We can argue over the impact of specific decisions or policies of the new government or even if any of them will be put in place. There will never be a consensus. But one thing is certain. In this new world of "alternative facts," there are some facts that rise above all else and cannot be questioned.

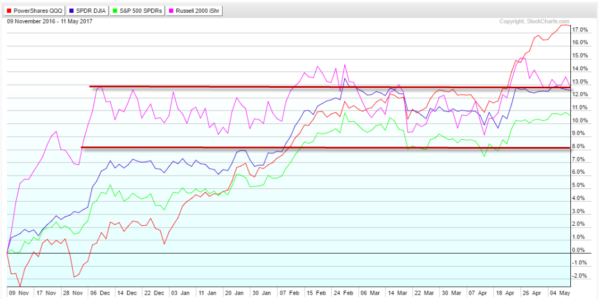

Another one is the stock market. You may have a different interpretation of why stock prices are moving as they do. Some favor fundamental reasons. Some look to macro policy. Others look at behavioral aspects. But whatever your approach, the closing price is the closing price. And looking at those closing prices on the major market indexes shows that post U.S. election, all rose between 8% and 12.5%. Lets call it 10% for now.

Some got there faster than others. The Russell 2000 ETF (NYSE:IWM) took less than a month whereas the S&P 500 ETF (NYSE:SPY) took 3 months, with the Dow ETF (NYSE:DIA) and Nasdaq 100 ETF (NASDAQ:QQQ) in between. Each index has stalled as it hit this range. The IWM has been in it for nearly the full 6 months since the election. The others for about 3 months.

It seems with earnings mostly done that the Nasdaq is ready to move past the election. It broke out of the range as earnings season started. The Russell 2000 tried as well but has fallen back lately. This leaves the S&P 500 and Dow Jones Industrials as laggards. Historically, this makes sense as they are the largest capitalization stocks. Will it continue this way? I don’t know. But what's certain is that the passing of the election gave stocks a 10% boost.