Technically Speaking For June 5Summary

- The Beige Book was very defensive in its characterizations of the economy.

- Chairman Powell is keeping an eye on the trade situation.

- I explain what I'd like to see happen for this relief rally to be "real".

The Federal Reserve issued the latest Beige Book: here is how they described the economy overall (emphasis added):

Economic activity expanded at a modest pace overall from April through mid-May, a slight improvement over the previous period. Almost all Districts reported some growth, and a few saw moderate gains in activity. Manufacturing reports were generally positive, but some Districts noted signs of slowing activity and a more uncertain outlook among contacts. Residential construction and real estate both showed overall growth, but both sectors saw wide variation in sentiment across Districts. Reports on consumer spending were generally positive but tempered. Tourism activity was stronger, especially in the Southeast, but vehicle sales were lower, according to reporting Districts. Loan demand was mixed but indicated growth. Agricultural conditions remained weak overall, but a few Districts reported some improvements. The outlook for the coming months was solidly positive but modest, with little variation among reporting Districts.

There are a number of clarifying statements that are modestly bearish. Manufacturing was positive, "but some districts noted signs of slowing". Contraction growth was up, but there was "side sentiment across districts". The Fed is going out of its way to hedge its bets.

The Federal Reserve is very aware of the trade war risk. Yesterday I flagged comments from St. Louis Federal Reserve President Bullard. Chairman Powell opened his latest speech with this observation (emphasis added):

We do not know how or when these issues will be resolved. We are closely monitoring the implications of these developments for the U.S. economic outlook and, as always, we will act as appropriate to sustain the expansion, with a strong labor market and inflation near our symmetric 2 percent objective.

Fed Governor Bullard made similar observations in a Yahoo News interview. Trade isn't just on the Fed's mind; it was at least a partial reason for the RBA dropping rates 25 basis points earlier this week: "Growth in international trade remains weak and the increased uncertainty is affecting investment intentions in a number of countries". The general pattern in economics is that sentiment leads to activity. So in the area of business activity, future sentiment is what declines first, which, should it remain at lower levels for a sufficient amount of time, eventually leads to decreased activity such as investment and hiring.

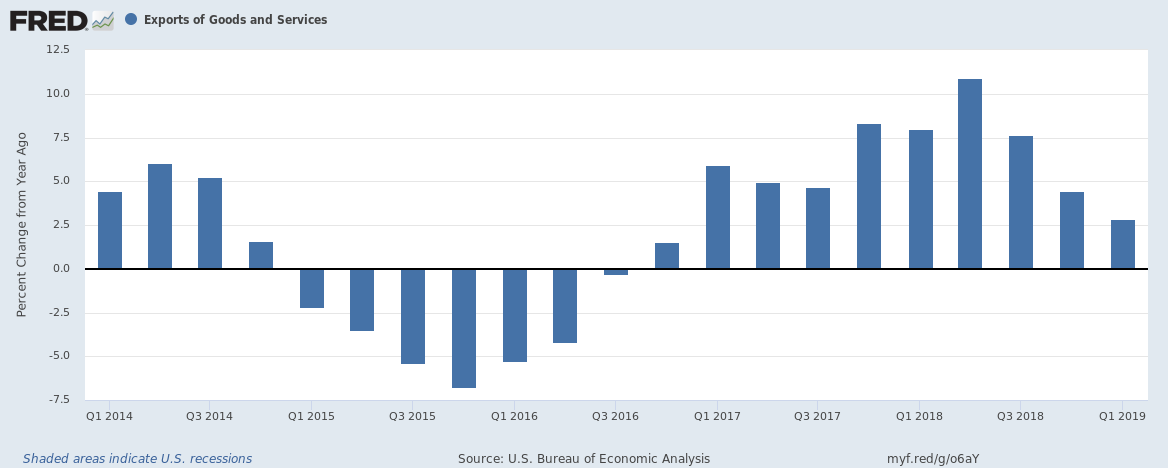

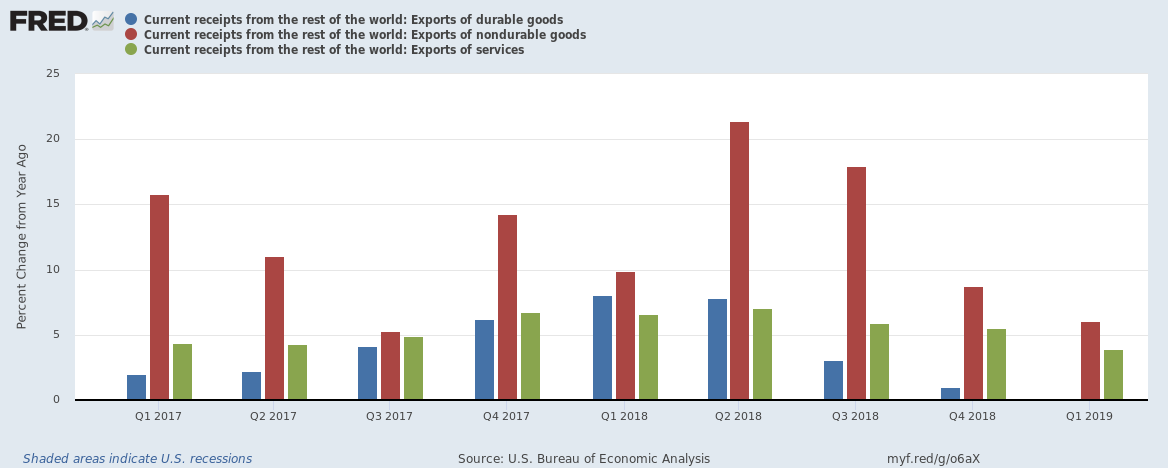

What is happening with U.S. exports? The following graphs place that question into context:

This is the total Y/Y percentage change in exports, which have been declining for the last three quarters.

Trade war rhetoric really started to escalate in late 2017/early 2018, which probably pulled sales forward. This explains the large increase in exports in the second and third quarter of early 2018. Since then the pace of all three categories of exports has been decreasing. Durable goods exports (in blue) aren't growing; the other two categories, while growing, are seeing diminishing growth.

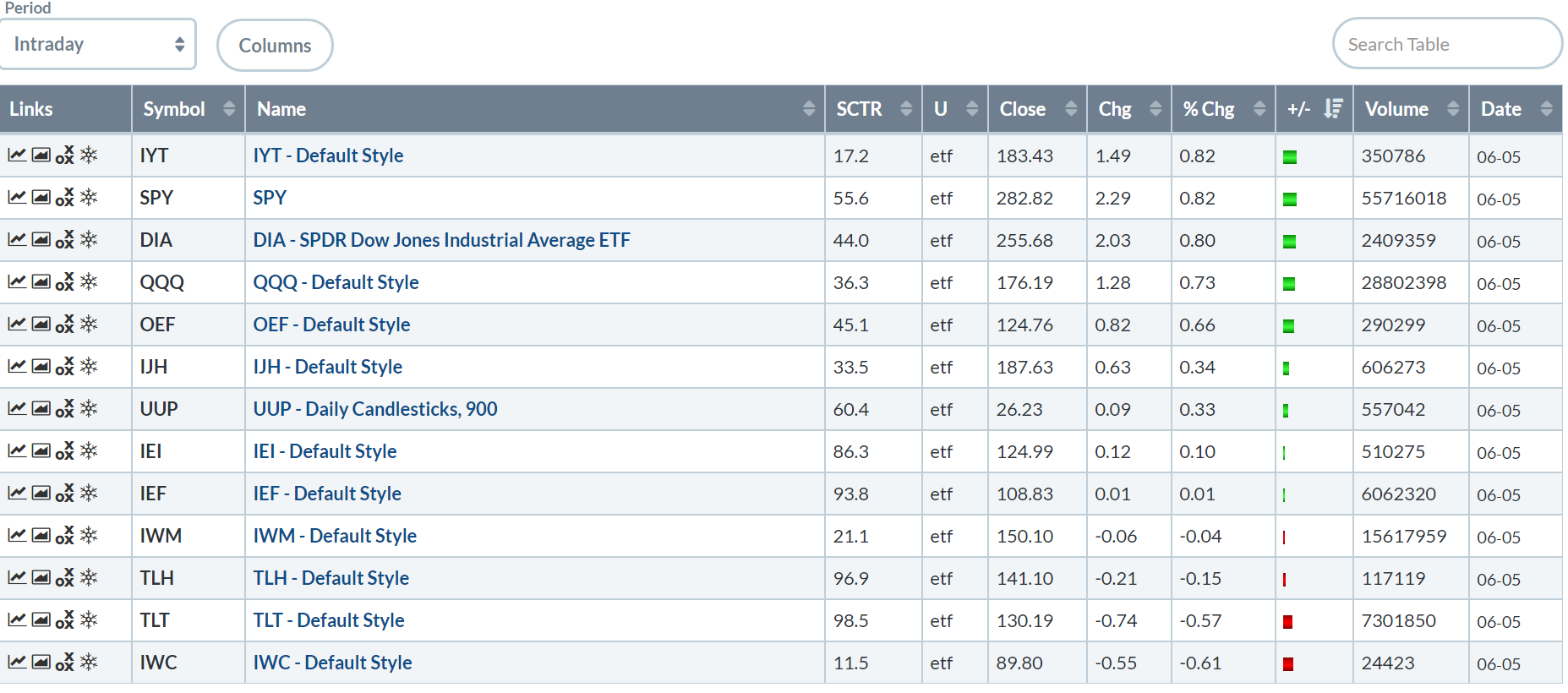

Let's turn to today's performance table:

On the surface, this looks like a win: the equity indexes were mostly up while there was a modest selloff in the Treasury market. But - as was the case with the spring rally - the large-caps are the indexes leading the pack. Mid-caps were up a modest 0.34% while micro-caps declined 0.61%.

Yesterday, I argued that we could see a counter-rally based on technicals. Today, I want to outline what needs to happen for me to be convinced a relief rally is more than a technical bounce.

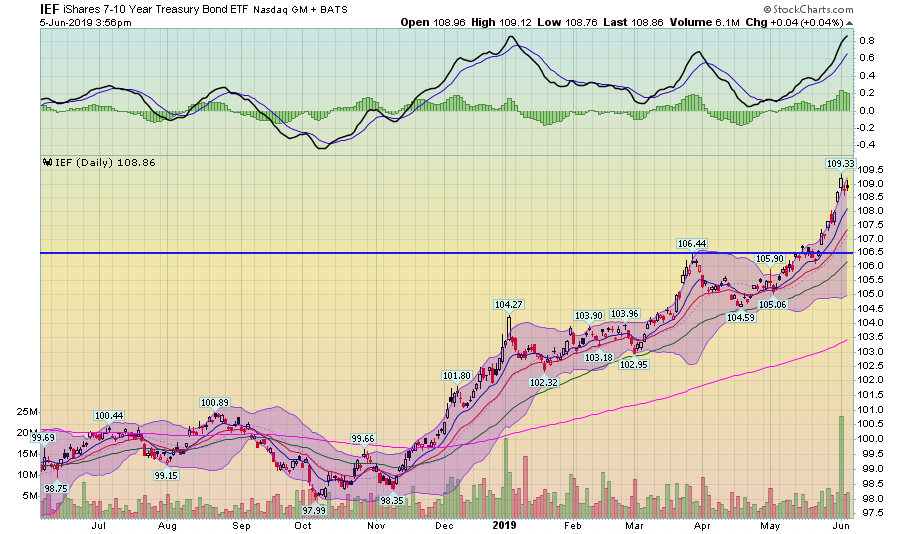

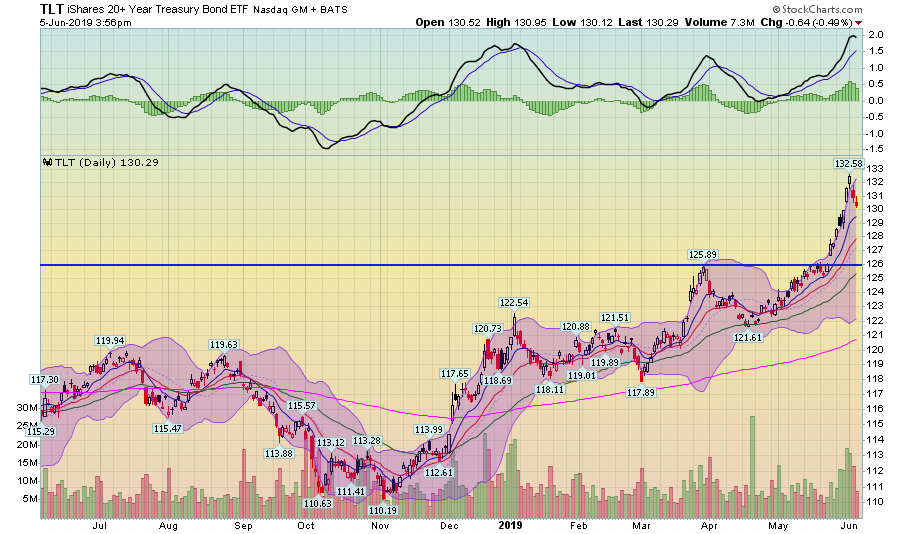

Let's start with the Treasury market:

There has to be a modest selloff, at least to key levels of resistance. For the IEF, that would be 106 (top chart); for the TLT that would be 125-126. The Treasury market has rallied thanks to concerns about low growth; a selloff would signal that sentiment about future growth had turned at least modestly bullish.

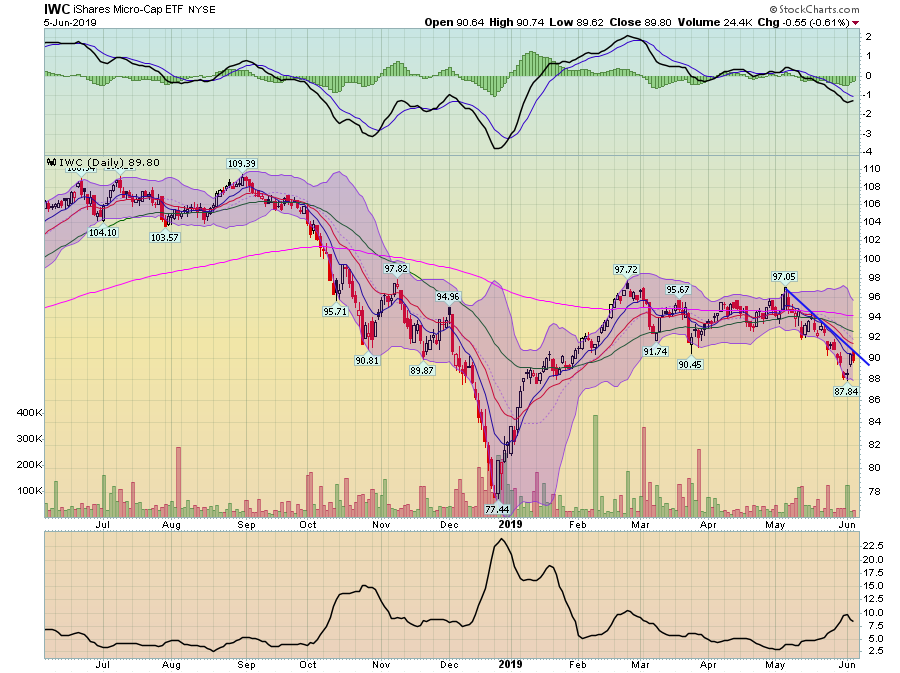

Micro-caps need to rally and stay above their 200-day EMA, as do ...

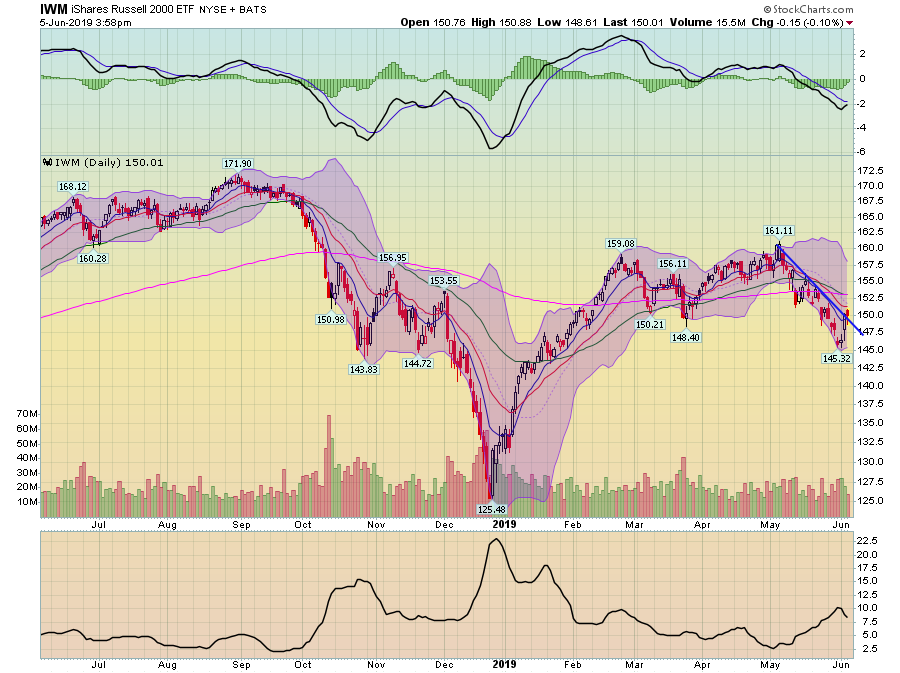

... small-caps.

This would indicate that the markets were taking a far more "risk on" attitude about economic activity.

We're only two days into the rally, so expecting more than a modest technical development is a bit much. But, given the above charts and weakening fundamentals, it's getting more and more difficult to see this rally as nothing more than a technical bounce.