The US dollar struggles, despite the Federal Reserve's upgrade of its economic assessment and confirmation that it still anticipates raising rates this year. At the same time, the Greece situation has devolved, and the run on deposits has accelerated, which forced to the ECB to lift its ELA ceiling twice within a couple of days.

Sterling drew succor from hawkish central bank comments, firmer than expected retail sales and a jump in average weekly earnings, which offset the slightly softer than anticipated core inflation. Sterling was the strongest of the major currencies last week, rising 2% against the US dollar.

The dollar fell against most of the major currencies last week. The two exceptions, the Norwegian krone, and New Zealand dollar were driven lower by the same consideration. Namely both the central banks have cut rates in the last fortnight and has signaled investors that another cut will likely be delivered. Both central banks are more concerned about growth than inflation.

The Dollar Index returned within 40 points of its mid-May low recorded just below 93.15. It flirted with the lower Bollinger Band®, which now is found near 93.50. Although it recovered before the weekend, the tone remains fragile. Over the past two weeks, it has closed only once above its five-day moving average. The technical indicators are not generating strong signals.

The euro remains firm in the upper end of its recent range. A brief dip below $1.13 was snapped up ahead of the weekend. The euro's resilience is notable in light of the angst over Greece and the 30 bp pullback in German 10-Year bunds since June 10. It appears that some fund managers are picking a bottom to the bunds (top in yields), but not hedging the currency risk as they did before.

However, in the options market, the discount for euro calls over puts stood at the highest for the year before the weekend. This coupled with rising volatility, would suggest that perhaps that some investors are buying euro puts, which could also be a hedging vehicle. Some are suggesting that due investors are repatriating overseas investments, and this is an important prop forth for the euro. While this is a possible explanation, there does not seem to be much evidence for this, or at least not yet. In any event, as we have reported in recent weeks, speculators in the futures market has cut gross short positions by 80k futures contracts (each contract is for 100k euros).

For medium-term investors, it is difficult to get excited about the euro between $1.10 and $1.15. For shorter-term traders, the euro looks neutral in the range has confined it for the better part of two week between $1.1150 and $1.1440. In the big picture, we regard the price action in here in Q2 as a consolidative phase after the sharp 6-9 month slide that had accelerated in Q1.

The two key pressures on the yen have eased. U.S. 10-Year Treasury yields have fall 22 bp since June 10. The Nikkei's powerful eight-month old rally has faltered, and it finished last week below the uptrend line. If Japanese policy makers wishes were also a weight on the yen, Kuroda's recent remarks have reduced this weight, even though he was not talking about nominal bilateral exchange rates and argued his intent was not to weaken the yen.

We suspect market positioning exaggerated the reaction to a rather academic point. Speculators in the futures market have recently turned very bearish the yen. Very bearish means that they have amassed a large short yen position. The gross short yen position has risen by nearly 90k contracts since mid-May (each contract is JPY12.5 mln). At the same time, over the past three weeks, Japanese investors have become aggressive sellers of foreign bonds. They have sold about JPY2.6 trillion of foreign bonds over this period. In essence, this means that Japan's export of its savings has essentially stopped in over the past eight weeks, net-net.

The RSI is neutral while the MACDs are trending lower. The five-day average moved below the 20-day average early last week. Initial support is seen near JPY122.40, and a break could spur a move toward JPY121.50. However, like with the Nikkei we suspect the near-term technical weakness will prove a better buying opportunity.

Sterling has rallied nearly 5% since June 5. It recorded new highs for the year last week near $1.5930. To do so it had to surpass the 50% retracement objective of the downtrend that began last July. The move does not look over. Technical indicators do not look toppish. The only note of caution is that sterling finished the week above it upper Bollinger Band (~$1.5870). While the next immediate psychological target is $1.60, we note that the 61.8% retracement is found just below $1.62. Initial support is seen in the $1.5800-$1.5815 area.

The US dollar slid against the Canadian dollar in the aftermath of the FOMC meeting to hit a low near CAD1.2130 before reversing higher. It created a bullish hammer candlestick pattern. The dollar's recovery extended before the weekend with the help of a disappointing Canadian retail sales report (-0.1% in May vs. consensus expectations for a 0.7% rise). The greenback stalled in front of CAD1.2300. The near-term upside potential extends toward CAD1.2330-CAD1.2360. While initial support is seen near CAD1.2250, stronger support is seen closer to CAD1.2220.

The Australian dollar rallied to new highs for the month following the FOMC meeting. It reached almost $0.7850. This seems to have fulfilled the 50% retracement of the losses since mid-May (~$0.7880). It quickly came back off. We expect the Aussie to continue to churn in $0.7600-$0.7800 trading range.

The August light sweet crude oil futures finished about a dollar lower on the week. The $62 are continues to frustrate the bulls. The lower end of the range is in the $58 area. To illustrate the narrow price action, consider that the 5, 20, and 50-day moving averages converge in the middle of the range ($59.95)-$60.20.

The US 10-year yield fell 22 bp over the past week. By way of comparison, the German bund yield shed 8 bp. Technical indicators suggest that yields may fall further in the period ahead. On a convincing break of 2.25%, there is immediate potential toward 2.15% and below there is the 2.00%-2.05% band.

The S&P 500 gained almost 1% this past week. It was the only G7 bourse to do so. It moved within 0.5% of its record high. It consolidated before the weekend in narrow ranges. We look for another attempt at the record next week. The RSI is no particularly helpful, but the MACDs are more interesting. It is turning higher from over-sold levels.

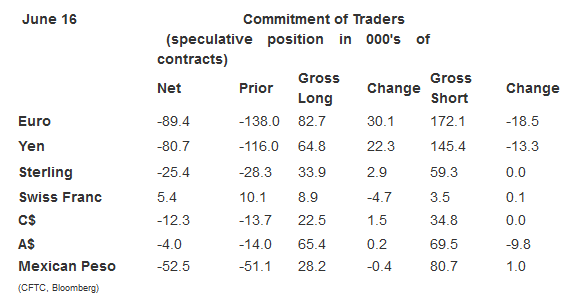

Observations based on the speculative positioning in the futures market:

1. Significant position changes were limited to the euro and yen in the CFTC reporting week ending June 16. Of the remaining 10 gross positions we track only one was above 5k contracts (gross short Australian dollar position was cut by 9.8k to 69.5k). There was only one other gross currency adjustment of more than 4k contracts, and that was the gross long Swiss franc position, which was trimmed by a third (4.7k contracts) leaving 8.9k contracts.

2. The gross long euro position jumped by 30.1k contracts to 82.7k. This was the largest accumulation in a year, which itself was the biggest since January 2011. The gross short position was trimmed by 10% (18.5k contracts) to 172.1k. The euro bottomed in mid-March, but until this past week, the gross long position was flat to lower. In fact, it made a new low for the year in late-May. Up until now, the adjustment has been confined to covering shorts. During this most recent reporting period, the euro averaged about $1.1275. This is the middle of the $1.10-$1.15 range. These new longs may be in weak hands; vulnerable to a near-term setback.

3. The gross long yen position increased by roughly the same percentage as the gross long euros. It rose by 22.3k contracts to 64.8, but such large swings in positioning are more common in the yen futures. The gross short position, which has grown rapidly in recent weeks, was trimmed by 13.3k contracts to 145.4k. The dollar averaged about JPY123.25 during the reporting period.

4. The net short US 10-year Treasury futures position swell to 96.4k contracts from 36.6k. The longs cut 29.1k contracts, leaving 383.3k. The gross shorts grew 30.8k contracts to 479.8k. The US 10-year yield peaked on June 11. The yield has shed 25 bp since and it finished last week with the lowest yield since June 1.

5. The speculative positioning in the crude oil futures was essentially unchanged. The net long position increased by 1.3k contracts to 327.1k. The longs rose by 1.1k contracts to 484.9, while the shorts were reduced by 100 contracts to 157.8k.