A trade war is heating up with China. This has impacted the stock market in both countries. The Chinese Shanghai Composite is off over 6% since the May Day break, while the S&P 500 is off 4%. Amidst all of the grandstanding and hyperbole, it would seem like they had dropped a lot more. But checking under the surface there is one sector that has had a more difficult time, Technology.

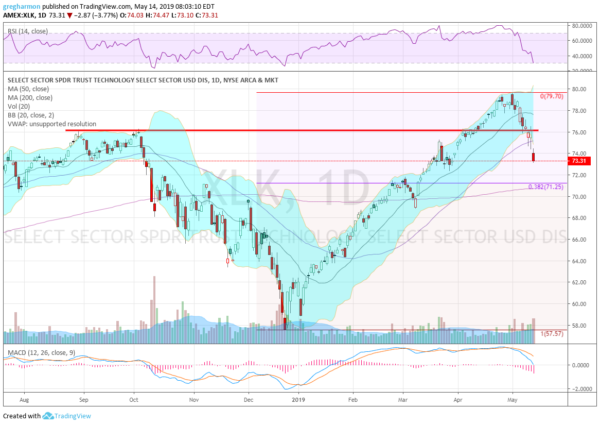

The Technology Sector ETF, $XLK, pictured below, is having a rougher time. It is off 7.5% its peak as of Monday’s close and over 6% in the last 6 trading days. Is the trade war just about technology? The stock market appears to think so. The chart below shows signs of moving too far too fast, and it appears a bounce will come Tuesday at the open.

But the damage has been seen. And the natural stopping place may still be lower. A 38.2% retracement of the leg higher from the December lower is now only $2 lower and very near the 200 day SMA. That would make for a 10% correction. The good news is a hold at that level would likely be viewed as just a healthy reset in the uptrend. Will that happen?

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.