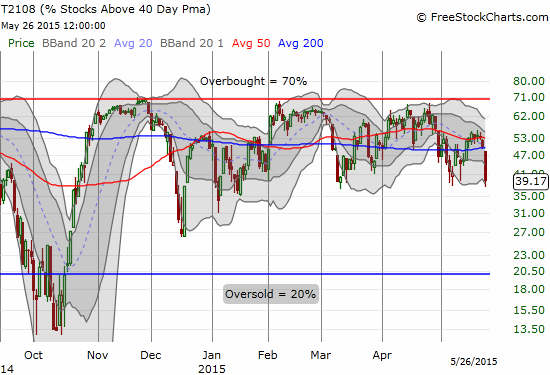

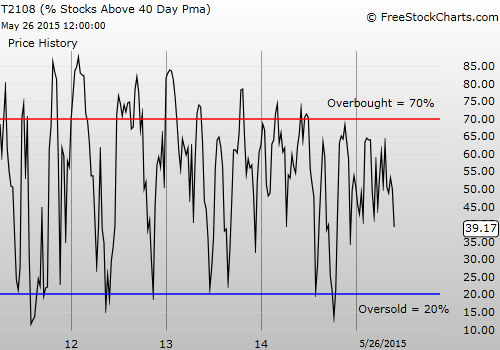

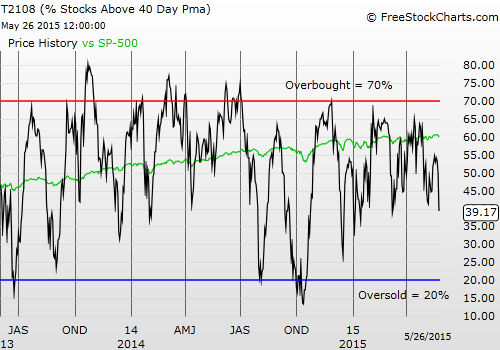

T2108 Status: 39.2% (a 11 percentage point plunge, a 2 1/2 month low, and the bottom of recent trading range)

T2107 Status: 50.0%

VIX Status: 14.1

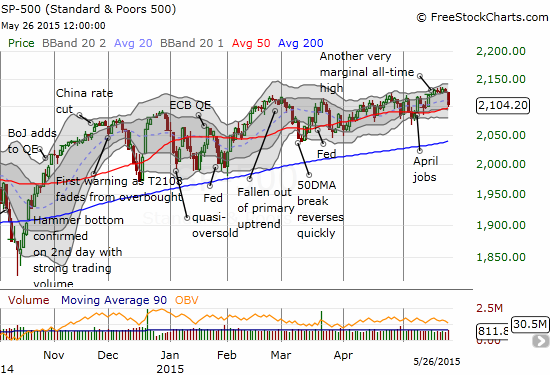

General (Short-term) Trading Call: Neutral. See caveats below for slight bearish bias. Setup for S&P 500 run-up comes to a screeching halt.

Active T2108 periods: Day #150 over 20%, Day #109 above 30%, Day #1 under 40% (Friday ended 40-day overperiod at 51 days), Day #19 under 60%, Day #219 under 70%

Commentary

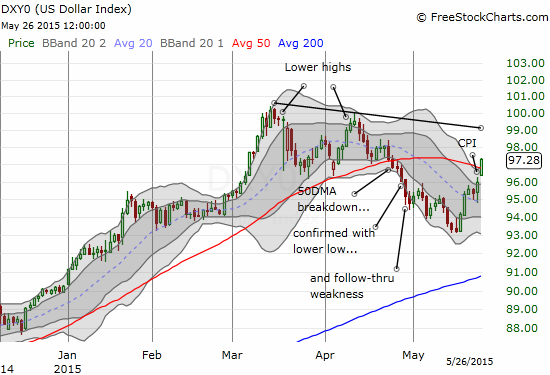

The U.S. dollar (via the PowerShares DB US Dollar Bullish ETF (NYSE:UUP)) was the major theme for the day yesterday. The index powered through its 50-day moving average (DMA) and set a fresh tone in the market.

The U.S. dollar index is surging again as follow-through buying from the CPI data powered the index through 50DMA resistance.

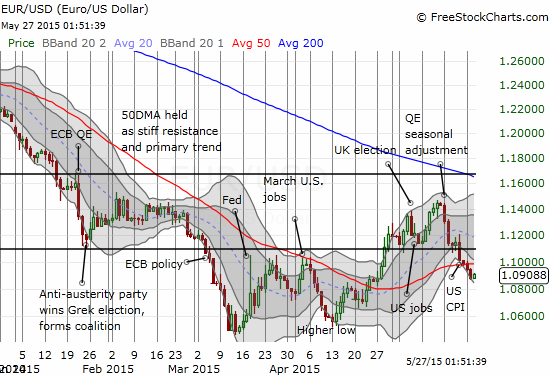

This surge in the dollar index was pent-up buying from the U.S. Memorial Day holiday on Monday where dollar momentum continued from Friday’s CPI print. A prime example came from the euro (via Guggenheim CurrencyShares Euro ETF (NYSE:FXE)) which broke through 50DMA resistance on Monday. This breakdown unfolded much faster than I was imagining when I updated my trading outlook for the euro, here, and after I concluded that the market over-reacted to the U.S. CPI data.

A major technical breakdown below the 50DMA for the euro against the U.S. dollar

Having Monday to ruminate on the currency moves, I decided to take a bearish bias on Tuesday’s trading action no matter how the market opened. The market gapped down slightly and almost never looked back. I had to work quickly at the open. By the time the smoke settled, T2108 closed with a massive plunge of 11 percentage points to 39.2%.

T2108 quickly plunges back to the bottom of the recent trading range.

T2108 is sending some important signals, especially given the S&P 500 (via the SPDR S&P 500 ETF (ARCA:SPY)) “only” fell 1.0%.

The S&P 500 quickly drops back to its 50DMA support/pivot

The marginal, gradual, yet choppy, rise in the market has apparently flattened out a lot of moving averages on individual stocks. This is the main way to explain how T2108 can drop so deeply on a simple 1% decline on the S&P 500 with 50DMA support intact. In other words, T2108 is extra sensitive to material moves in the stock market.

With T2108 at the bottom of its recent trading range (measuring from January) and the S&P 500 floating above its very reliable 50DMA support, conditions are set up for yet another bounce and chop upward, to another marginal all-time high by July. Moreover, the numerous “pricks” of this 50DMA support since December suggest that another dip below the 50DMA will be temporary and deliver another buying opportunity for quick-handed traders. Working in the favor of such a trade should be a T2108 which would be ever closer to overbought and its low for the year. This catalyst becomes doubly powerful if the 200DMA gets retested: T2108 will certainly be at or beyond the oversold threshold by then.

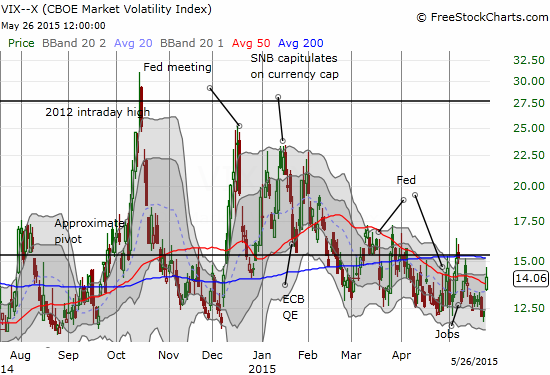

Despite my Tuesday morning bearishness, I could not pull the trigger on ProShares Ultra S&P500 (ARCA:SSO) put options. Instead, I grabbed a fresh tranche of call options on ProShares Ultra VIX Short-Term Futures (ARCA:UVXY). I went out to the June monthly to accommodate the potential for a major volatility-positive event going into summer. With currency markets providing a notable wildcard, I think volatility is exposing a surprisingly high level of complacency.

Volatility surges 16% but remains well within the confines of the steady downtrend from January’s highs

I made two other notable bearish moves: put options on Apple (NASDAQ:AAPL) and iShares Nasdaq Biotechnology ETF (NASDAQ:IBB).

The move on AAPL turned into a daytrade as the drop in the stock proved sufficient to take a 2.5x gain on the puts. This gain excludes the small loss I have on a single call option I bought as a potential play on the tendency for AAPL to rally into the Worldwide Developers Conference. I plan to accumulate a position at least one more time this week.

This year’s WWDC runs from June 8 to 12. The short-term bearishness on AAPL was accentuated by the stock’s distance from its 50DMA. Last week, AAPL managed to rally right to the top of its upper-Bollinger® Band, short of a new all-time high, and right at presumed resistance formed by two topping patterns – I only needed to see the first sign of wavering at the open. I did not bother running the Apple Trading Model for this trade (I decided a while back to just play the 50DMA pivot).

Apple stops short of resistance from former highs but can the upcoming WWDC provide a fresh catalyst for ever higher highs?

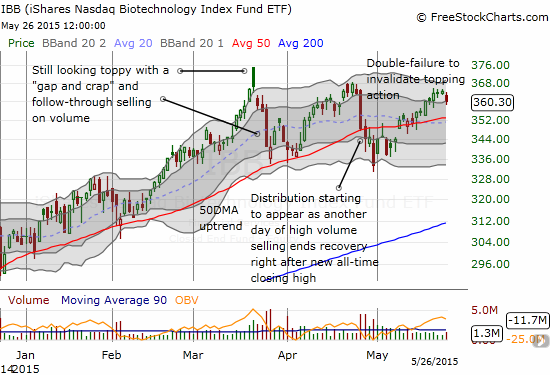

I wrote previously about the bearish distribution pattern showing up on iShares Nasdaq Biotechnology (IBB). This bearishness was beaten back once IBB managed to gap higher above its 50DMA. As of Friday, the comeback took IBB back to the marginal all-time high from April that did NOT invalidate the topping action from March (a gap-and-crap at all-time highs on high volume and confirmed by subsequent selling). So, given my bearish bias, it seemed like a good spot to try put options again on IBB. So far, so good. I imagine I cannot expect much downside past 50DMA support in the short-term.

iShares Nasdaq Biotechnology (IBB) is positioned to provide double confirmation of a top yet the 50DMA still provides formidable support

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Be careful out there!

Disclosure: Long UVXY call options, short EUR/USD (net short the U.S. dollar), long an AAPL call option, long IBB put options