Investing.com’s stocks of the week

Stocks were mixed Thursday, with the S&P 500 falling 20 bps and the NASDAQ 100 rising 20 bps. But it was worse than the number let on because the NASDAQ 100 had been up by over 1% on the day, only to give it all back. Meanwhile, the S&P 500 still has that giant gap to fill from the other day.

When looking around the market place, nothing is supporting this moving higher, and I’m not referring to fundamentals. Options betting remains bearish, and there have been very few bets building for higher prices on the S&P 500. Copper was smoked yesterday, falling by 3.3%, and below $2.80. The significant gains from the financials and industrial have vanished, and the XLK was up by just ten bps. Volume levels were low yesterday as well.

S&P 500

The SPX has been unable to push through resistance around 3,385 and is likely to fill that gap yesterday around 3,340 or so.

Additionally, the RSI in the SPX is now rolling over, and it could suggest a change in trend is here.

Nasdaq

The QQQ ETF, which tracks Nasdaq, rose to resistance at $275.50 and failed to push higher, not a good sign at all. The RSI is now clearly trending lower as well, and that is a negative sign as well.

Overall, the movement in the market seems to suggest it is completely worn out, buyers are exhausted, and a change in trend is not only coming but is likely here. I think it may be pretty much over for now. Copper is telling us the big run is over.

Junk bonds are telling us it is over.

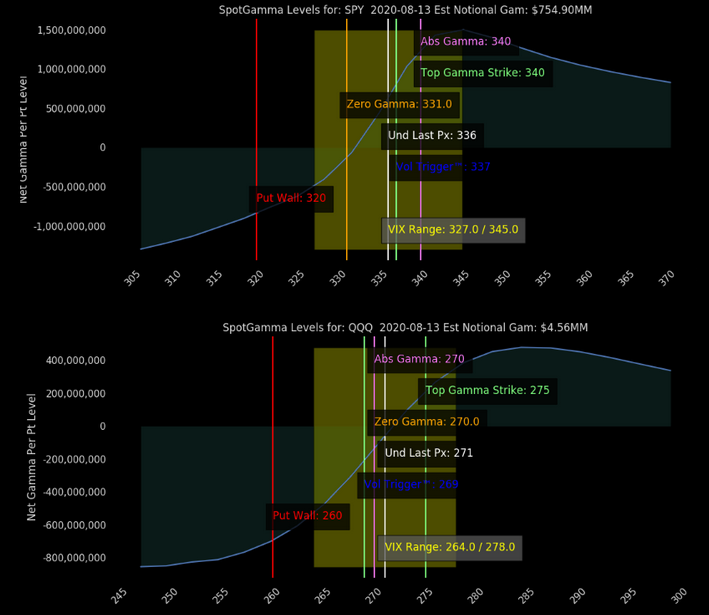

Even gamma levels are telling us it is about over. The high strike $340 level on the SPDR S&P 500 ETF (NYSE:SPY) has hardly moved higher since August 7’s, reading at $335. Meanwhile, QQQ hasn't seen its high gamma strike price rise above $275 since August 6. It means nobody is rolling their bets higher; it means the options market is not anticipating higher prices.

Amazon

Amazon (NASDAQ:AMZN) failed at the downtrend yesteday and is likely moving lower still and a date at the uptrend line around 3,000. That RSI is telling you the next major in Amazon is lower, not higher.

Netflix

Netflix (NASDAQ:NFLX) has broken its uptrend on the chart and the RSI. The next significant level is $450.

Micron

Micron (NASDAQ:MU) came within my margin of error, falling to $45.90. I had been looking for $45.50.

Uber

Uber's (NYSE:UBER) chart looks flat out scary with a chance for the shares to fall to around $28.30.