As I noted last week, the “Ides Of March” is upon us and there is a LOT of stuff going on that could send ripples through the market. Here is a brief listing of the key events to watch:

- The most important, if mostly priced in, event is this FOMC announcement on Wednesday where Traders view a quarter-point Fed hike this week as a virtual certainty and will be watching the central bank’s policy decision for signals on what will come next.

- The Dutch general election whose results should be known on Thursday morning. Focus will be on the performance of the anti-EU, anti-immigration party PVV, and party leader Geert Wilders’ pledge to hold a referendum on EU membership.

- On Wednesday the US debt ceiling limit expires and is due to be reinstated on Thursday absent some last minute breakdown in communication.

- UK Prime Minister May is expected to invoke Article 50 of the Treaty of Lisbon as soon as Tuesday. This begins the long goodbye from the EU.

- President Trump may also reveal his first budget outline for fiscal year 2018 on Thursday.

- The G-20 Meeting will convene in Baden-Baden on March 17-18. This is the first meeting since Donald Trump’s U.S. election victory in November where his protectionist stance on international trade is likely to be a key issue.

- The BoJ is expected to maintain the status quo for monetary policy, leaving its long rate and short rate targets unchanged at 0.0% and -0.1%, respectively. Watch for a potential reduction to QE programs.

- The BOE is expected to keep rates on hold.

- And there is a bunch of economic data out this week with a focus on inflation and sentiment data.

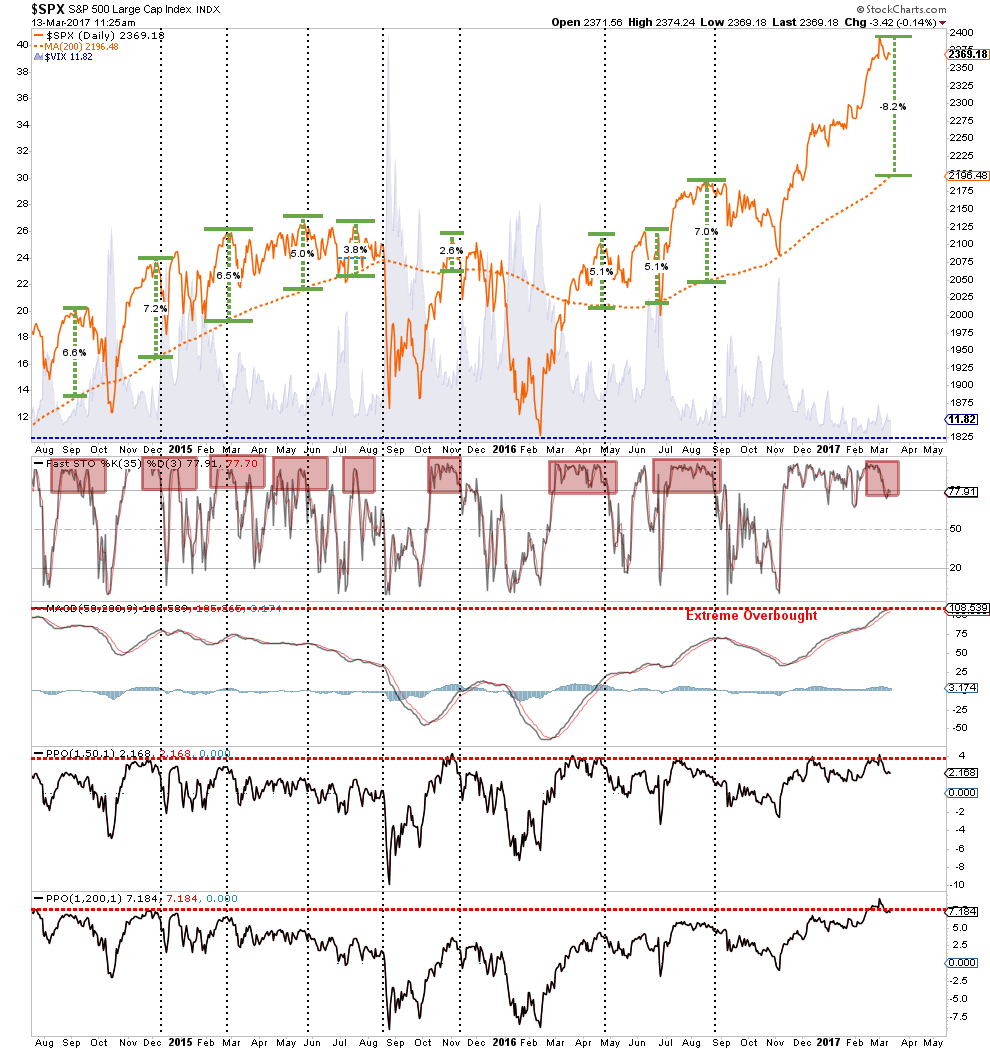

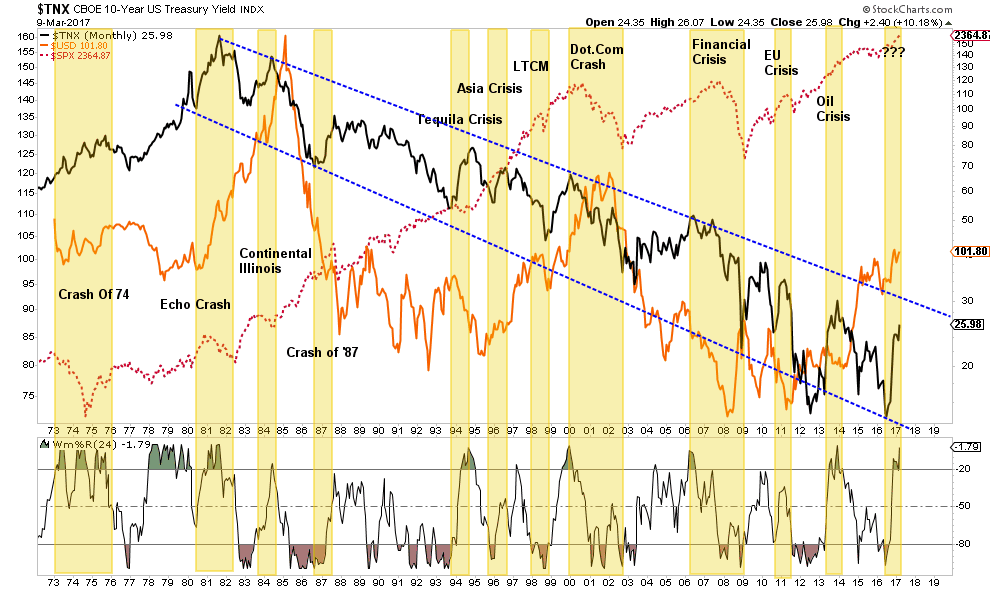

Since the November election of Donald Trump, the investing landscape has gone through a dramatic change of expectations with respect to economic growth, market valuations and particularly inflation. As I discussed previously, there is currently “extreme positioning” in many areas which have historically suggested unhappy endings in the markets. To wit:

As we saw just prior to the beginning of the previous two recessions, such a bump is not uncommon as the impact of rising inflation and interest rates trip of the economy. Given the extreme speculative positioning in oil longs, short bonds, and short VIX, as discussed yesterday, it won’t take much to send market participants scrambling for the exits.

While I am NOT suggesting that we are about to have the next great market crash tomorrow, the current sensation of ‘Deja Vu’ might just be worth paying attention to.

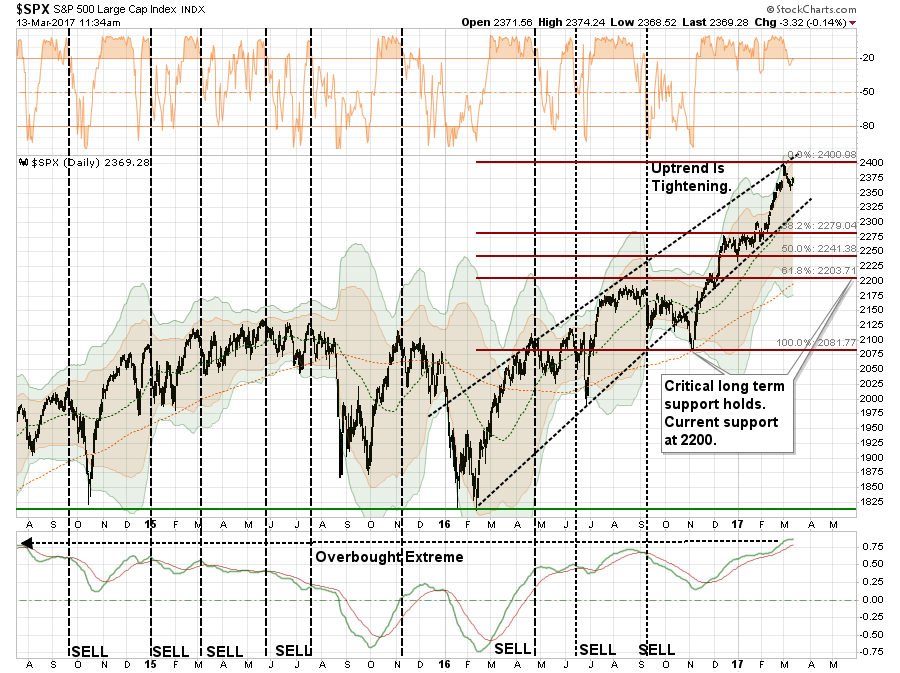

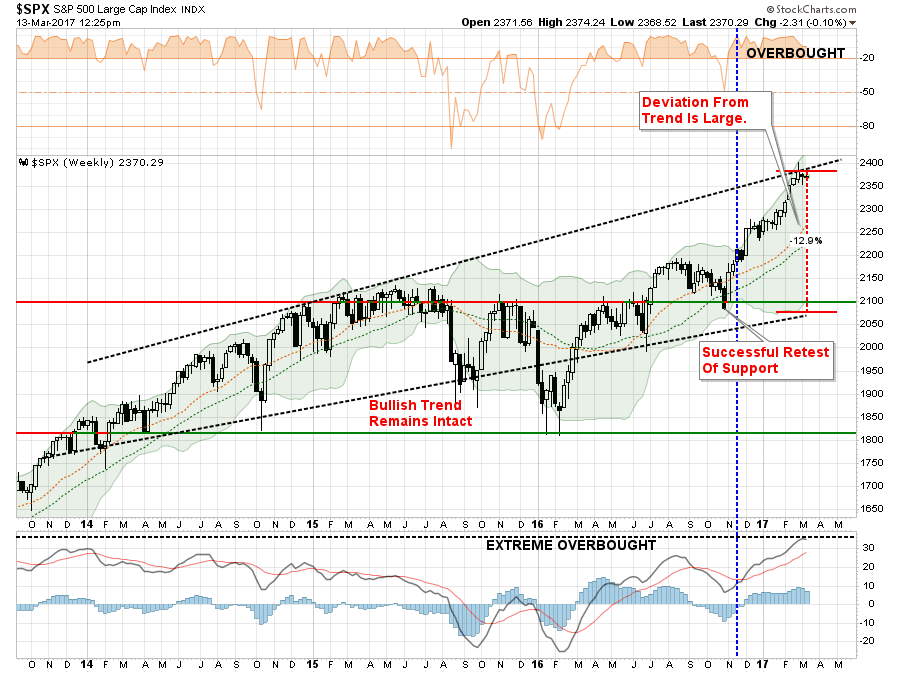

Even though there was a mild correction last week, the still extreme extension of prices above the 200-dma remains. Such extensions, which are always combined with extreme overbought conditions, have typically not lasted long and have been a good indication to take profits in the short-term. This provides some opportunity to invest capital following a correction to some level of support.

Buy The Dip? Probably

Will any correction in the days/weeks ahead be a “buyable correction?”

My best guess is probably for the following reasons:

- The bullish trend remains intact. (Currently at 2350 short-term, 2250 intermediate-term.)

- We remain within the seasonally strong period of the year currently.

- Investor optimism remains unabashedly bullish.

- There is little fear of a correction in the markets.

However, it is important to denote the market is currently more overbought than at any point of over the previous couple of years AS the Fed moves to tighten monetary policy further. As I noted in last weekend’s newsletter:

This recent pop in rates, when combined with a stronger dollar which drags on corporate exports (roughly 40% of earnings), has historically been an excellent opportunity to add to bond exposure. As shown below, the Federal Reserve, in their eagerness to hike rates, are once again likely walking into an ‘economic trap.’

Sector By Sector

With that bit of analysis in place, let’s review the market environment for risks and opportunities.

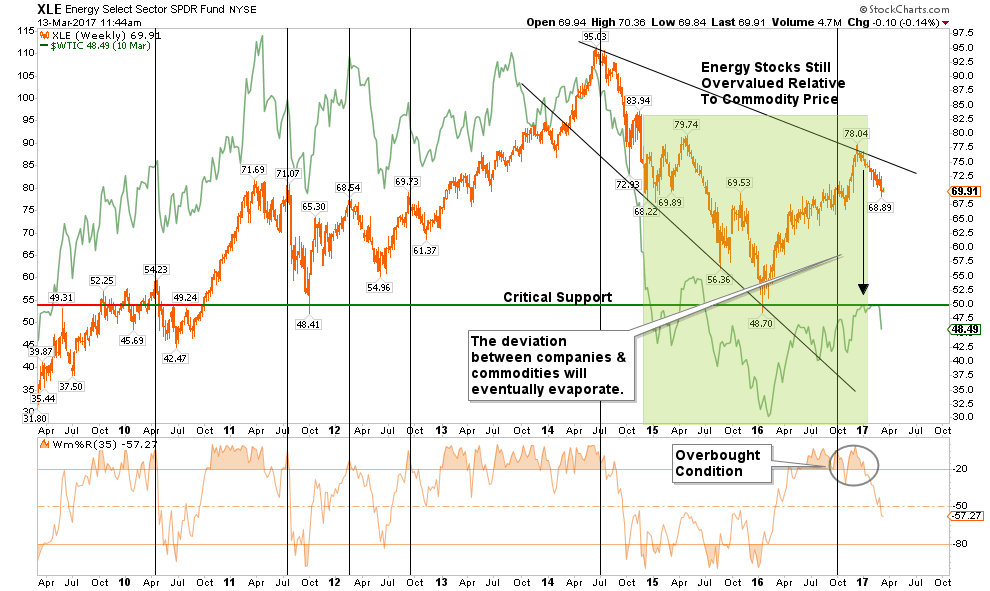

Energy

The OPEC oil cut will likely end over the next couple of months as the ramp up in production continues in the Permian Basin. The Saudi’s are only going to give up so much “market share” before returning back to full production.

Furthermore, a break below $48/bbl is going to start putting pressure on the extreme “long” positioning currently remaining by speculators. There is an extremely high probability the supply increase that is currently happening will not only cap oil price temporarily, but will likely continue to push oil prices lower in the months ahead.

Energy companies remain extremely overvalued, and disconnected, relative to the underlying commodity price. When the next economic recession hits, energy-related equities will likely once again recouple with its base commodity.

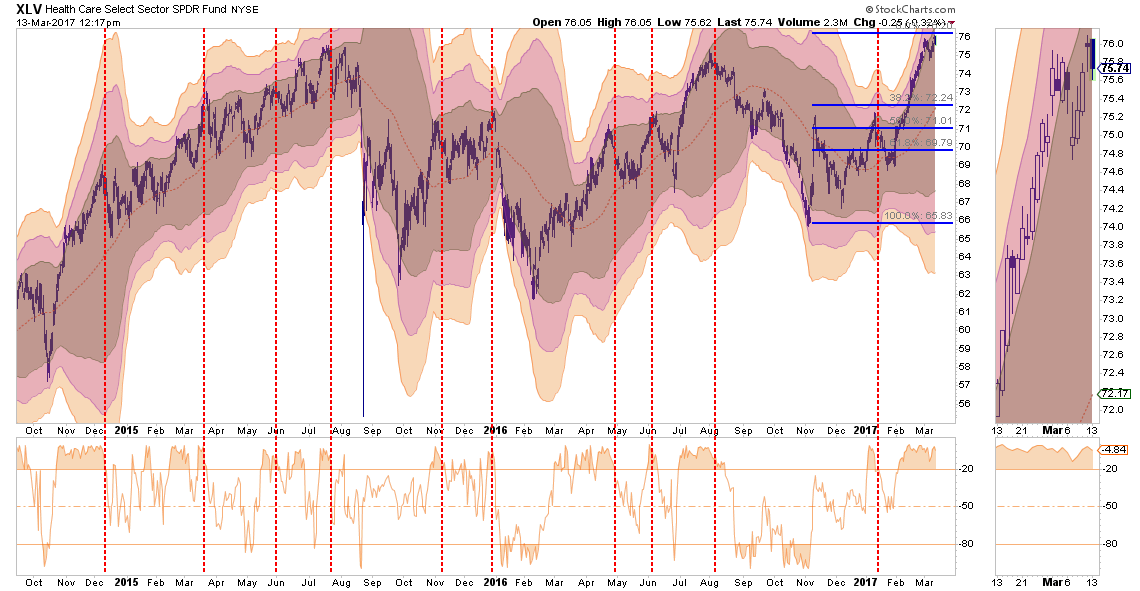

Health Care

The health care sector moved from laggard to leader, as anticipated, over the last couple of months. With the raging debate over the repeal/replacement of the Affordable Care Act, there is volatility risk to the sector due to the very overbought condition that currently exists.

Current holdings should be reduced to market-weight for now as there is not a good stop-loss setup currently available. A correction to $70-72 would provide an entry point while maintaining a stop at $69.

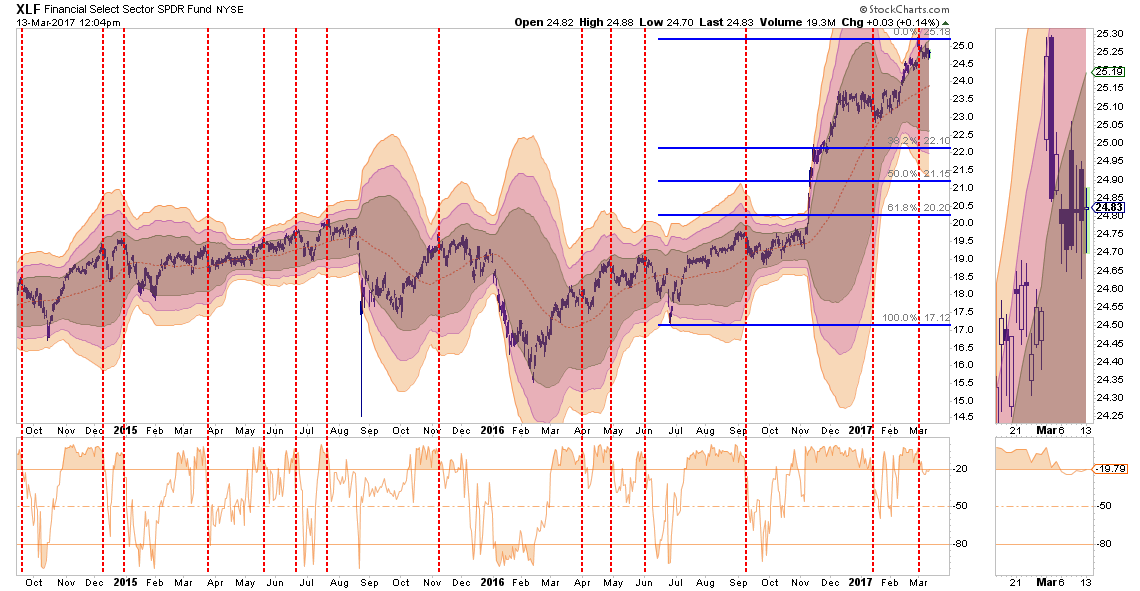

Financials

Financials have weakened as of late in terms of relative performance. However, the sector is currently extremely overbought and very deviated from long-term moving averages. A correction back to support between $20 and $22 could provide for an entry point with a stop at $18.50.

There is a tremendous amount of exuberance in the sector at a time that loan delinquencies are rising and loan demand is falling. Caution is advised.

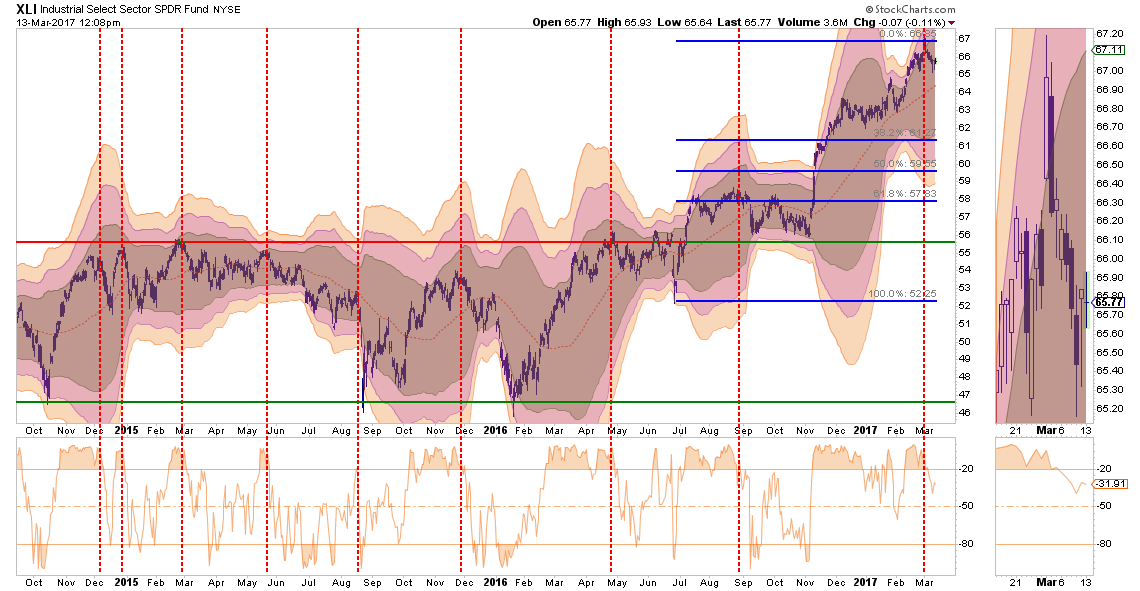

Industrials

Industrial stock’s, like Financials, relative performance has begun to lag as of late. However, the “Make America Great Again” infrastructure trade is still on. Importantly, this sector is directly affected by the broader economic cycle which continues to remain weak so the risk of disappointment is very high if “hope” doesn’t become reality soon.

While the sector broke out to new highs, there is not a good risk/reward setup as there is a long way to a good stop level at $56. I would reduce holdings back to portfolio weight for now and take in some of the gains.

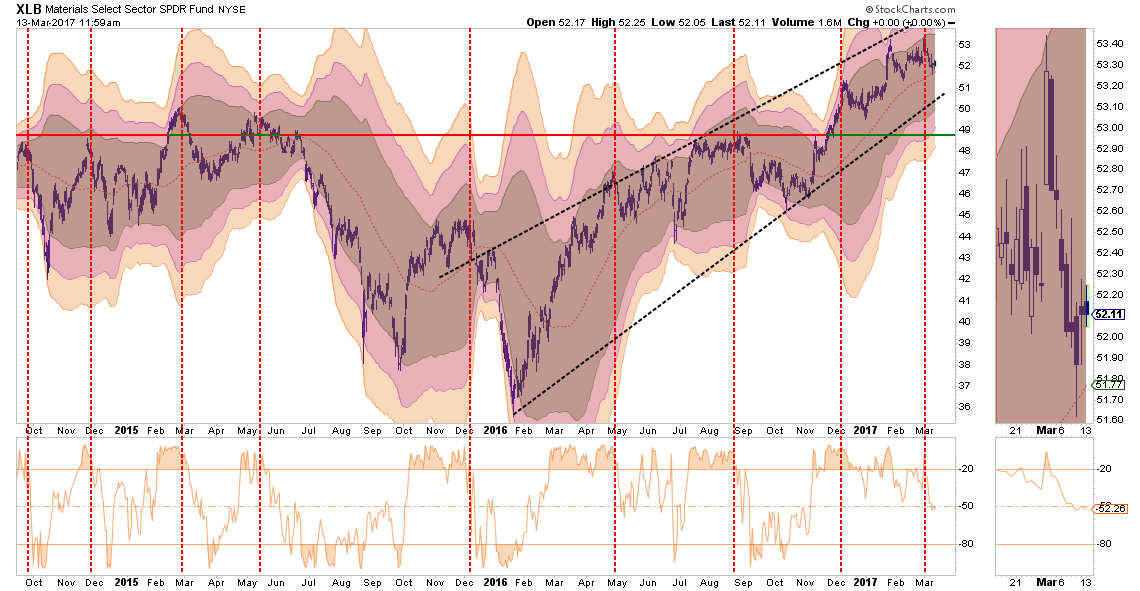

Materials

As with Industrials, the same message holds for Basic Materials, which are also a beneficiary of the dividend / “Make America Great Again” chase. This sector should also be reduced back to portfolio weight for now with stops set at the lower support lines $49.00.

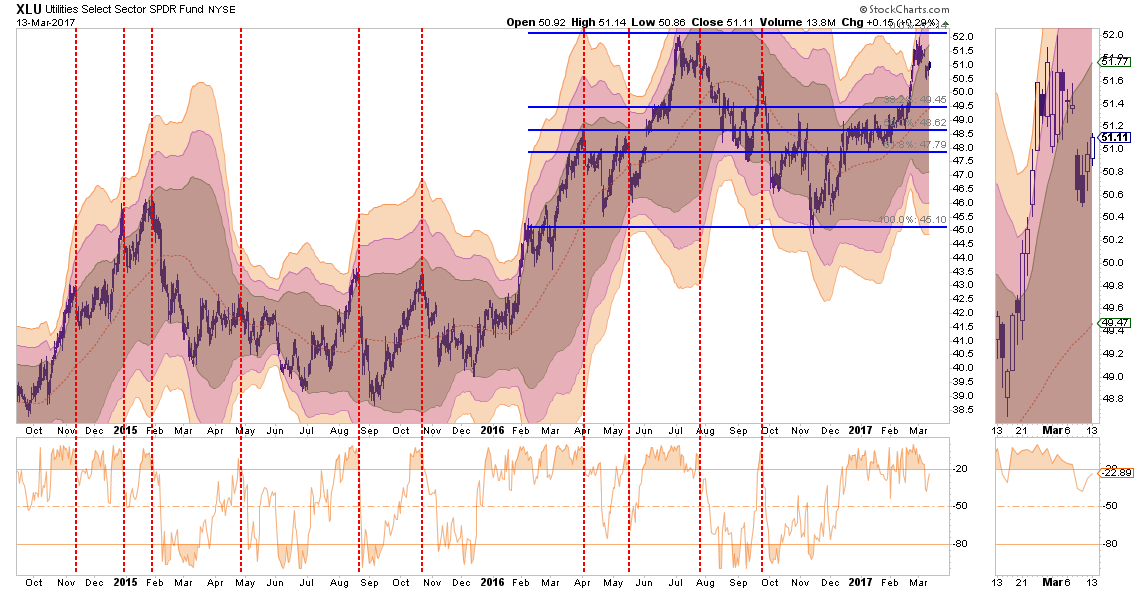

Utilities

Back in January, I discussed the “rotation” trade into Utilities and Staples. That performance shift has played out nicely and the sector is now extremely overbought.

There is not a good stop currently available on a risk/reward basis as it resides all the way down at $45.00. However, a pullback to support between $48 and $49.50, could provide a reasonable entry to point to increase exposure. I would maintain a stop on all positions currently at $47.50.

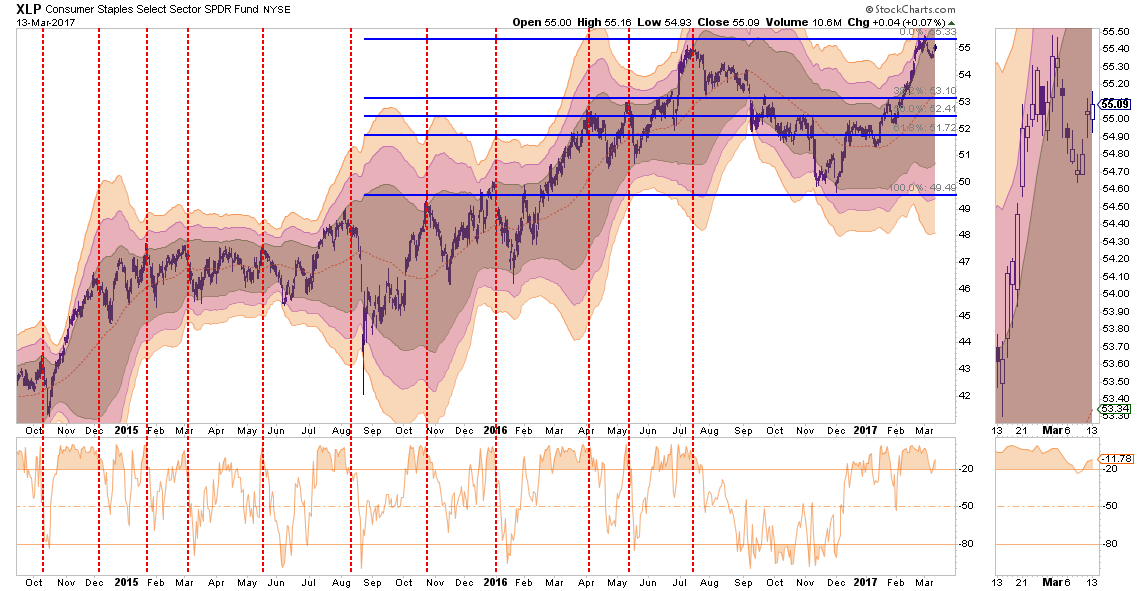

Staples

Staples, have recovered as of late and are now back to extreme overbought, along with every other sector of the market. As with Utilities, there is not a good technical stop available. Set stops for now at $51 and look for a correction to $52 to $53 before increasing exposure to the sector.

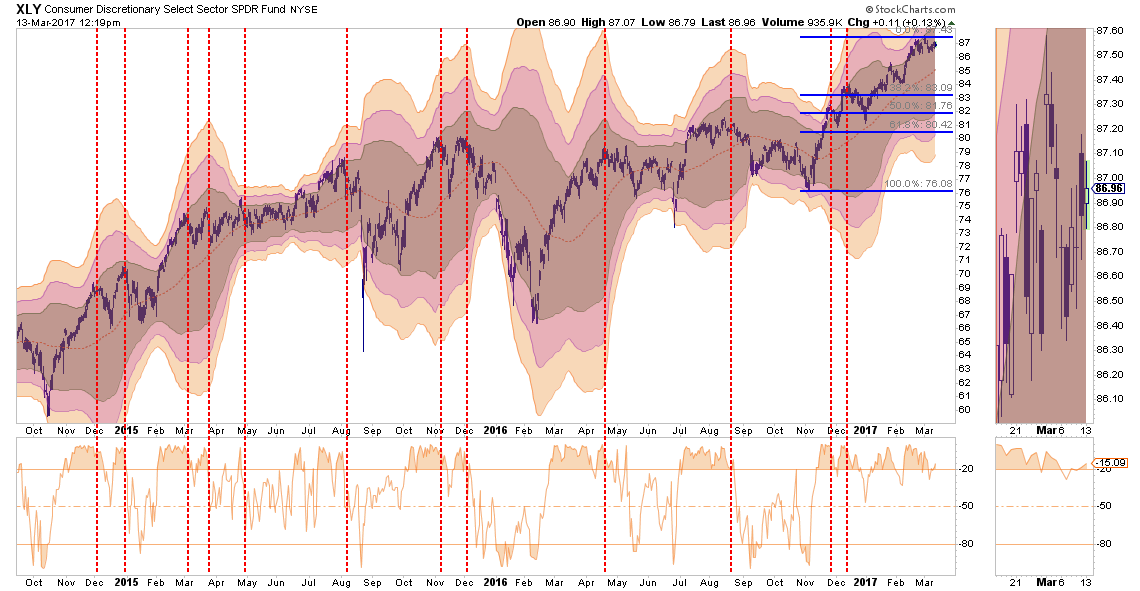

Discretionary

Discretionary has been running up in hopes the pick-up in consumer confidence will translate into more sales. There is little evidence of that occurring currently, BUT with discretionary stocks at highs, profits should be harvested.

Trim portfolio weightings should back to portfolio weight with stops set at $80. With many signs the consumer is weakening, caution is advised and stops should be closely monitored and honored.

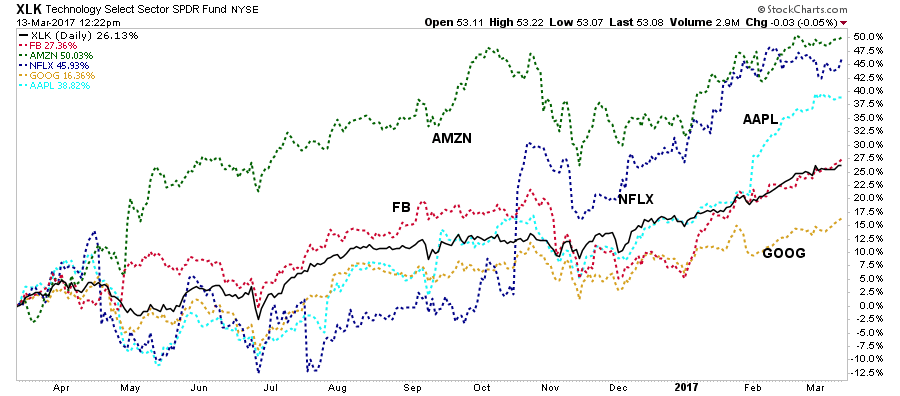

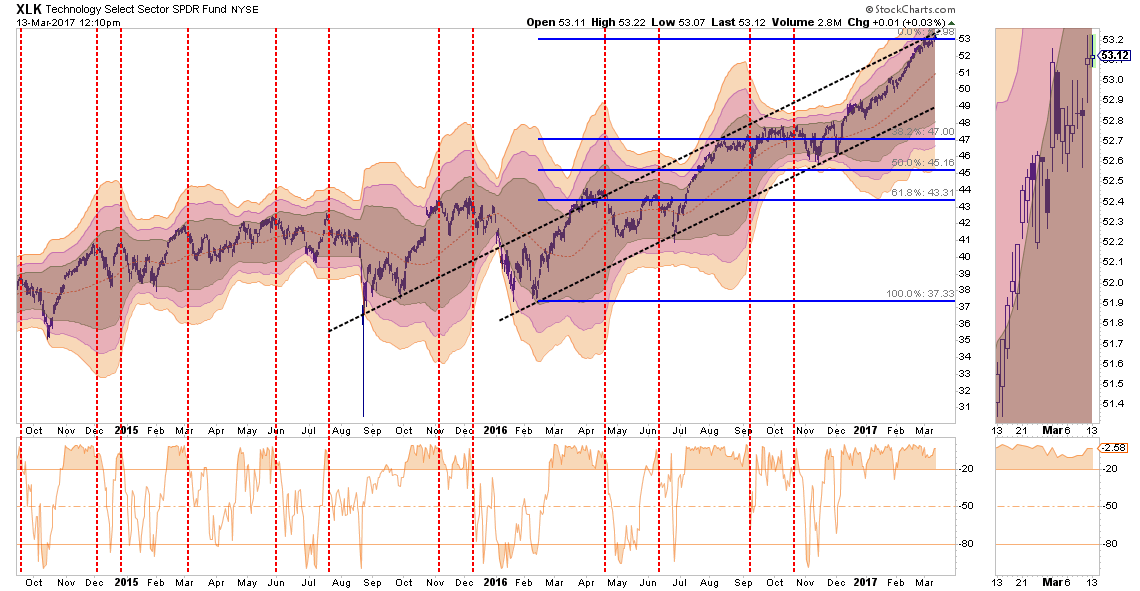

Technology

The Technology sector has been the “obfuscatory” sector over the past couple of months. Due to the large weightings of Apple (NASDAQ:AAPL), Google (NASDAQ:GOOGL), Facebook (NASDAQ:FB), and Amazon (NASDAQ:AMZN), the sector kept the S&P 500 index from turning in a worse performance than should have been expected prior to the election and are now elevating it post election.

The so-called FANG stocks (FB, AMZN/AAPL, NFLX, GOOG) continue to push higher, and due to their large weightings in the index, push the index up as well.

The sector is extremely overbought and stops should be moved up to $45 where the bullish trend line currently intersects with the previous corrective bottom. Weighting should be revised back to portfolio weight.

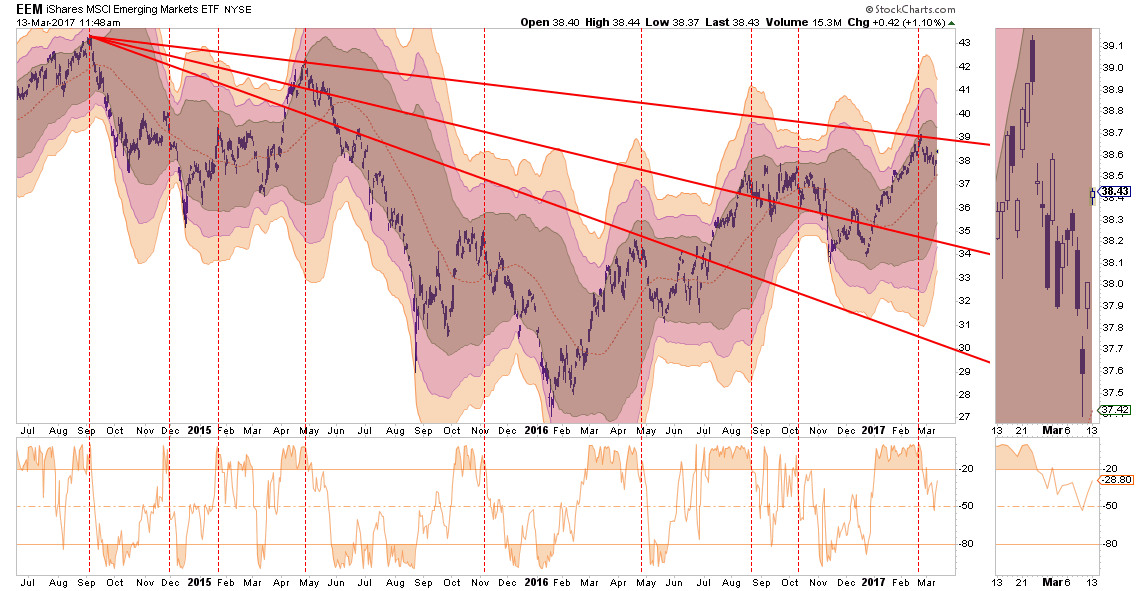

Emerging Markets

Emerging markets have had a very strong performance and have now run into the top of a long-term downtrend live. The strengthening of the US Dollar will weigh on the sector and will only get worse the longer it lasts. With the sector overbought, the majority of the gains in the sector have likely been achieved. Profits should be harvested and the sector under-weighted in portfolios. Long-term underperformance of the sector relative to domestic stocks continues to keep emerging markets unfavored in allocation models for now.

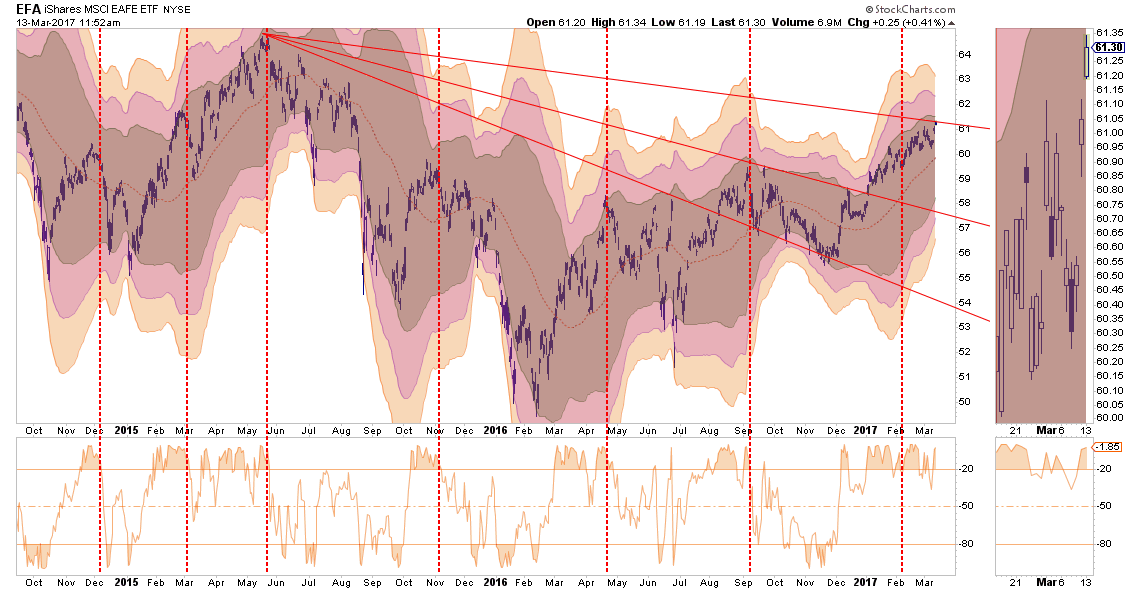

International Markets

As with Emerging Markets, International sectors also remain extremely overbought and unfavored in models due to the long-term underperformance. Underweight the sector, take profits, and focus more on domestic sectors for now.

Domestic Markets

As stated above, the S&P 500 is extremely overbought, extended and exuberant. However, while a “buy signal” is currently in place, a sell signal registered from such a high level has previously coincided with bigger corrections.

Caution still advised for now.

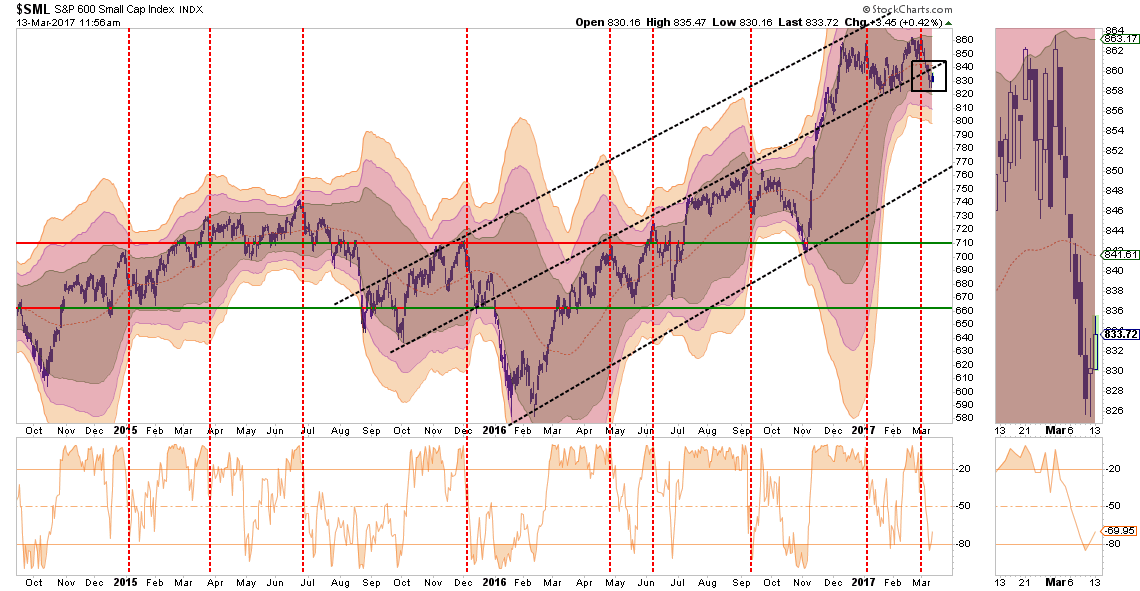

Small Cap

Small cap stocks went from underperforming the broader market to exploding following the Trump election. However, as of late, that performance has stalled and the sector has now violated a bullish trend line.

Importantly, small capitalization stocks are THE most susceptible to weakening economic underpinnings which are being reflected in the indices rapidly declining earnings outlook. This deterioration should not be dismissed as it tends to be a “canary in the coal mine.”

Currently, small caps are back to an oversold condition which suggests the current corrective process is likely near completion. However, a failed rally attempt and a break below $820 would suggest a much deeper reversion is in process. Reduce exposure back to portfolio weight for now and carry a stop at $820.

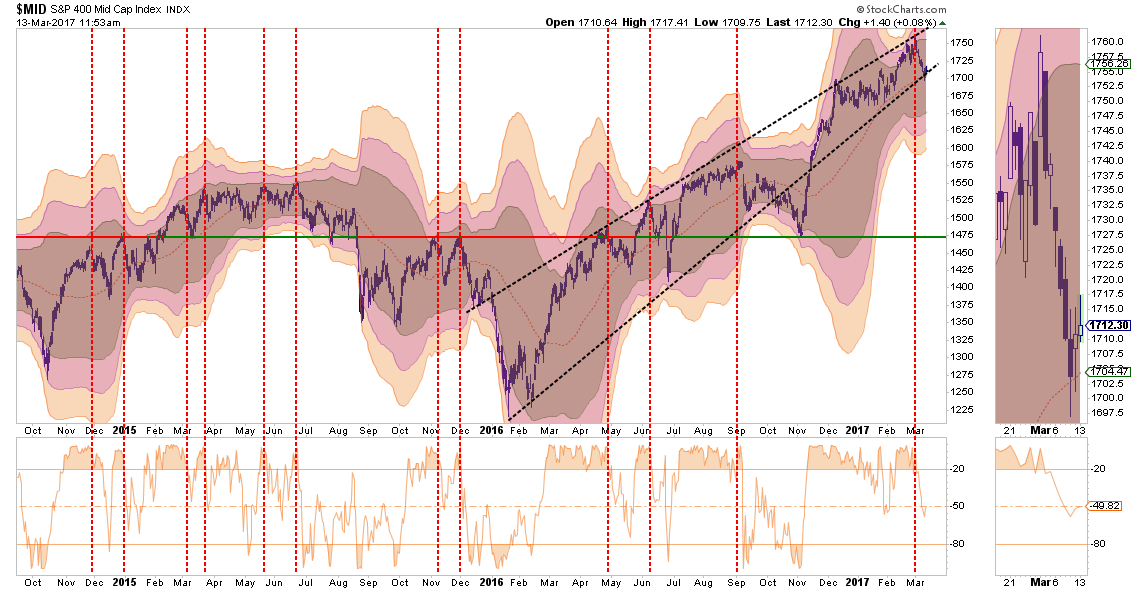

Mid Cap

As with small cap stocks above, mid-capitalization companies had a rush of exuberance following the election. However, Mid-caps currently remain overbought and is threatening to violate its bullish trend-line support. Reduce exposure back to portfolio weight for now and carry a stop at $1675.

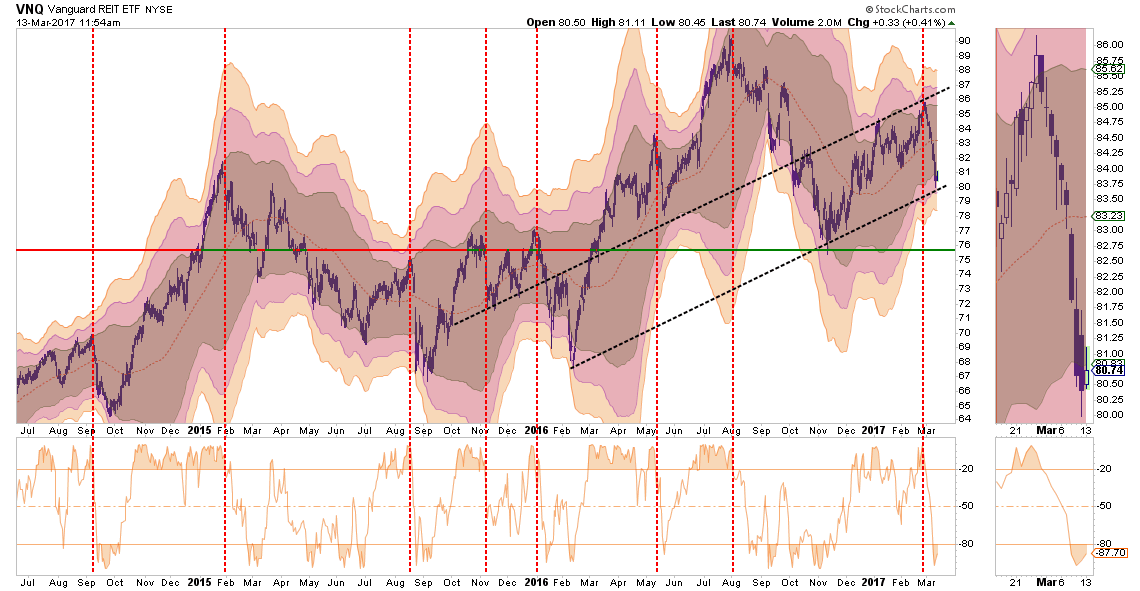

REIT’s

REIT’s had been under pressure heading into the Fed’s expected rate hike this week. However, the sector is now oversold and maintained its bullish uptrend. Positions can be added with a stop set at $79.

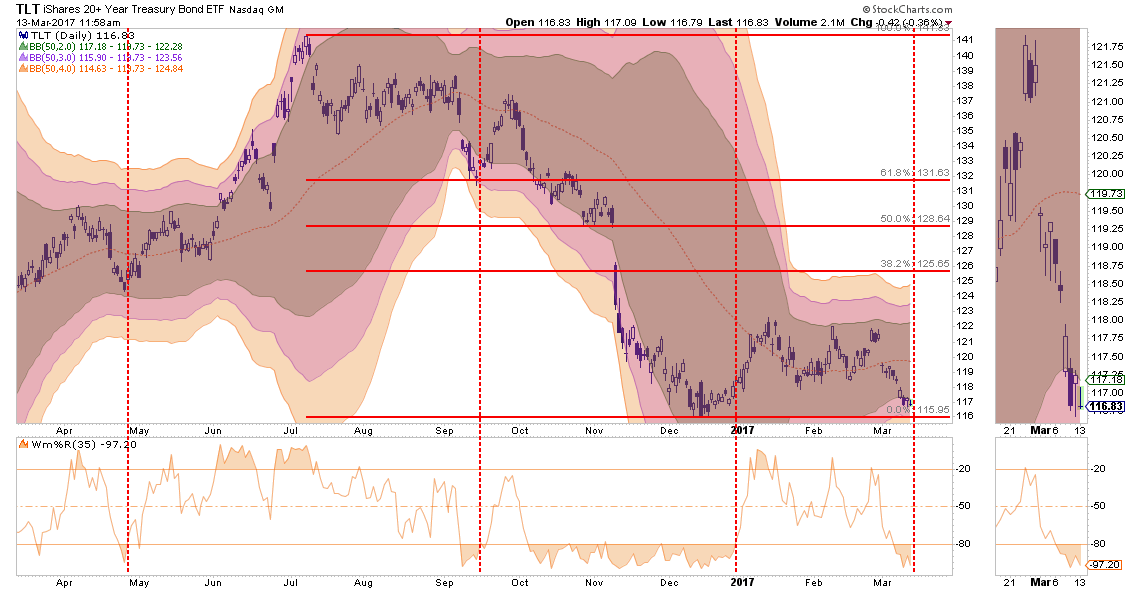

TLT – Bonds

Like REIT’s, and other interest rate sensitive sectors of the market, bonds are now oversold and sitting on support. With the massive “short interest” position currently outstanding on bonds, a retracement of the previous decline to anywhere between $126 and $132 is very possible. Furthermore, bonds are now back to extreme oversold conditions at more than 2-standard deviations below their moving averages.

Stops should currently be set at $115.

Important Note

If you go back through all the charts and note the vertical RED-DASHED lines, you will discover that each time previously these lines denoted the peak of the current advance. Overall, in the majority of cases above, the risk/reward of the market is NOT favorable.

If, and when, the market corrects some of the short-term overbought conditions which currently exist, equity risk related exposure can be more aggressively added to portfolios.

Just be cautious for the moment.

It is much harder to make up losses than simply adding preserved cash back into portfolios.