Time to put up or shut up for bulls and bears as we enter the final 2 months of the year and with the US election just a few days away.

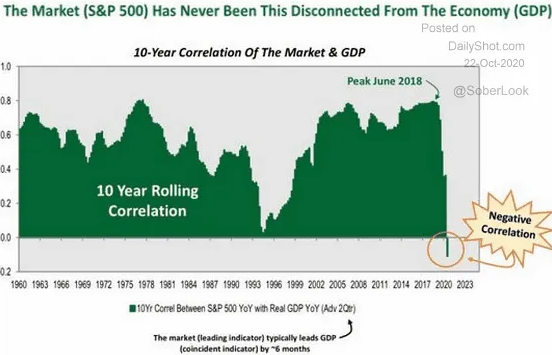

As traders are watching the ongoing stimulus headline drama unfolding the bull case may be rather obvious but worth highlighting in the charts. At a time when valuations no longer seem to matter and most of traditional correlations lay in ruins due to unprecedented interventions by central banks the bull case is the obvious one: Get more stimulus and markets will rally higher once again.

After all, and it must be acknowledged, the intervention has so far once again worked in 2020, indeed interventions have created the largest break in correlation between the economy and market prices ever:

And indeed, all corrections since the March lows have found steady support on retests and have engaged in a series of higher lows.

So if nothing matters and more stimulus is to come the bull case then counts on historic distortions to continue unabated.

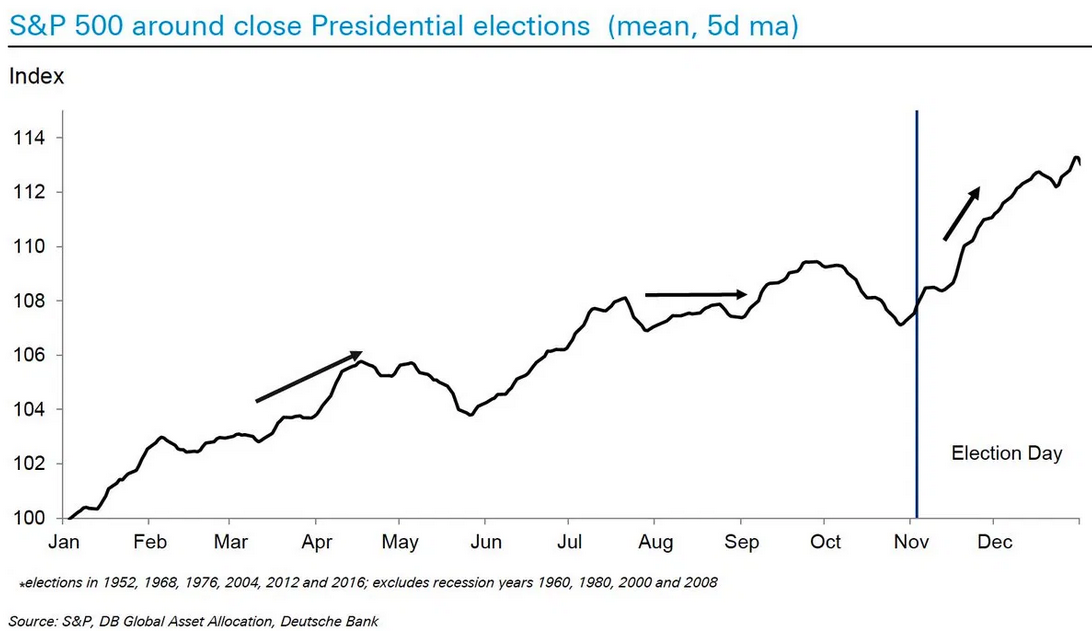

And there is a standard seasonal script in favor of bulls into year end, that of the presidential election year kind:

In context the current chop and weakness since the September peak is fitting perfectly with that seasonal script..

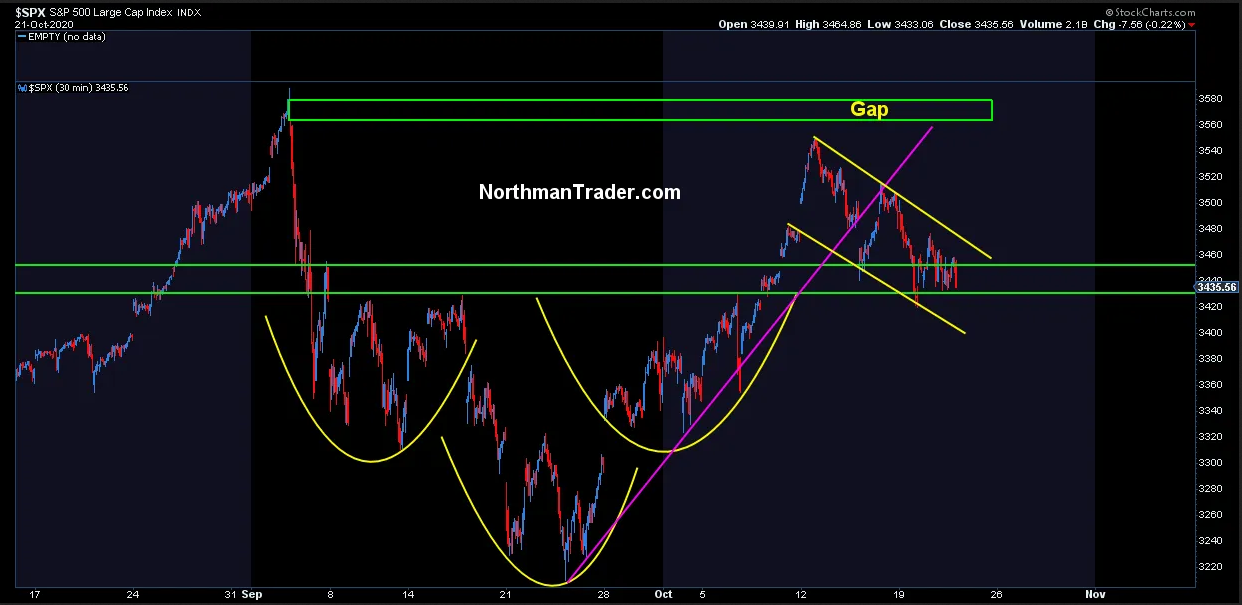

And speaking technically now, the bullish pattern I highlighted in my recent videos have not been invalidated despite several downdrafts this week.

For reference the pattern I mentioned again last Friday:

And now with several more days of price action under their belt this pattern continues to defend the backtest of the neckline and is sporting a potential bull flag to boot, see NDX and SPX charts below:

So yea, get more stimulus or the belief in more stimulus and these charts are primed for a rip.

Even last night’s further drop in futures found perfect support at the bottom of the flag on the futures chart:

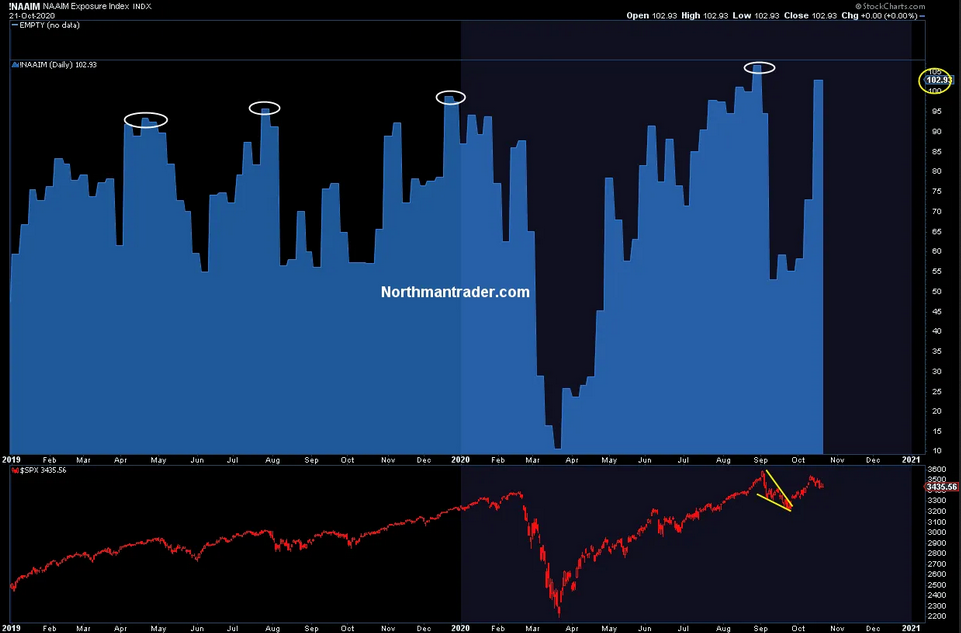

So yes, the bullish case is obvious and apparently very much embraced by participants as asset managers have again loaded fully long:

For bears the challenge is clear: Invalidate these patterns and fast for the potential dollar cup and handle pattern is teetering at the brink of extinction as markets continue to expect more stimulus:

Perhaps of note here is that bulls have not been able to take advantage of this renewed weakness in the dollar and that could prove to be an important divergence.

Why? Because, for one, these bullish patterns, while not invalidated, have yet to validate themselves.

And the VIX? Well, oddly enough it keeps staying in its potential very bullish structure having defended the breakout out of its consolidation pattern several times this week:

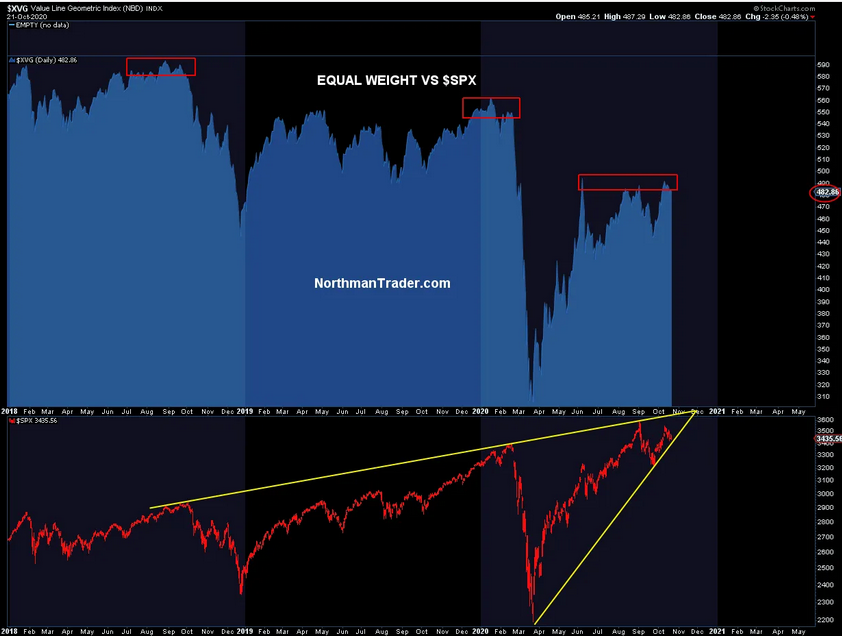

The battle line for control in all of this? Perhaps equal weight and the tightening price structure in SPX:

Bulls need to break above equal weight resistance and bears need to prevent the breakout.

The battle zone for control is inside the SPX pattern structure above. Upside risk per the inverse pattern outlined is into 3650 and the upper trend line.

So you see, the next few hours, days and weeks are be key for all this and the time is rapidly approaching for bulls and bears to put up or shut up.

The bear case? We can visit that one once/if the patterns outlined above are invalidated, but know the downside risks are vast and if $VIX maintains its structure the bear case may come in a hurry, but at the time of this writing bulls are maintaining control with a razor thin margin above $SPX 3400-3430.