In last week’s update, I discussed the case of why it was “now or never” for the bulls to take control of the market. To wit:

If you are a bull, what is there not to love?

Despite a long laundry list of concerns, as stated, we remain equity biased in our portfolio models currently for two primary reasons:

- The trend remains bullishly biased, and;

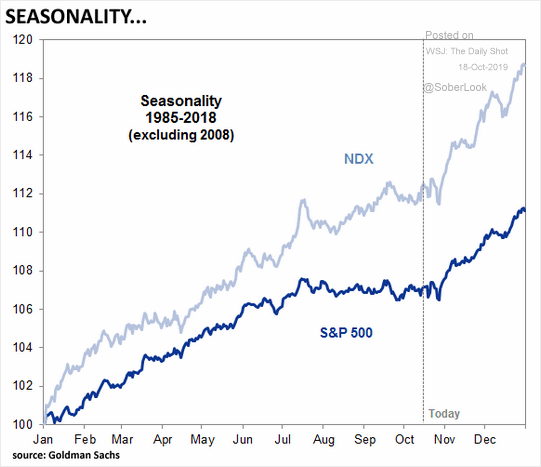

- We are now entering into the historically stronger period of the investment year.

With the volatile summer now behind us, being underweight equities paid off. As I discussed in Trade War In May & Go Away:

“It is a rare occasion the markets don’t have a significant intra-year correction. But it is a rarer event not to have a correction in a year where extreme deviations from long-term moving averages occurs early in the year. Currently, the market is nearly 6% above its 200-dma. As noted, such deviations from the norm tend not to last long and “reversions to the mean” occur with regularity.”

Of course, we saw corrections occur in June, August, and September with little gain to show for it. The point, of course, is the avoidance of risk, which tends to occur more often that not during the summer months, allows us to adhere to our longer-term investment goals.

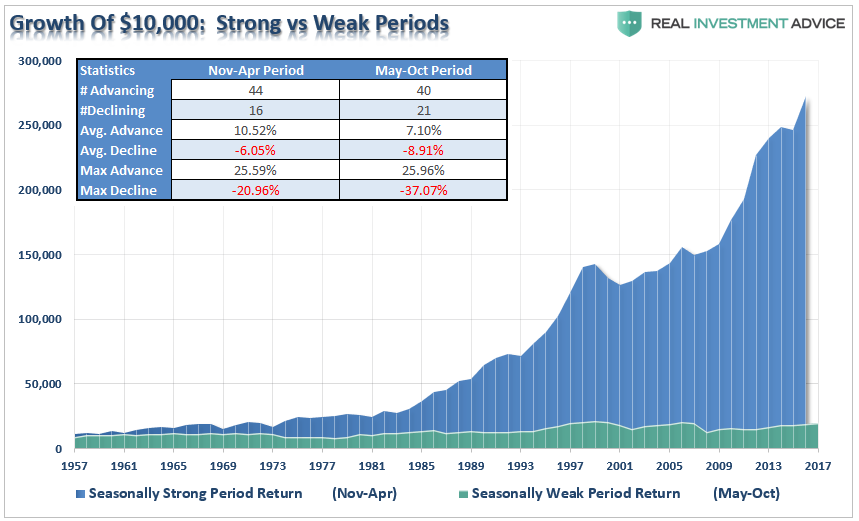

The data bears out the risk/reward of summer months:

“The chart below shows the gain of $10,000 invested since 1957 in the S&P 500 index during the seasonally strong period (November through April) as opposed to the seasonally weak period (May through October).”

It is quite clear that there is little advantage to be gained by being aggressively allocated during the summer months. More importantly, there are few individuals that can maintain a strict discipline of only investing during seasonally strong periods consistently due to the inherent drag of psychology, leading to performance chasing.

Seasonal Strong Period Approaches

Readers are often confused by our more bearish macro views on debt, demographics, and deflation, not to mention valuations, which will impair portfolio returns over the next decade versus our more bullish bias toward equities short-term. That is understandable since the media wants to label everyone either a “bull” or a “bear.”

However, markets are not binary. Being a bear on a macro-basis doesn’t mean you are only allowed to hold cash, gold, and stock in “beanie-weenies.” Conversely, being “bullish” on equities, doesn’t necessarily mean an exclusion of all other assets other than equities.

There is a definitive positive bias to the markets currently.

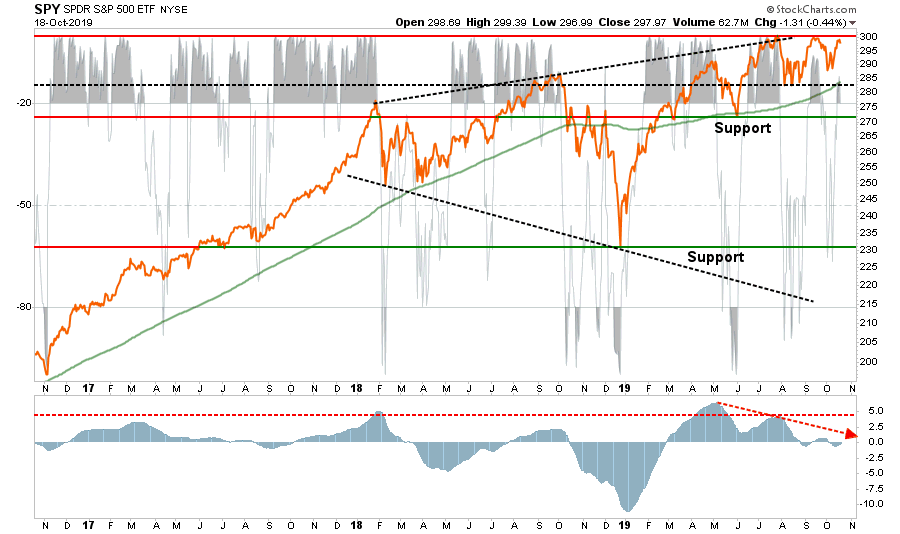

“We are maintaining our core equity positions for now as the bullish trend remains intact. As noted in this past weekend’s newsletter, the bulls have control of the narrative for now. With the “sell signal” reversed, there is a positive bias. However, without the market breaking out to new highs, it doesn’t mean much, especially given the market is pushing back into an overbought condition. We will wait for a confirmation breakout to add to our core equity holdings as needed.“

This doesn’t mean we have “thrown in the towel.”

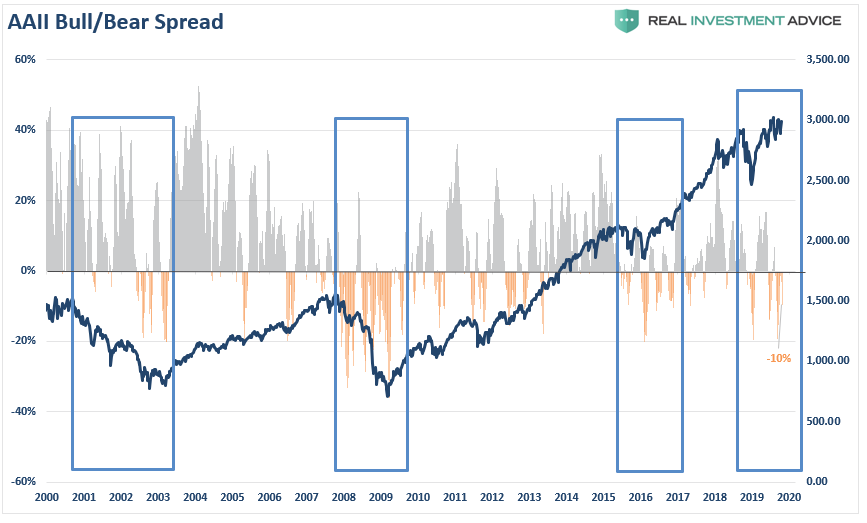

We remain bearish on the long-term returns due to mountains of historical evidence that high valuations, coupled with excess leverage, and slow economic growth generate low returns over very long-periods of time. However, we are also short-term bullish on equity-risk because of stock buybacks, momentum, Central Bank interventions, and seasonality. Also, sentiment has gotten short-term very negative.

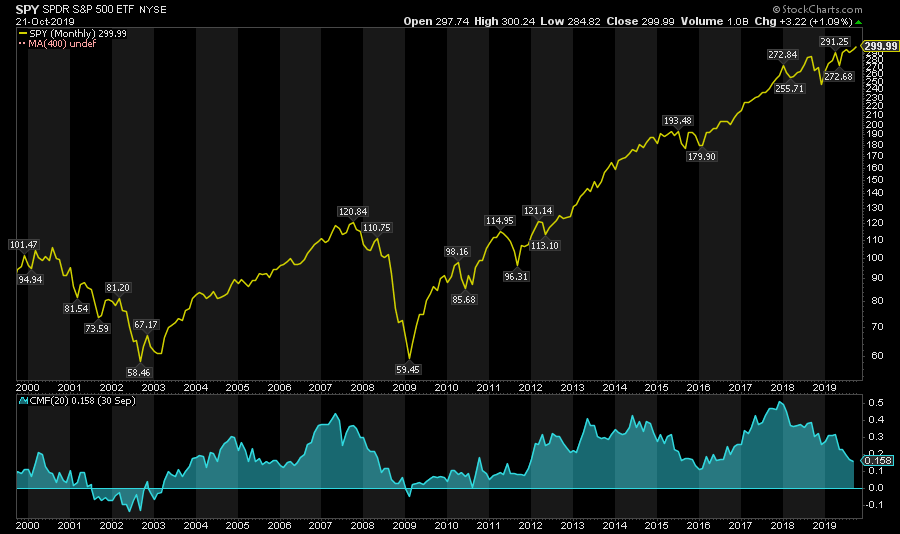

Money flows have also been negative even as the market has been climbing. This is due primarily to the surge in share repurchases, but still remains a contrarian indicator.

While it may seem “crazy,” it is for these reasons, despite the longer-term bearish backdrop, that we need to “gradually” and “incrementally” increase exposure for the next couple of months. Importantly, I did not say leverage up and buy speculative investments. I am suggesting a slight increase in exposure toward equity risk, as opportunity presents itself, until we have an allocation model that both hedges longer-term risks, but can take advantage of shorter-term bullish cycles.

There is no guarantee, of course, which is why investing is about managing risk. In the short-term the bulls have control of the market, and seasonal tendencies suggest higher asset prices by year-end.

Is that a guarantee? Absolutely not.

However, statistical analysis clearly suggests probabilities outweigh the possibilities. Longer-term, statistics also state prices will take a turn for the worse. However, as portfolio managers, we can’t sit around waiting for something to happen. We have to manage portfolios for what is happening now. It is always the timing that is the issue, and history shows there will be little warning, fanfare, or acknowledgment that something has changed.

That is why we manage for “risk.” The risk of the unknown, unexpected, exogenous event which unwinds markets in a sharp, and unforgiving fashion. This risk is increased by factors not normally found in “bullishly biased” markets:

- Weakness in revenue and profit growth rates

- Stagnating economic data

- Deflationary pressures

- High levels of margin debt

- Expansion of P/E’s (5-year CAPE)

How To Play It

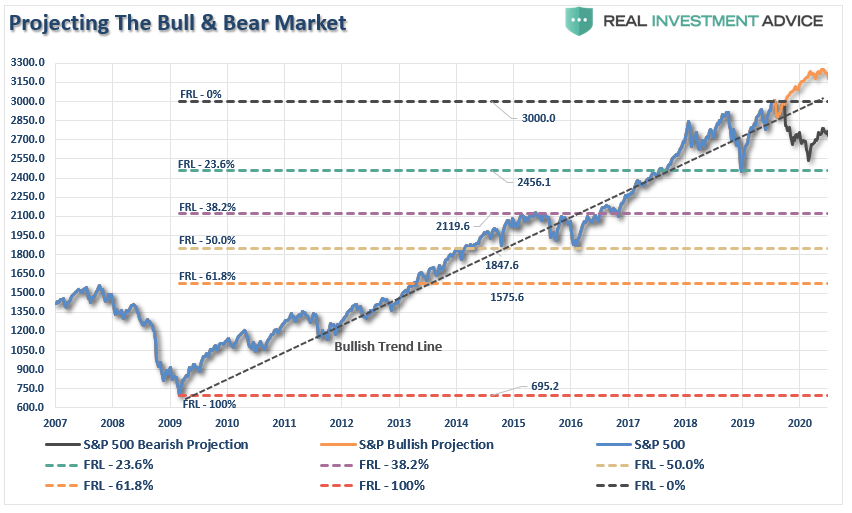

With the markets currently in extreme intermediate-term overbought territory and encountering a significant amount of overhead resistance, it is likely that the current “hope driven” rally is likely near an intermediate-term top, which could be as high as 3300.

Assuming we are correct, and Trump does indeed ‘cave’ into China in mid-October to get a ‘small deal’ done, what does this mean for the market.

The most obvious impact, assuming all ‘tariffs’ are removed, would be a psychological ‘pop’ to the markets which, given that markets are already hovering near all-time highs, would suggest a rally into the end of the year.”

For individuals with a short-term investment focus, pullbacks in the market can be used to selectively add exposure for trading opportunities. However, such opportunities should be done with a very strict buy/sell discipline just in case things go wrong.

Longer-term investors, and particularly those with a relatively short window to retirement, the downside risk still far outweighs the potential upside in the market currently. Therefore, using the seasonally strong period to reduce portfolio risk, and adjust underlying allocations, makes more sense currently. When a more constructive backdrop emerges, portfolio risk can be increased to garner actual returns rather than using the ensuing rally to make up previous losses.

I know, the “buy and hold” crowd just had a cardiac arrest. However, it is important to note that you can indeed “opt” to reduce risk in portfolios during times of uncertainty.

For More Read: “You Can’t Time The Market?”

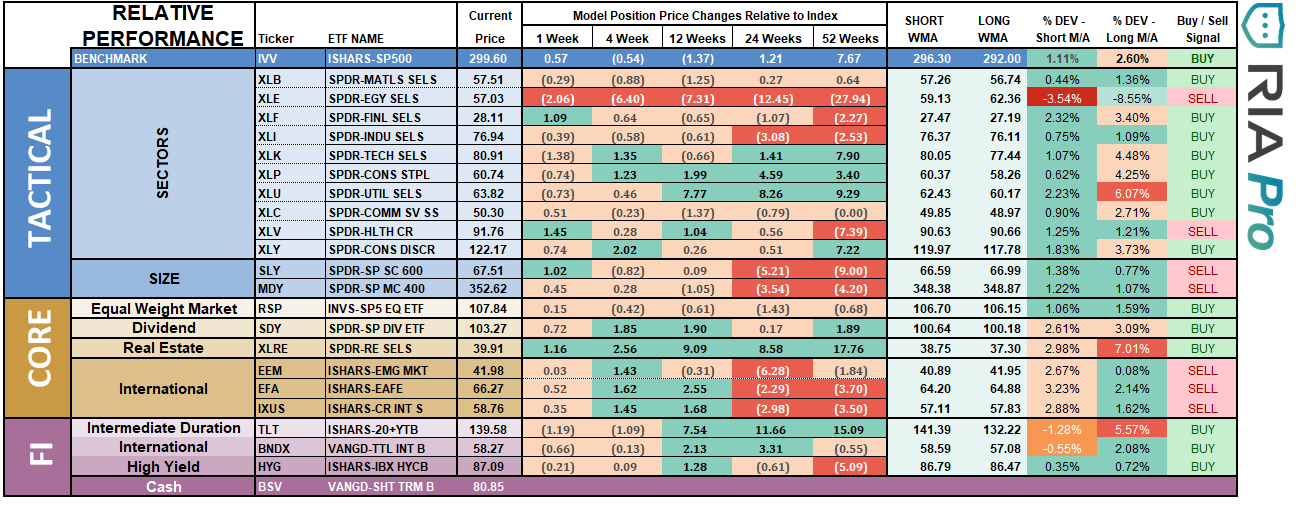

On a positioning basis, the market has been heavily skewed into defensive positioning, which is beginning to rotate back towards more cyclical exposures. Materials, Industrials), Healthcare, Small, and Mid-Caps will likely perform better.

This is not a market that should be trifled with, or ignored. With the current market, and economic cycle, already very long by historical norms, the deteriorating backdrop is no longer as supportive as it has been.

Our portfolios have been primarily long-biased for the last few years. While it may seem a “little crazy” to be adding “equity risk” to the markets currently, we are doing so with a very strict buy/sell discipline in place and are carrying very tight stop-losses.

There is more than a significant possibility that I will be writing in a month, or two, about why we are reducing risk. But this is just how portfolio management works. No one can predict the future, we can only manage the amount of “risk” we undertake.