In last week’s update, I discussed the question of whether the recent rise in the markets was actually being driven by the underlying improvement in the fundamentals. To wit:

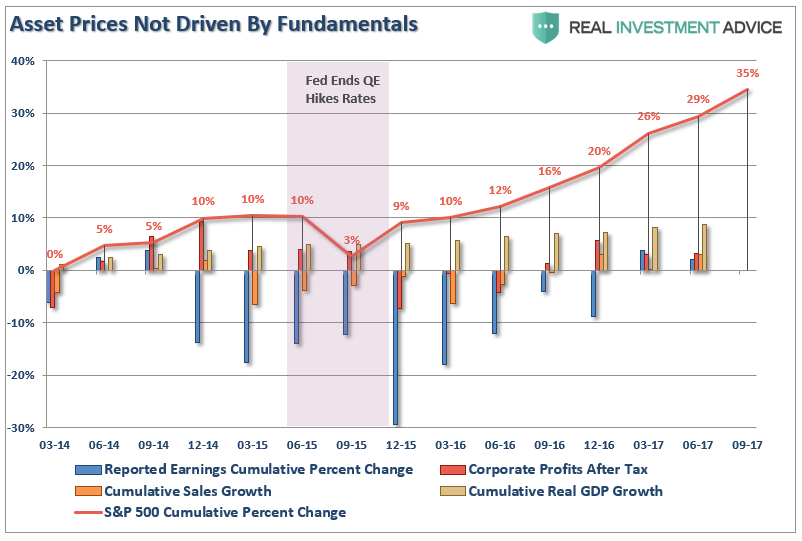

“The chart below expands that analysis to include four measures combined: Economic growth, Top-line Sales Growth, Reported Earnings, and Corporate Profits After Tax. While quarterly data is not yet available for the 3rd quarter, officially, what is shown is the market has grown substantially faster than all other measures. Since 2014, the economy has only grown by a little less than 9%, top-line revenues by just 3% along with corporate profits after tax, and reported earnings by just 2%. All of that while asset prices have grown by 29% through Q2.”

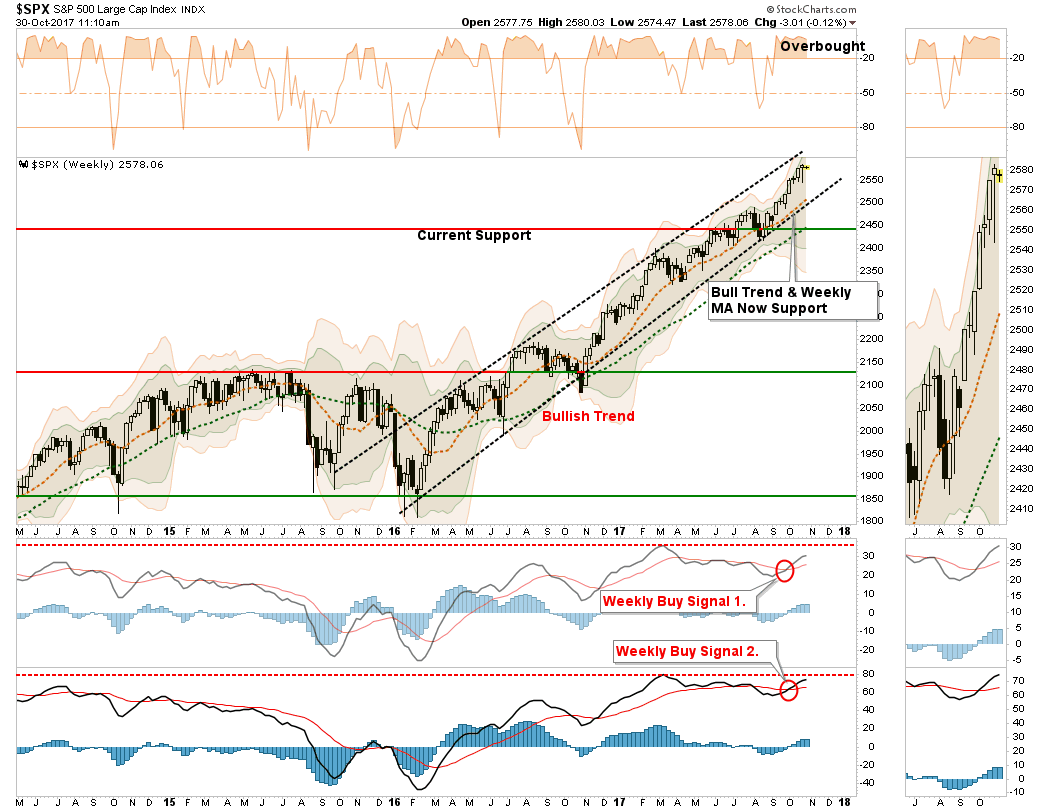

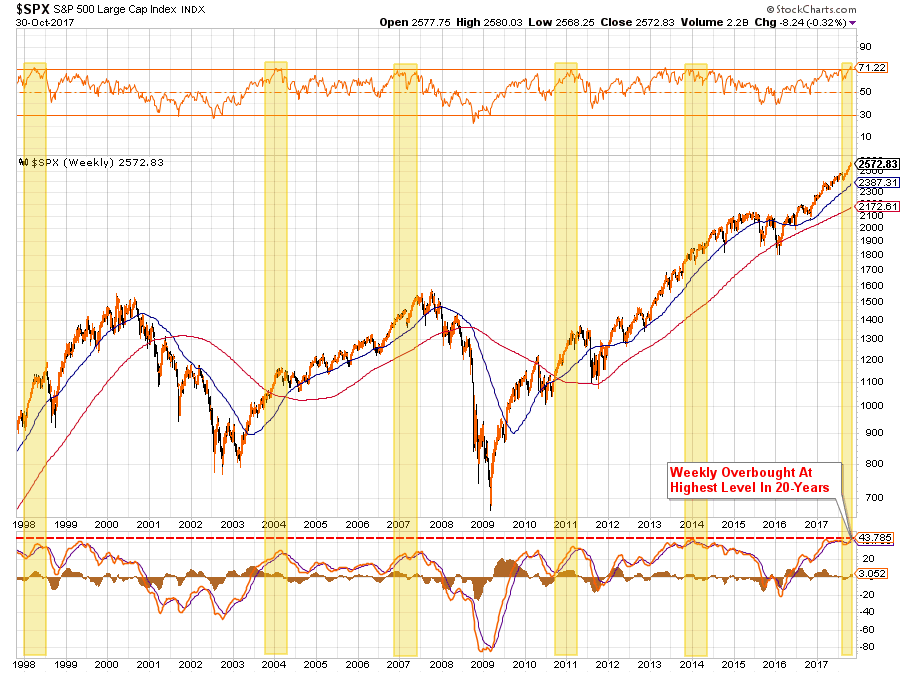

As I have been repeatedly stating in each weekend’s missive, despite my reservations and caution regarding the surge in prices, portfolios remain allocated to equity risk currently. As shown below, the trend of the market is clearly bullish and “fighting the trend” has always been a losing battle.

With the market currently on WEEKLY buy signals, both short and intermediate term, the trend and momentum are clearly in favor of the bulls. However, (and you knew this was coming) with the market pushing large deviations from both the trend and running support levels, a correction of 3-5% is not out of the offing. This suggests that increasing equity risk at these levels is outweighed by the risk of a corrective action.

Patience will likely be rewarded.

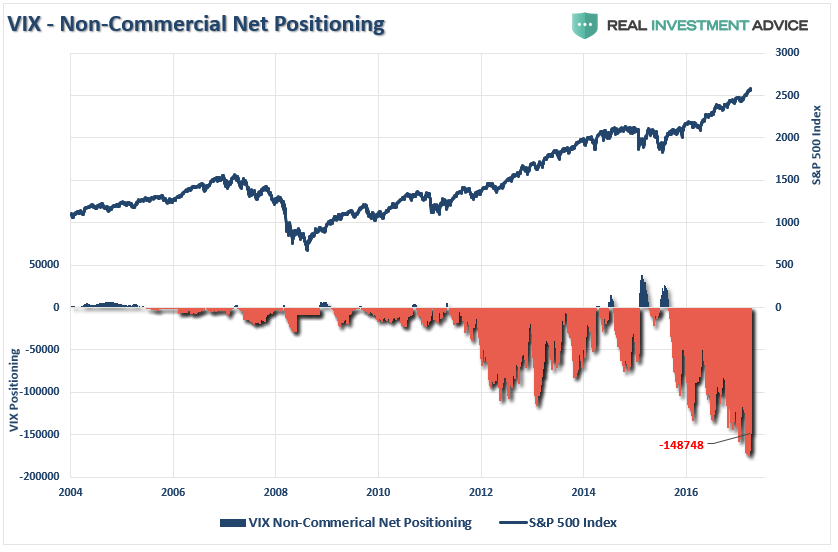

There are two other concerns currently worrying me at the moment as well. The first is the outrageous level of complacency in the markets as denoted by the extremely lopsided trade in volatility options. While the net-short positioning was reduced a bit last week, it is still the largest net-short positioning in history. The concern, of course, is not the positioning, but the “fuel” it eventually provides to a “sell off” when the unwinding of those speculative shorts occurs.

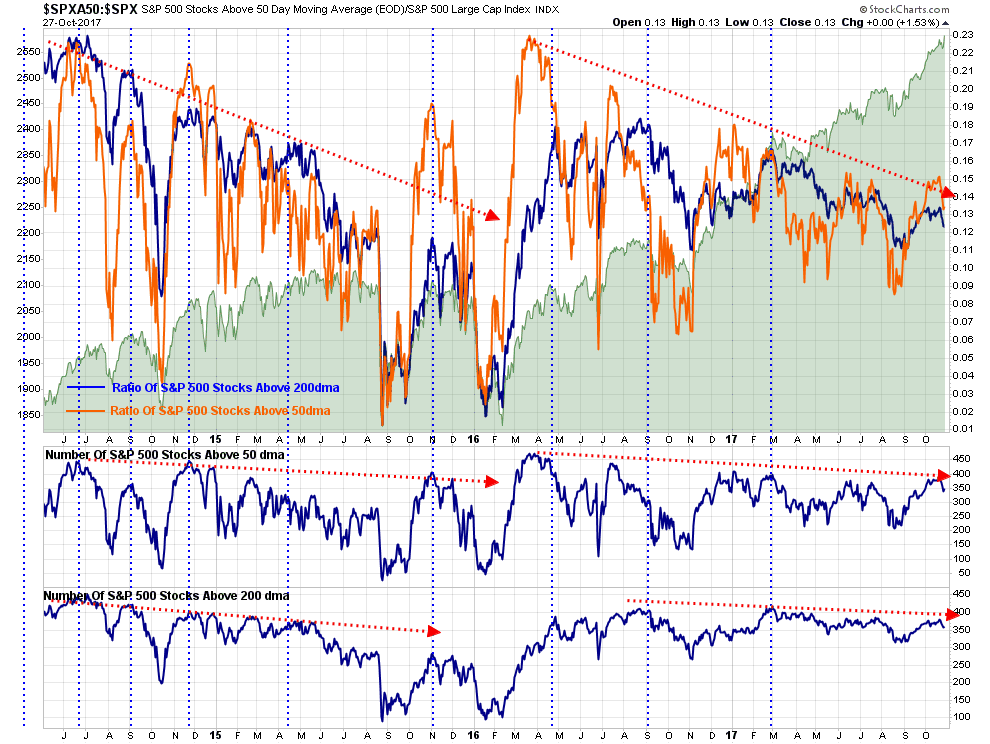

The second is the deterioration in the participation rate of the market, as I pointed out this past weekend.

“It is worth noting, that just as we saw during the run-up in the markets in 2014 and into 2015, the participation rate, as measured by the number of stocks trading above their respective 50 and 200 day moving averages, were declining which signaled a deterioration in participation. That deterioration eventually led to the decline in late 2015 and early 2016.

Currently, even as the market has made a seemingly unstoppable advance this year, the breadth of the advance has once again narrowed markedly.”

Lastly, the current overbought condition, where the WEEKLY RSI is over 70, has only occurred only a handful of times over the last 20-years. While the reading alone has not always been indicative of the onset of a full-fledged bear market, corrections in the market were often close by. With the market more overbought now than at any other time over the past 20-years, some caution is advised.

Seasonally Strong Period Of The Year

Despite those concerns, as stated we remain equity biased in our portfolio models currently. (We will soon be publishing those models live on the site for tracking purposes.) As stated, this is primarily for two reasons currently:

- The trend remains bullishly biased, and;

- We are now entering into the historically stronger period of the investment year.

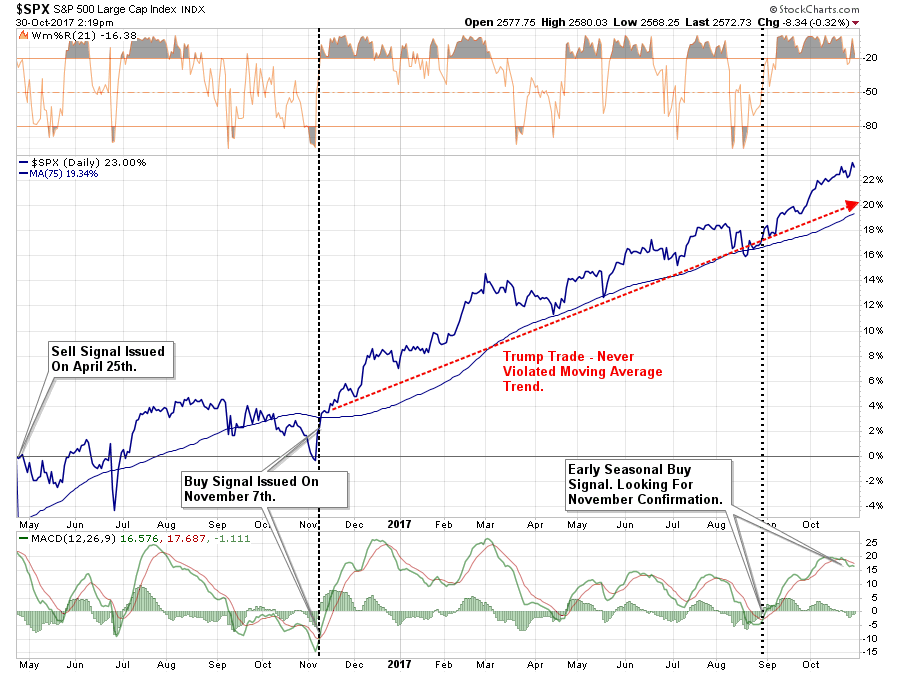

While the summer months put in a positive return, the returns came with a good bit of volatility. While a “sell signal” never occurred this summer, which would have led to a reduction in portfolio equity, I did discuss the seasonal tendencies back in May:

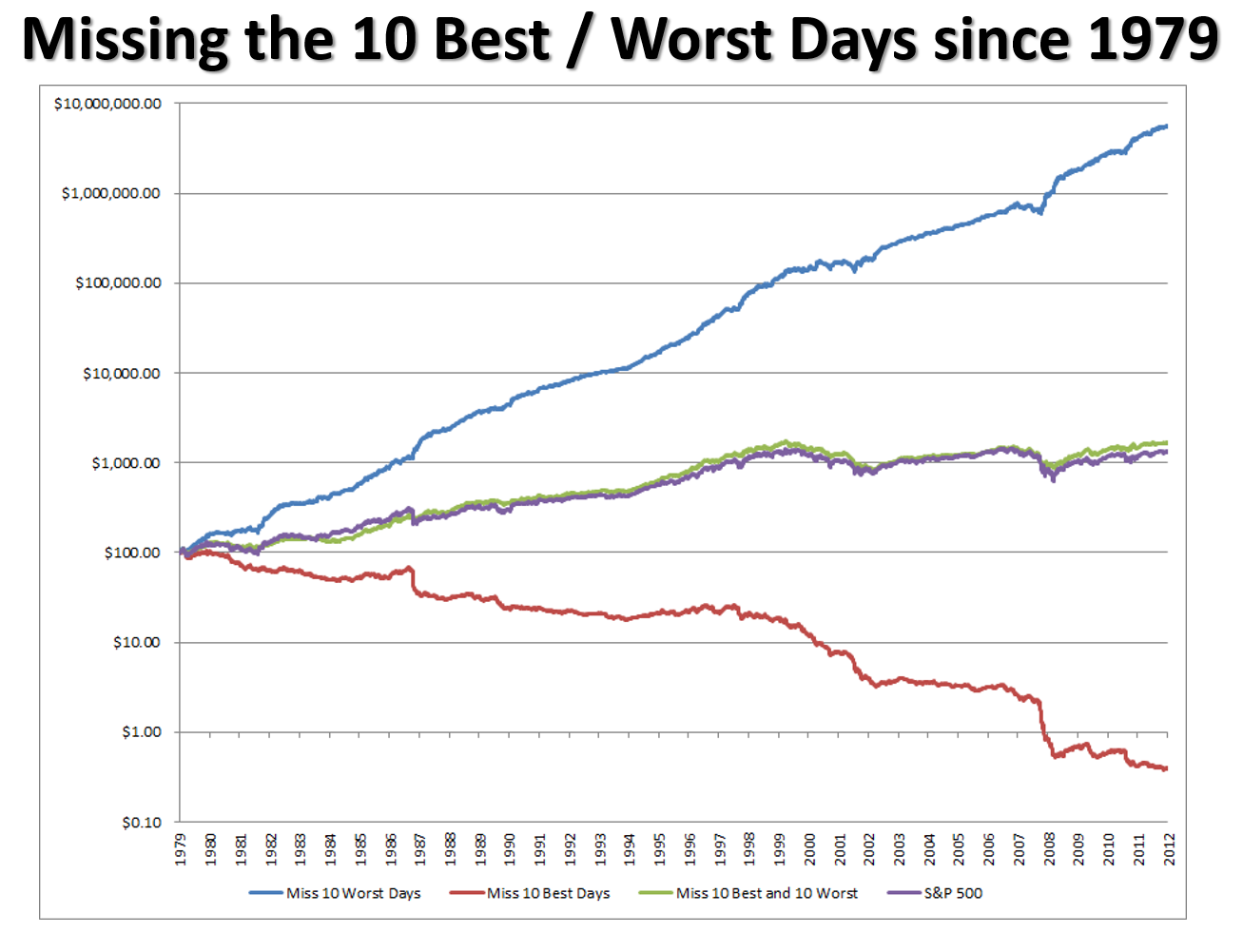

“However, the ‘risk’ to investors is not a continued rise in the markets, but the risk of a sharp decline. As discussed in ‘The Math Of Loss:’

The reason that portfolio risk management is so crucial is that it is not “missing the 10-best days” that is important, it is ‘missing the 10-worst days.’ The chart below, from Greg Morris’ recent presentation, shows the comparison of $100 invested in the S&P 500 Index (log scale) and the return when adjusted for missing the 10 best and worst days.”

“Clearly, avoiding major drawdowns in the market is key to long-term investment success. If I am not spending the bulk of my time making up previous losses in my portfolio, I spend more time compounding my invested dollars towards my long term goals. As Greg notes in his presentation, the markets are only making new highs roughly 4% of the time. Spending a bulk of bull market cycle making up previous losses is hardly a successful investment strategy one can utilize.

Since our job, as investors, is to compound our investment over time, the REAL RISK is NOT MISSING UPSIDE in the markets, but CAPTURING DECLINES. The destruction of investment capital is far more damaging to long-term investment goals than simply missing a potential for rather limited gains at this very late juncture of the investment market cycle.

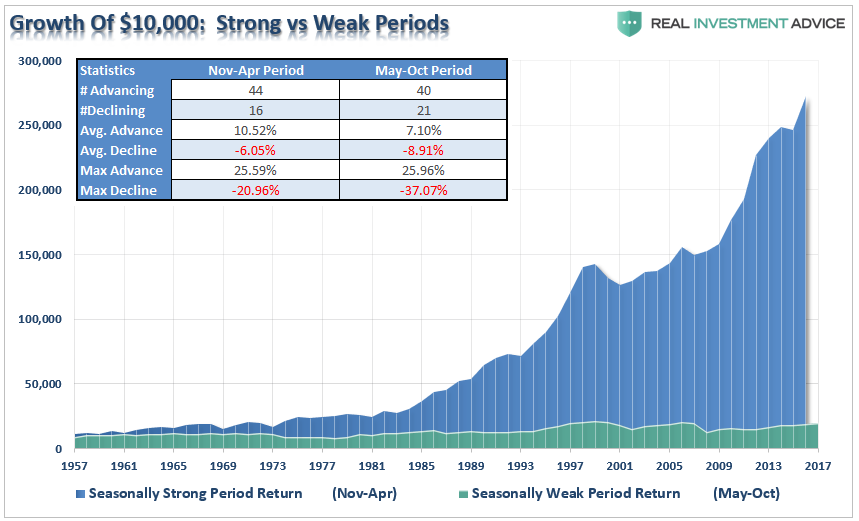

The chart below shows the gain of $10,000 invested since 1957 in the S&P 500 index during the seasonally strong period (November through April) as opposed to the seasonally weak period (May through October).”

It is quite clear that there is little advantage to be gained by being aggressively allocated during the summer months. More importantly, there are few individuals that can maintain a strict discipline of only investing during seasonally strong periods consistently due to the inherent drag of psychology leading to performance chasing.

While the data is certainly interesting, we follow a strict discipline of risk management as it relates to our models and indicators. In 2016, a sell-signal was triggered leading to a reduction in equity exposure heading into the election, such was not the case this year. Despite multiple short-term corrections, the trend remained positive and the short-term moving average was never violated.

While market returns cannot be anticipated with any given degree of certainty from one day to the next, we do know prices will take a turn for the worse after extended bull runs. Timing is always the issue, and history shows that there will be little warning, fanfare or acknowledgment that something has changed.

As noted above, there is a statistical probability that the markets will potentially try and trade higher over the next couple of months particularly as portfolio managers try and makeup ground heading into the end of the year reporting season.

However, it is important to note that not ALL seasonally strong periods have been positive. Therefore, while it is more probable that markets could trade higher in the few months ahead, there is also a not-so-insignificant possibility of a correction phase.

Furthermore, the probability of a correction is increased by factors not normally found in more “bullishly biased” markets:

- Weakness in revenue and profit growth rates

- Stagnating economic data

- Deflationary pressures

- Excessive bullish sentiment

- Rising levels of margin debt

- Expansion of P/E’s (5-year CAPE)

(For visual aids on these points read: 4 Warnings)

How To Play It

With the markets currently in extreme intermediate-term overbought territory and encountering a significant amount of overhead resistance, it is likely that the current “hope driven” rally is likely near a short-term top.

For individuals with a short-term investment focus, pullbacks in the market can be used to selectively add exposure for trading opportunities. However, such opportunities should be done with a very strict buy/sell discipline just in case things go wrong.

However, for longer-term investors, and particularly those with a relatively short window to retirement, the downside risk far outweighs the potential upside in the market currently. Therefore, using the seasonally strong period to reduce portfolio risk and adjust underlying allocations makes more sense currently. When a more constructive backdrop emerges, portfolio risk can be increased to garner actual returns rather than using the ensuing rally to make up previous losses.

I know, the “buy and hold” crowd just had a cardiac arrest. However, it is important to note that you can indeed “opt” to reduce risk in portfolios during times of uncertainty. Read more here.

This is not a market that should be trifled with or ignored. With the current market and economic cycles already very long by historical norms, the deteriorating backdrop is no longer as supportive as it has been.

“Benchmarking” your portfolio remains a bad choice for most investors with a visible time frame to retirement. While it is true that over VERY long periods of time, “benchmarking” your portfolio will indeed lead to gains. The problem is that most individuals do not have 117 years to garner 7% annualized rates of return.

With our portfolios invested at the current time, it makes little sense to focus on what could go right. You can readily find that case in the mainstream media which is biased by its needs for advertisers and ratings. However, by understanding the impact to portfolios when something goes “wrong” is inherently more important. If the market rises, terrific. It is when markets decline that we truly understand the “risk” that we take. A missed opportunity is easily replaced. However, a willful disregard of “risk” will inherently lead to the destruction of the two most precious and finite assets that all investors possess – capital and time.

Just something to consider when the media tells you to ignore history and suggests “this time may be different.”

That is usually just about the time when it isn’t.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI