Stocks continue to roll, for how much longer and how much further is the question on everyone’s mind. The S&P 500 set a new intraday record rising above 2,940.

S&P 500 (SPY)

The S&P 500 continues to rise in a friendly channel at this point. I’m not sure what’s going to keep it from rising further. I have shown you all the charts and all the data points. I know markets don’t rise in a straight line, but for now, I do not see any clues to suggests otherwise, at least not in the short-term.

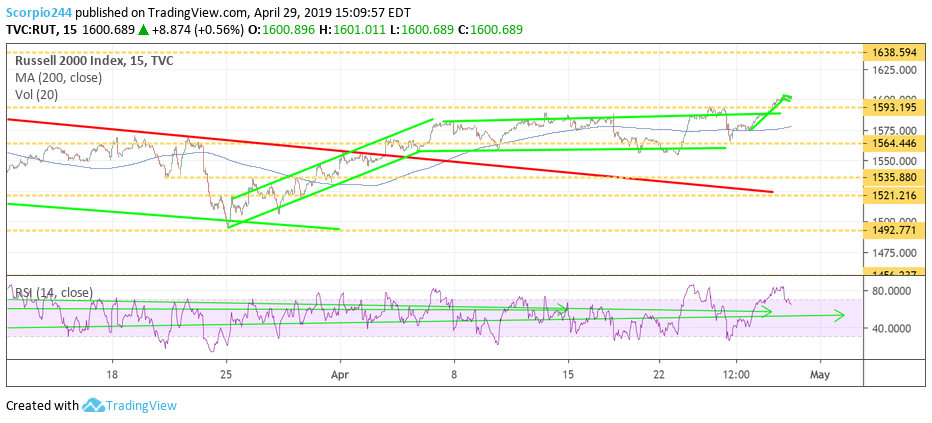

Russell 2000 (IWM)

The Russell appears to have broken out rising above 1,594, and then 1,600. I think that sends the Russell up to around 1,640.

Financials (XLF)

The financials continue to rise, and the XLF is breaking out and maybe running higher towards $28.75. I’m thinking that perhaps the financials are sending us a message about an improving economy.

Bank of America (BAC)

BAC may be on is its way to $31.85.

Apple (AAPL)

Apple Inc (NASDAQ:AAPL) reports results tomorrow at the end of the day, and the chart continues to look very strong, with the potential for a break out above $209. There may be a rising triangle pattern forming. It today’s video, I talk about how Apple is becoming a consumer products company, and it’s about more than just services, and how it may lead to multiple expansion.

Intel (INTC)

Intel Corporation (NASDAQ:INTC)’s problems continue with the stock falling below support at $52.50. I had hoped there’d be a bounce today –wrong. Now the next level of support doesn’t come until $50.60.

Netflix (NFLX)

Netflix Inc (NASDAQ:NFLX) continues to flirt with a breakout but seems to be stuck in this slow grind higher. $378 is still posing as a problem for the stock.

Mastercard (MA)

Mastercard Inc (NYSE:MA) continues to grind higher, and the company reports results tomorrow before the open. The stock appears to have a date at $253.

Facebook (FB)

Facebook Inc (NASDAQ:FB) is testing resistance at $194; it could lead to a move towards $204.

Disclaimer: Michael Kramer owns IWM calls.