Stocks finished the day, yesterday, mostly higher driven by the top 5 or 6 stocks in the S&P 500. The problem here is that these stocks haven’t done anything for a while and are at their own important resistance levels.

So either Amazon (NASDAQ:AMZN), Apple (NASDAQ:AAPL), Nvidia (NASDAQ:NVDA), Microsoft (NASDAQ:MSFT), et al., will need to break out of their resistance zones, or new leadership will need to emerge today, which is certainly possible.

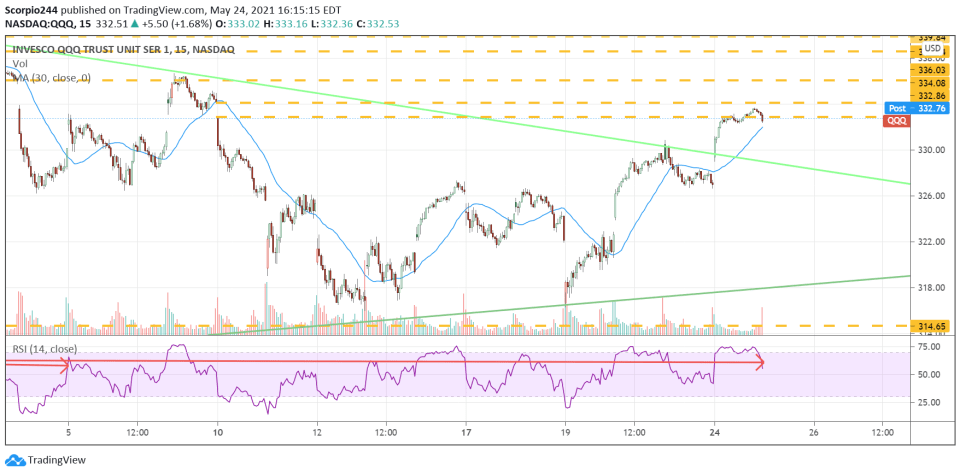

NASDAQ

The Invesco QQQ Trust (NASDAQ:QQQ) was trying to fill its own gaps, which was around $334. We got pretty close on Monday, perhaps close enough to consider the gap filled.

I don’t see any more gaps that need to be filled on the upside, but there are plenty of gaps that need to be filled at lower prices. It would not be surprising to see the Qs drop back to $322 over the next few days, no. That is why I do generally not believe in Monday's rally.

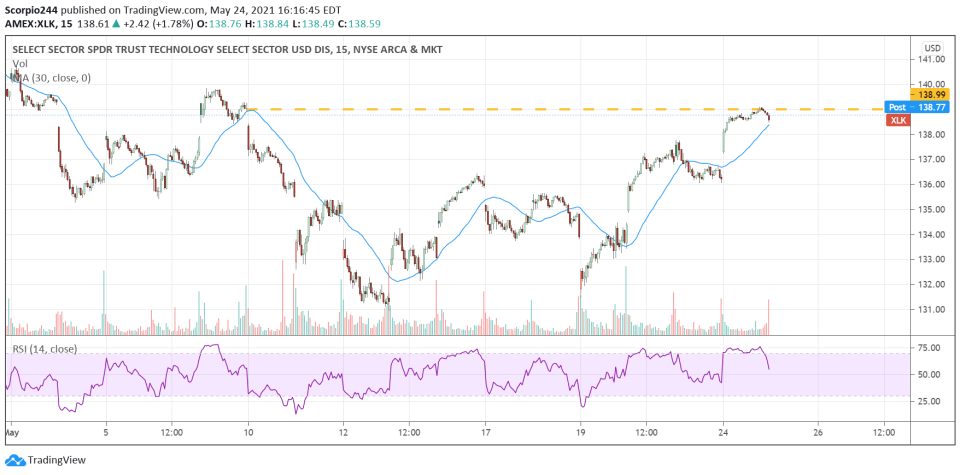

Technology

The gap on the Technology Select Sector SPDR® Fund (NYSE:XLK) did close completely yesterday and sold off promptly thereafter.

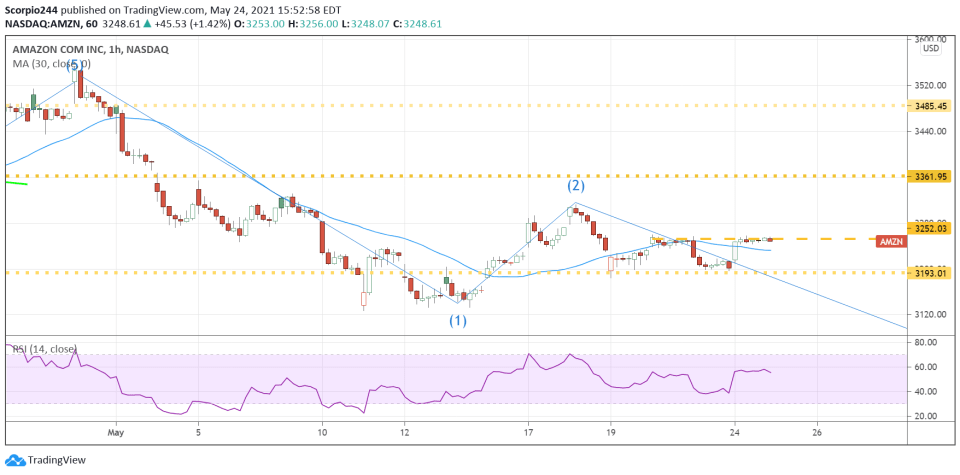

Amazon

Amazon.com (NASDAQ:AMZN) was the best example of this as the stock has struggled the past few days at the $3,250 price.

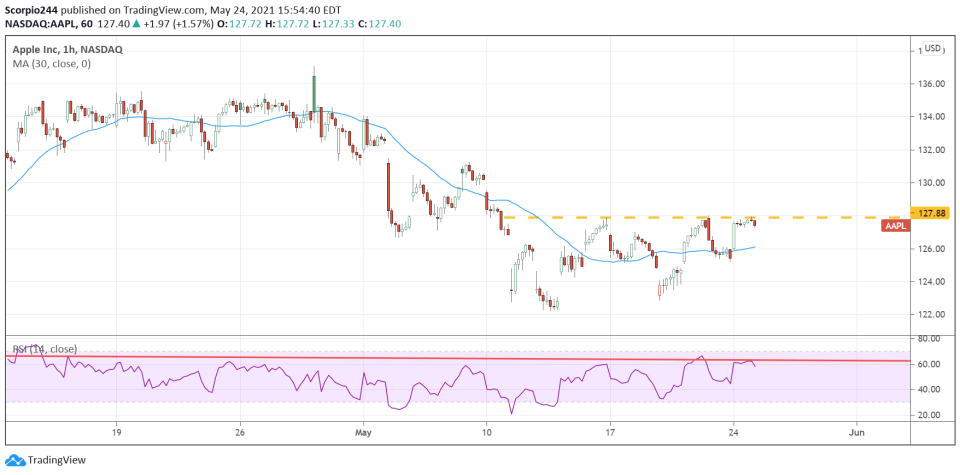

Apple

Apple (NASDAQ:AAPL) also struggled at resistance Monday around $128.

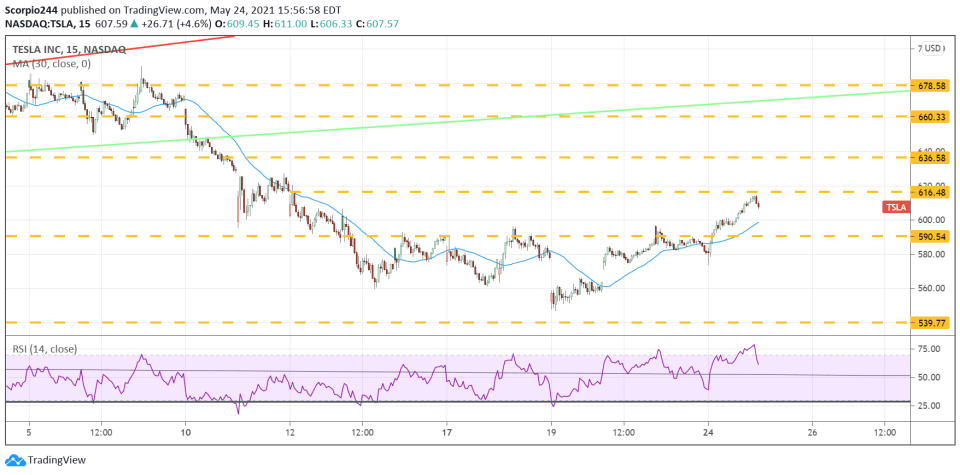

Tesla

Tesla (NASDAQ:TSLA) managed to fill a gap around $616, and then it turned around after hitting that resistance level.

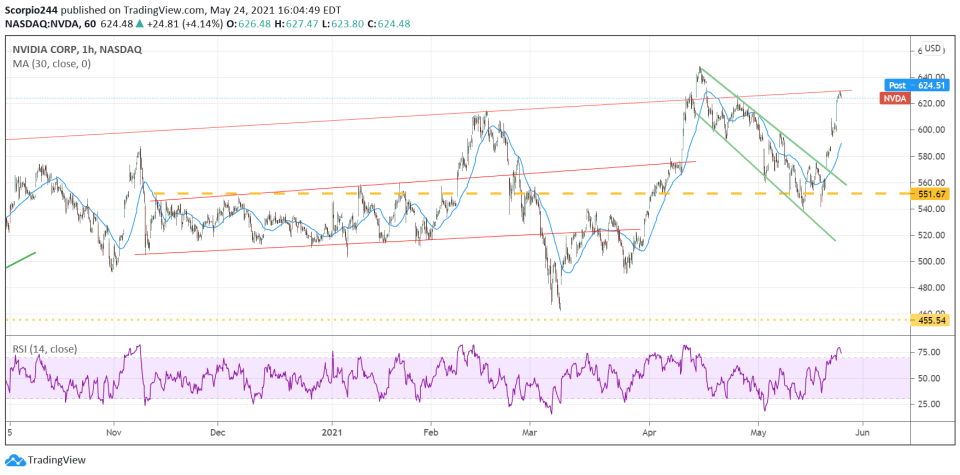

Nvidia

NVIDIA Corporation (NASDAQ:NVDA) rose all the way back to the upper end of its trading range and hit resistance as well.

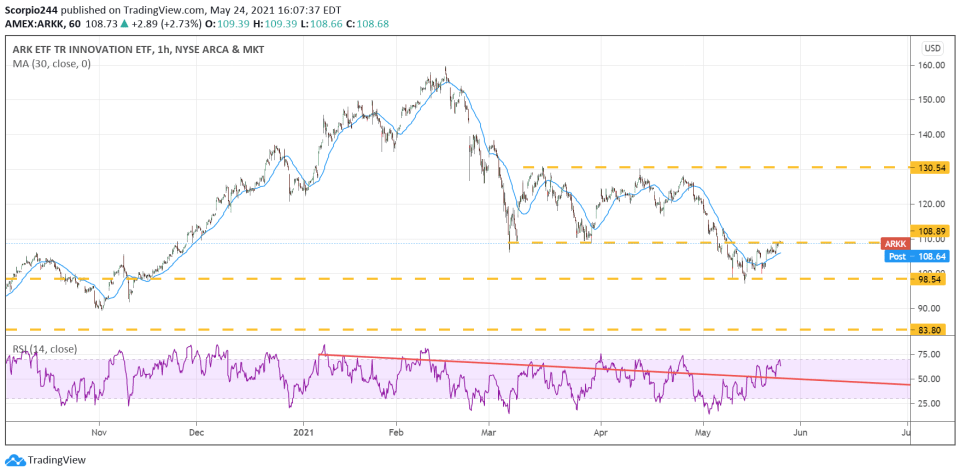

ARKK ETF

Even the ARK Innovation ETF (NYSE:ARKK) hit resistance at $109 and failed to push through.

This seemed to indicate that there just weren’t enough buyers in the market to get through the wall of sellers waiting at various resistance levels in the market.

Low volume on the SPDR® S&P 500 (NYSE:SPY), Q, and the S&P 500 e-minis all seemed to suggest that the sellers decided to take the day off. The question is if they decide to show up today.