This post was written exclusively for Investing.com

Labor Day not only brought the unofficial end of summer, but also, to some extent, the end of recession talk. However, a new fear may be about to take hold for investors, one that may be even worse, the fear of missing out. Because, in the blink of an eye, stock markets around the globe are rising above their August doldrums and advancing higher.

It may be premature, but with central banks like the Federal Reserve and the European Central Bank in easing mode, there may be hopes of a global economic recovery beginning to take hold. At least some sector rotation seems to be signaling that, and that means the recent stock rally may only be starting. Should these signs continue to develop, it could send equity markets higher into the year-end.

Nearing Its All-Time Highs

The S&P 500 rose above its August highs on Sept. 5. The index has continued to advance and is now once again challenging key levels of technical resistance at 3,015. Should it conquer that level, it could set up a sort of momentum rally that pushes the index on to new record highs.

Broad Based Rally

It seems that this last leg higher is coming on a stronger footing, with a rally that appears to be broadly based. Since Aug. 27, the small-cap Russell 2000 has risen by over 8%, compared with the S&P 500 gain of roughly 5%. Additionally, indices such as the Dow Jones Transportation, which has traded sideways since February, is now up about 10% over the same time period.

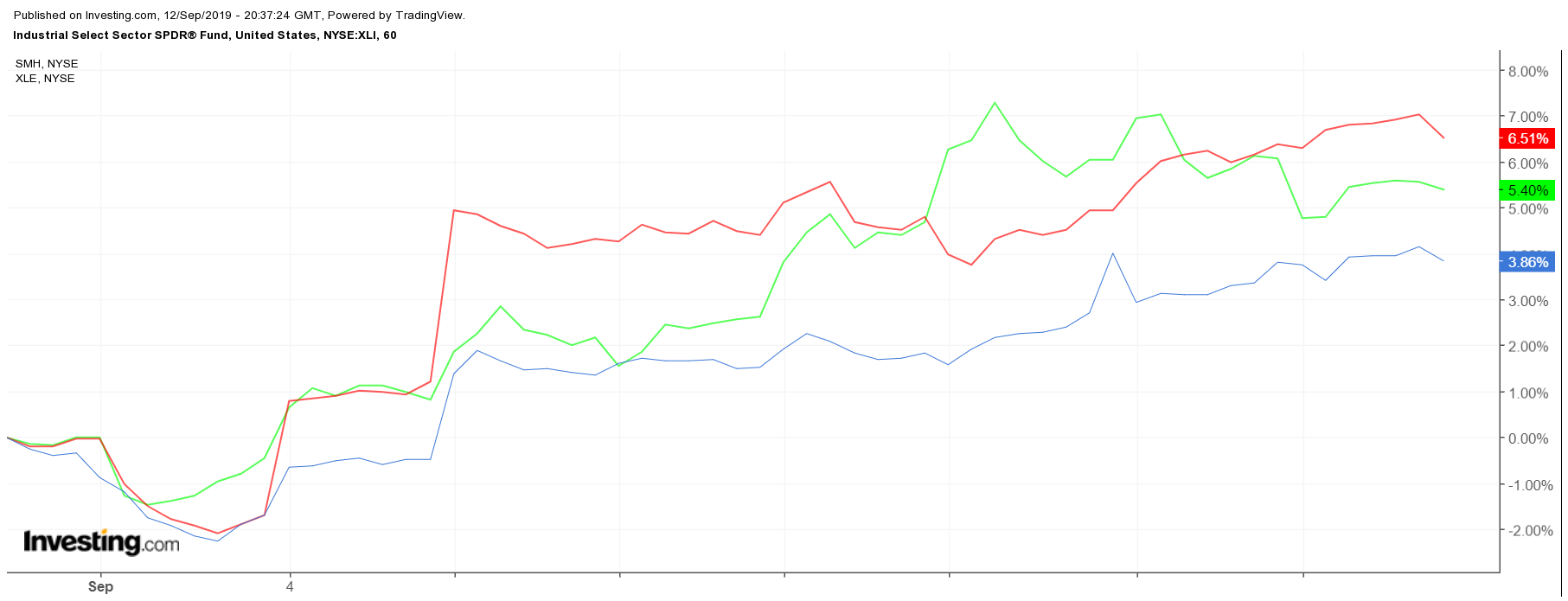

Also, some of the sectors that are performing the best in September carry a great amount of exposure to the economic cycle. The Semiconductors sector, as measured by the VanEck Vectors Semiconductor ETF (NYSE:SMH), is up about 6%; the Energy Sector, as measured by the Energy Select Sector SPDR (NYSE:XLE), is up approximately 5%; the economically sensitive Industrial stocks, as measured by the Industrial Select Sector SPDR (NYSE:XLI), is up roughly 4% — all sectors that are sensitive towards global growth.

Global Markets Are Rising

But more important is an improving landscape in global markets, like South Korea, with the KOSPI first climbing above its August highs on Sept. 4, crossing above a key level of resistance around 1,980. Now, the export-driven economy’s stock market just scaled above a multi-month downtrend which started in April. Even Germany has seen its DAX index rise by about 5% since the start of September. It is also nearing a technical break out that could send the German index higher.

What Recession, Some May Ask?

Together all these indications are suggesting that the specter of a recession in the U.S. may have receded. Even the dreaded yield curve inversion has vanished, with the spread between the 10-year and 2-year Treasury rates returning to more healthy levels. The recession gauge inverted to around -6 basis points at the end of August, and now it stands at a positive six basis points.

The Fear of Missing Out

Were the risk of recession to fade away and global growth re-emerge, based on the performance of some economically sensitive markets and sectors, investors' next big instinct will result in a fear trade of a new kind, the fear of missing out and an end-of-year rally.

Should that happen, then perhaps the U.S. equity markets could finally break out of this nearly two-year-long period of consolidation. This may mean that the next leg higher in the bull market may only just be starting. The next several weeks may tell a very powerful story.