In November there was a lot of excitement as the Nasdaq 100 finally surpassed its March 2000 high level. It was the last major Index to reach a new all-time high. The Dow, S&P 500 and Russell 2000 had all been marching to higher highs for some time. And the ETF’s based on these indexes were also making all-time highs. so when the Nasdaq peaked and then started lower many were shocked that the peak in the PowerShares QQQ Trust Series 1 (NASDAQ:QQQ) the Nasdaq 100 ETF, did not make an all time high.

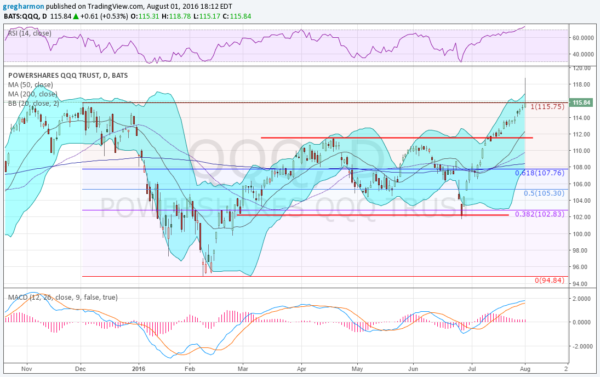

The QQQ had an all-time high print on March 24, 2000. It reached as high as 120.50 and closed at 117.88. The November intraday high was only at 115.75, over 4% below the record high and almost 2% below the record high close. How could that be? The ETF then pulled back to the low in February as the entire market retrenched. It rose again with the broad market through the rest of the 1st Quarter before finding a range in the 2nd Quarter. The final drawdown, following the Brexit vote, found support and it started a 5 week move higher.

It was not until Monday that the ETF returned to that November high, and then eclipsed it. An intraday buy sweep spiked it to 118.78, a new 16 year and 3 month intraday high, before pulling back but still closing at a 16 year and 3 month closing high. But not the all-time high. Will it continue higher and take the ETF over that final hurdle? It is set up to do so. The momentum indicators are bullish and rising. Some will point out that the RSI is technically overbought, but it is only in the low 70’s so it can get more overbought. And the Bollinger Bands® are shifted higher. These support more upside price action.

The candle printed Monday though, with that long upper shadow, is a warnings for a reversal. A price close Tuesday under Monday’s close would confirm a Shooting Star reversal. This candlestick pattern does not give any target. In fact the initial lower close which confirms it might be the full extent of the pullback. Or it might go lower to retest the 112 breakout area or more. All we can say right now is that all-time high print remains elusive, the final frontier for the ETF. All indications are that it could achieve this milestone very soon, but one warning flag has now been raised.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.