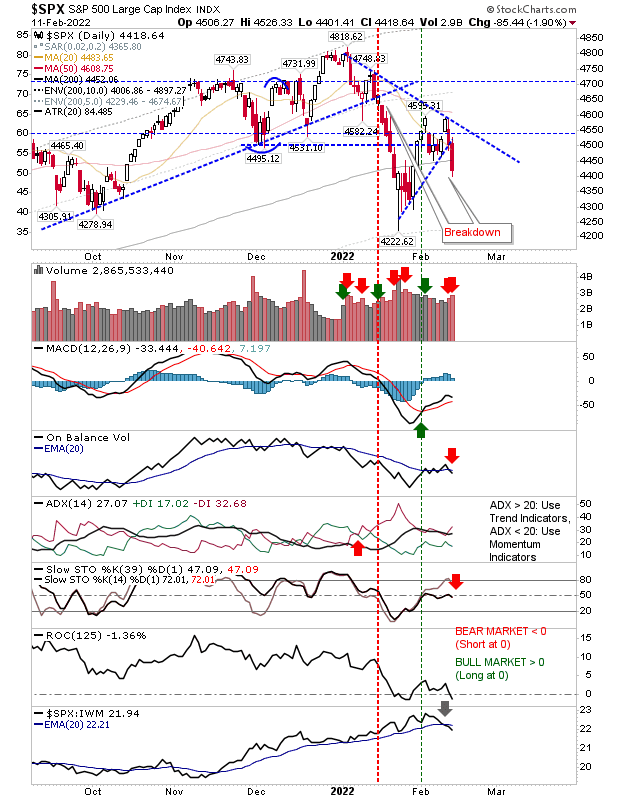

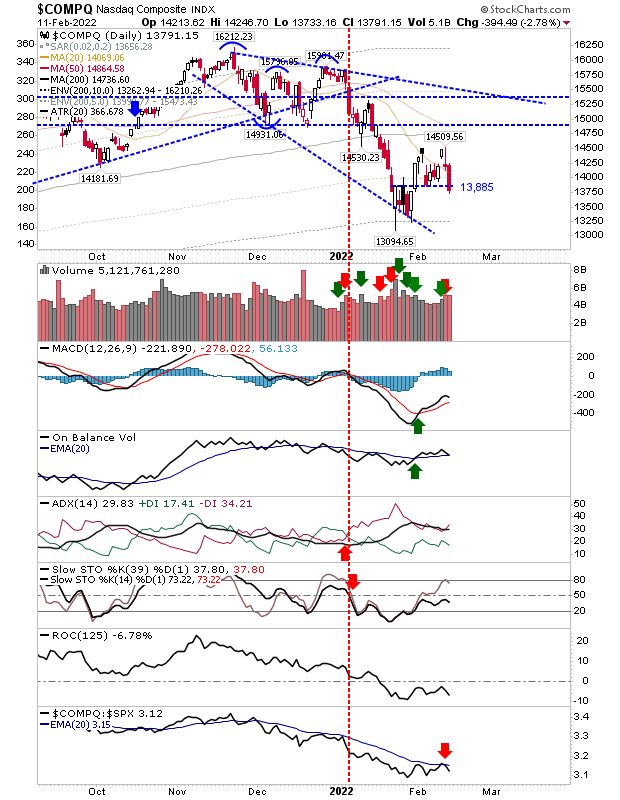

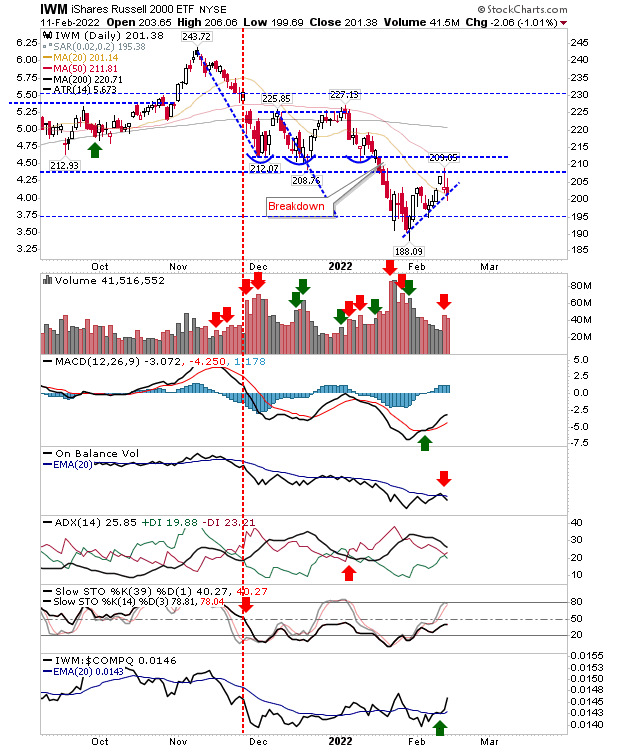

The bounce off January swing lows tapped out Friday as traders were keen to take profits on higher volume distribution.

In the case of the S&P there was a confirmed 'sell' trigger in relative performance over the Russell 2000 along with an On-Balance-Volume 'sell' trigger. Friday also delivered a trendline break and an undercut of the 200-day MA for a second time in less than a month. Intermediate term stochastics were also rebuffed at the mid-line, another sign we are in a bearish market. We are probably looking at a measured move lower to around 4,000; it would take a break of 4,600 to negate this target.

The NASDAQ flashed a gravestone doji on Thursday and followed through with an undercut on Friday. The nascent recovery in relative performance against the S&P took a hit on Friday's losses, although we are still seeing 'buy' triggers in On-Balance-Volume and the MACD, although the latter occurred well below the bullish mid-line.

The Russell 2000 (via IWM) is under pressure but hasn't suffered the same level of selling as either the NASDAQ or S&P. Having said that, there was a fresh 'sell' trigger in On-Balance-Volume and intermediate term stochastics are hovering in bear territory. Relative performance is running in Small Caps' favor, so if there is an index to attract money it will be Small Caps (and it has already reached its measured move target from the initial decline off its highs).

The NASDAQ and S&P are positioned for further losses, but I would be more optimistic on the Russell 2000. For the latter there might be an undercut of the January swing low but the likelihood of it extending much beyond that is slim.