Technically Speaking For The Week Of April 29-May 3

Summary

- Thanks to the Chinese stimulus, Asia appears to have dodged a bullet; emerging markets are fair; the EU/UK/Canada have some weakness.

- U.S. data was very good; central banks continue to take a dovish tone.

- There are some interesting cross-currents in the market right now.

International Economic Releases of Note

- Asia/Australia

- China Markit PMI down from 50.8-50.2

- South Korean Industrial Production +1.1% M/M/-.7% Y/Y

- South Korean Retail Sales +2.4% Y/Y

- South Korean Business Sentiment up 2 points

- South Korean exports down 2% Y/Y

- South Korean PMI 49.8-50.2

- Australian PMI +3.8 points to 54.8

Asia conclusion: it's looking increasingly likely that China's stimulus measures have taken root and are slowly spreading into other Asian economies. The ASEAN PMI index was positive with a majority of the countries experiencing manufacturing growth.

Emerging Market

- Russian manufacturing PMI down from 52.8-51.8

- Brazil Consumer Confidence down to 48.4

- Brazil Unemployment at 12.7%

- Brazil PMI 52.8-51.5

- Mexican GDP +1.3% Y/Y

- Mexico PMI 49.8-50.1

Emerging Market Conclusion: overall, these markets are holding up well, with most pointing to modest expansion. Whatever problems exist have been contained (see Argentina, South Africa, and Brazil). Declining/weak trade continues to be the biggest problem, with numerous PMI reports noting weak international demand.

- EU/UK/Canada

- UK manufacturing PMI down from 55.1-53.1

- EU Business Climate Indicator down .12%

- EU Business Sentiment Indicator down 1.6 points

- EU GDP +1.2% Y/Y

- EU PMI 47.5-47.9

- German Consumer Confidence unchanged at 10.4

- German Unemployment at 3.2%

- Canada GDP contracts .1% in March

- Canadian Manufacturing PMI down 50.5-49.7

- Spanish GDP up 2.4% y/y

EU/UK/Canada Conclusion: This region of the world is still modestly weak; EU GDP growth was still low and Canada had a modest contraction in the latest month. Economic sentiment is still declining and PMIs are reporting weak order books.

U.S. Economic Releases of Note

The BEA released the latest monthly income and spending report:

Personal income increased $11.4 billion (0.1 percent) in March according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $0.6 billion, (less than 0.1 percent) and personal consumption expenditures (PCE)increased $123.5 billion (0.9 percent).

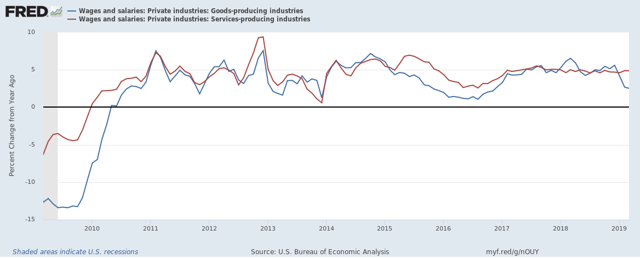

Let's look at a graphical depiction of the data:

Wages and salaries in the service sector are growing right around 5% Y/Y, while the rate of growth for wages and salaries for manufacturing employees is down to a little under 3% Y/Y.

Spending picked-up last month. Durable goods purchases (in blue) rose for the first time in three months. Non-durable goods (in red) have been a bit more volatile over the last five months. Service spending (in green) has been a bit more consistent.

This week, the Institute of Supply Management released their latest manufacturing and service sector numbers. The manufacturing PMI decreased from 55.3 to 52.8. Production and new orders declined with 13/18 industries are growing. The anecdotal comments were strong: business is steady and some prices are declining. The only area of concern was the U.S. Mexico border, which is the subject of political controversy right now. The service sector PMI was modestly lower (-.6 to 55.5), but business activity was up. The anecdotal comments pointed to solid activity, although there was some weakness due to US-Mexico border issues.

Finally, we have Friday's jobs report, which was very strong:

Total nonfarm payroll employment increased by 263,000 in April, and the unemployment rate declined to 3.6 percent, the U.S. Bureau of Labor Statistics reported today. Notable job gains occurred in professional and business services, construction, health care, and social assistance.

Here's a chart of the 3-, 6-, and 12-month moving average of job gains:

The 6- and 12-month MAs are still above 200,000, while the 3-month average is still at a very healthy level.

US conclusion: it appears the slowdown concerns from the beginning of the year are over. Manufacturing and service sector sentiment squarely point to expansion while the jobs market's early-in-the-year slowdown was a temporary aberration. I've lowered my recession probability in the next 6-12 months to 15% in my Turning Points Newsletter.

Central Bank Actions of Note

The Bank of England kept rates at .75% and offered the following assessment of the economic situation (emphasis added):

The MPC has noted previously that UK data could be unusually volatile in the near term, due to shifting expectations about Brexit in financial markets and among households and businesses. GDP is expected to have grown by 0.5% in 2019 Q1, in part reflecting a larger-than-expected boost from companies in the United Kingdom and the European Union building stocks ahead of recent Brexit deadlines. That boost is expected to be temporary, however, and quarterly growth is expected to slow to around 0.2% in Q2. Smoothing through those developments, the underlying pace of GDP growth appears to be slightly stronger than previously anticipated, but marginally below potential. That subdued pace reflects the impact of the slowdown in global growth and ongoing Brexit uncertainties. The latter is having a particularly pronounced impact on business investment, which has been falling for a year. The MPC judges that there is currently a small margin of excess supply in the economy.

Obviously, Brexit remains the big issue for UK business; the recent "solution" merely kicked the can down the road six months. The UK experienced increased 1Q19 activity in some areas, but that was due to stockpiling in anticipation of a hard Brexit. The economy remains in a difficult spot thanks to Brexit uncertainty.

The Fed kept rates at 2.25-2.5%. Their release contained the following assessment of the current economic situation (emphasis added):

Information received since the Federal Open Market Committee met in March indicates that the labor market remains strong and that economic activity rose at a solid rate. Job gains have been solid, on average, in recent months, and the unemployment rate has remained low. Growth of household spending and business fixed investment slowed in the first quarter. On a 12-month basis, overall inflation and inflation for items other than food and energy have declined and are running below 2 percent. On balance, market-based measures of inflation compensation have remained low in recent months, and survey-based measures of longer-term inflation expectations are little changed.

The commentary was solid; there was no mention of a slowdown or international issues.

Central Bank Conclusion: the trend toward either a neutral or dovish stance continues. Central banks have taken note of the recent data softness and have altered their plans accordingly.

Market Overview For the Week of April 29-May 2

Let's start with this week's performance table

Despite the solid performance on Friday, overall performance for the week was lackluster. The good news is that the small and micro caps were the top performers, but they only gained 1.5% and 1.25%, respectively. The larger cap indexes were up modestly.

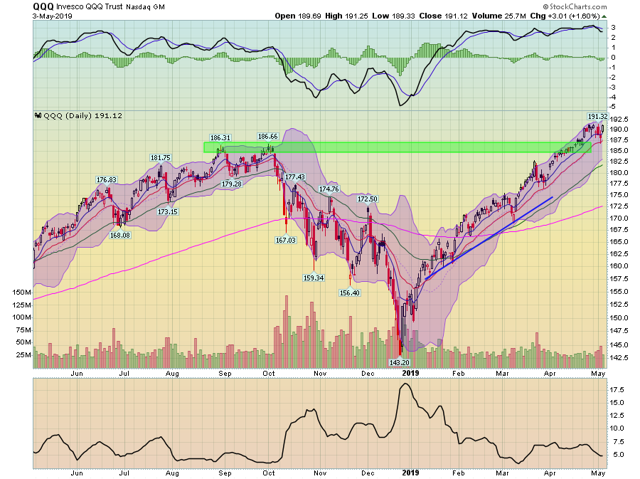

Right now, the markets are at a very interesting technical crossroads. Let's start with the QQQ. Earlier this week, I argued it was topping. That trend is continuing:

The QQQ is consolidating gains after crossing above the mid-180 level. But see the article linked to above and note that momentum remains very high.

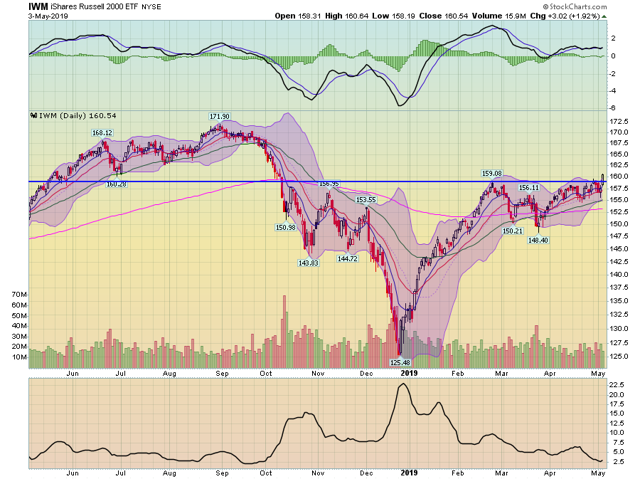

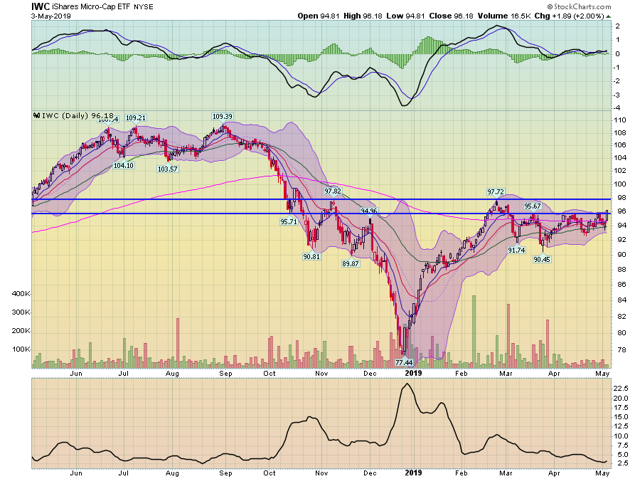

At the same time, smaller cap indexes are either close to or are breaking out.

Mid-caps are right below the 198.3 level, which holds a fair amount of technical importance on the yearly chart.

The IWM has broken through the 159 level, printing a solid candle today.

And the IWC broke through lower-level resistance today but still faces resistance at the 97.72.

As trading starts next week, we'll see two competing trends: is the QQQ really topping or will small caps lead the market higher?

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.