T2108 Status: 80.6%

T2107 Status: 32.2%

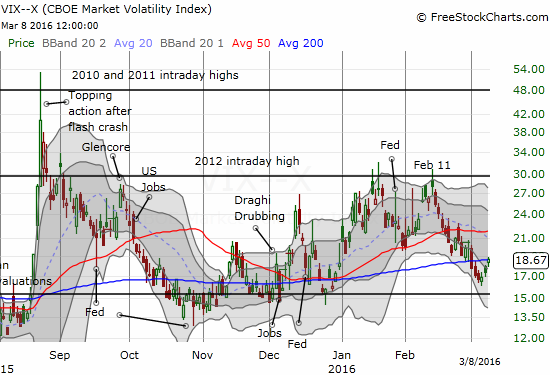

VIX Status: 18.7

General (Short-term) Trading Call: cautiously bullish

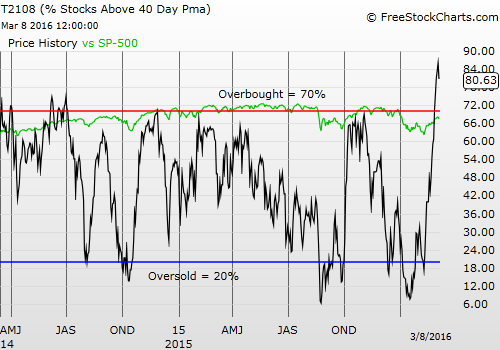

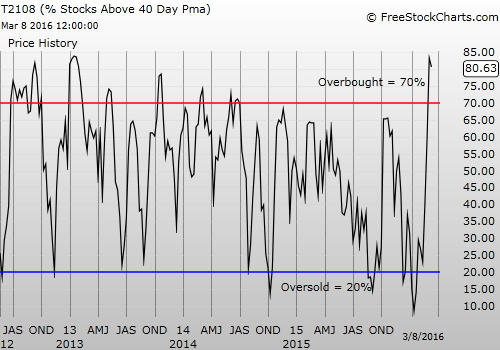

Active T2108 periods: Day #18 over 20%, Day #17 over 30%, Day #14 over 40%, Day #11 over 50%, Day #7 over 60%, Day #6 over 70%, Day #4 over 80% (overbought)

Commentary

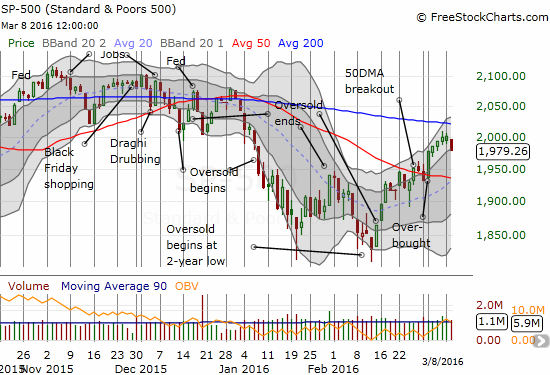

In the last T2108 Update I described a synchronous failure of market leaders. These same leaders followed-up with an attempted rally that fizzled across the board with all closing the day flat. The S&P 500 could not hold flat and instead lost 1.1%.

The S&P 500 closes down for the first time in March.

The volatility index, the VIX, gained for the third straight day. I had previously expected a rendezvous with the old 15.35 pivot. Instead, the VIX may have another rally to go before sinking that low again.

The volatility index is trying to sustain a rebound from recent lows.

T2108, the percentage of stocks trading above their respective 40-day moving averages (DMAs), fell along with the market. It closed at 80.6%. This is only the fourth loss since the February 11 low at oversold conditions. The decline in T2107, the percentage of stocks trading above their respective 200DMAs, fell for only the third day since February 11th’s low. The decline from 35.7% to 32.2% was significant and confirms the market’s first notable setback in this bounce from oversold conditions.

I am keeping the trading call at “cautiously bullish.” Recall that I am not flipping bearish until the S&P 500 (SPDR S&P 500 (NYSE:SPY)) falls below and follows through its selling below its 50DMA AND after T2108 has fallen from overbought conditions. If T2107 shows significant weakness, I could pull the trigger on bearishness a little earlier.

Speculative stocks were hit particularly hard. These are stocks that have enjoyed out-sized gains in this rally; membership has been dominated by commodity-related stocks. For example, Cliffs Natural Resources Inc (CLF) plunged 20.7% and fell back under its 200DMA.

Cliffs Natural Resources Inc (NYSE:CLF) plunges and erases two days of heady gains tied to a record surge in iron ore prices.

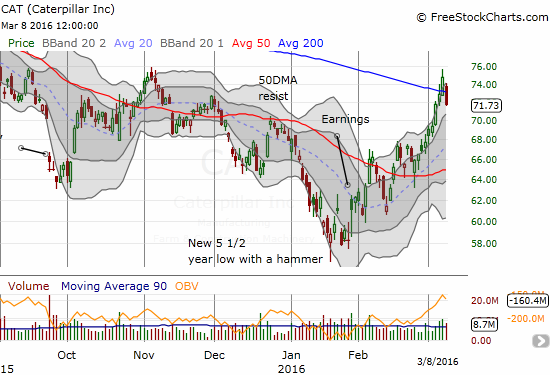

Even Caterpillar (NYSE:CAT) sank under its 200DMA.

Does a false 200DMA breakout signal the beginning of the end for the strong rally in Caterpillar (CAT)?

United States Steel Corporation (NYSE:X) is on the verge of confirming resistance at its 200DMA.

The rally in U.S. Steel (X) stops dead in its tracks at 200DMA resistance.

These are just examples of what a sinking T2107 meant for the market today. They confirm today as a notable day of setbacks for this rally.

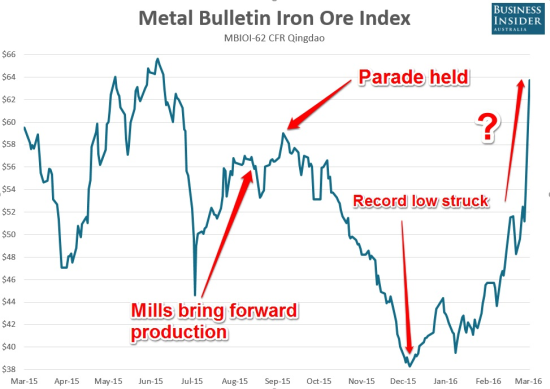

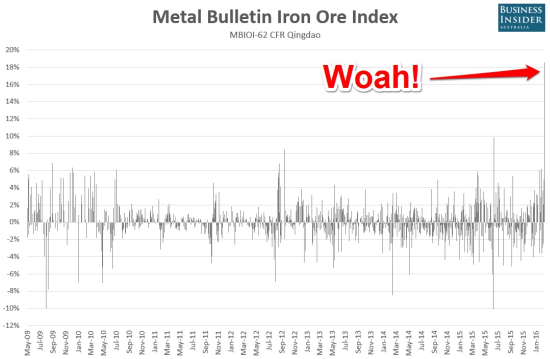

The sharp move in iron ore particularly concerns me. These kinds of moves are typically a rally’s last gasp as buyers finally exhaust themselves in one last panicked buying spree. Sure enough, the immediate aftermath of Monday’s sharp spike has created major reversals like in CLF.

When I wrote “Glencore’s Instructive Reversal On Commodity Prices,” I did not cover the insane gain in iron ore from Monday. Its price surged 20% in a move that had to include a lot of short-covering. This conclusion was echoed by traders and analysts. Even industrial mining giants cast doubts on the sustainability of the move as quoted in the Sydney Morning Herald in “Iron ore price leap stuns industry’s top brass.” The mechanics of the move were also discussed in an aptly titled Bloomberg article: “Iron Ore Jumps Most on Record as Market Goes ‘Berserk’.” Business Insider Australia provided some context in “CHART: The overnight surge in iron ore nearly doubled the previous record gain.”

Monster run-up in iron ore may have some precedence in last year’s pull-forward in steel production.

Iron ore’s one day gain even surpassed last July’s sudden burst higher.

Apparently, shorts are also running from their bets against oil. In “Specter of $20 Oil Recedes as Speculators Flee Bearish Bets,” Bloomberg notes “hedge funds unwound bearish bets at the fastest pace in 10 months…Speculators’ short positions in WTI fell by 25,639 contracts of futures and options combined to 150,718, the biggest decline since April 21, CFTC data show. Longs, or bets on rising prices, fell by 753. The exodus of bearish bets resulted in a 24,886-contract jump in the net-long position.”

I am more worried about iron ore than oil for now because of iron ore’s heavy dependence on China’s economy.

Speaking of speculative stocks, I have not posted a chart of iShares Nasdaq Biotechnology (NASDAQ:IBB) in a long while. Biotech stocks have benefited little from the current rally as IBB has largely churned in a tight range since the initial bounce from the February 11 lows. Today, IBB fell 3.6%.

iShares Nasdaq Biotechnology (IBB) is struggling mightily to resume making progress.

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Weekly T2108

Be careful out there!

Full disclosure: short FB, long FB call options, long CAT put options