With very little to push the market around during the session on Friday, we will look to the charts to make our decisions going forward. There are a few Canadian numbers, but beyond that the market should be rather quite as far as headlines are concerned. Of course, you have to keep in mind that the situation in Greece could change at any moment, but beyond that it should be quiet.

The FTSE 100 initially fell during the course of the session on Thursday, but found enough support near the 6600 level in order to form a hammer. The hammer of course suggests that buyers are coming back into the marketplace, and as a result we are buyers above the top of the handle of calls. We believe that this is a short-term call buying opportunity, but ultimately the FTSE should bounce.

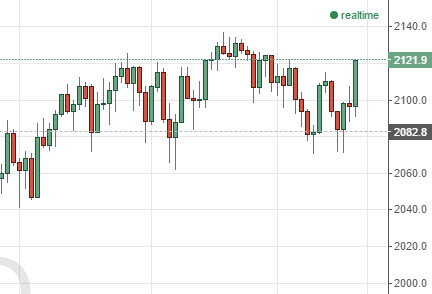

The S&P 500 took off to the upside during the session on Thursday, mainly predicated upon the idea of US dollar weakness. We believe that short-term pullbacks will be call buying opportunities in the S&P 500 unless of course we can break above the 2135 level, which is also a call buying opportunity.

Gold markets followed suit as the US dollar fell apart, and the gold markets of course gained as a result. We are buyers of calls on short-term pullbacks, as we believe the market should then head to the $1220 level, possibly as high as the $1230 level.