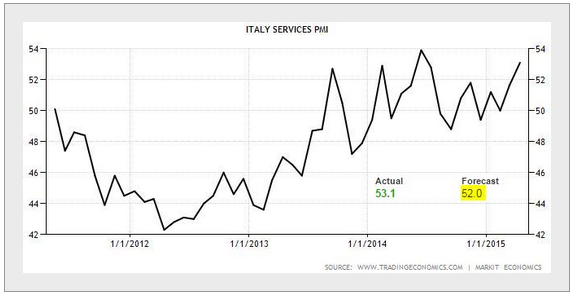

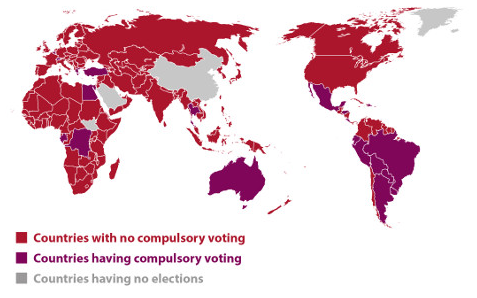

We begin with the eurozone where the recovery remains uneven. On one hand we see strong improvements in Italy's services sector, with the PMI index beating consensus.

The eurozone's overall composite PMI (services and manufacturing) also beat consensus slightly.

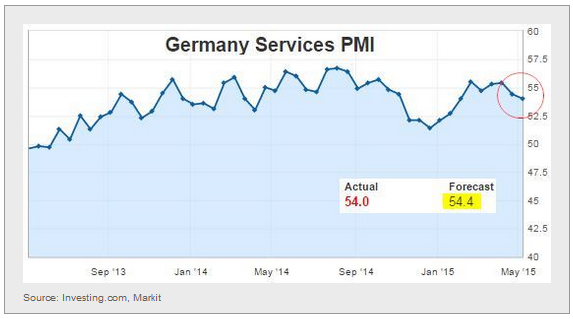

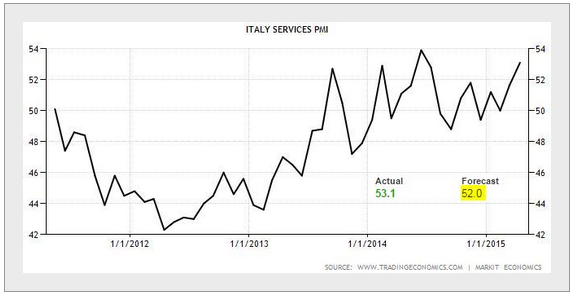

On the other hand, German services sector growth stalled.

And growth in retail sales declined across the euro area.

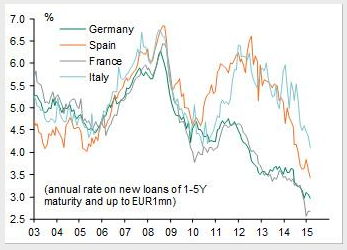

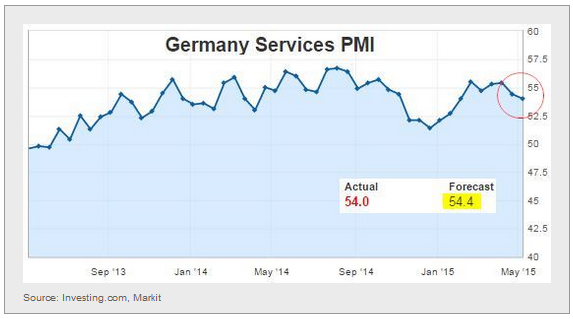

I remain constructive on the recovery in the near-term assuming the situation with Greece can be "managed". The ECB stimulus is finally starting to make its way into the real economy as rates on new loans to small and medium-sized businesses in the eurozone "periphery" decline sharply.

This so-called monetary transmission wasn't taking place before because the banking system was rapidly deleveraging - a process that was recently concluded.

Speaking of Greece, here is a photo of the finance minister Varoufakis and the chief negotiator Tsakalotos on the same bike. My guess is Tsakalotos will need to be on a different bike in order to reach a deal with the Eurogroup/IMF.

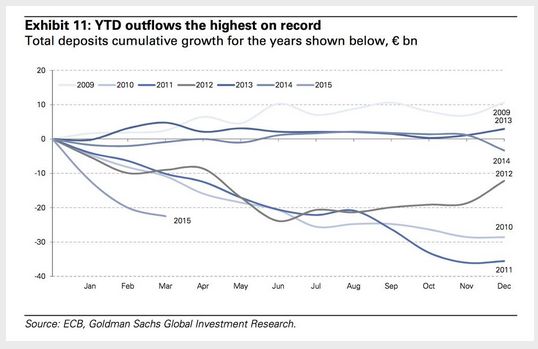

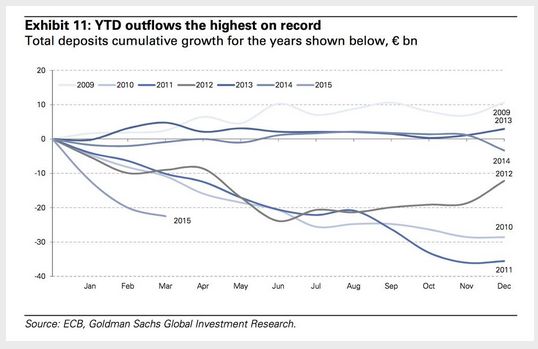

In the meantime deposits continue to leave the Greek banking system.

The ECB approved an additional €2 Billion to Greek banks via emergency lending (ELA) as the nation's banking system becomes completely dependent on the Eurosystem. Should the ECB stop additional funding, Greek banks will begin defaulting on their bonds.

Bank shares jumped 9% (after losing 10% the day before).

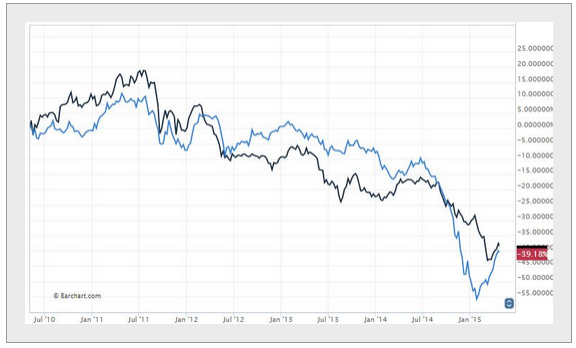

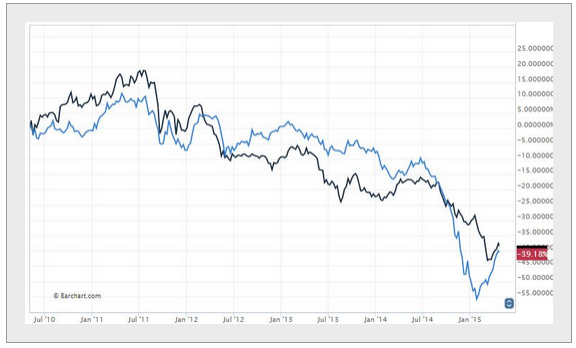

Switching to emerging markets, it's worth noting that over the past 5 year the (blue) and the (black) had very similar performance vs. the dollar-

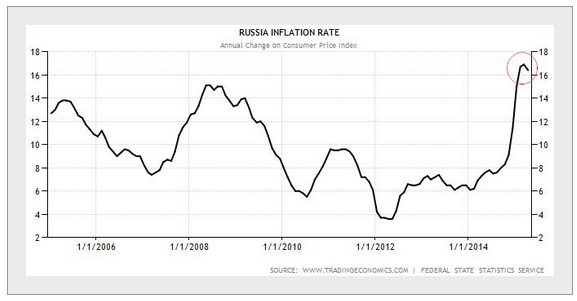

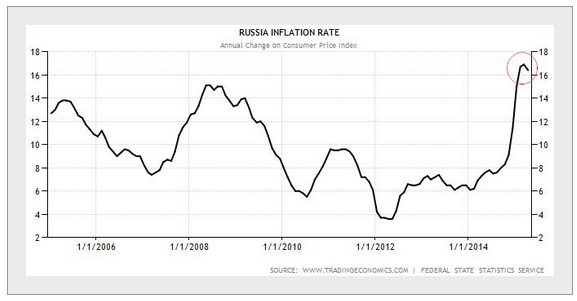

Staying with these two countries, Russian inflation seems to have stabilized as the ruble rallied from the lows.

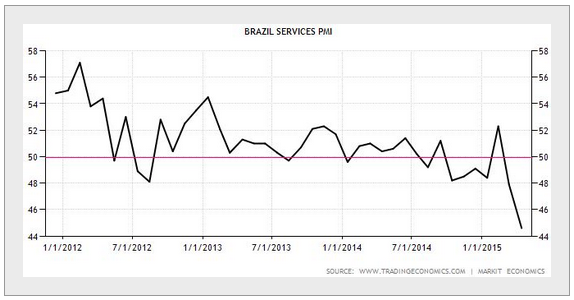

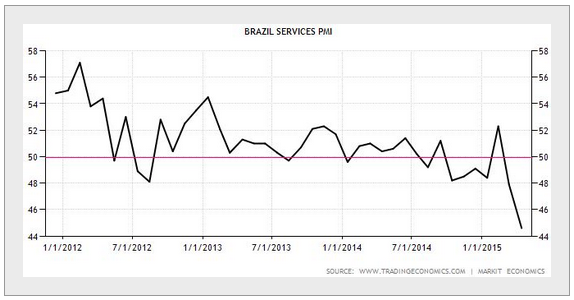

Previously I discussed Brazil's manufacturing sector contracting (falling PMI). Here is the services sector PMI for Brazil.

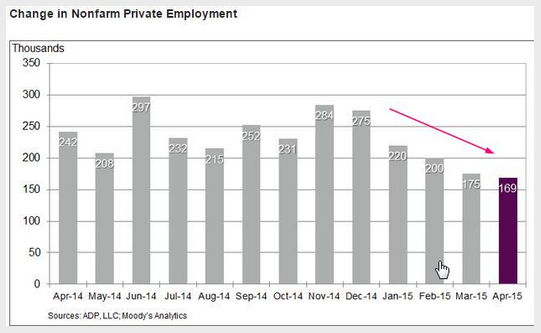

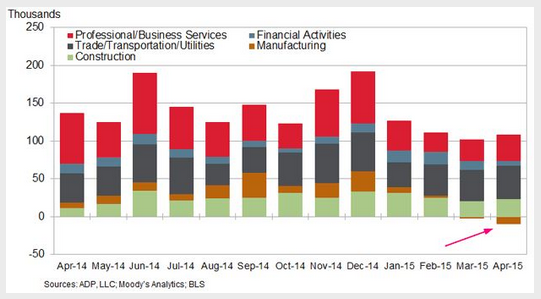

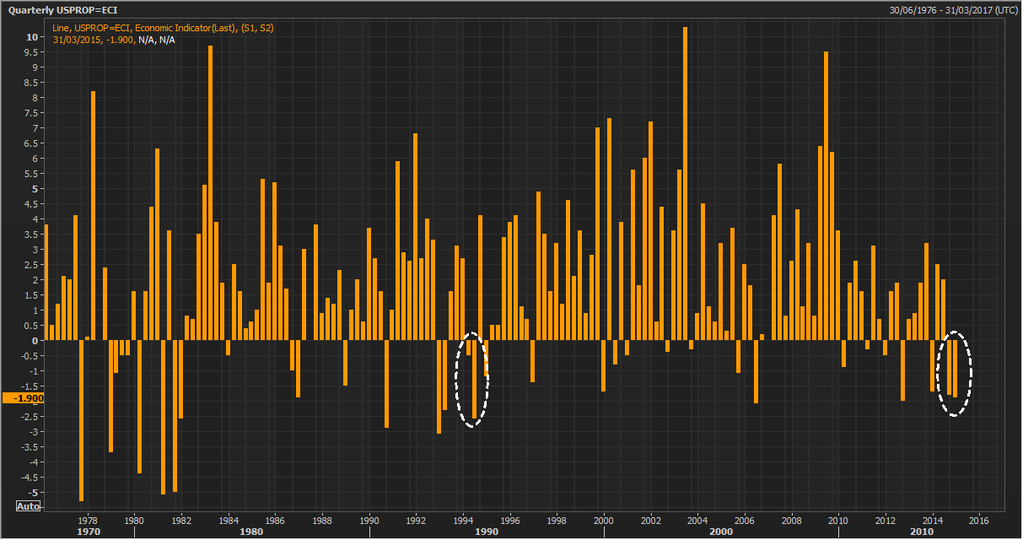

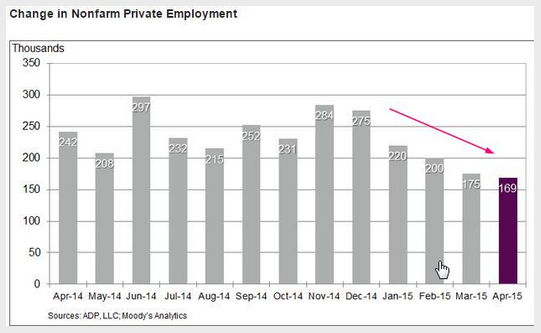

In the United States economic data continues to disappoint. Here is the latest ADP private payrolls report:

1. The nonfarm payrolls growth continues to soften. Credit Suisse is suggesting that some of this is driven by the energy sector pain - which definitely was the case in March.

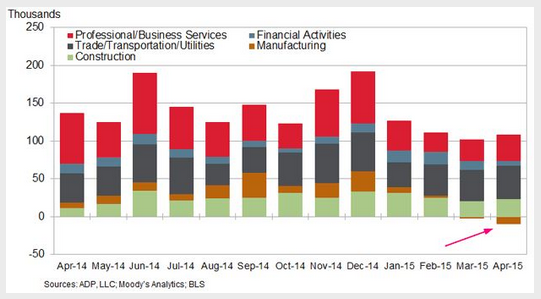

2. We also see the recent weakness in manufacturing (due to strong dollar) contributing to the payrolls weakness.

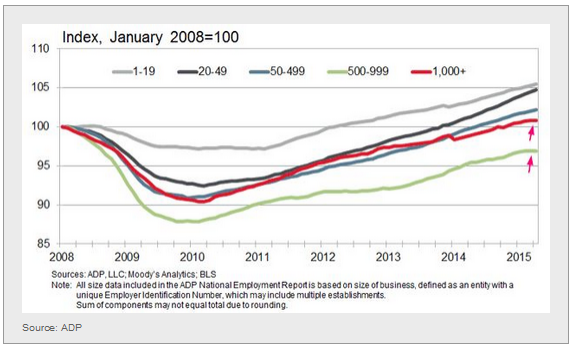

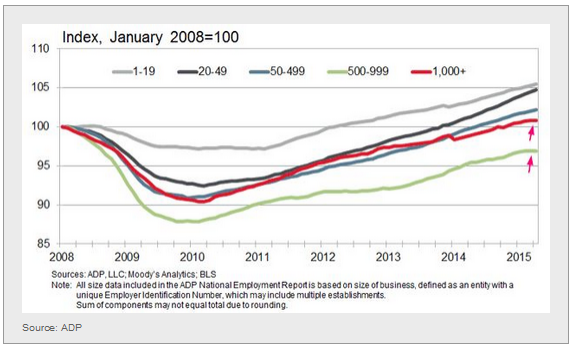

3. Moreover, ADP data shows payrolls growth for large and middle market firms stalling as small business remains the backbone of the US economy.

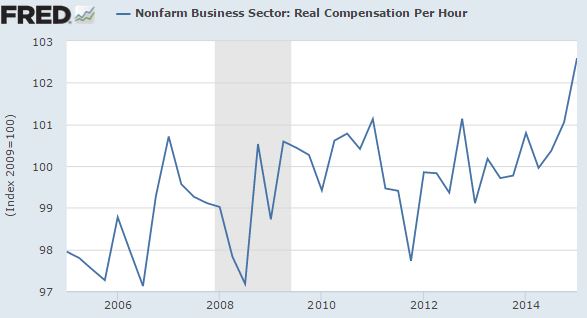

Some are pointing to stronger real compensation as evidence for tighter labor markets (chart below). But one must keep in mind that nominal wage growth remains at 2% per year and this increase was due to unusually low inflation. If inflation picks up again, real wages are likely to decline.

Chart

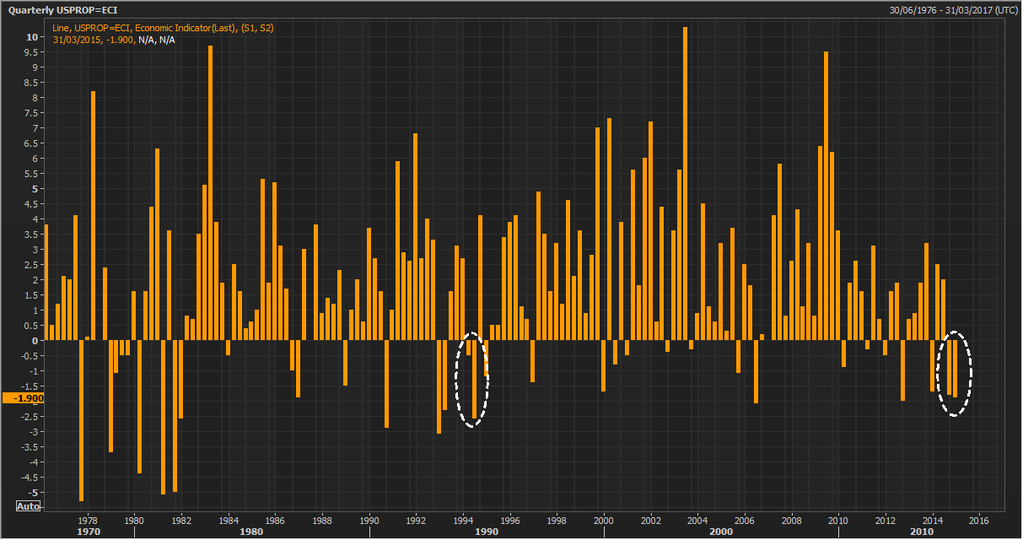

| US productivity fell for two consecutive quarters - something we haven't seen in over 20 years. |

|

|

| Source: @ReutersJamie |

|

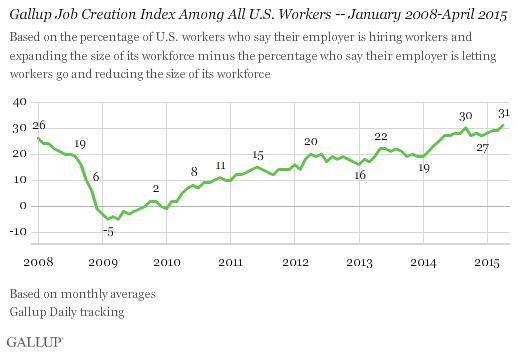

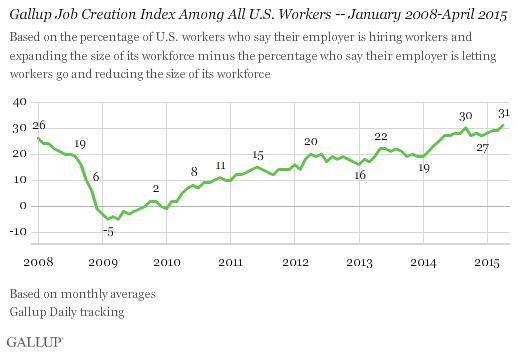

| There was one surprisingly positive report. The Gallup U.S. Job Creation Index reached a new high. This is definitely worth watching closer. |

|

|

| Source: @GallupNews |

|

| Janet Yellen has been prepping the markets for rate hikes. She brought up overvalued shares, tight HY spreads and in particular low term premium. The Fed is trying to avoid another "taper tantrum". |

|

| Reuters: - “When the Fed decides it’s time to begin raising rates, these term premiums could move up and we could see a sharp jump in long-term rates. So we’re trying to ... communicate as clearly about our monetary policy so we don’t take markets by surprise,” she said. |

|

|

Now let's revisit the continuing government bond market rout around the world. It's amazing to see this global crowded trade being rapidly unwound.

1. The yield is now back above 3% - in spite of the soft ADP report. |

|

| In fact, a popular long-term treasury ETF called ARCA: is getting destroyed. |

|

|

| Source: barchart |

|

|

| Source: Investing.com |

|

| And the yield turned positive - an impressive reversal. |

|

|

| Source: Investing.com |

|

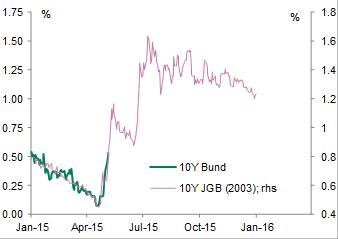

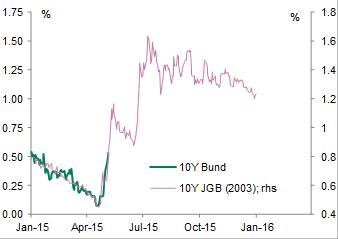

| Some are suggesting that Bunds are undergoing the same type of correction we saw with JGBs in 2003. Unlikely, given the limited amounts of paper issued vs. what the ECB (via Bundesbank) is buying. |

|

|

| Source: @fwred |

|

Let's take a look at a couple developments in China.

1. The is down 3 days in a row. My guess is many of these investors are so new, they haven't seen this type of correction before. But no worries, there are too many other new investors ready to plow all their savings into this. |

|

|

| Source: Investing.com |

|

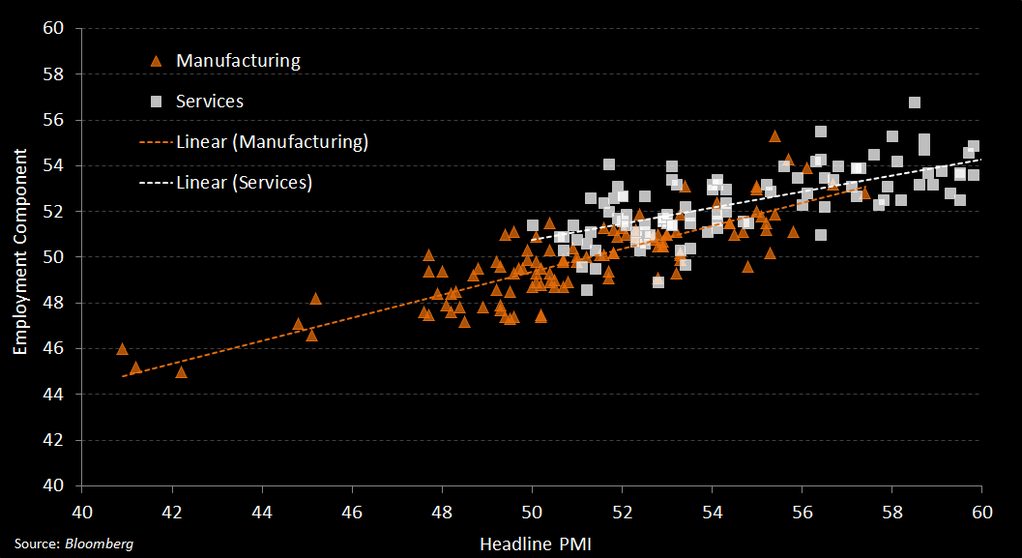

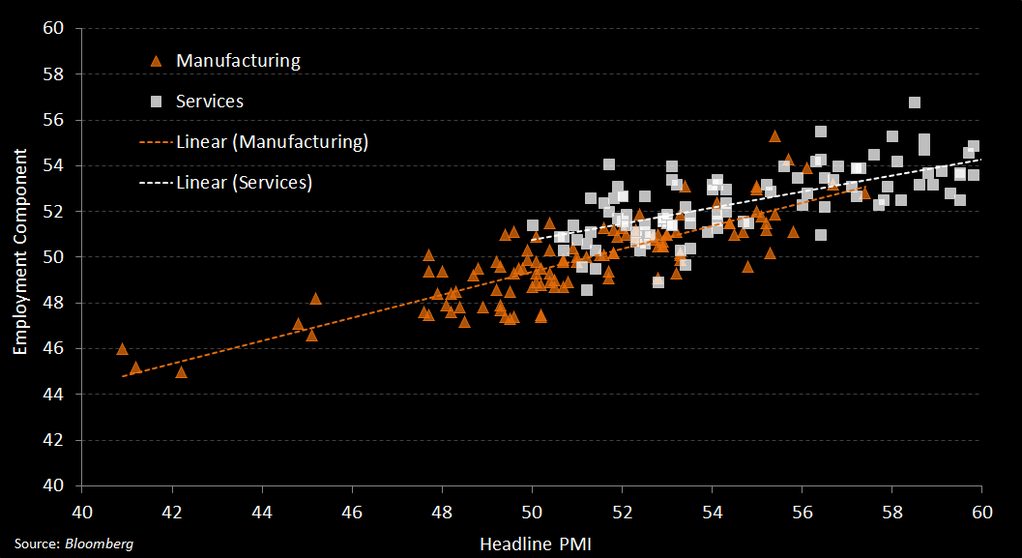

| 2. Here is why China is looking to expand its services sector. Service sector jobs are less vulnerable to a slowdown than manufacturing jobs. Take a look at the slopes in the chart below. |

|

|

| Source: @TomOrlik |

|

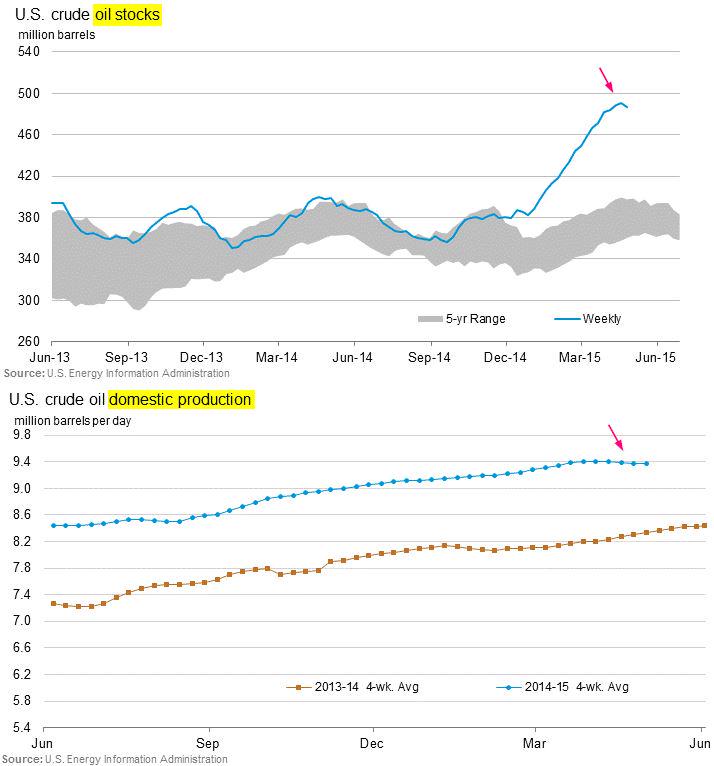

| In the energy markets, is up nearly 40% from the lows. US inventories declined last week and production remains flat. |

|

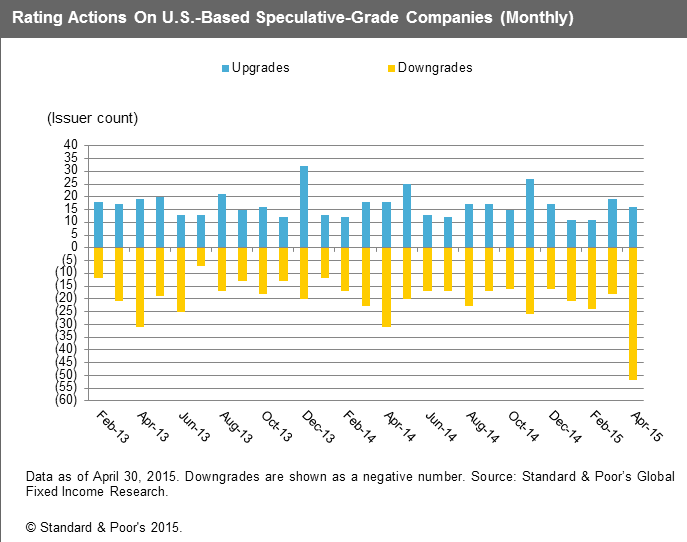

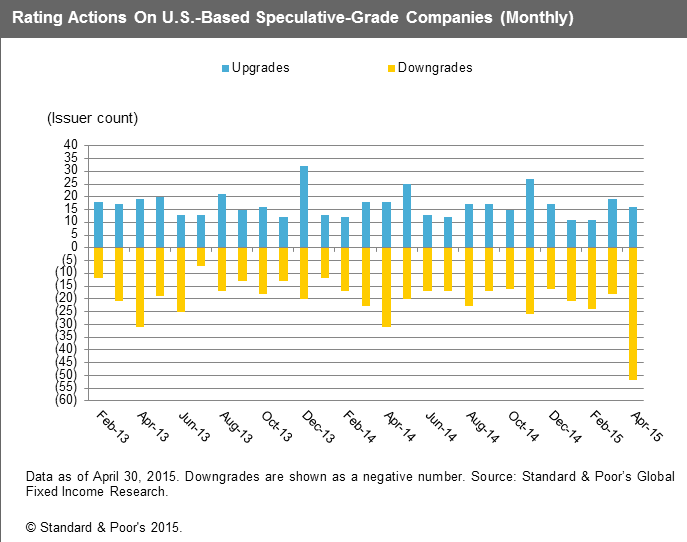

| Related to the above, it's worth noting that downgraded 52 HY companies last month - mostly energy firms. This is the most since June 2009. |

|

|

| Source: @RobinWigg |

|

Now some food for thought - 4 items:

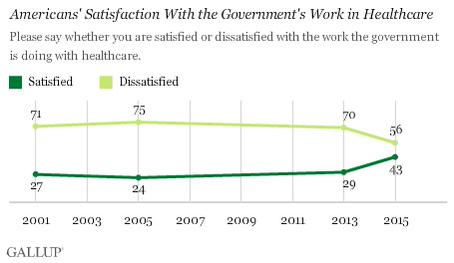

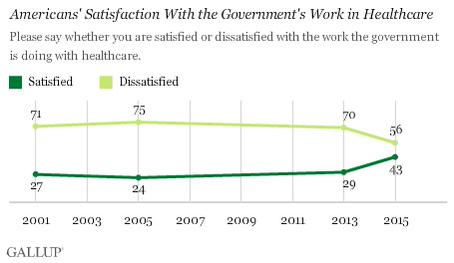

1. More Americans like the government's handling of healthcare. |

|

|

| Source: @GallupNews |

|

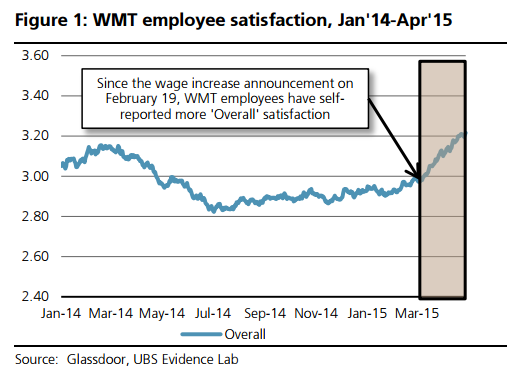

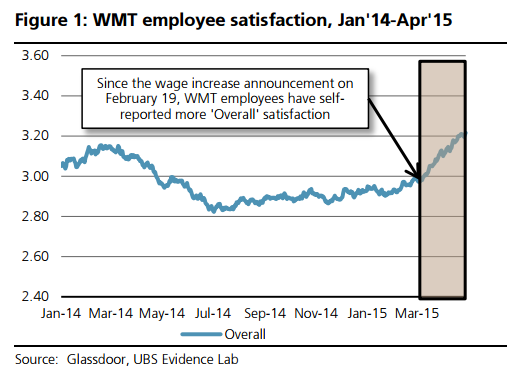

| 2. It's amazing how a raise can improve employee satisfaction ("WMT" is Wal-Mart (NYSE:)). Who could have guessed? |

|

|

| Source: @NickatFP |

|

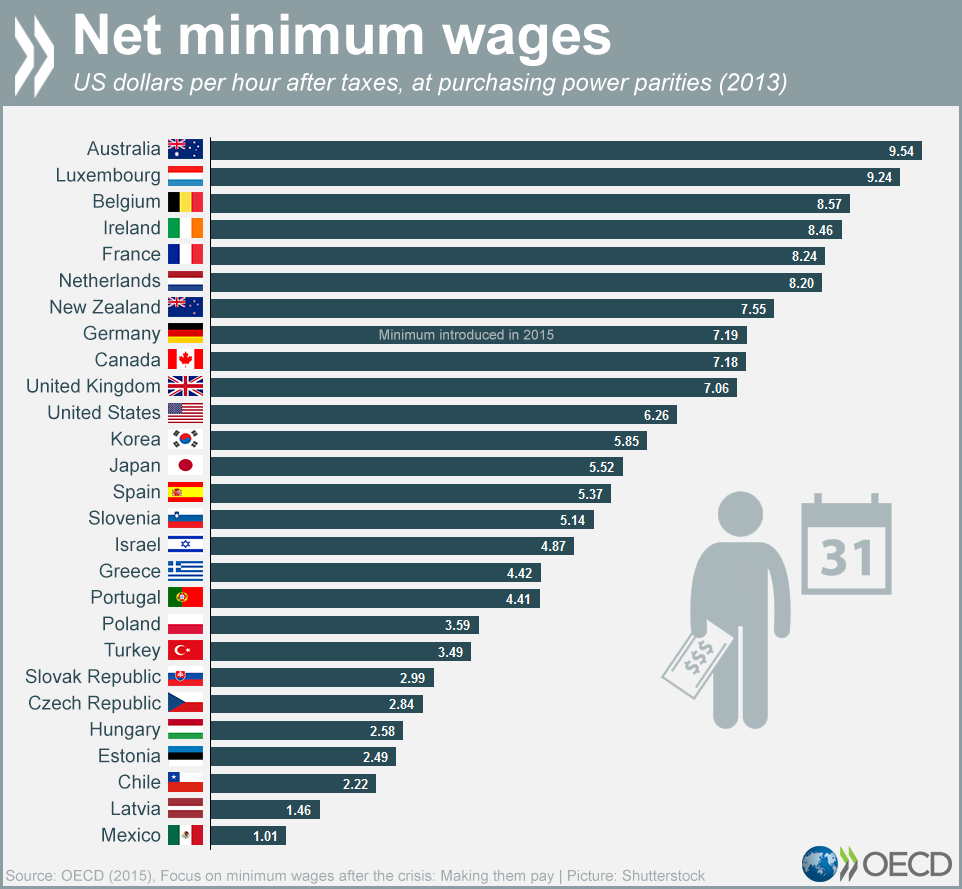

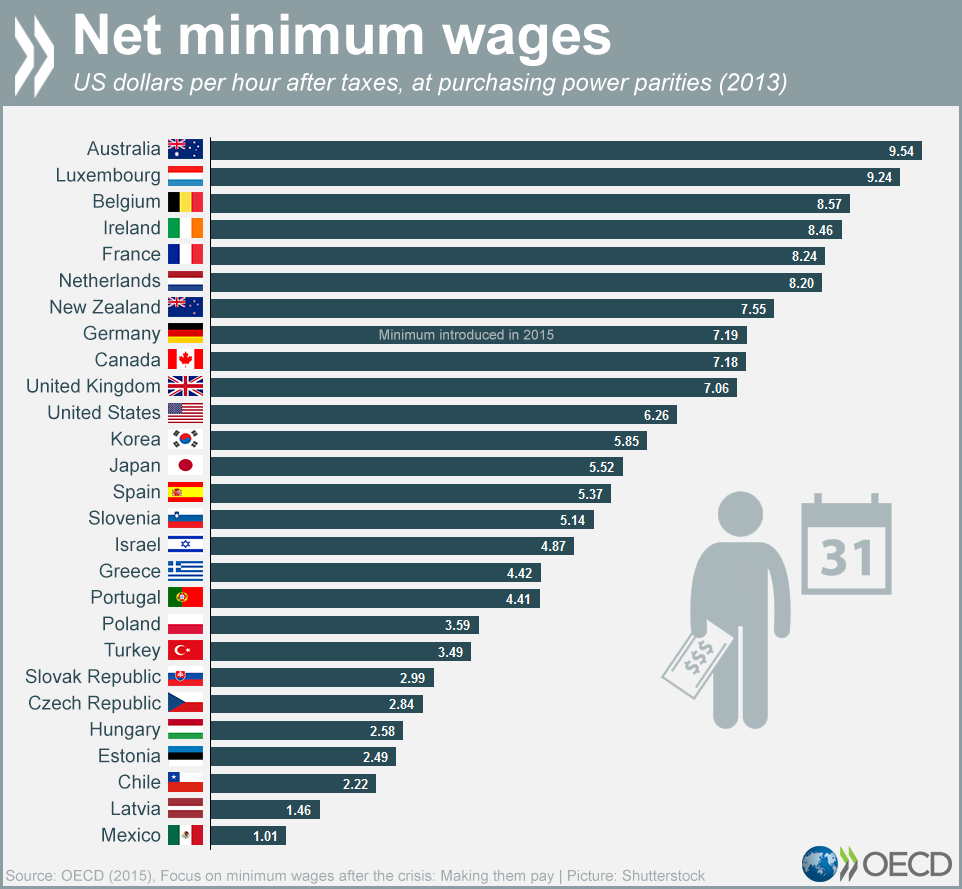

| 3. Ater-tax minimum wage by country. |

|

|

| Source: @OECD |

|

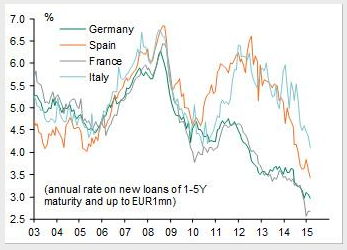

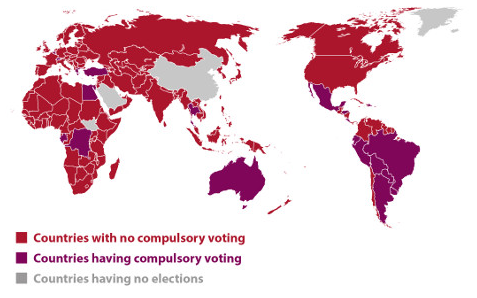

| 4. Countries with compulsory voting laws. |

|

|

| Source: @conradhackett |

|