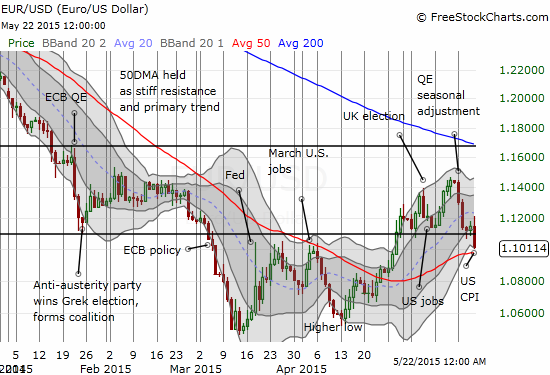

On Thursday night, May 21st, I observed the daily chart of the euro (FXE) and concluded it was ready for the next swoosh downward against the U.S. dollar. I posted this opinion on Stocktwits coincidentally at the same time someone else posted the exact opposite opinion.

Different perspectives, opposing opinions on the euro

As it turned out, we were both correct. On a short intraday basis, “Jasonsignals” got a higher euro but it fell far short of the target. The “final” destination was the big swoosh lower as EUR/USD experienced convincing follow-through selling.

The euro barrels lower on CPI-inspired follow-through selling

On an intraday basis, this 30-minute chart shows how the last attempted breakout for the euro failed at resistance and preceded the expected follow-through selling

The key catalyst was a print on U.S. CPI that was ever so slightly higher than expectations. I was surprised by the depth of the reaction, even though it supported the message from the technicals. Note that on an intraday basis, a last warning sign came as the euro failed to surpass the high from the failed relief bounce from “swoosh #1.”

The next technical battle for EUR/USD rests at 1.10. Note how traders absolutely refused to let EUR/USD drop below that level going into Friday’s close. I can only imagine a lot of stops are sitting just below 1.10.

I finally closed out my short EUR/USD position on the first bounce away from 1.10. It was a large position, and I did not want to hold it for another weekend with such critical support on the line. I am sure I am not alone in preparing my next trade based on how well 1.10 holds up.

The next support for EUR/USD is at the 50-day moving average (DMA) right around 1.097. That support rests below the lower-Bollinger Band (BB), so I fully expect a rapid sequence for a lower euro: stops get taken out by longs to limit losses, the 50DMA get tagged maybe even surpassed, EUR/USD over-extends beyond the lower-BB, and the next bounce unfolds. I expect 1.11 to serve as stiff resistance all over again for such a bounce. If I am wrong to the downside – that is momentum takes the euro even lower without a bounce – the technical make-up becomes VERY bearish all over again for the euro.

Be careful out there!

Full disclosure: no position