Since the markets were closed on Monday, there really isn’t much to update from this past weekend’s newsletter. The markets remain clearly and undeniably overbought and the risk of a short-term correction outweighs the potential for reward.

My blogs and newsletters regularly generate responses from those whom, most likely, have never witnessed the damage caused by a “mean reverting event” in the markets. Like this one:

“I just bought more equities and am now 100% invested. I don’t really care about corrections, because I am invested primarily in high yield investments. Sure, the market might correct a little, buy since you can’t time the market, over the long-term I will be fine.”

In the end, they will care about corrections and the “chase for yield” will end as badly as every other bubble throughout history. But I have written plenty about that in the past.

It is the “you can’t time the market” part of the email that I want to address today.

The Market Timing Myth

Back in 2010, Brett Arends wrote: “The Market Timing Myth” which primarily focused on several points that I have been making for years. Brett really hits home with the following statement:

“For years, the investment industry has tried to scare clients into staying fully invested in the stock market at all times, no matter how high stocks go or what’s going on in the economy. ‘You can’t time the market,’ they warn. ‘Studies show that market timing doesn’t work.’

He goes on:

“They’ll cite studies showing that over the long-term investors made most of their money from just a handful of big one-day gains. In other words, if you miss those days, you’ll earn bupkis. And as no one can predict when those few, big jumps are going to occur, it’s best to stay fully invested at all times. So just give them your money… lie back, and think of the efficient market hypothesis. You’ll hear this in broker’s offices everywhere. And it sounds very compelling.

There’s just one problem. It’s hooey.

They’re leaving out more than half the story.

And what they’re not telling you makes a real difference to whether you should invest, when and how.”

The best long-term study relating to this topic was conducted a few years ago by Javier Estrada, a finance professor at the IESE Business School at the University of Navarra in Spain. To find out how important those few “big days” are, he looked at nearly a century’s worth of day-to-day moves on Wall Street and 14 other stock markets around the world, from England to Japan to Australia.

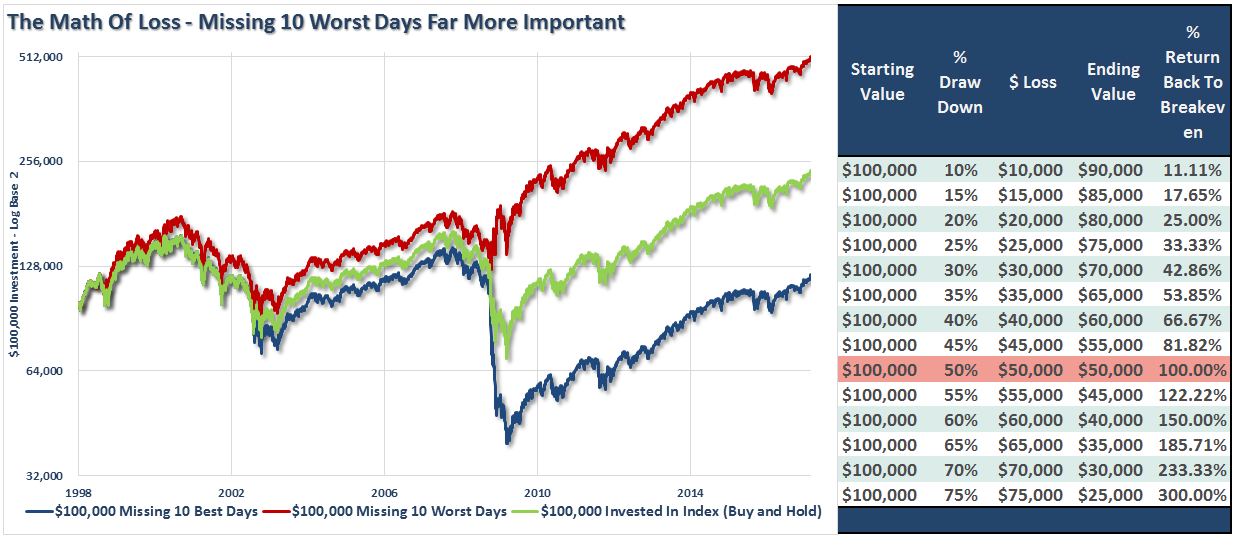

Yes, he found that if you missed the 10 best days you missed out on a lot of the gains. But he also found that if you managed to be out of the market on the 10 worst days, your profits went through the roof.

Clearly, avoiding major drawdowns in the market is key to long-term investment success. If I am not spending the bulk of my time making up previous losses in my portfolio, I spend more time compounding my invested dollars towards my long term goals. As Brett points out:

“Over an investing period of about 40 years, he calculated, missing the 10 best days would have cost you about half your capital gains. But successfully avoiding the 10 worst days would have had an even bigger positive impact on your portfolio. Someone who avoided the 10 biggest slumps would have ended up with two and a half times the capital gains of someone who simply stayed in all the time.

In other words, it’s something of a wash. The cost of being in the market just before a crash are at least as great as being out of the market just before a big jump and may be greater. Funny how the finance industry doesn’t bother to tell you that.”

The reason that the finance industry doesn’t tell you the other half of the story is because it is NOT PROFITABLE for them. The finance industry makes money when you are invested – not when you are in cash. Therefore, it is of no benefit to Wall Street to advise you to move to cash.

A Simple Method

Now, let me clear. I do not strictly endorse “market timing” which is specifically being “all in” or “all out” of the market at any given time. The problem with market timing is consistency.

You cannot, over the long term, effectively time the market. Being all in, or out, of the market will eventually put you on the wrong side of the ‘trade’ which will lead to a host of other problems.

There are no great investors of our time that “buy and hold” investments. Even the great Warren Buffett occasionally sells investments. (He just recently sold almost his entire stake in Walmart (NYSE:WMT).) True investors buy when they see value, and sell when value no longer exists.

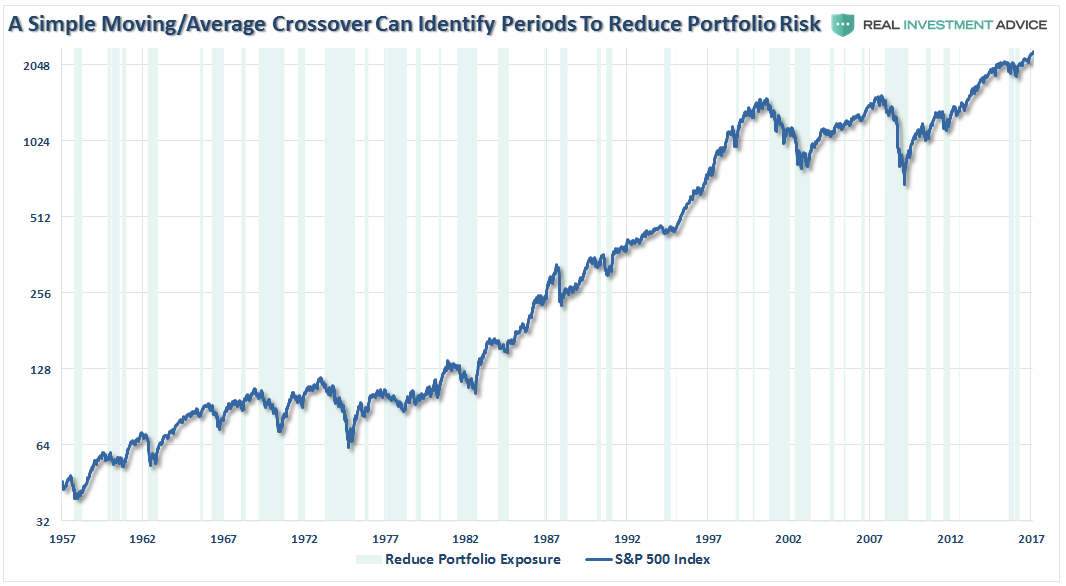

While there are many sophisticated methods of handling risk within a portfolio, even using a basic method of price analysis, such as a moving average crossover, can be a valuable tool over the long term holding periods. Will such a method ALWAYS be right? Absolutely not. However, will such a method keep you from losing large amounts of capital? Absolutely.

The chart below shows a simple moving average crossover study. The actual moving averages used are not important, but what is clear is that using a basic form of price movement analysis can provide a useful identification of periods when portfolio risk should be REDUCED. Importantly, I did not say risk should be eliminated; just reduced.

Again, I am not implying, suggesting or stating that such signals mean going 100% to cash. What I am suggesting is that when “sell signals” are given that is the time when individuals should perform some basic portfolio risk management such as:

- Trim back winning positions to original portfolio weights: Investment Rule: Let Winners Run

- Sell positions that simply are not working (if the position was not working in a rising market, it likely won’t in a declining market.) Investment Rule: Cut Losers Short

- Hold the cash raised from these activities until the next buying opportunity occurs. Investment Rule: Buy Low

By using some measures, fundamental or technical, to reduce portfolio risk by taking profits as prices/valuations rise, or vice versa, the long-term results of avoiding periods of severe capital loss will outweigh missed short term gains. Small adjustments can have a significant impact over the long run.

As Brett continues:

“First, let’s be clear what it doesn’t mean. It still doesn’t mean you should try to ‘time’ the market day to day. Mr. Estrada’s conclusion is that a small number of big days, in both directions, account for most of the stock market’s price performance. Trying to catch the 10 biggest jumps, or avoid the 10 big tumbles, is almost certainly a fool’s errand. Hardly anyone can do this sort of thing successfully. Even most professionals can’t.

But, second, it does mean you that you shouldn’t let scare stories dominate your approach to investing. Don’t let yourself be bullied. Least of all by someone who isn’t telling you the full story.”

There is little point trying to catch twist and turn of the market. But that also doesn’t mean you simply have to be passive and let it wash all over you. It may not be possible to “time” the market, but it is possible to reach intelligent conclusions about whether the market offers good value for investors.

There is a clear advantage to providing risk management to portfolios over time. The problem, as I have discussed many times previously, is that most individuals cannot manage their own money because of “short-termism.”

Despite their inherent belief that they are long-term investors, they are consistently swept up in the short-term movements of the market. Of course, with the media and Wall Street pushing the “you are missing it” mantra as the market rises – who can really blame the average investor “panic” buying market tops and selling out at market bottoms.

Yet, despite two major bear market declines, it never ceases to amaze me that investors still believe that somehow they can invest in a portfolio that will capture all of the upside of the market but will protect them from the losses. Despite being a totally unrealistic objective this “fantasy” leads to excessive risk taking in portfolios which ultimately leads to catastrophic losses. Aligning expectations with reality is the key to building a successful portfolio. Implementing a strong investment discipline, and applying risk management, is what leads to the achievement of those expectations.

As Brett concludes:

“Can’t time the market? It was clear as a bell that investors should have gotten out of stocks in 1929, in the mid-1960s, and 10 years ago. Anyone who followed the numbers would have avoided the disaster of the 1929 crash, the 1970s or the past lost decade on Wall Street. Why didn’t more people do so? Doubtless, they all had their reasons. But I wonder how many stayed fully invested because their brokers told them ‘You can’t time the market.”‘

Something to think about.