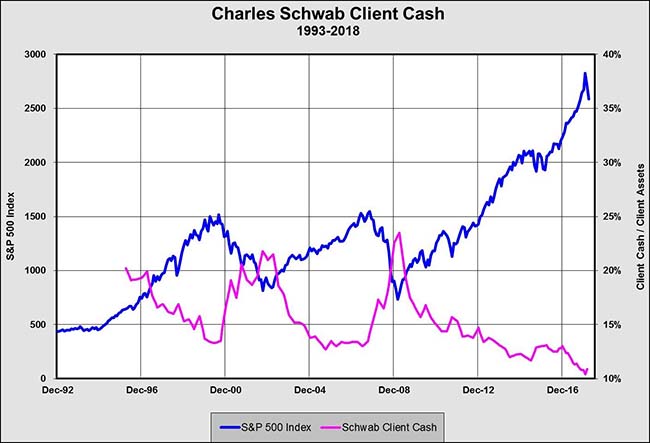

Unfortunately it looks like individual investors are deer in the headlights…

(@TihoBrkan)

If the market return remains a key measuring stick…

Dow Jones Industrial Average return, if you invested in that basket of stocks, for a president’s first 444 days (ranked since 1900,) per Bloomberg:

1. FDR : 70.4%

2. Reagan: 41.4%

3. Teddy Roosevelt: 37.4%

4. Obama: 32.5%

5. Bill Clinton: 32.2%

6. George H.W. Bush: 21.4%

7. Trump: 20.7%

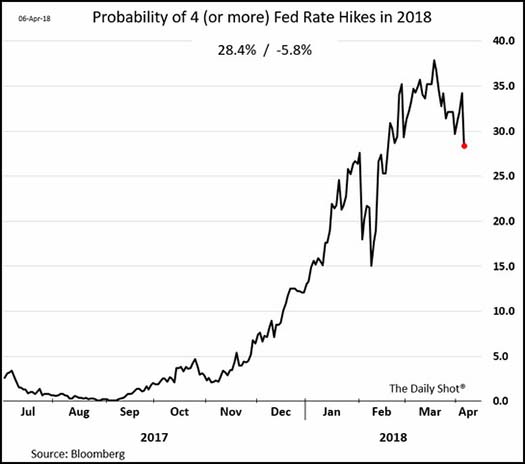

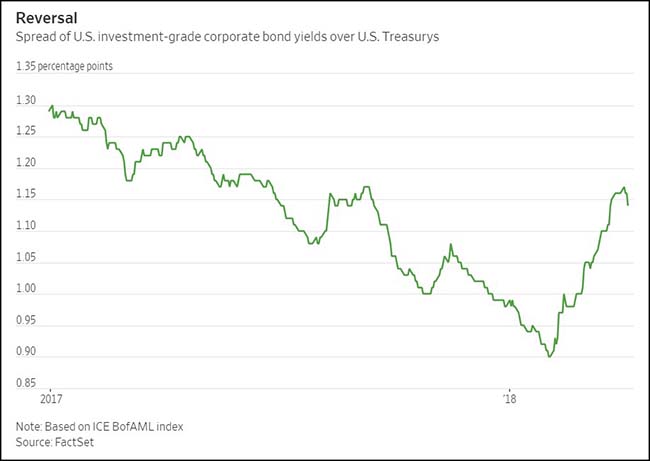

Not only are stocks pulling in, but so is the market’s bet on a strengthening U.S. economy…

The probability of three additional rate hikes in 2018 dipped after the disappointing payrolls report. If trade tensions continue to escalate, we may see this indicator decline further.

(WSJ/DailyShot)

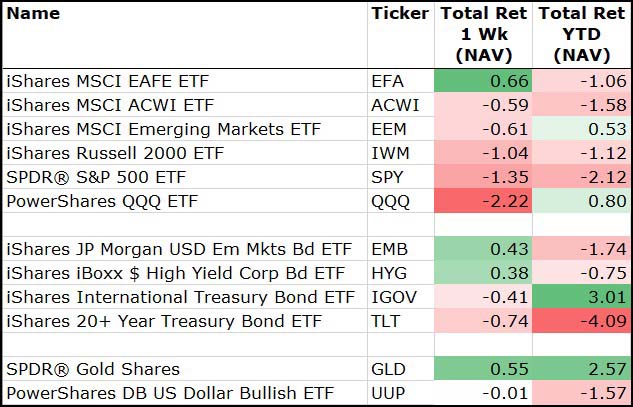

For the week, the Nasdaq got caught up in the Government’s inquiry into Facebook, while U.S. Large Caps were hit by the trade wars…

(4/6/2018)

Among sectors, gold miners were a place to hide while biotech and semis were playing dodge ball blindfolded…

We are going into earnings season with elevated expectations. Investors would prefer the opposite…

Given the tendency of companies to report results above Wall Street estimates, those numbers might be expected to come in even higher. For example, first-quarter profits should rise by 24 percent if results achieve the median out-performance of the past eight quarters, according to Thomson Reuters analyst David Aurelio.

“A downside risk is that everyone is hoping for the earnings to come through and that is really a main pillar for the bull case,” said Keith Lerner, chief market strategist with SunTrust Advisory Services in Atlanta. “And if earnings surprise to the downside then you have to say, what is the bull case hanging onto at this point?”

Expectations for first quarter profits have risen from an expectation of 12.2 percent growth on Jan. 1 to 18.4 percent now, an increase of 6.2 percentage points as analysts have factored in the new tax law.

That is unusual: In general, estimates decline by about 4 percentage points from the start of a quarter to the beginning of earnings season, according to Thomson Reuters data, which strategists say tends to help companies to post earnings “beats” when they ultimately report results.

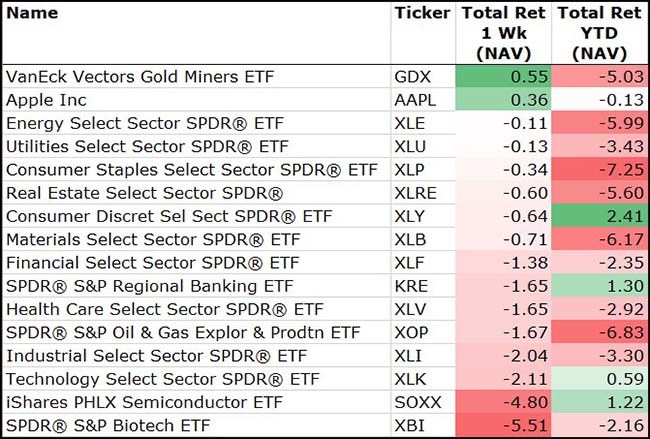

P/E multiples have pulled into the 25-year average, but that doesn’t mean stocks are cheap for a troubled environment…

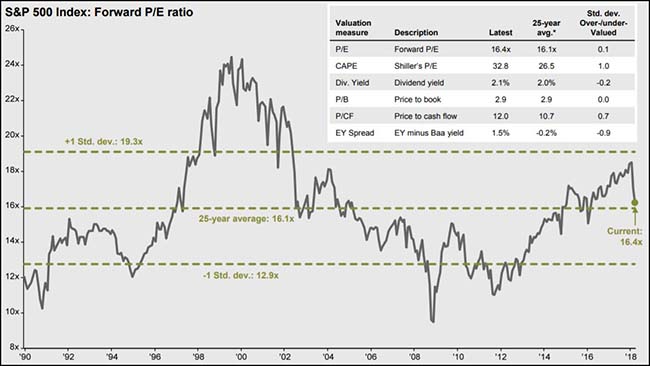

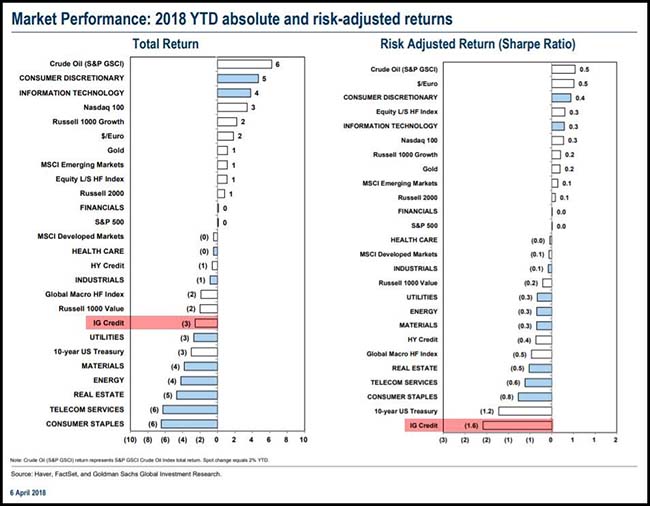

Rising uncertainty is also leading to wider corporate spreads…

But it isn’t necessarily higher rates that explain wider spreads. After all, if Treasury yields are rising because of stronger growth and inflation, that should be good news for company balance sheets. The rub is that credit spreads also behave like measures of volatility, in that they reflect a premium for uncertainty about the future. U.S. policies on trade, taxes and spending are raising the prospect of higher economic volatility in the future; market-based measures like the VIX index have risen from unusually low levels too. If volatility is here to stay, so are wider spreads, making it harder for corporate bonds to recoup their losses.

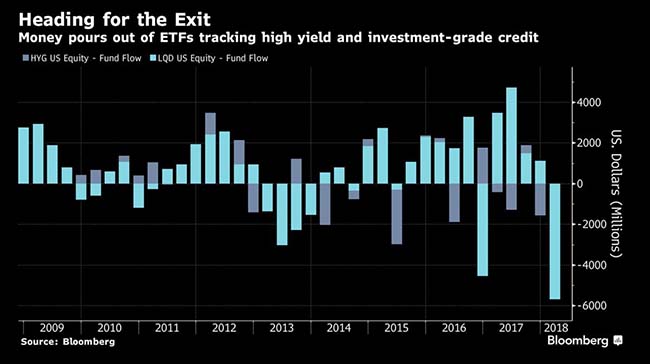

Part of the reason for wider spreads is investors pulling $9.7B from corporate bond fund ETFs in the Q1…

As a result, investment grade bonds are now the worst risk-adjusted investment for 2018…

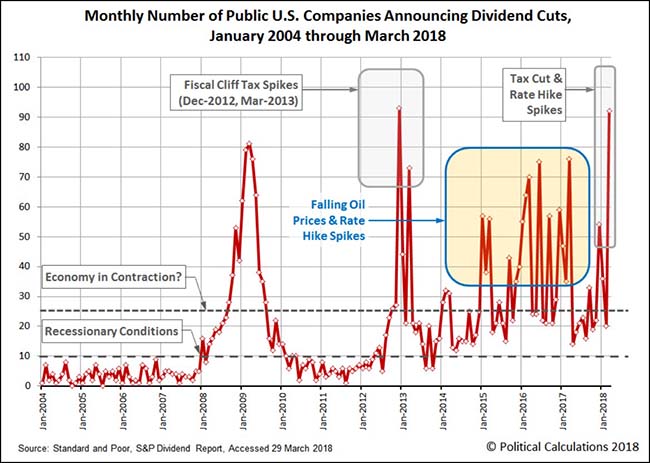

I found this series surprising; wouldn’t have figured dividend cuts to be breaking out right now…

March 2018 saw the second-largest ever number of dividend cuts be declared by U.S. firms and funds in a single month. The month’s 92 dividend cuts reported was just one shy of the record 93 cuts that were recorded during the Great Dividend Raid of 2012, when the very real threat of greatly higher taxes on dividends taking effect in 2013 prompted U.S. firms to drain money from the accounts they had set up to pay dividends in 2013 to instead pay out before the end of 2012 to avoid a major income tax hit.

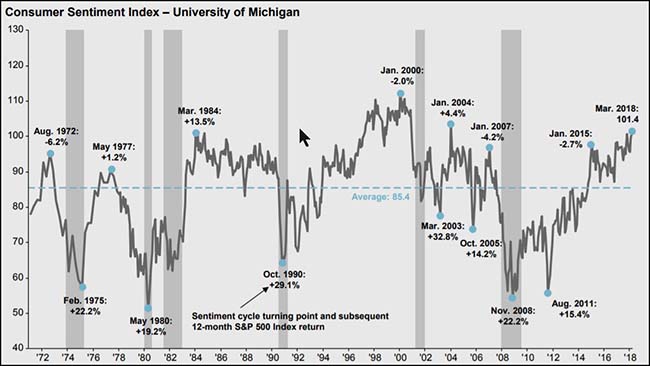

Another interesting chart is this J.P. Morgan Consumer Sentiment Index and forward market performance chart…

Bottom line, best money is made at the sentiment bottoms and not the peaks. So if tariffs push prices higher, job growth slows and the yield curve continues to flatten, guess where consumer sentiment is likely headed?

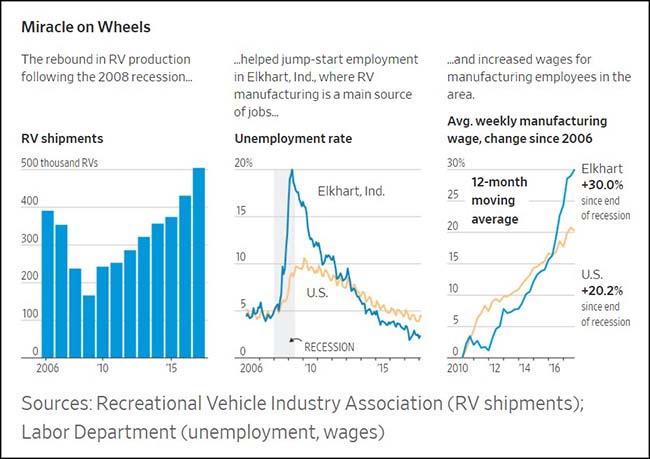

The Elkhart Mayor, its bankers and real estate owners need to work overtime to try and diversify their economy. These RV boom times will not last forever…

ELKHART, Ind.—The self-proclaimed RV capital of the world gives a glimpse of what the American economy looks like when operating at full tilt.

High-school students around here skip college for factory jobs that offer great pay and benefits. For-hire signs sprout like roadside weeds. And workers are so flush that car dealers can’t keep new pickups on the lot.

At the same time, the strains are showing. Employers can’t hang on to employees, and house prices are zooming. The worker shortage prompted a local Kentucky Fried Chicken restaurant to offer $150 signing bonuses. A McDonald’s failed to open for lunch last fall because managers couldn’t corral enough hands at $8 an hour to serve the lines waiting at the door…

The RV industry sets wages at levels others find hard to match: Eight of Elkhart’s 10 largest employers make RVs or RV parts. Workers are paid based on units produced. At full production, that translates to as much as $90,000 a year for assembly workers at RV plants and $100,000 for foremen.

During the last RV slowdown, Winnebago lost 80%+ of its equity value…

Thor did not do much better…

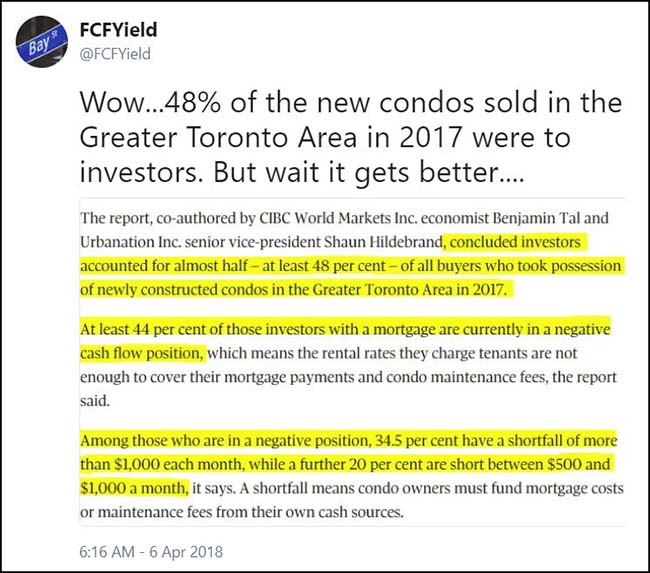

Looking for some scary new data points?

Look into Canadian real estate activity. The worst part is that in their Friday jobs numbers, it was the construction industry which helped push the numbers to the upside. It’s gonna get ugly, eh?

Good thing Toronto is such a small part of the Canadian real estate economy. Not!

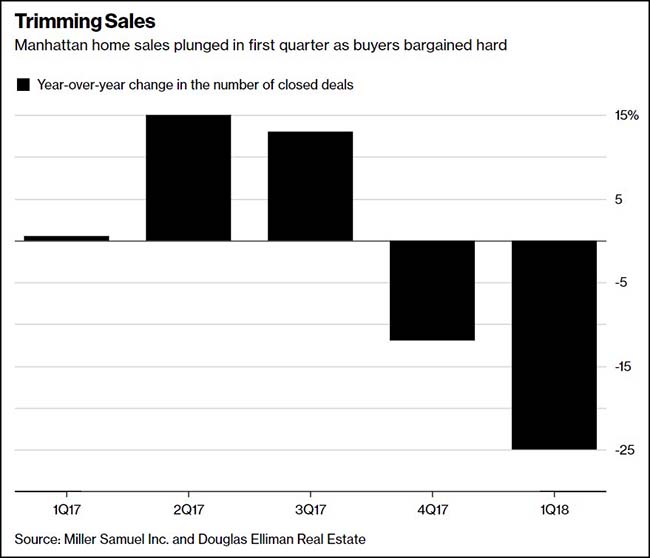

Now skip from the edge of the abyss in Canada to look at Manhattan real estate…

Sales of all condos and co-ops fell 25 percent in the first quarter from a year earlier to 2,180, according to a report Tuesday by appraiser Miller Samuel Inc.and brokerage Douglas Elliman Real Estate. It was the biggest annual decline since the second quarter of 2009, when Manhattan’s property market froze in the wake of Lehman Brothers Holdings Inc.’s bankruptcy filing and the global financial crisis that followed.

The drop in sales spanned from the highest reaches of the luxury market to workaday studios and one-bedrooms. Buyers, who have noticed that home prices are no longer climbing as sharply as they have been, are realizing they can afford to be picky. Rising borrowing costs and new federal limits on tax deductions for mortgage interest and state and local levies also are making homeownership more expensive, giving shoppers even more reasons to push back on a listing’s price — or walk away.

Another scary chart is the level of disappointment in the European economic data…

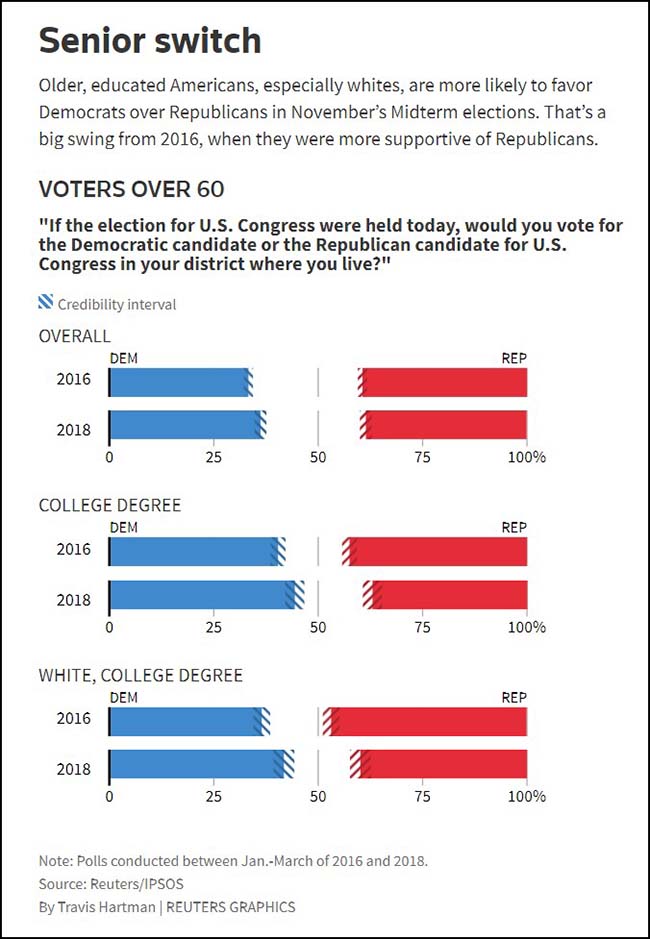

One more big change in a data series is in the political landscape where older voters are shifting quickly into the mid-term elections…

Nationwide, whites over the age of 60 with college degrees now favor Democrats over Republicans for Congress by a 2-point margin, according to Reuters/Ipsos opinion polling during the first three months of the year. During the same period in 2016, that same group favored Republicans for Congress by 10 percentage points.

The 12-point swing is one of the largest shifts in support toward Democrats that the Reuters/Ipsos poll has measured over the past two years. If that trend continues, Republicans will struggle to keep control of the House of Representatives, and possibly the Senate, in the November elections, potentially dooming President Donald Trump’s legislative agenda.

The trade wars are definitely not playing out well in the heartland…

The well-liked 22 year governor of Iowa might just have to find permanent residency in China instead of returning home at the end of his term.

Iowans were promised Trump had their backs. State party officials swore that the billionaire from New York City, a man whose fortune was built by stiffing the little guy, would look out for Iowa farmers. They assured Iowans that their votes in the U.S. Senate, which sent Big Oil sycophants to cabinet positions at the Environmental Protection Agency and Energy Department, wouldn’t haunt their home state. They promised that Iowa’s interests would be protected if it played ball with Trump.

The rhetoric about Trump’s alleged commitment to the Midwest was never believable, and the weird deification of him by Iowa party officials was disturbing from the outset. On Wednesday, the benefits promised to disciples of the Trump’s cult of personality were proven completely bunk.

And how will Iowa Rep. Steve King be able to stick with the POTUS and keep his seat in Congress?

In Iowa, Rep. Steve King is seeking his ninth term representing the vast northwest corner of his state by linking arms with Trump, largely on their shared hardline views on immigration. King won there in 2016 with 54% of the vote (Trump carried it with 60%). But the district is the nation’s richest for hogs and pigs, per the USDA; more than $4.3 billion in sales in 2012 alone. The district is the number four when it comes to the number of total farmers (48,863) and number three when it comes to soybeans (4.6 million acres). Those farmers’ pork and soybeans could soon find themselves without eager Chinese buyers.

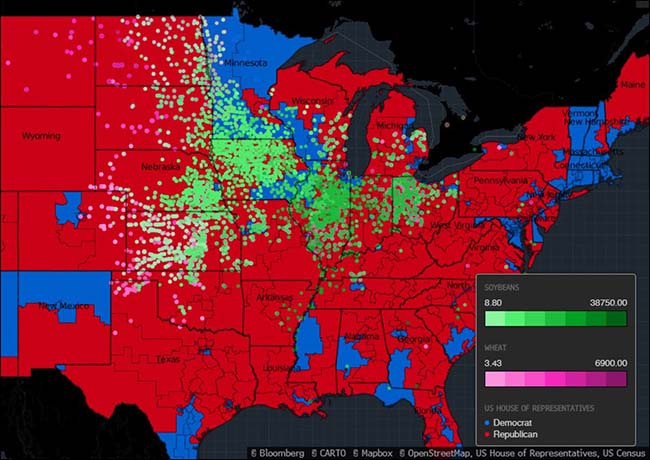

Here is the map of Soybean and Wheat farmers. Xi studied in America and knows how to hit back…

@M_McDonough: Soybean, Wheat and U.S. Congressional Districts

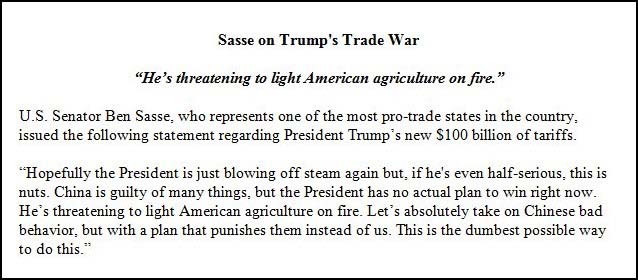

The Senator from Nebraska is also defending his voting farmers…

And in Indiana, this Senate seat should be a layup for the GOP, not a tossup…

At a diner in Rensselaer, Indiana, last week, Democratic Senator Joe Donnelly faced some agitated constituents. It wasn’t Donnelly’s opposition to the GOP tax-cut that animated these voters in the Republican-dominated state.

Instead, many of the more than two-dozen farmers gathered aired complaints about President Donald Trump’s policies, primarily escalating trade tensions that threaten exports of pork and soybeans to China and corn sales to Canada and Mexico, as well as an uncertain future for a government mandate that fuel be mixed with corn-based ethanol.

They were the type of voters Donnelly is doggedly cultivating as he seeks a second term in a state that Trump won by 19 percentage points in 2016. The only member of the Indiana congressional delegation with a spot on an agriculture committee, he stressed his work with GOP senators on a forthcoming crop-subsidy bill and his contacts with Trump administration officials to urge a better trade climate.

Meanwhile, The Kids Are NOT Alright…

And according to recent surveys, they are two to three times more likely to vote in November’s elections.

We all know that women are wide awake for the midterms…

The amulets are on, golden lasso on the belt and invisible plane out back.