Speaking of lean years, it took the NASDAQ stock market index almost 17 years to recover its March 2000 high of 5,048.

The core skill going forward--frugality--is largely a forgotten skill set. So let's examine frugality.

Conspicuous waste is part and parcel of conspicuous consumption, which is a signifier of wealth and status. The more one wastes, the higher the status, as waste implies "I'm so rich, I can waste as much as I want."

This reach for status by consuming (and wasting) more is the engine of the waste is growth Landfill Economy.

In good times, when jobs, stock market/real estate gains and credit are all plentiful, even those with average income earn enough to waste money, food, etc. Even though we complain about the high cost of food now, there is little evidence that we're no longer wasting up to 40% of the food we buy/order out.

In a deep, prolonged recession, jobs, capital gains and credit become scarce, and so we have less to spend, and so frugality--eliminating waste and superfluous spending--is either incentivized or forced by necessity: forced frugality. TINA is the first source of frugality: there is no alternative.

(So you wanna be a writer? First take a vow of extreme poverty/frugality.)

Frugality has another source: the desire to save income to invest in long-term goals via careful planning. It's well established that the difference between "rich" and "poor" in middle-income brackets is deferred gratification, the ability to defer consumption today (instant gratification) to serve long-range goals, such as buying a house or saving for a child's education.

A third source of frugality is genetics. Some of us are naturally frugal by nature, others naturally profligate. What others consider normal--throwing out the leftover rice in the pot because eating leftovers is for poor people--is absolute anathema to us.

Others mock those of us who save plastic bags and rubber bands, while for us it's second nature: why throw something away that can be re-used? We save random screws in a jar (a real treasure for handy people), smoothed-out wrapping paper and scraps of wood. Composting kitchen waste is second nature. And so on. (You want to see my collections of stubby pencils, extra screws and plastic bags?)

Cultural values are another source of frugality. It's common for the third generation to remark on the extreme frugality of their grandparents from The Old Country, with the implication that poverty-induced frugality no longer makes sense in The Land of Plenty.

A fifth source of frugality is ideological/ethical: 1) waste is a sin, and 2) wasting one's income enslaves one to the grindstone of the debt-serf / wage slave status quo. From this perspective, frugality is necessary to be free.

As I've noted in previous essays, frugality and self-reliance were core tenets of the Counterculture of the 1960s and 70s. Yes, sex, drugs and rock-n-roll received the wide-eyed, sensationalist media coverage, but escaping servitude to The Establishment by learning how to do things for oneself and being frugal were core to the Counterculture. I discussed this in Access to Tools, Tools for Living: 50 Years of Forgetting https://charleshughsmith.substack.com/p/access-to-tools-tools-for-living

The book How To Live On Nothing by Joan Ranson Shortney sold thousands of copies in the 1960s and 70s. (You can find a used copy on eBay (NASDAQ:EBAY)). It makes for interesting reading now because its entire point of view and value system is so alien to the present-day zeitgeist, which we can describe thusly: 100,000 smart, well-paid people are working feverishly every day to break down our deferred gratification and persuade us to impulse-buy something at full price.

Another 100,000 smart, well-paid people are working feverishly every day to trigger our innate desire to enhance our status with a costly signifier of consumption that we can brag about on social media: look at me!

An even larger army of smart, well-paid people are working feverishly every day to make us believe that "buying now" will "save us money" because "this deal won't last."

Frugality and consumption are relative, of course. If you've been living in a pup tent in a field without running water or electricity for weeks (as we did), then moving into a plywood shack (ahem, a micro-home) you built with hand tools is the acme of luxurious living: life is good, and looking up.

If you've been evicted from your foreclosed mansion on the golf course and are offered a plywood micro-home as your replacement living arrangement, your reaction will be considerably different.

In the old days, eating out was a luxury reserved for birthdays or the once-a-year family vacation. Fast food, snacks or a soda were luxuries enjoyed a few times a year. Now we consider eating out multiple times a week as a birthright, and giving that up a hardship that's beyond bearing.

What is frugality? We can start with a simple dictum: waste nothing. Food costs less when none is wasted.

We can then ask: what is the bare minimum we need to survive? Those struggling with everyday life in the wake of Hurricane Helene offer an object lesson to the rest of us. Frugality is both stripping life of non-essentials and also making sure we have the real essentials on hand. This takes planning and preparation.

Another useful question: what expenses can I eliminate as the means to meet larger goals?

A related question: what can I learn to do for myself so I don't have to pay someone else to do it for me?

What is the point of frugality? Is it all about saving money? Or is it really about freedom from the invisible shackles of conspicuous consumption and a burdensome sense of entitlement? Or is it about the confidence of knowing how to do a great many things, and knowing we can get by on much less?

Perhaps it's also about authenticity. There's something artificial about relying on conspicuous consumption for one's identity and sense of self. No longer caring makes one "poor" in appearance but rich in invisible ways.

I don't think frugality is about not spending money per se. It's about focusing on building a foundation we own, control and maintain of life's essentials, a sense of self disconnected from consumption and freedom from want, debt and servitude.

Frugality is a value system, a lens to view the world and a set of skills that become increasingly valuable should the good times fade and the seven lean years begin. I discuss this in my book Self-Reliance in the 21st Century.

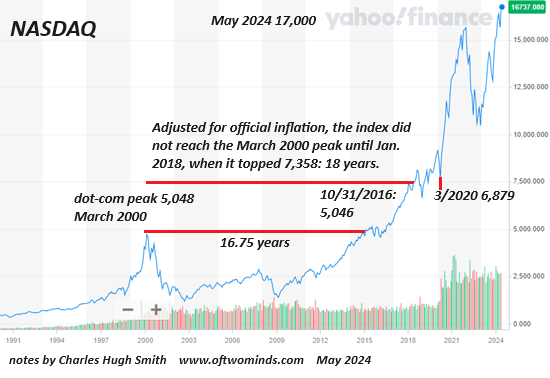

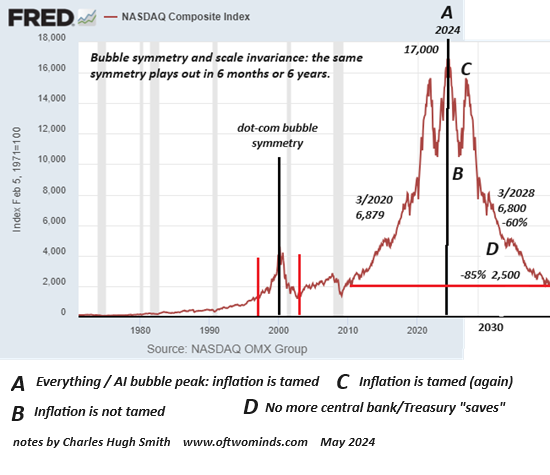

Speaking of lean years, it took the NASDAQ stock market index almost 17 years to recover its March 2000 high of 5,048. That high wasn't reached until October 31, 2016. Adjusted for official inflation (i.e. lower than real-world inflation), the index needed to top 7,358, a level not reached until January 2018--18 long years after its euphoric bubble peak in the dot-com era (AI! Oops, sorry, that's today's euphoric bubble.)

Bubble symmetry suggests a retrace of the current NASDAQ might finally hit bottom around 2032, seven long years ahead. Yes, yes, this is "impossible," as the Federal Reserve will never let it happen, but the Fed was very active in 2000 to 2003, and the NASDAQ still lost 80% of its value.

Perhaps we should add a sixth source of frugality: the evaporation of all the phantom wealth inflated in speculative credit-asset bubbles.