Earlier this week, Mish released her annual report for the year ahead "2022 Trends, Themes, and Trades to Watch," and on Wednesday, the market showed why she has inflation as one of her 8 important themes.

For example, inflation has been a part of Mish's conversation and the market's narrative for months, but on Wednesday it became the catalyst that sunk the market.

Everyone has heard the Fed talk about inflation being transitory and while many have questioned their thought process, the Fed has stayed relatively steady in pushing the transitory narrative as they waited for it to come true.

However, Wednesday’s Fed minutes showed that inflation has further spread in the economy and is going to stick around longer than they had originally anticipated.

Traditionally, the best way to fight inflation is by increasing interest rates which the Fed is looking to accelerate through the year.

Because the stock market and economy love cheap money, the market sold off following the news. With that said, will Wednesday’s drastic selloff continue, or will the market find support?

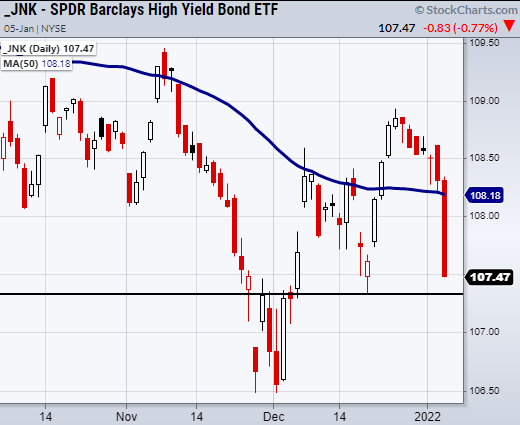

One risk indicator we have been watching is the High Yield Corporate Debt ETF (JNK). Looking at the above chart, JNK has broken down near a previous support level at $107.33 on 12/20/2021. If Wednesday’s panic selling continues, watch this level break or hold as the next key support area.

One possible reason the market could rebound is that many traders and institutions have already realized that prices, along with inflation, will take more time to dissipate, and thus part of Wednesday's news has already been priced into the market.

Therefore, while we are watching JNK, we can also watch the lower ranges of the major indices, for instance, the NASDAQ 100 (QQQ) and Russell 2000 (IWM) to hold.

If the market is looking to break significantly lower, it will need to pass these major support areas next.

ETF Summary

- S&P 500 (SPY) Broke support area. Now watching to hold the 50-DMA at 465.86.

- Russell 2000 (IWM) Next main support 208 area.

- Dow (DIA) 362.30 support from Monday's low.

- NASDAQ (QQQ) 377.37 support

- KRE (Regional Banks) 71.90 support area.

- SMH (Semiconductors) 300.60 the 50-DMA. Main support 288.14.

- IYT (Transportation) 281.45 resistance. Watch to hold the 10-DMA at 275.39.

- IBB (Biotechnology) Broke support from 143.75.

- XRT (Retail) 83.54 next support level.

- Junk Bonds (JNK) 107.33 needs to hold.

- SLV (Silver) Needs to hold 20.89.

- USO (US Oil Fund) 53.90 support.

- TLT (iShares 20+ Year Treasuries) 141.45 support.

- DBA (Agriculture) 19.55 support area.