The PCE price index increased by 0.4% vs. an estimated 0.5% monthly. Likewise, the core PCE price index increased by 0.1% vs. an estimated 0.2%.

The Fed’s decision to maintain the interest rate within the 5.25 – 5.50% range at the last FOMC meeting appears to have been justified. Friday’s Bureau of Economic Analysis report shows that the Personal Consumption Expenditures (PCE) price index came in under expectations.

On a monthly basis (for August), the PCE price index increased by 0.4% vs. an estimated 0.5%. Likewise, the monthly core PCE price index increased by 0.1% vs. an estimated 0.2%. For both versions annually, PCE matched expectations at 3.5% and 3.9% (core).

This marks the lowest PCE rise since September 2021. Of the different inflation indicators, core PCE is the preferred gauge for the Federal Reserve as it excludes more volatile items like food and energy. As such, the core PCE price index is more useful to determine monetary policy.

Equally, this inflation gauge is closely watched for the same reason, often impacting market moves.

Market’s Reaction to Soft Inflation Report

Tracking the 30 largest American blue chip stocks, the Dow Jones Industrial Average (DJI) opened 0.64% higher on Friday, rising by 216.27 points. Other benchmarks were equally receptive to positive PCE news. The S&P 500 (SPX) rose by 0.66%, while the tech-focused Nasdaq Composite (IXIC) jumped by 1.03%.

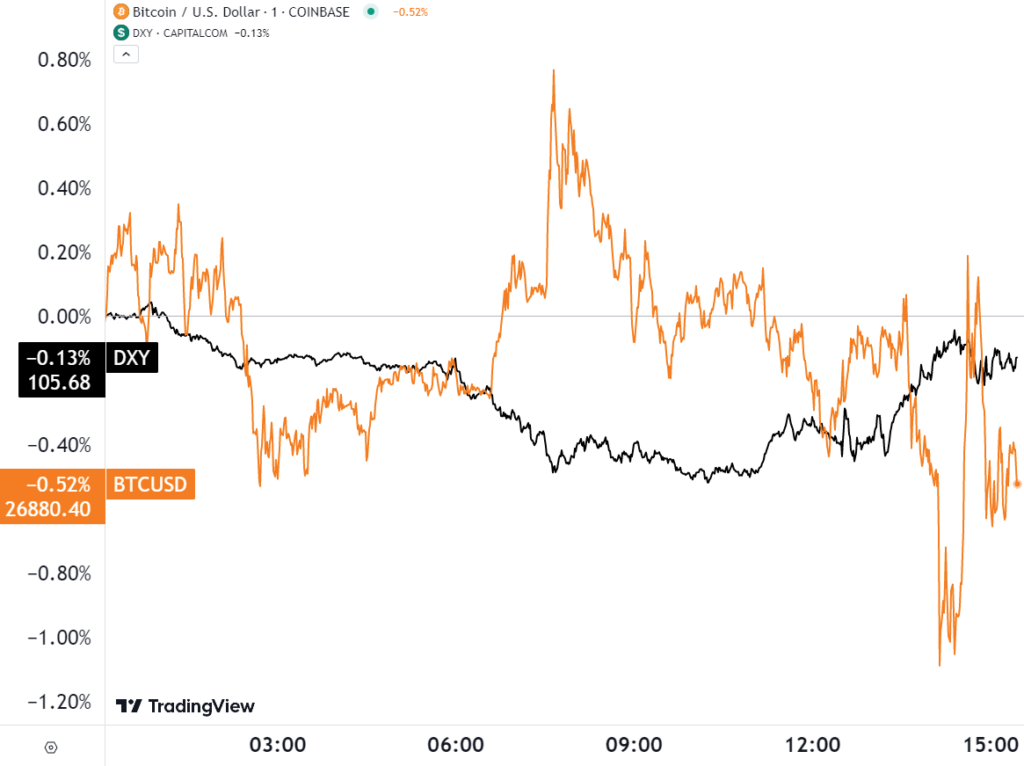

Interestingly, Bitcoin dropped sharply in the afternoon, going to $26.7k, only to stabilize at $26.9k again. This is not surprising, given Bitcoin’s perception as a hedge against inflation. If the inflation trends downwards, demand for bitcoins may be less pressing.

On the other hand, if the Federal Reserve is now less likely to raise interest rates and more likely to accelerate rate cuts, this would be favorable for crypto investors. After all, the historic inflow of cheap capital during 2020/21 allowed Bitcoin to reach an all-time high price of $68,789 in November 2021.

Regarding the dollar itself, softer inflation figures slightly raised the US Dollar Index, which is often inversely related to Bitcoin’s price moves. This played out again on Friday.

Typically, the potential of rate cuts leads to DXY decline as the dollar becomes cheap again. Nonetheless, this plays out differently if a hard landing is on the horizon, as it appears to be. In that scenario, investors seek safe-haven bonds in anticipation of a stock market decline., which would raise DXY further.

Market Expectations for Future Rate Cuts

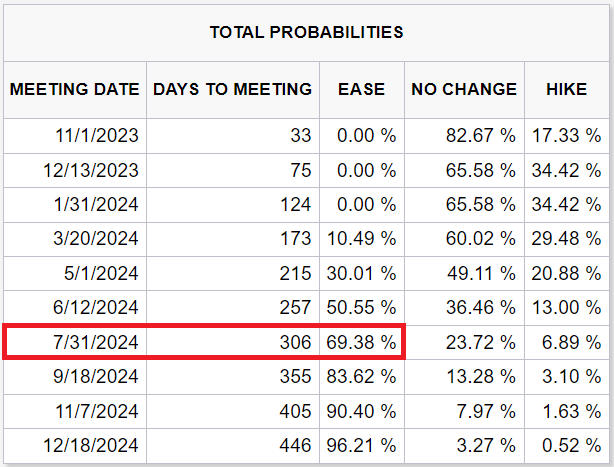

With two more FOMC meetings by the end of the year, investors are more confident in the Fed maintaining the rate. In contrast to the prior 40% fed fund futures bet, the probability for another hike lowered to 34%.

By present market expectations, the first rate cut (ease) is on the table by August 2024.

However, as excess savings depleted to the pre-lockdown level of March 2020, this is likely to change. Per the Federal Reserve report on household finances, only 20% of the top wealthiest have more cash, at 8% above. By June, households held an aggregate excess savings of just under $190 billion.

At the same time, US credit card debt hit a record $1 trillion in August, with household debt rising to $17.06 trillion. This debt will have to be serviced under a higher interest rate regime for now. By the same token, the US net interest payments, as a percentage of government receipts, increased to 15%.

In other words, the government’s tax revenue is increasingly drained into merely servicing its debt, which is monetized through bond issuance. This represents immense pressure to cut rates as it becomes difficult for the USG to finance spending.

As the 10-year Treasury yield surges to the highest level since the Great Recession, at 4.6%, long-term federal deficits are poised for new records. Given how this is likely to create a debt crisis, interest rate cuts should be coming sooner rather than later.