We continue to alert our followers of the extended Wedge (Flag or Pennant) formation that has setup over the past 16+ months in most of the US major indexes. The reason these are so important for skilled technical traders is because the Apex of these formations typically result in a violent price move that may result in a dramatic profit opportunity (or massive risk event). The most interesting facet of the current Wedge formation is that it is happening just 12 months before the US Presidential Election cycle.

It is our believe that a major price reversion event will begin to take place over the next 2 to 6+ weeks and complete near the end of 2019 or into early 2020. This reversion event is and continues to align with our super-cycle event analysis from earlier this year. Our researchers believe this reversion event is essential for price to establish “true valuation levels” and to begin a renewed future price trend. We believe that trend will begin between June 2020 and August 2020 and will result in a strong bullish price trend. We also believe this bullish price trend in the US stock market may last well beyond 12+ months – well into 2021 and beyond.

Custom Technology Weekly Index Chart

This Custom Technology Index chart highlights the Wedge formation that is one of our main concerns. The Technology sector is one of the most heavily weighted sectors in the US stock market and the one that typically has the highest price to earnings multiple. Over the past 5+ years, billions have poured into the Technology sector chasing the rally and the security of the US stock market/US Dollar. A breakdown in this sector (like the DOT COM crash) could be devastating for the global markets. As you can see, the price is already very close to the lower price channel and could breakdown within the next 2 to 5+ weeks. Pay attention to weakness in the NASDAQ and/or the technology sector overall.

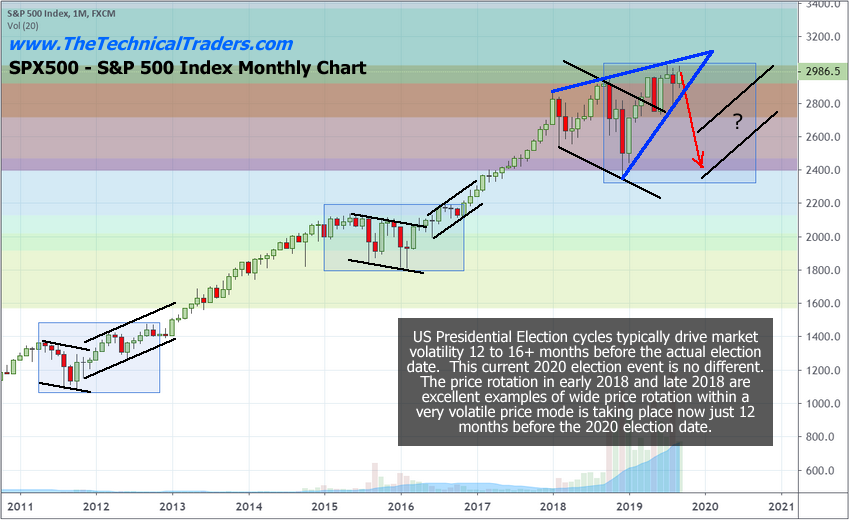

Monthly S&P 500 Chart

This S&P 500 chart highlights the rising Wedge formation that is set up and nearly complete. This Monthly chart also highlights the extended volatility within the global markets compared to levels prior to 2018. It is our opinion that the Apex of this Wedge will result in a breakdown/price reversion event targeting levels below 2600 on the SPX. This reversion could extend to levels below 2000 on extended price weakness. Our opinion is that the bottom will form sometime between December 2019 and April 2020 where a new Wedge formation will setup before reaching the Apex and starting a new upside price trend near August/October 2020.

We prepared for a very volatile price rotation/reversion event as these Wedges reach their Apex moment. Skilled technical traders should be able to find lots of opportunity for profits over the next 6+ months with these big price rotations.

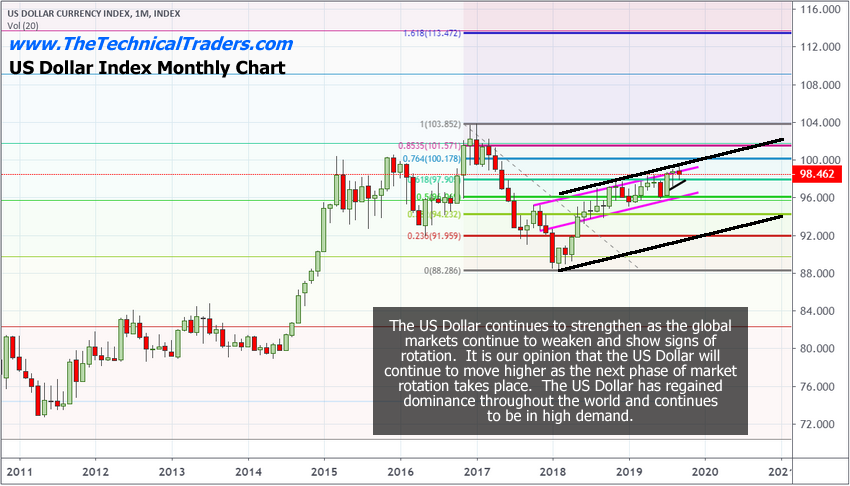

Weekly US Dollar Chart

The US Dollar will likely rotate within the Magenta price channel as this has continued to provide very clear price support over the past 20+ months. We don’t believe the US Dollar will decline by more than 5% to 7% throughout the reversion event. The fact is that the US Dollar has regained a level of dominance within the world and the US Dollar may continue to strengthen for many months into the future.Remember, these reversion events are essential for proper price exploration and future price trends to establish. They are fundamental to all price activity. A healthy price rotation will allow for future trends to establish and mature well into 2021~2024. The current Wedge formations must complete and the Apex rotation must happen in order for price to conduct “true price exploration” and “true price valuation”. From these levels, price will establish a new price trend that may continue for many years into the future.

Concluding Thoughts:

We strongly suggest all readers consider the risks of their open portfolio positions and take steps to protect against any unwanted risk exposure. As we are suggesting, we believe the Apex event will begin within 2 to 4+ weeks – possibly sooner.