- Apple and semiconductors push Nasdaq 100 to new record high

- But Fed repricing limits gains outside of tech as yields edge up

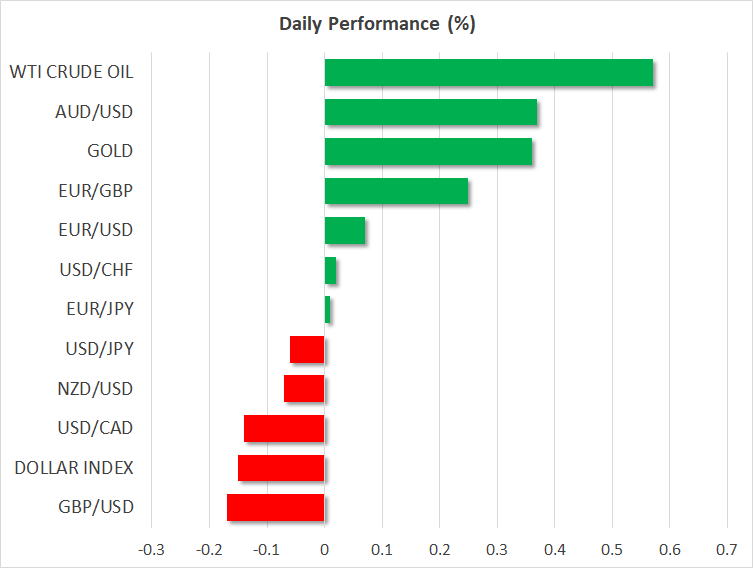

- Dollar holds firm, pound slips on data, yen propped up by verbal intervention

AI optimism spurs tech rally

AI mania made a comeback on Thursday as optimism about a recovery in AI-related demand as well as the broader tech sector boosted equity markets. Apple and TSMC were the main catalysts for yesterday’s rally, ending a two-day rout on Wall Street and lifting sentiment ahead of the Big Tech earnings coming up next week.

Apple shares (NASDAQ:AAPL) notched up their biggest daily rise (+3.3%) since last May after an analyst upgrade from Bank of America. Meanwhile chip giant Taiwan Semiconductor Manufacturing Company saw its stock surge in both New York and Taiwan after it reported better-than-expected results for the fourth quarter and forecast strong revenue growth for 2024.

Nvidia (NASDAQ:NVDA) and Meta (NASDAQ:META) were the other big beneficiaries of the revived optimism surrounding artificial intelligence, all of which helped the Nasdaq 100 advance by 1.5% to close at a new peak. The broader Nasdaq Composite index remains some distance from its all-time high but the S&P 500 (+0.9%) came within a whisker of setting a new record.

Shares in Europe and Asia followed Wall Street higher on Friday, though Hong Kong and Chinese indices bucked the trend amid ongoing concerns about China’s property market and fears about a crackdown on the financial sector.

Swimming against the tide?

The rally in global equities comes even as investors have started to scale back some of their very dovish bets about the interest rate outlook in the US and elsewhere. In the bigger picture, most stock indices remain within their recent range amid a range of uncertainties weighing on the outlook that’s hindering policymakers from laying out a clear path for interest rates.

Nevertheless, this latest rally shows that tech and AI stocks have the ability to decouple themselves from the usual risk factors driving the markets and their defensive nature will likely be put to the test should Fed rate cut bets continue to be trimmed.

Investors now see just more than a 50% probability of the Fed cutting rates in March compared to more than 75% last week. This latest repricing comes after US jobless claims fell to their lowest in more than a year last week, suggesting a still tight labour market. Moreover, Fed officials continue to cast doubt on the prospect of an imminent dovish pivot, with Atlanta Fed president Raphael Bostic being the latest on Thursday to warn against premature rate cuts.

Euro finds its feet, but pound slips as dollar holds at one-month high

US and European bond yields have been creeping up all week as policymakers from the Fed and European Central Bank repeatedly pushed back on the markets’ timeline of how soon rates would be cut. The 10-year Treasury yield is currently trading near one-month highs, lifting the US dollar to similar highs against a basket of currencies.

But after falling sharply at the start of the week, the euro has managed to stabilize around $1.0880, and the Australian dollar has also perked up somewhat. However, sterling, which was boosted mid-week from a hot UK CPI report, has come under pressure on Friday following a much worse-than-expected drop in retail sales in December. The weak data increases the chances that the British economy contracted in the final quarter of 2023, entering a technical recession.

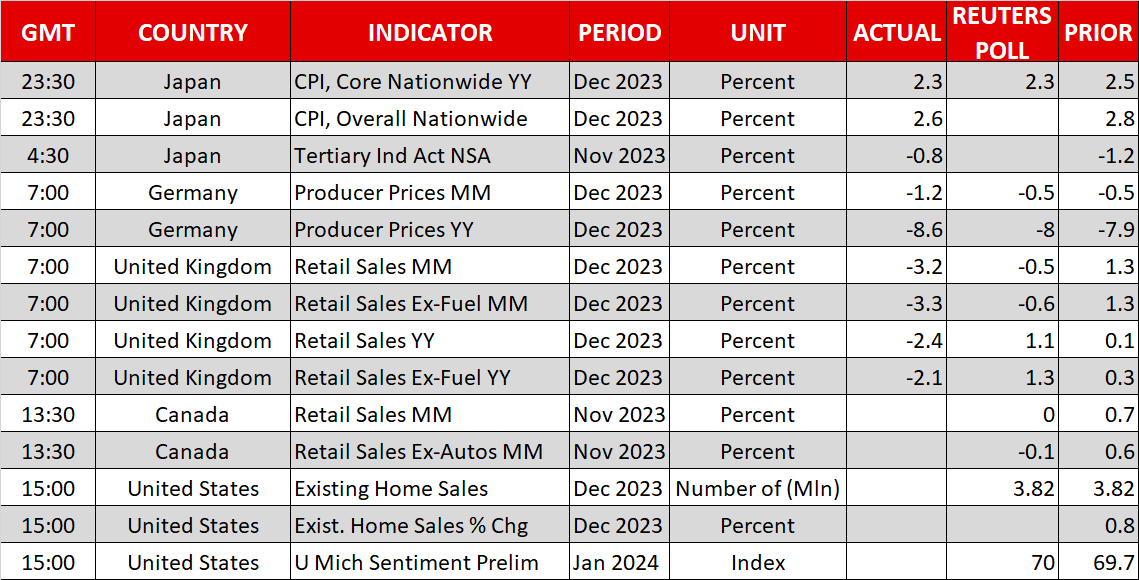

Japan’s Suzuki comes to the yen’s rescue

Investors also digested the latest CPI figures out of Japan today. Consumer prices rose by 2.3% y/y in December, easing from 2.5% in the prior month. Whilst the data was inline with expectations, the yen skidded in the immediate aftermath as it added to the doubts about the Bank of Japan being able to hike interest rates anytime soon. This prompted some verbal intervention from Japan’s finance minister Shunichi Suzuki against any rapid moves, triggering a reversal in the yen’s decline.

The dollar was last trading slightly around 147.90 yen, having spiked to 148.80 yen soon after the CPI data was released.