Any good-will to risk assets on Friday has faded through Asia, and there the preservation of capital is the overriding theme, although there is absolutely no panic. The market was clearly wrong-footed during the many months where the narrative was that trade talks were progressing and a deal was imminent. Although the fact central banks are far more flexible than in Q4, when many were signalling tighter monetary policies, seems to be curbing the upside in implied volatility here.

What we are witnessing now can be only described as a schmozzle, with the war of words heating up from both camps and media. Trump detailing that we are here as China walked away, going onto say, "I think that China felt they were being beaten so badly in the recent negotiation that they may as well wait around for the next election, 2020, to see if they could get lucky & have a Democrat win." Punchy stuff and that would have been aimed squarely at VC Liu He et al., and the psychology that there is no middle ground here and that one party will win, the other loses – and, this is how it is being sold to the voters.

At the same time, the China People Daily have joined the Global Times with defiant rhetoric, with calls that the ”US OBSTRUCTS PROGRESS ON BILATERAL TRADE TALKS”. There would be little doubt that sentiment in the mainland would be moving against the US here, and markets will feed off this.

The fact Vice Premier Liu He has provided three conditions required for China to come back to the table could be construed as positive, and we understand Xi and Trump will meet at the June G20 meeting in Osako, a stage they have form, where the prior trade truce was forged in the November G20 meeting in Argentina. That said, if we consider the three criteria (detailed by Liu He), these being; the removal of additional tariffs, a balanced tone in the narrative to ensure the ‘dignity’ of both nations, and defined targets on Chinese purchases, it actually feels as though we are moving further away from these criteria, not closer.

The focus now falls on any countermeasures from the Chinese and also any specifics around the placement of 25% tariffs on the $325b tranche of Chinese exports. This will mark an escalation of the tensions, with economists having spent the weekend giving their modelling around the sensitivity of each tranche of tariffs on Chinese and US growth, as well as the impact it will have on US core inflation. It doesn’t make encouraging reading. Protectionism and the impact that can have on demand can be hard to model, and it feels that with these dynamics in play the market will further de-risk, with traders wanting a return of their equity, as opposed to on their equity.

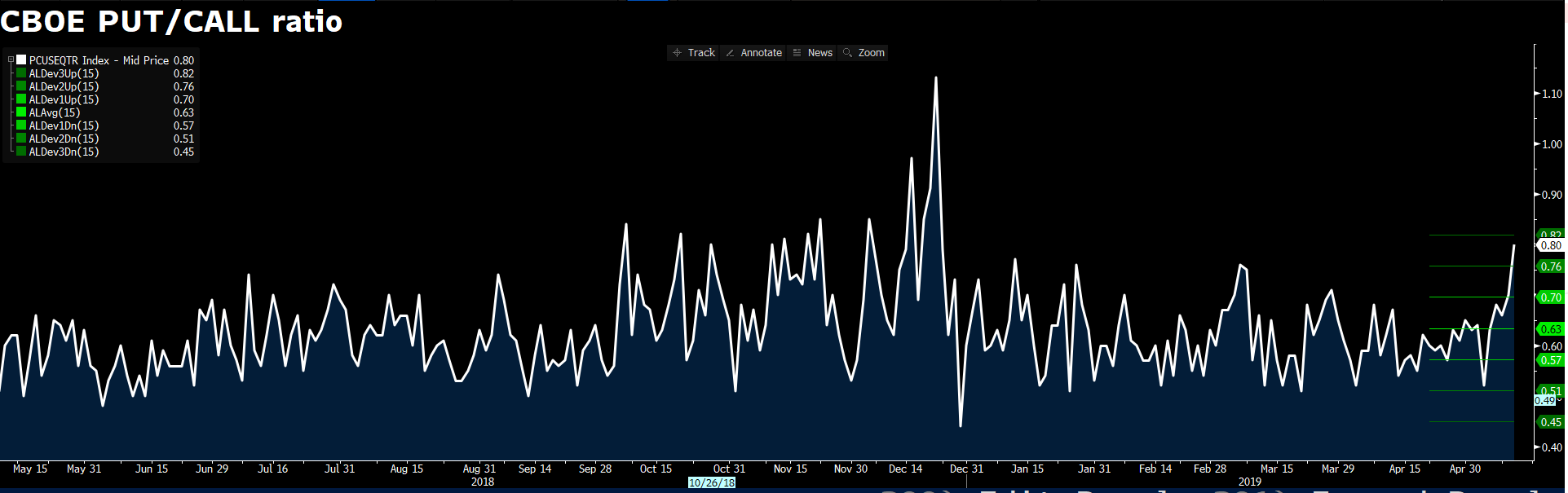

One way we can visualise this is through the demand for put options (on the S&P 500) outweighing that of calls, with the skew now at the highest since 24 December. One could argue this is a contrarian indicator, but I am not so sure this time around and reflects a view that traders see the path of least resistance in US equities as lower.

In fact, if I look around the traps, I see S&P 500 and Nasdaq futures lower by 1% and 1.2% respectively, with the US 5-year Treasury -4bp, US crude 0.2% and the JPY finding buyers against all G10 currencies. I focused on the weekly of the S&P 500 (US500) last week, and there is little doubt the set-up looks progressively bearish. Tactically, the best time to be short of any asset is when the buyers have growing reasons to be concerned and little in the way of answers to inspire. That is the case now, and if we marry this move with the fact that some of the key hedge funds players will have to further liquidate this week, then there are enough reasons to feel the US indices go lower.

From a price point, the fact we see the S&P 500 tracking below the 7 May low of 2862 seems important. As we saw on both Thursday and Friday, the buyers defended this low, so a daily close below here would suggest increasing conviction on shorts on US equities.

Chinese equities had a solid day on Friday, but are giving some of this back in early trade (the CSI 300 is currently -1.1%), although this is a hard market to short as local authorities are instructing funds to buy stocks and that seems to limit much of the volatility. USD/CNH is gaining a punchy 0.7% and now trending beautifully, and it seems a matter of time before we see 6.90 coming into play. The cross would be higher if the PBoC had aggressively moved the mid-point of USD/CNY higher in its daily ‘fix’ at 11:15 aest, but for the second day in a row, the fix came in lower than estimates. This calmed some fears China was about to embark on a sizeable near-term devaluation of the currency, but how they intend to come back at the US is still the subject of much debate, although it will have to be measured and highly tactical, so as to not completely derail what little scraps that can be salvaged here.

One to watch, as the USD/CNH cross is putting further pressure on the AUD, with AUD/USD near session lows at 0.6978 and AUD/JPY looking like it wants to break 79.50 – I will happily follow this pair lower, closing on a daily close above the 5-day EMA. Poor Aussie (March) housing credit data won’t have helped sentiment towards the AUD either, with total loans -2.7%. There has been a small bid in Aussie bonds, with the 3-year -1bp to 1.26%, and in the rates markets, the implied probability of a June rate cut (from the RBA) has increased to 33%. While it’s US-China trade talks that are dominating, Thursday’s Aussie jobs report could easily affect rates pricing and should the unemployment rate tick up to 5.1% then I’d imagine we will see the prospect of a June cut closer to 50%.

I looked at USD/CHF last week and suggested longs should the pair kick on, and that hasn’t played out, with price rolling over, and we have seen horizontal support giving way. I am eyeing a short position here, with stops set should price close above the 5-day EMA. I will keep position sizing small and look to add on a move through 1.0066.