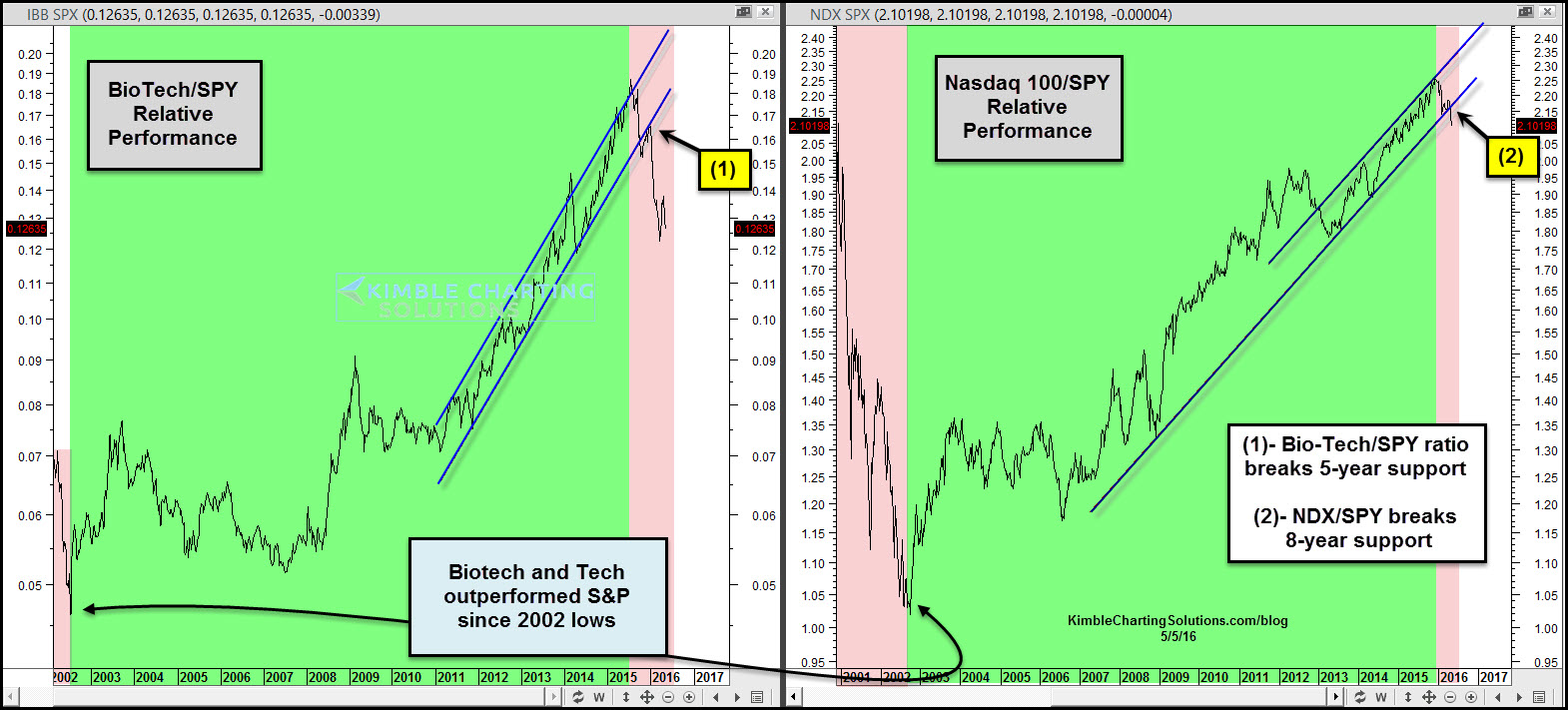

Biotech and Tech have been stock-market leaders for years and years. Below shows how these sectors have been up to lately.

The Biotech/SPX ratio (left chart above) broke below its 5-year rising channel last year at (1).

NDX/SPX ratio (right chart above) is attempting to break its own 8-year rising support at (2).

Should bulls be concerned that leadership is breaking support?

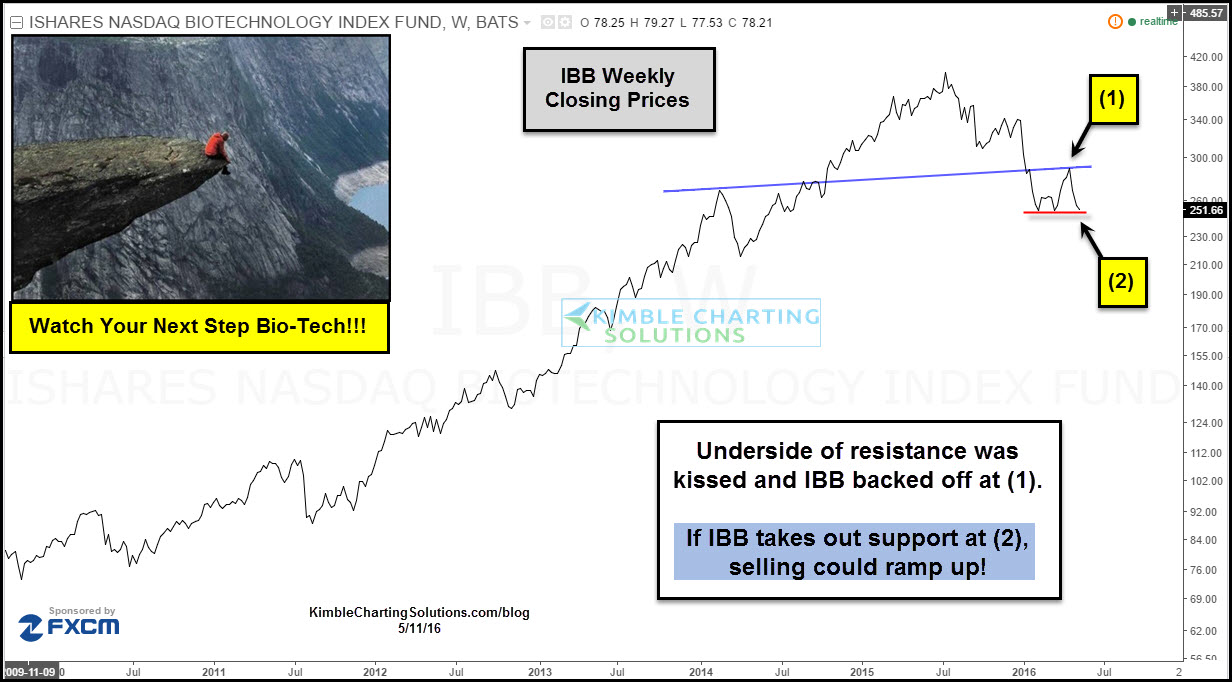

Meanwhile the iShares Nasdaq Biotechnology ETF (NASDAQ:IBB) continues to create a series of lower highs and lower lows since last summer's highs. IBB kissed the underside of resistance at (1) and has recently backed off.

Now IBB is testing weekly closing support at (2). If it takes out support at (2), selling pressure in the weak sector could ramp up.

I'm keeping a close eye on the old upside leaders, just in case they become new downside leaders.

With the S&P 500 within 4% of all-time highs and the NYSE, Wilshire 5000 and Valu-Line Geometric all up against 1-year falling resistance, what happens with these leading sectors could be very important for portfolio construction in the near future.