With the Dow down over three thousand points from its bull market peak, there is naturally a lot of chatter about how far the market is going to fall. You already know how wildly bearish I am, but let me temporarily leap to the other side and share some charts which argue for a bounce at these levels.

First up is the SPDR S&P 500 (NYSE:SPY), the biggest ETF in the world, which is coming right upon the same trendline that offered support on February 9th before a gigantic reversal. Take note also how this trendline was the support trendline when the market was trapped in a channel for months.

The Dow Industrials trendline, by way of the SPDR Dow Jones Industrial Average (NYSE:DIA), goes back even farther. This is the first time in years we’ve approached this major supporting line.

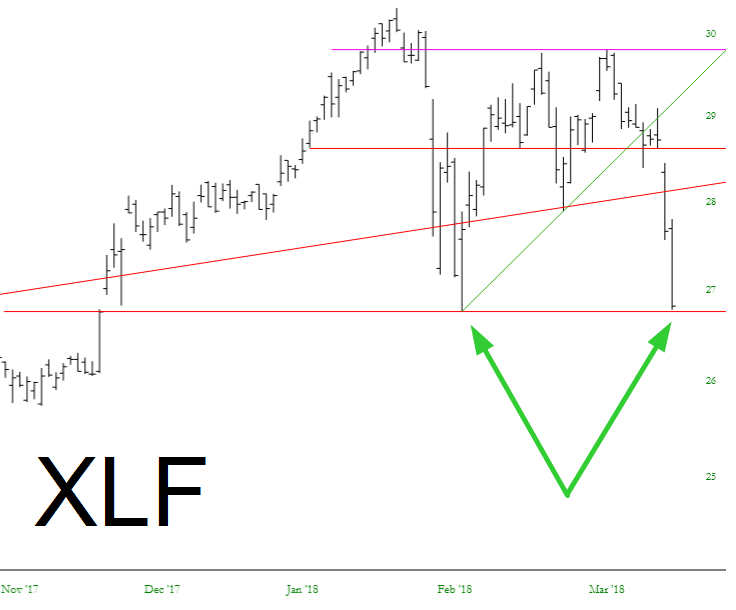

Financials (NYSE:XLF), having taken a beating recently, are approaching their own “February 9th” level, which could constitute a double bottom.

And, obliquely related, the commodities (NYSE:DBC) look to be complete a cup with handle formation, preceding a bullish breakout.

At this point, it’s really all about those February 9th lows. Take those out, and all holy hell is going to break loose. As always, I am managing my positions on a case-by-case basis, letting their own individual stops handle themselves and make decisions in my behalf.