Summary

EU data continues to point towards a recession. The Markit Economics EU manufacturing PMI dropped from 47 to 45.6 in the latest report with new orders, backlogs, and sentiment declining. Employment was up but is weak. German manufacturing's PMI declined from 43.5 to 41.4. The new orders data for both economic sectors was especially concerning (emphasis added):

The survey showed a sustained decline in underlying demand, with total inflows of new business falling for the third month running and at the quickest rate for seven years. Slumping manufacturing orders led the decline, recording the steepest drop in more than a decade in September, though notably there was also a drop in service sector new business–the first recorded since December 2014

Until now, economists could argue the positive data for the German service sector indicated the weakness was contained. That may no longer be the case.

The UK Supreme Court has ruled that Johnson's suspension of Parliament was unconstitutional:

The British Supreme Court ruled on Tuesday that Prime Minister Boris Johnson illegally suspended Parliament, dealing him another heavy blow and thrusting the nation’s politics into even deeper turmoil, barely a month before Britain is scheduled to leave the European Union.

The unanimous decision, which upheld a ruling from Scotland’s highest civil court, said that the suspension of Parliament until Oct. 14 is void. That means that the lawmakers are still in session and will continue the debate over Brexit that was short-circuited when Mr. Johnson asked the queen to suspend, or prorogue, Parliament for five weeks.

We're almost a month away from the possibility of a hard Brexit with absolutely no idea what will happen. This doesn't bode well for the outcome.

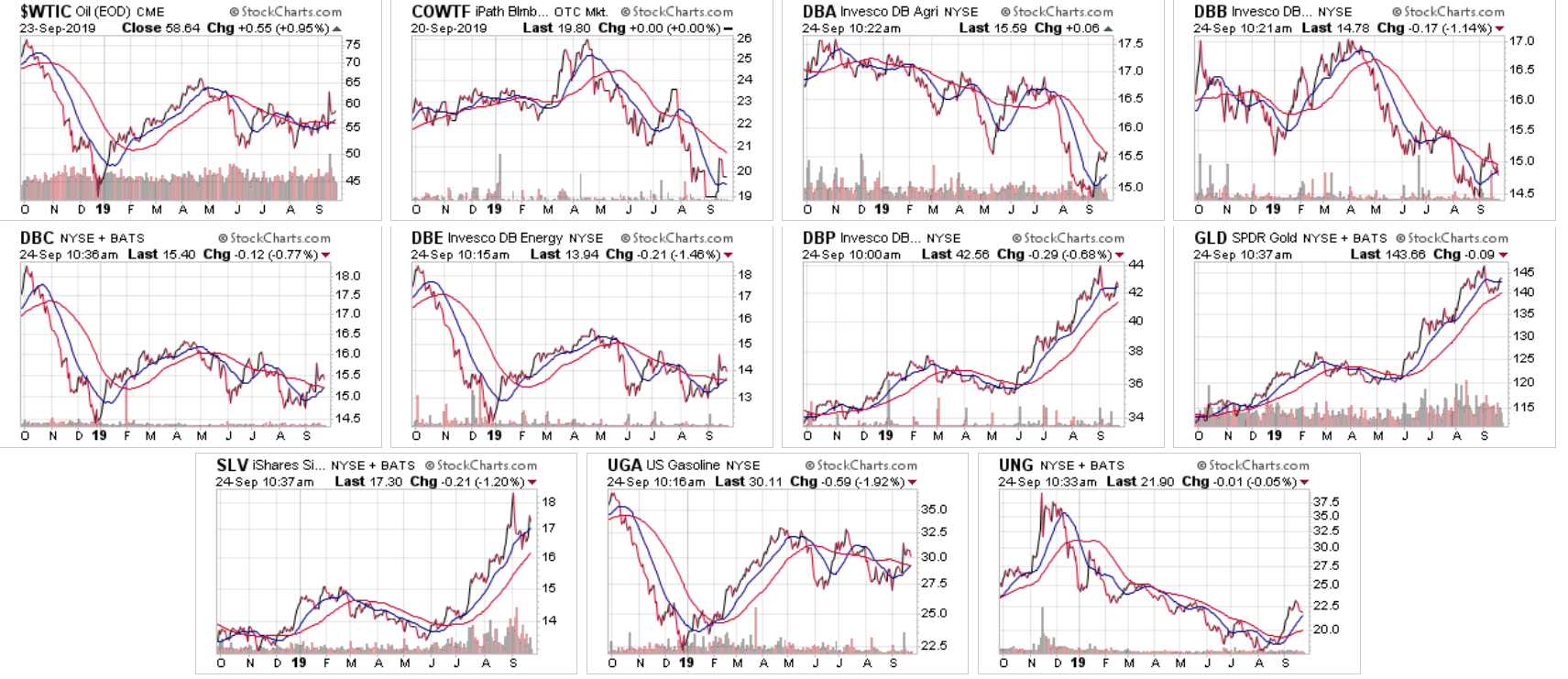

The commodity charts are still bearish:

There are five broad-based commodity-tracking ETFs above: the DBA, DBB, DBC, DNE, and DBP. With the exception of the DPP (which tracks precious metals) all the ETFs are in the lower third of their year-long charts. The spike in the precious metals ETFs indicates that policy uncertainty is high. The combined reading of the above charts is that we're at the end of an economic cycle.

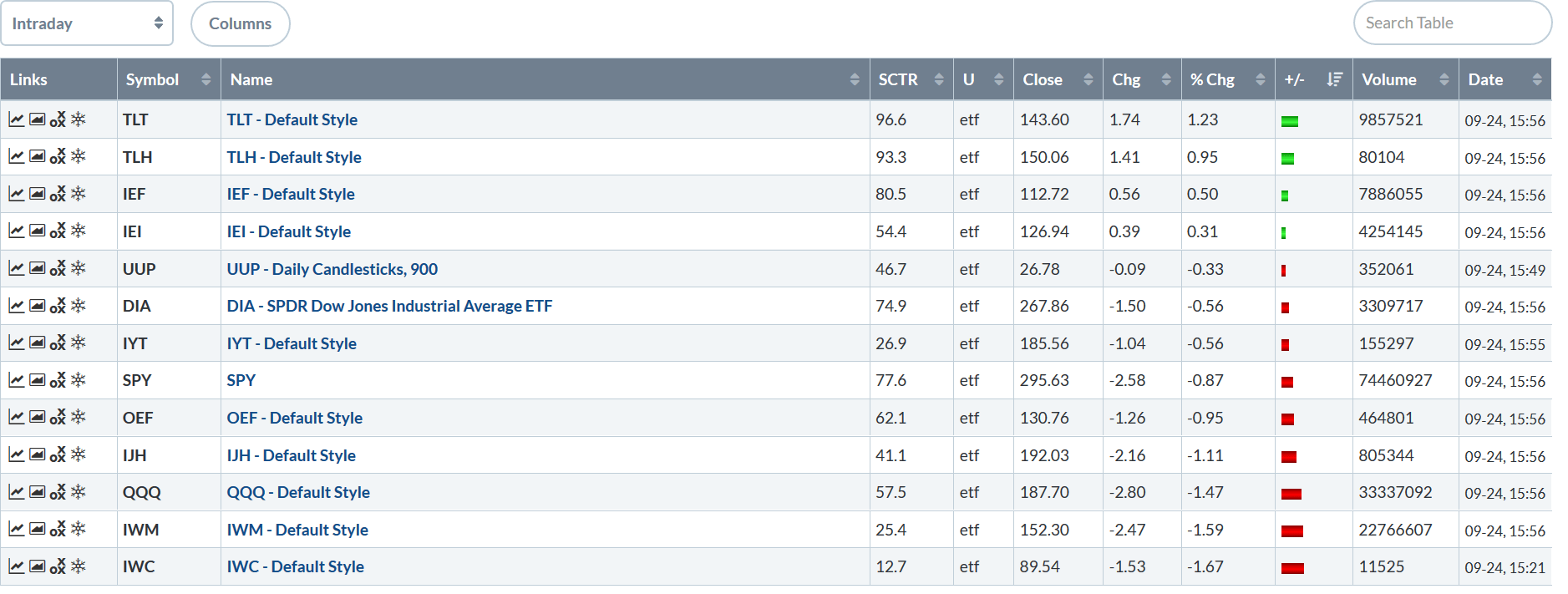

Let's turn to today's performance table:

We're back to the pattern we saw during the Spring: the Treasuries are rallying -- especially the long-end, while the larger-caps are outperforming the smaller-caps.

In Friday's weekly wrap, I noted that the markets were engaged in the big stall. Most of the major equity indexes were approaching new highs but just couldn't get through key levels. Now, prices have started to pull back from those levels while the Treasury market has started to rally again.

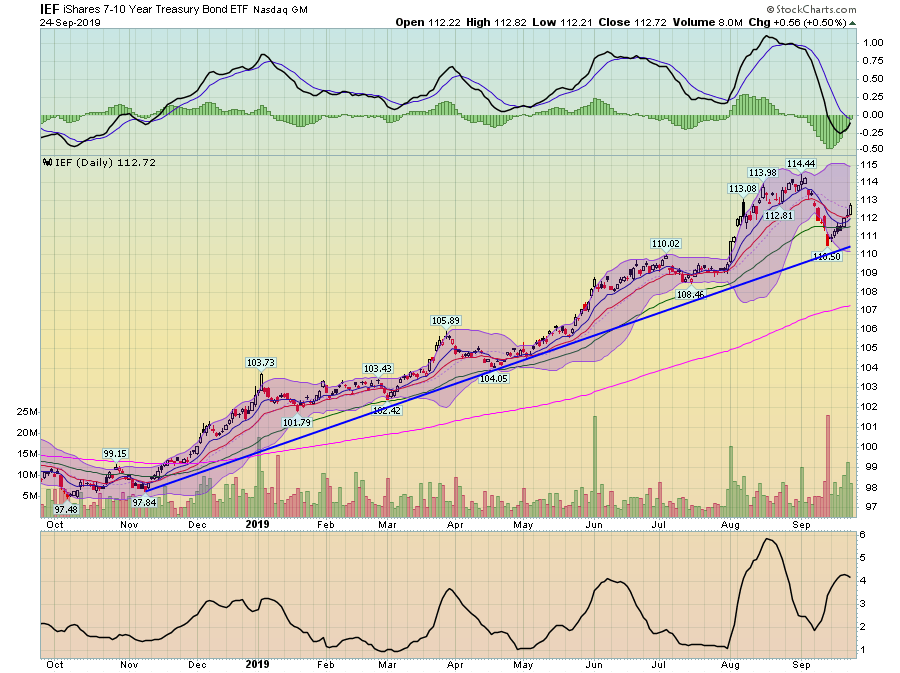

The IEFs started to move higher a little over a week ago. Now they are starting a bigger upswing. Also, note that volume is picking up a bit and the MACD is about to give a buy signal.

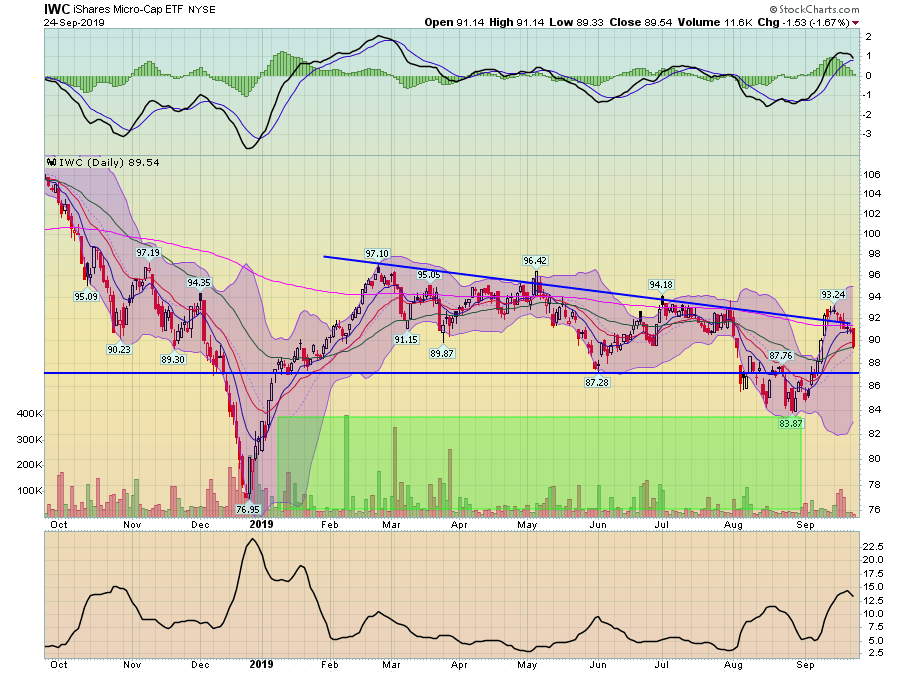

Micro-caps had finally moved through resistance a few weeks ago. But today, prices made a big move backward. Of key importance is the MACD which is about to give a sell signal.

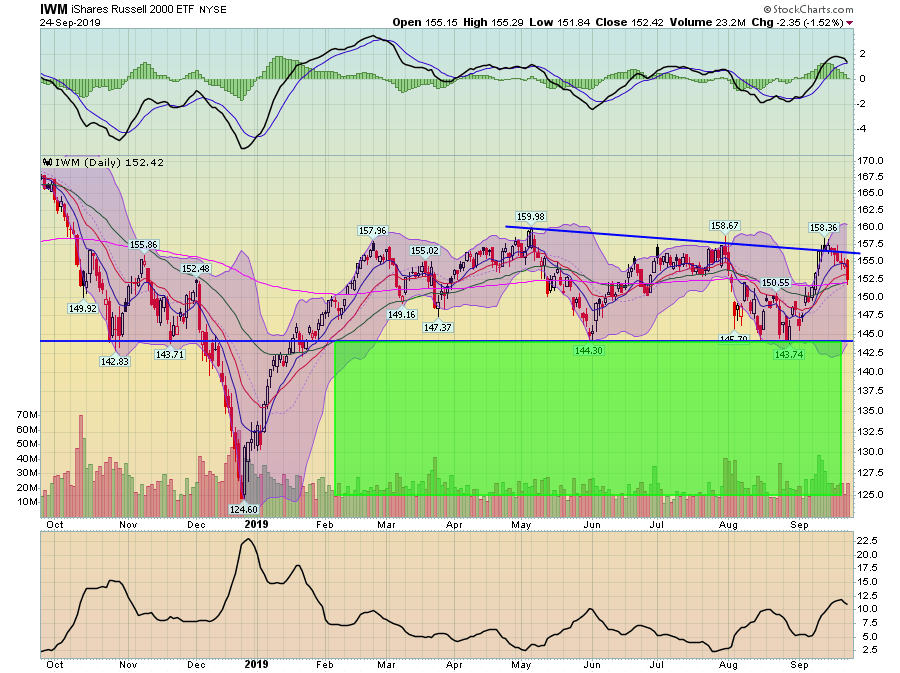

Small-caps are exhibiting the same pattern.

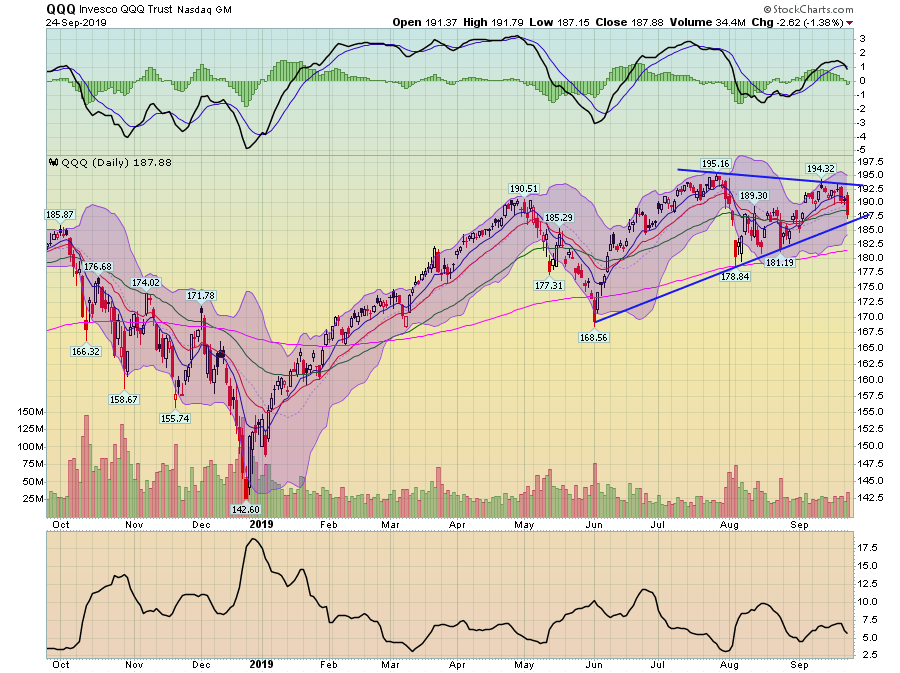

The Nasdaq is also pulling back, as is ...

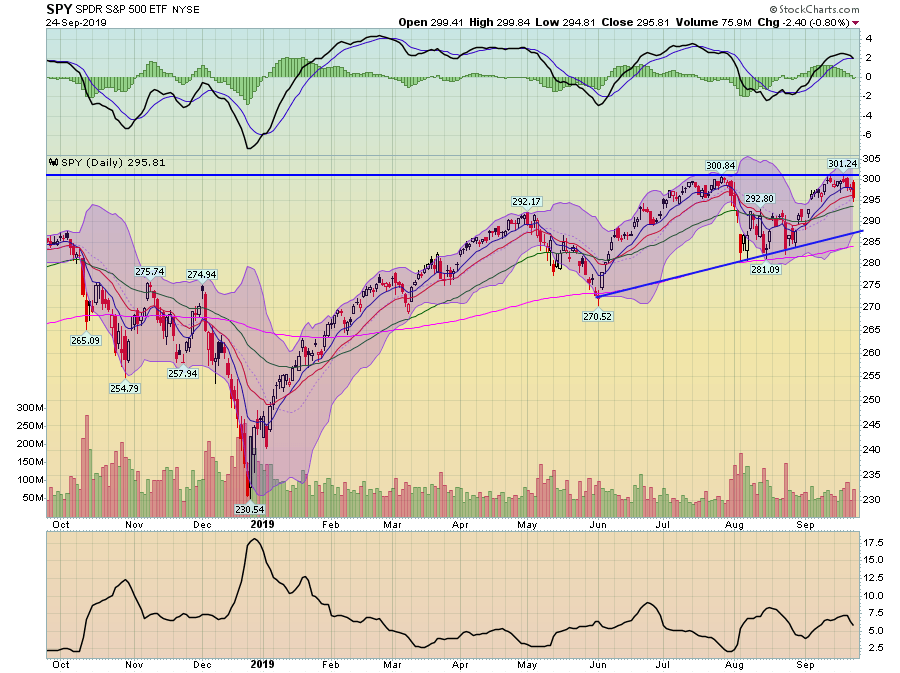

... the SPY.

Yesterday's moves were pretty large from a candle perspective. It doesn't mean that the possibility of a rally through the highs is gone, but it certainly doesn't help.