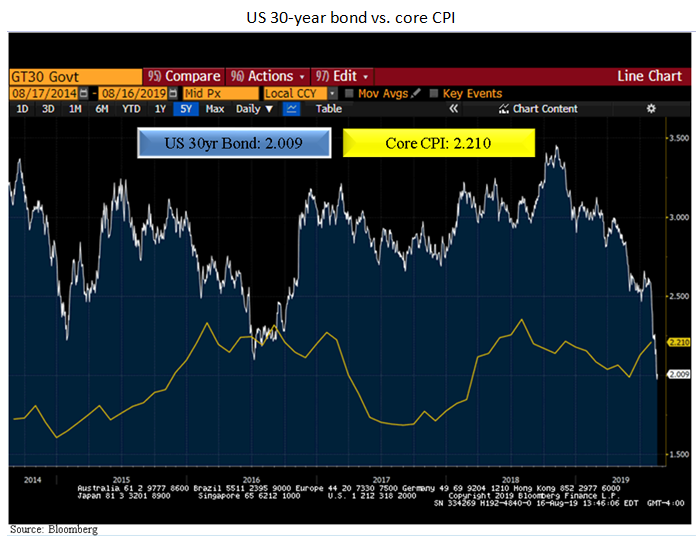

The past couple of weeks have been breathtaking for bond investors and observers of the bond market. The yield on the 30-year Treasury bond is now at a record low—it dipped under 2% this week— and the 10-year Treasury is not far off its record low of 1.36% set in July 2016, the yield now sits at 1.53%. With a little more than two weeks gone in August, we have seen the 10-year drop 47 basis points and the 30-year 53 basis points. This is more movement in two weeks than we sometimes see in six months.

There are many crosscurrents here. Most pundits are using the inversion of the yield curve as a forecast of a slowdown. But as we have noted in other pieces, economic slowdowns are far from synchronous with inversions. Growth continued for a year and a half after the yield curve inverted in 2006.

Looking at recent economic data, it’s pretty hard to find the slowdown:

- Retail sales advanced 0.7% month-over-month in July, versus an expectation of 0.3%.

- The Empire Manufacturing Index (New York survey of business conditions) advanced 4.8% versus an expectation of 2.0%.

- Core CPI is 2.2 % over the trailing 12-month level—right where it was at the end of December when the 10-year bond yield stood at 2.685% and the 30-year bond yield was 3.01%.

- Second-quarter nonfarm productivity is at 2.3% vs. a 1.4% expectation.

This does not look like an economy that is rolling over. Nor is it.

This is a bond market that has been buffeted by a number of factors that are not U.S.-related.

Europe is mired in negative interest rates. The wisdom of having negative interest is strongly debated. One thing that is pretty clear to us is that negative rates have not helped the European banking system, and negative rates here do not help U.S. banks, either—witness how poorly financials have done since the Federal Reserve changed its tune towards the end of last year.

The slowdown in China has pushed the yuan lower, and China’s growth rate has dropped. This has contributed to the rush into Treasuries. But we think there may be more playing out here, and it is symbolized by the protests in Hong Kong in recent weeks. Coming on top of the slowdown in Mainland China, the protests may herald the beginning of new freedom movements that the Chinese government will struggle to contend with.

How to manage bond assets

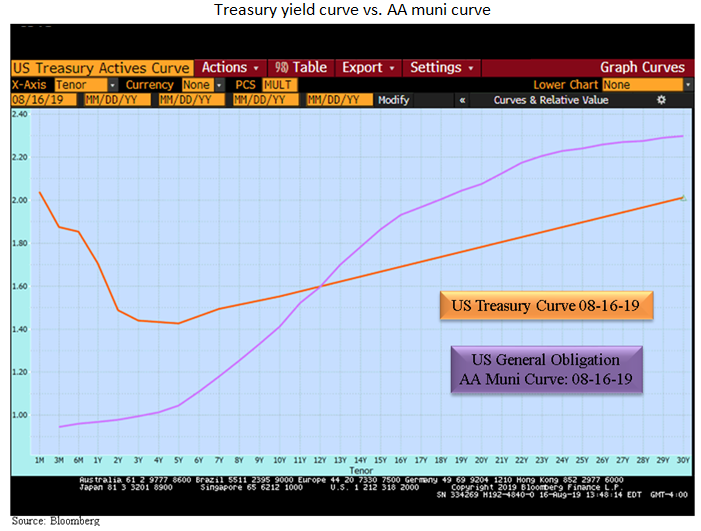

We continue to manage Cumberland total-return bond assets in a barbell method, accenting both shorter-term securities for liquidity and longer-term bonds to lock in yields, with what have been non-Treasury securities in the taxable world and longer tax-free bonds in munis. Indeed, with the fast rush down in Treasury yields, longer-dated munis, though at historical lows, offer value when you can get 3% higher grade in a world where long Treasuries are at 2%.

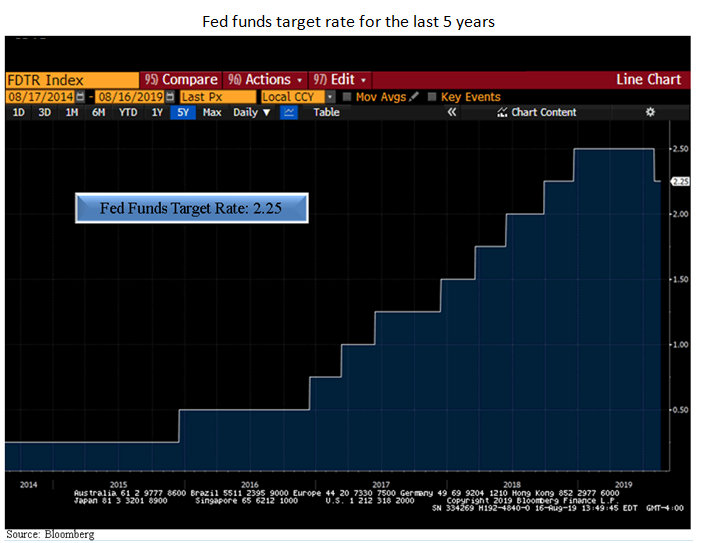

We will take our chances with 160% yield ratios, knowing that defensiveness is built into the cheapness. The front end of the muni curve is VERY expensive relative to Treasuries, so even with a barbell and very low nominal yields, it’s been prudent to have exposure to the longer end of the market. The barbell strategy works less well when the Fed is at the end of a hiking cycle. We don’t believe the Fed is done yet: This is a pause in the Fed’s addressing the U.S. economy. For all the change in talk from the Fed’s being on autopilot to now being data-dependent, the Fed has raised the Fed funds target by 25 basis points in December and lowered it by 25 basis points last meeting; so from a Fed funds target standpoint we are where we were last fall.

Equity markets are decently higher, and our economy continues to improve, yet the bond market has seen yields come down dramatically, in a manner that doesn’t square with U.S. data but is more sympathetic towards the slower growth in Europe and China.

The trade war and concerns about slow growth notwithstanding, the U.S. economy continues to do well. Our thoughts are that this race to the bottom in yields will slowly give way to a recognition that the U.S. economy is on firm ground; the force of higher wages will push inflation higher; and the Fed will resume—albeit slowly—addressing the U.S. economy. This is why Chairman Powell gave the markets a rate cut of only 25 bps last meeting though the markets were clamoring for 50.

Bond market yields here are high versus those in Europe, and that will keep a lid on things for a while. But the rush down has been overdone, in our opinion. My colleague David Kotok often likes to quote Herbert Stein, former chairman of the Council of Economic Advisers under Presidents Nixon and Ford. Stein’s commonsense “law” was that “If something cannot go on forever, it will stop.” We feel that’s true with long bond yields. The ride down in yields has helped portfolios. But backups can hurt, which is why we continue to get more defensive at the margin. The barbell is still in place.