Summary

Trade war pressures are increasing.

Oil prices are rising.

Taking their cue from the strong underlying economy, markets should keep moving higher.

Another week, another discussion about trade issues. As of this writing, the administration will impose new tariffs on Chinese imports on Friday, July 6. The Chinese will retaliate in kind. The Canadians have imposed tariffs on about $13 billion in goods. The EU has warned the US about the negative impact of quotas and tariffs but to no avail. There are conflicting reports about tariffs on EU car imports, with one story saying Trump was considering this option but another saying these may be off the table. Yet another news story said Trump wanted to withdraw the US from the WTO. And this week's ISM manufacturing report had several anecdotal comments that the increased cost of steel and aluminum was starting to bite. The bottom line is the pressure caused by these actions continues to build in the economy. At some point, there will be a tipping point into a negative feedback loop.

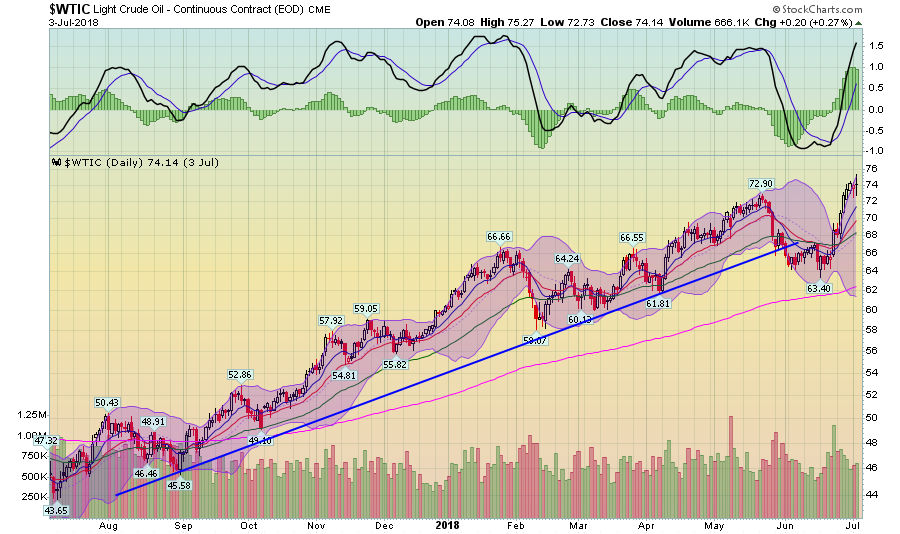

Oil prices are back:

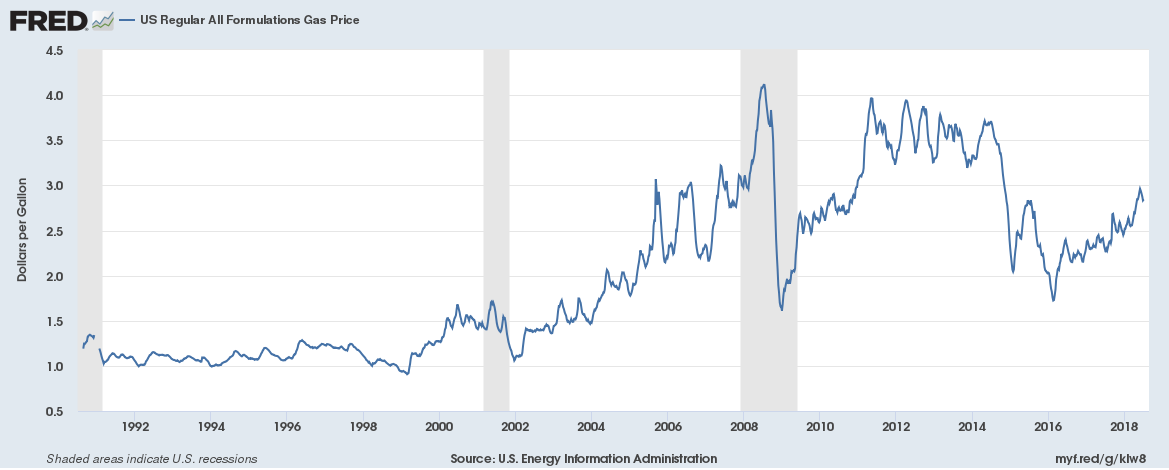

After dipping at the end of May, prices have moved back through their previous trend line area and are again hitting yearly highs. Although OPEC has considered increasing production, the decreased production from Venezuela, Iran, and Libya is weighing on trader sentiment and leading them to bid-up prices. As a result of increased oil prices, we're seeing an uptick in gas prices:

Prices at the pump hit $3 earlier this year but have fallen back a touch. But the overall trend for the last two years is clearly higher. Although we're still below the $4 level that occurred during the last recession, this cost, much like the tariff issue, is slowly adding pressure to the economy.

Other economic news was solid. Both the ISM Manufacturing and Service Reports were strong, showing a continued expansion throughout the economy. Friday's jobs report was strong, showing broad-based gains throughout the labor market. And the economy should continue to experience gains, at least according to projections from the latest Fed Minutes which were released earlier this week:

In the U.S. economic forecast prepared for the June FOMC meeting, the staff continued to project that the economy would expand at an above-trend pace. Real GDP appeared to be rising at a much faster pace in the second quarter than in the first, and it was forecast to increase at a solid rate in the second half of this year. Over the 2018-20 period, output was projected to rise further above the staff's estimate of its potential, and the unemployment rate was projected to decline further below the staff's estimate of its longer-run natural rate. Relative to the forecast prepared for the May meeting, the projection for real GDP growth beyond the first half of 2018 was revised down a little in response to a higher assumed path for the exchange value of the dollar. In addition, the staff continued to anticipate that supply constraints might restrain output growth somewhat. With real GDP rising a little less, on balance, over the forecast period, the projected decline in the unemployment rate over the next few years was a touch smaller than in the previous forecast.

The only thing we need to be on the lookout for is potential shocks to the economy that would slow everything (something like a trade war or oil price spike ...)

Turning to the markets, we're about the enter the next earnings season, which should be good. From Factset.com

Because of the upward revisions to earnings estimates, the estimated year-over-year earnings growth rate for Q2 2018 has increased from 18.9% on March 31 to 20.0% today. All eleven sectors are predicted to report year-over-year earnings growth. Seven sectors are projected to report double-digit earnings growth for the quarter, led by the Energy, Materials, Telecom Services, and Information Technology sectors.

Because of the upward revisions to sales estimates, the estimated year-over-year sales growth rate for Q2 2018 has increased from 7.9% on March 31 to 8.7% today. All eleven sectors are projected to report year-over-year growth in revenues. Three sectors are predicted to reported double-digit growth in revenues: Energy, Materials, and Information Technology.

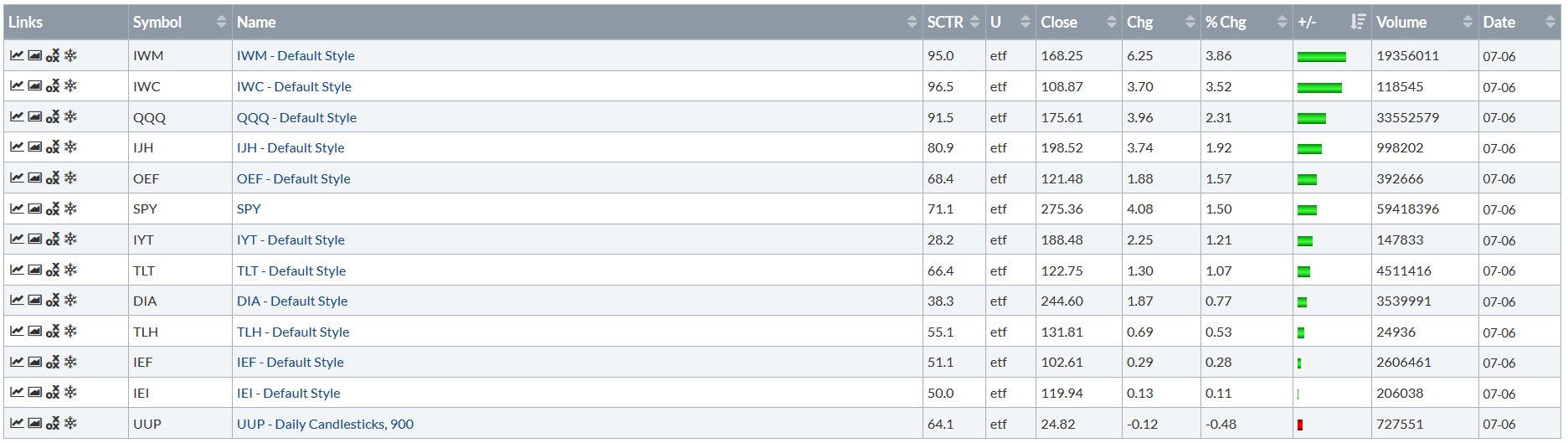

The markets aren't waiting for the next earnings season to start. They rallied strongly this week:

The Russell 2000 led the way, rallying almost 4%. This was followed by the QQQ, Midcap, and large caps. With the exception of the dollar, all the major indexes and treasury market sectors were higher.

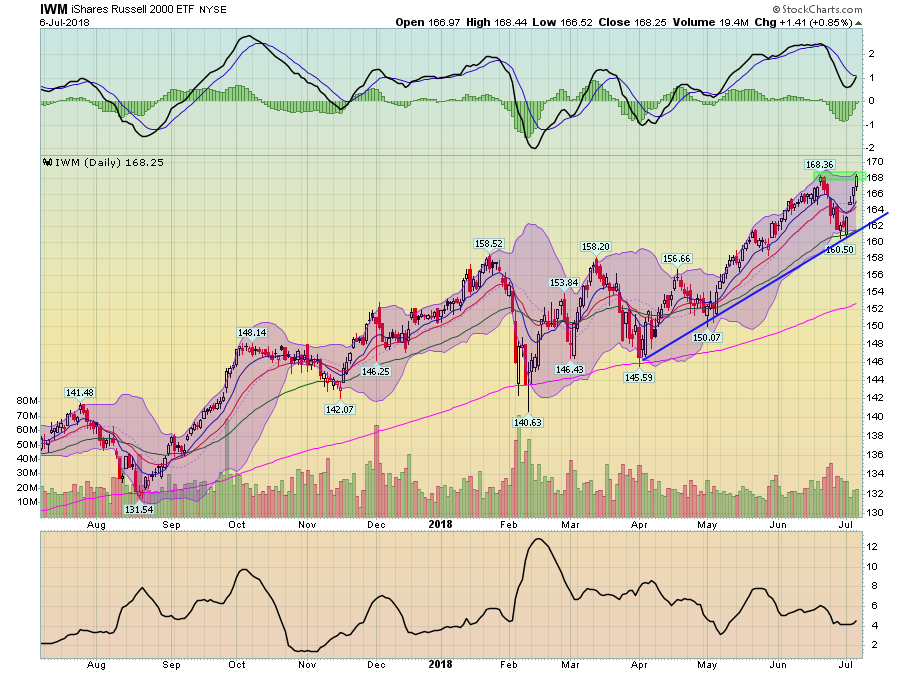

Now let's turn to the daily charts, starting with the IWM:

The IWMs are in the middle of a rally that started at the beginning of April. There's a trend line connecting lows of April, early May, and early July supporting the rally. This week prices hit resistance from mid-June levels. With momentum rising, expect this move to continue higher.

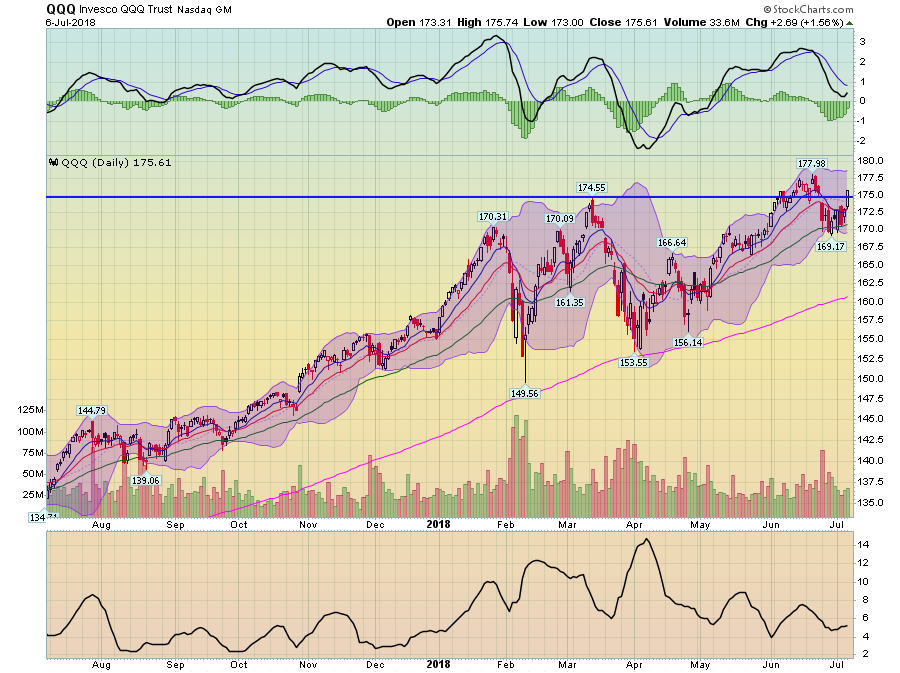

Many of the IWM's overall momentum traits apply to the QQQ. The primary difference is the QQQ isn't at highs. But, as with the IWM, its momentum should take it higher.

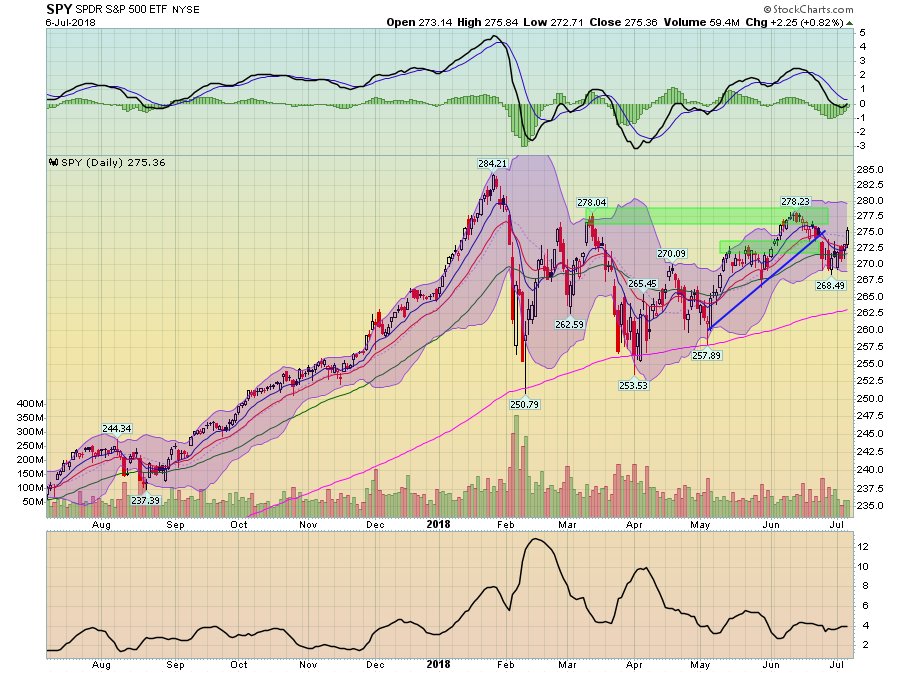

The SPY chart is a mirror-image of the QQQ, although prices are still lower than their respective recent highs.

The combination of strong economic news, rising earnings, and increasing momentum should keep the market moving higher for the next few weeks.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.