by Clement Thibault

Though it takes three months to play out, in the financial world a quarter is actually a very short period of time—particularly if you follow quarterly reports from publicly traded companies. And voila, once again, earnings season is upon us, that intense, one-and-a-half month period when most publicly traded companies release information about their earnings for the quarter just completed.

Beginning with the last quarter, reports from the big US banks were the starting signal for earnings season. The season began on July 14th with reports from JP Morgan, Wells Fargo and Citigroup, and ended on August 31st with Dollar General's earnings report.

The three sectors we'll focus on in this post are all at critical junctures for their industries. Banks' fortunes are on the rise, ahead of an anticipated rate hike in December. They're also often a mirror of investor sentiment about the US economy.

Technology has been the market leader—and primary growth engine—over the past few years, but recently has weakened. Retail, once a US powerhouse, has, over the past few years, been crashing.

Still, not all retailers are created equal; some are indeed stronger and more healthy than others. And quarterly reports are a useful tool with which to figure out which vendors are with us for the longer haul and which might not be around next year.

Banks

This coming Thursday, October 12, Q3 2017 earnings season kicks off once again. JPMorgan Chase (NYSE:JPM) and Citigroup (NYSE:C) will open the festivities, followed the next day by Bank of America (NYSE:BAC) and Wells Fargo (NYSE:WFC).

- JPMorgan – Reports Thursday, October 12. Expected EPS: $1.67; Expected Revenue: $24.84 billion.

- Citigroup – Reports Thursday, October 12. Expected EPS: $1.29; Expected Revenue: $17.73 billion.

- Bank of America – Reports Friday, October 13. Expected EPS: $0.46; Expected Revenue: $22.18 billion.

- Wells Fargo – Reports Friday, October 13. Expected EPS: $1.03; Expected Revenue: $22.30 billion.

Analysis:

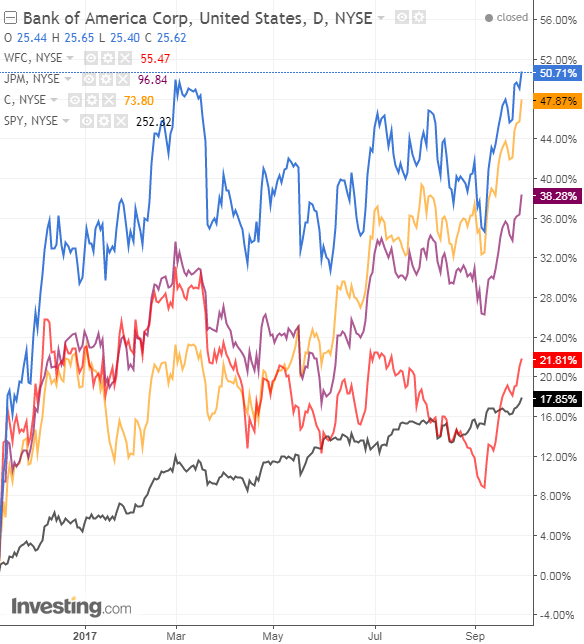

The Trump Bump is alive and well...at least for the banking sector. Since he was elected US President, all of the four financial majors have outperformed the S&P 500 (SPY). Bank of America is up 50.7%, Citigroup is up 47.7%, JPMorgan 38.2%, and Wells Fargo 21.8%.

Expectations of another rate hike this year are driving bank stocks higher, since they all stand to benefit from increased profits on lending, as interest rates rise. Wells Fargo continues to deal with the aftermath of its highly publicized fraudulent account scandal, making it something of a laggard behind its three competitors.

The financial sector, regarded as an economic barometer for the US, have been sensitive to any and every mention of tax reform which has so far increased both the stock prices and positive sentiment toward major US banks. Of course, it remains to be seen whether Trump and Congressional Republicans can actually get the initiative done. For the moment though, and the purposes of Q3 earnings, it's likely all good.

Combined, the major banks have beaten Wall Street earnings expectations 15 out of the last 16 times. The only miss came from Wells Fargo in Q4 2016, on the heels of the then recently revealed fraud and mounting scandal.

It certainly looks like, after years of under-performance following the Great Recession of 2008, banks are once again in the spotlight. Good reports will fuel the market rally and add to overall optimism, which would be something new for banks stocks which have just come off a rough decade.

Technology

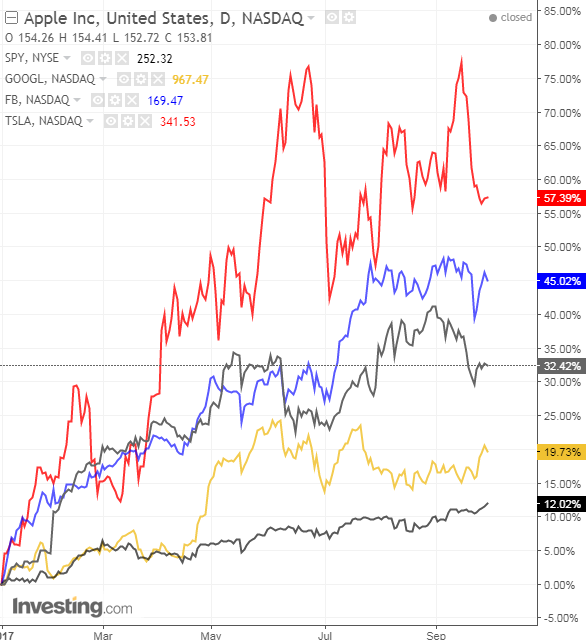

For the Tech sector, the first half of 2017 can be summed up in just one word—domination.That makes sense. Technology is getting more and more important to the smooth running of our daily lives, and current technology powerhouses, including Apple (NASDAQ:AAPL), Alphabet (NASDAQ:GOOGL), Facebook (NASDAQ:FB) and Tesla (NASDAQ:TSLA), have scalability options and economies of scale of a size never seen before.

Editor's Note: Tech earnings report dates may change; these were the dates available at time of publication.

- Apple – Expected Report, Tuesday, October 31: Expected EPS: $1.86; Expected Revenue: $51.05 billion.

- Google – Expected Report, Thursday, October 26: Expected EPS: $8.40; Expected Revenue: $21.95 billion.

- Facebook – Expected Report, Wednesday, November 1: Expected EPS: $1.30; Expected Revenue $9.88 billion.

- Tesla – Expected Report, Tuesday, October 31: Expected EPS: $2.23; Expected Revenue $2.95 billion.

Analysis:

Apple (up 32% YTD) just released the next generation of the iPhone, which unfortunately we found rather disappointing. Nevertheless, there's little doubt Apple loyalists will still buy it, or they'll opt to wait for the iPhone X which will become available in November.

Google, the worst performer of the bunch YTD (but still up 19.7%, versus the S&P's 12%), has been dealing with legal troubles in Europe. The company deducted $2.7 billion from its Q2 bottom line because of an EU fine. It has since separated its shopping business from its main ad business in order to comply with competitive regulatory requirements.

Facebook (up 45% YTD) has been embroiled in the political quagmire swirling around the alleged help the Trump election campaign is supposed to have received from Russia. Still, it's likely little can stop the social media powerhouse at this point. Strong growth is expected once again, and will surely be delivered, as it has been in the past.

Finally, Tesla (up 57% YTD) has started shipping its Model 3, but continues to struggle to consistently meet production numbers. Nevertheless, Tesla's report rarely has any long-term effect on the stock price.

With all that, and even after a terrific first half of 2017, tech stocks cooled over the summer, which has given the rest of the market a chance to catch up. It was hardly likely after all that tech stock prices would simply double in value over the course of a year. That just doesn't happen across an entire sector.

Still, a strong Q3 earnings season could provide a giant shot of adrenaline to lagging tech sector stocks and their market leadership just might resume. Apple, Google and Facebook have beaten expectations 11 out of 12 times over the past year.

Tesla's chances of a stunning report are much slimmer. The company continues to invest heavily in infrastructure which leaves the top and bottom lines looking relatively anemic.

Retail

- Amazon – Expected Report, Thursday, October 26: Expected EPS $0.02; Expected Revenue $42.02 billion.

- Walmart – Expected Report, Thursday, November 16: Expected EPS $0.97; Expected Revenue $120.8 billion.

- Home Depot – Expected Report, Tuesday, November 14: Expected EPS $1.81; Expected Revenue $24.40 billion.

- Macy's – Expected Report, Thursday, November 9: Expected EPS $0.19; Expected Revenue $5.32 billion.

Analysis:

Lately, earnings season has not been a time of joy for retail stocks, and this season will be no different. Amazon's (NASDAQ:AMZN) ascendance has made life increasingly difficult for competitors both small and large including Walmart (NYSE:WMT), Home Depot (NYSE:HD) and Macy's (NYSE:M). It's certain investors will continue to look for clues this earnings season regarding where retailers are headed.

A better than expected report often pushes a depressed stock price higher by as much as 15%. Best Buy (NYSE:BBY), for example, jumped 20% on May 25 after a positive earnings surprise, so the entire sector is worth keeping an eye on.

Amazon (up 27.2% YTD) has been trading sideways for five months now. Last earnings season, we said it needed a strong report to stay above $1000.

That didn't happen.

The company's EPS was a big miss, $0.4 actual versus $1.42 expected $1.42. The stock has been trading in the mid-$900 range ever since in the mid-900 ever since. We're making the same call for Amazon's upcoming report. A nice surprise will push the stock above the $1K threshold.

Because of the US's recent catastrophic hurricane season, Home Depot (up 22.1% YTD) will be interesting to watch. Hardware and construction materials are in demand whenever a destructive event occurs, and Harvey, Irma and possibly even Nate might just have been the catalysts for a positive earnings surprise...which wouldn't at all shock.

Walmart (up 14.2% YTD) is showing signs of renewed growth. It still largely owns the US grocery space and has been putting serious effort into improving its e-commerce offering. Amazon's purchase of high-end Whole Foods Market isn't likely to directly compete with Walmart.

As well, Walmart's e-commerce revenue has grown by over 50% in the past two quarters. A few more strong quarters for Walmart (growth of 1-2% YoY will do), and we believe we'll be seeing Walmart at all-time highs for the first time since early 2015 when the stock hit $90.

Macy's (down 40.7% YTD ) is one of the stocks that's been most affected by consumers' pronounced shift to online commerce. While the retailer remains profitable despite current shopping trends, the situation isn't improving.

Recently there's been a lot of chatter about potential, massive acquisitions of Nordstrom (NYSE:JWN) and/or Macy's. It wouldn't be surprising in the least to see a behemoth such as Amazon or maybe Walmart take advantage of struggling bricks-and-mortar giants to either establish a physical presence, or move the company upmarket.

Bear in mind, a positive surprise for Macy's is certainly worth at least a 6-7% pop on the news.

Conclusion

Here's to another earnings season. We can't predict exactly what will happen, but some things are certain. In the next few weeks there will be companies reporting stellar results while others will falter.

Some stocks will skyrocket more than they should; some will plunge on negative reports. Savvy investors might take advantage of the short-term, post-report volatility with some results providing extraordinary buying opportunities.

Here's a summary of our expectations:

Banks: Strong quarter for all four majors.

Technology: Strong quarter for Facebook; a weaker quarter for Apple and Google; and the usual money burn from Tesla.

Retail: Strong quarters for Amazon—which will have put an emphasis on profitability after last quarter—Walmart, and Home Depot. No change expected in Macy's downward trend, with a "less worse than expected" result, at best.

As the earnings season proceeds, we'll aim to pinpoint as many buying and selling opportunities as possible, and call out stocks which we believe either have potential or an inflated price.

In addition, many of the report dates above are estimates, since the companies have not yet released their official report dates. Check our Earnings Calendar which will be updated as additional information becomes available.