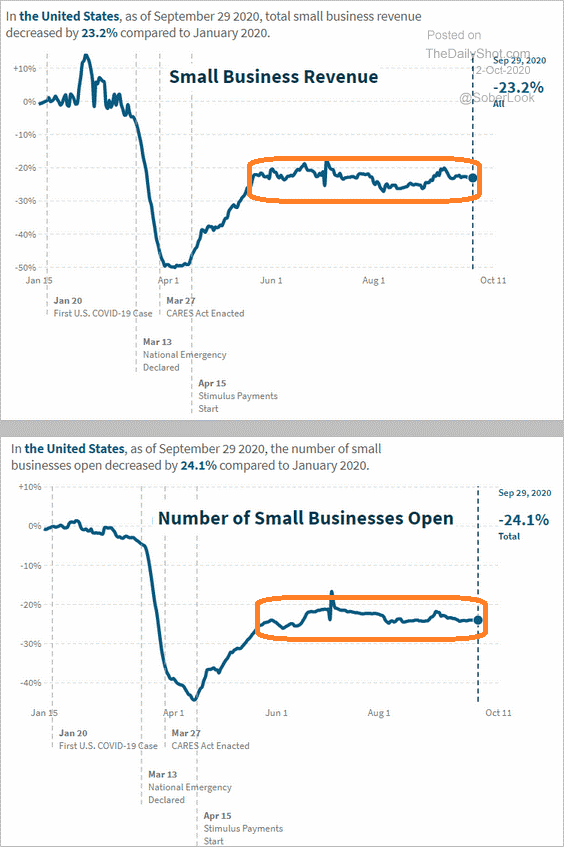

Small businesses employ roughly half of U.S. workers. What’s more, small companies create nearly half of the new jobs that come into existence.

Sadly, the small business community has lost 23% in revenue since the year began. In a similar vein, the number of small businesses that are open are down 24% since the start of 2020.

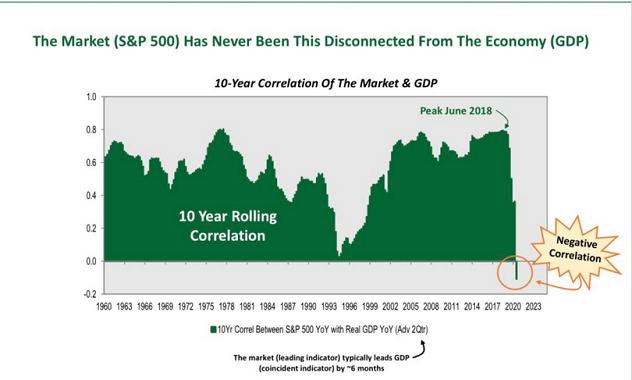

Without a doubt, the 2020 stock bubble is dismissing a gigantic portion of the economy. Yet, Federal Reserve money printing, permanent ultra-low interest rate policy and trillions upon trillions of federal government stimulus has neutralized the importance of genuine economic well-being.

To illustrate the phenomenal disconnect between the economy and the financial markets, Cornerstone Macro offered the chart below. Specifically, the relationship between the economy (as measured by GDP) and the stock market (as measured by the S&P 500), is broken. Never before has the relationship served up a negative correlation!

Endlessly bullish investors exclaim that there’s a difference between the “New Economy” and the “Old Economy.” For them, that’s why the mega-cap technology stocks in the QQQs are defying gravity. It’s also the reason why energy stocks via SPDR Select Energy (NYSE:XLE) and financial stocks via SPDR Select Financials (NYSE:XLF) are drowning in despair.

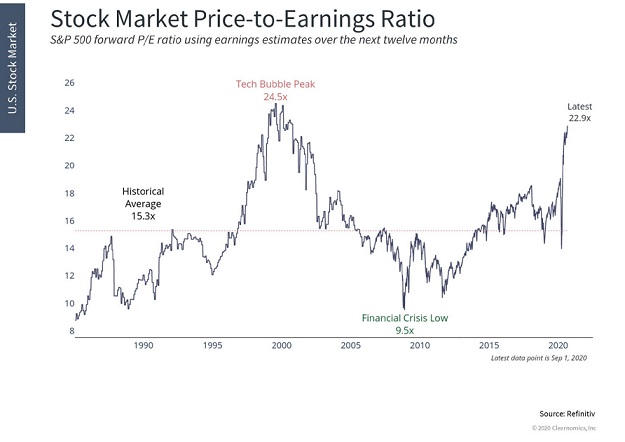

Still, purchasing a “New Economy” paradigm with relentless fervor might not end well. It didn’t end well for NASDAQ 100 (QQQ) investors who found themselves losing 80% in the tech wreck (3/2000-9/2002).

Might history rhyme?