Waiting for Godot is a tragicomedy in which two characters, Vladimir and Estragon, wait for a man named Godot who never arrives.

Today, our Godot is a Federal Reserve rate hike.

Yet another Federal Open Market Committee (FOMC) meeting has come and gone without the Fed raising short-term interest rates. It seems as though the Fed is concerned about the global economy and deflationary pressures, and thus decided to delay interest rate “liftoff.”

The Fed’s inaction and dovish statement (no clear inclination to hike) boosted U.S. Treasuries and sent gold higher.

Global equities didn’t receive the Fed inaction very kindly. Japan’s Nikkei 225 fell 2.0% and Germany’s DAX dropped 3.1%. The S&P 500 shed 1.6% on Friday.

This may have been a “buy the rumor, sell the news” type of event considering that global equities had been strong in recent days.

Perhaps a hike – and relief from continued rate hike uncertainty – would’ve caused stocks to rise. Maybe the dour reaction is a result of the Fed losing credibility. Also, it’s possible that the stock market is finally taking the global growth slowdown seriously.

What’s clear is that investors, especially retirees, will continue to have a tough time finding relatively low-risk ways to preserve purchasing power and produce income.

Even though it may not seem like it, this is one of the most treacherous environments for retirement investing, ever.

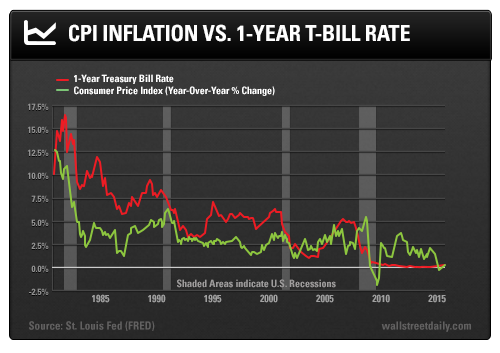

The following chart shows the 12-month Treasury Bill rate, which closely tracks the federal funds rate, and the year-over-year change in the consumer price index:

Notice where the red line is well above the green line. For much of the 1980s and ‘90s, you could invest in one-year T-Bills and earn a 2%-4% real return (after inflation) while taking on virtually zero risk. The purchasing power of the cash in your savings and brokerage accounts would grow, instead of being eroded by inflation.

Those days are long gone. Even when the Fed does hike, it will raise rates very gradually and the terminal Federal Funds rate (rate at the end of the tightening cycle) will be much lower than historical standards.

Granted, inflation is much less of a concern to savers than it has been in the past (the green line in the chart above is currently near zero).

Which brings us to the biggest surprise from the FOMC meeting last week…

The Final Act

One FOMC member forecast negative short-term interest rates in 2015 and 2016. Keep in mind, the European Central Bank (ECB) already took rates below zero in 2014.

When Fed Chair Janet Yellen was questioned about this shocking development, she said that she couldn’t dismiss the risk of being stuck at zero indefinitely or entirely rule out additional accommodation.

So there you have it: Negative interest rate policy (NIRP) and more quantitative easing (QE) stimulus have been foreshadowed.

Indeed, this situation is tragic and absurd, yet comedic on a certain level.

The Fed’s about-face wasn’t a surprise to Ray Dalio, the Founder of Bridgewater Associates, which is the largest hedge fund firm in the world. Even before the FOMC meeting, Mr. Dalio asserted that the next “big” move will be an easing via QE, even though the Fed may raise rates a small amount in the short term.

This uncertainty makes the investing environment even more challenging. Until more stimulus is announced, we need to employ strategies to weather – or even take advantage of – heightened volatility.

Of course, proper diversification is a necessity. Put selling strategies also become more attractive during times of higher volatility.

Basically, you need a sound investment plan for the twists and turns of this central banking tragicomedy.