Technically Speaking For May 6

Summary

- The news that the administration was considering increasing Chinese tariffs rattled the markets.

- Internals from the household report shows a very strong labor market.

- The markets did surprisingly well today, all things considered.

Up until yesterday, news on the U.S.-China trade negotiations was positive. There were even stories that an agreement was forthcoming. Sunday's announcement that the administration was considering increasing tariffs on a large number of Chinese imports casts the recent good news into a far less positive light. This shouldn't be surprising: it's highly doubtful that a quick resolution was ever in the cards. Trade deals usually require years of complex gamesmanship that appears to be absent in the current administration. Moreover, Trump wants China to change core policies, which is unlikely to happen. Not only has China profited from things like technology transfer but it also wants to assert its newly found position as a global power.

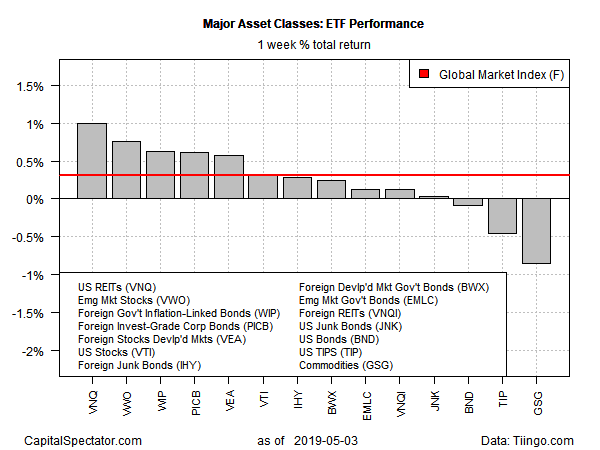

James Picerno at the Capital Spectator is one of my go-to economic blogs. Here is his sector performance chart from last week:

After US REITs, foreign sectors carried that day. On the other side are commodities and U.S. Bonds. Consider this information in conjunction with my Weekly Sector ETF Performance Review.

Let's look at a few data points from Friday's Employment report that may not have gotten a lot of attention.

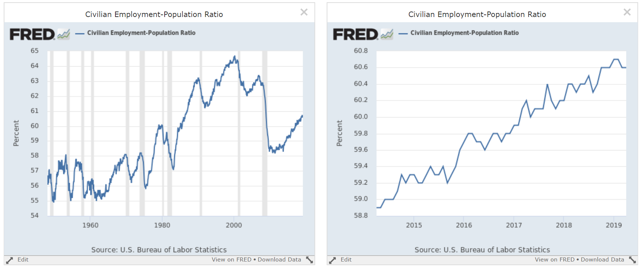

The employment/population ratio continues to rise. The left chart places the data into a longer-term perspective while the right chart shows the last 5-years of data. This tells us that people are continuing to come into the labor market. It's probably a reason why we're finally starting to see wage growth.

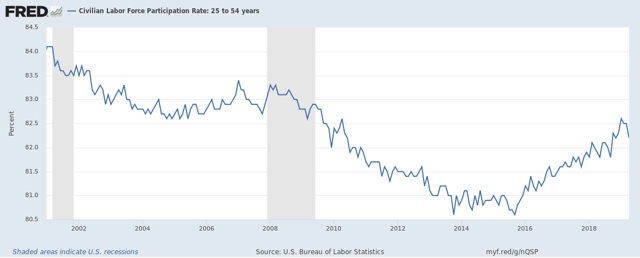

The labor force participation rate for ages 25-54 continues to rise. However, it is still below the lowest levels of the last expansion, which means we could continue to see job gains as members of this demographic group continue to re-enter the labor force.

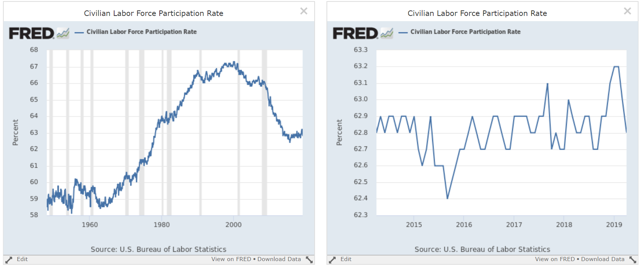

In contrast, the Labor Force Participation Rate continues to move sideways; it has printed between the 62.3-62.5 for the last five years. This tells us that the great retiring wave is having an impact.

The bottom line is that the US labor market is very strong right now.

At the close of last week, I wrote the following about the markets:

As trading starts next week, we'll see two competing trends: is the QQQ really topping or will small caps lead the market higher?

Today's action didn't really answer that question.

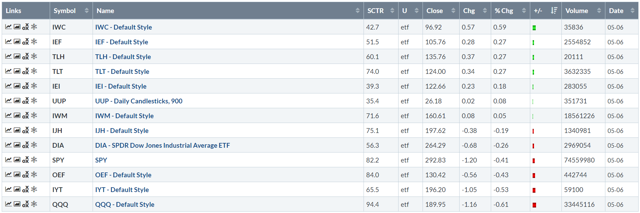

Let's start with the performance table:

Considering how the day started, this is a respectable conclusion. Micros led the pack higher, rising 0.59%. As expected, Treasuries were some of the top performers. On the other side is the QQQ, which was the worst performer on the day, falling 0.61%.

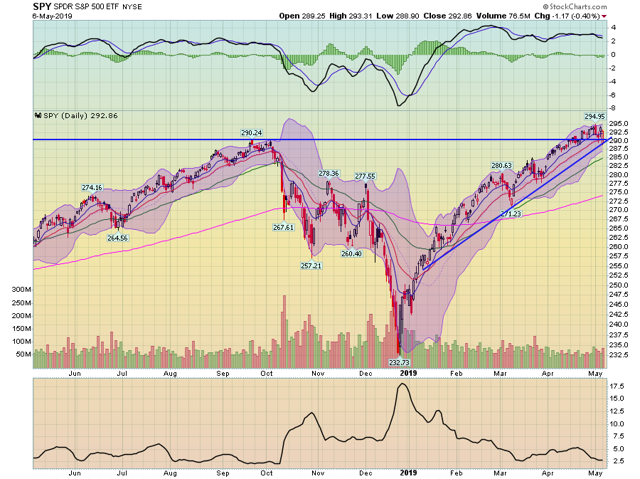

The large-cap uptrends are still in place:

While the QQQ temporarily fell below support today at the open, it rebounded to close above the trendline. Today's bar was one of the strongest we've seen in the last few months.

The SPY also fell to support but rebounded. It also printed a very strong bar.

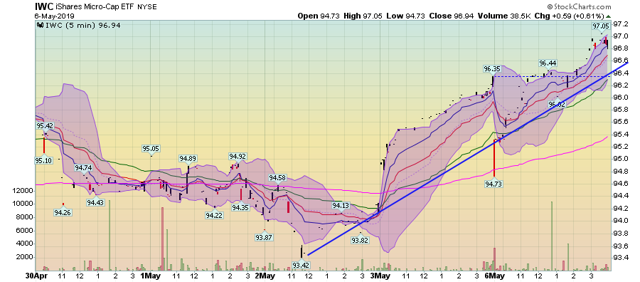

Meanwhile, the small-cap indexes are in surprisingly good shape all things considered.

Micro-caps closed near a five-day high. This index is in a three-day uptrend.

Small-caps are also near a five-day high. They closed above the 169.40 price level from Friday's close.

And mid-caps clawed their way back to Fridays' highs.

What this means is that large-caps are in an uptrend while the small-caps have maintained their upward momentum.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.