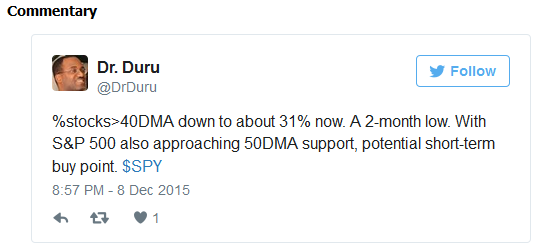

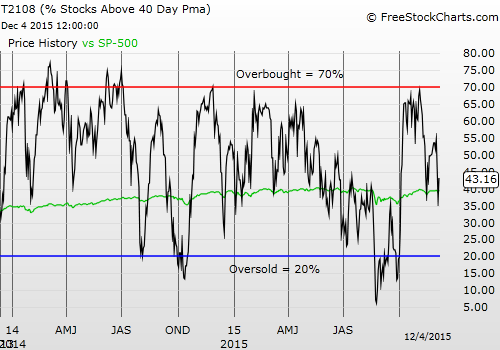

T2108 Status: 30.6%

T2107 Status: 29.3%

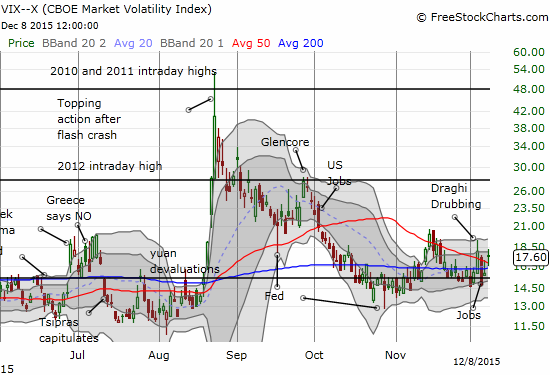

VIX Status: 17.6

General (Short-term) Trading Call: neutral

Active T2108 periods: Day #46 over 20%, Day #45 over 30% (overperiod), Day #2 under 40% (underperiod), Day #5 below 50%, Day #19 under 60%, Day #360 under 70%

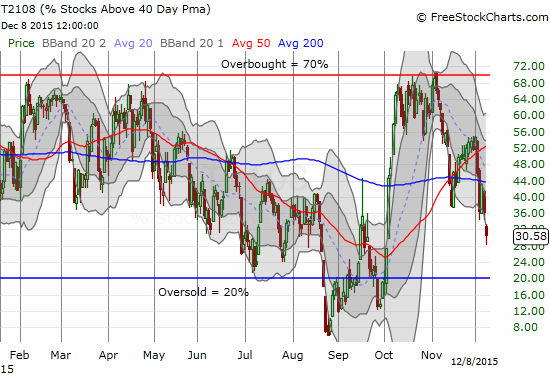

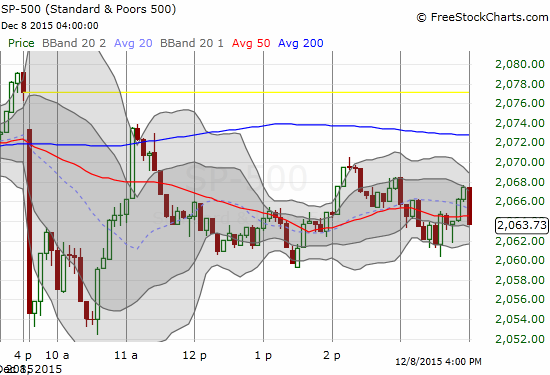

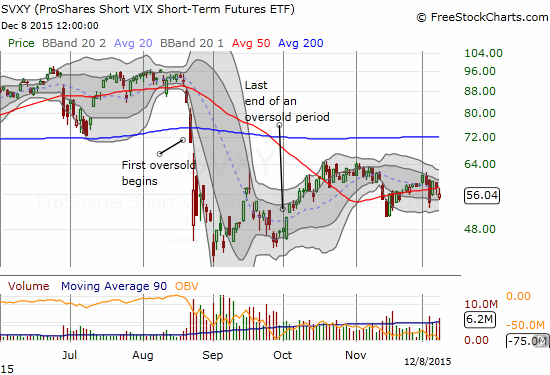

With my favorite technical indicator, T2108, stretched well below its lower-Bollinger Band (BB), I rushed to check the level of the S&P 500 (N:SPY). After I posted the above tweet, I immediately bought shares of ProShares Short VIX Short-Term Futures (N:SVXY) as my first play on a bounce. This has become my first step in my rule book for betting on short-term bounces. I also set a lowball buy order for call options on ProShares Ultra S&P500 (N:SSO).

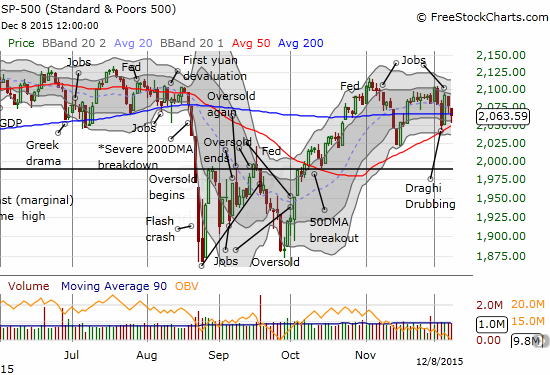

As regular readers know, once T2108 goes below 40%, I go on alert for “over-stretched” conditions. Below 30%, I am thinking about official oversold conditions. My order for call options never triggered as, quite to my surprise, the market quickly proceeded to bottom for the day. Even more amazing, SVXY soared $2 in rapid order. I quickly sold those shares for a quick gain. At the close of trading, the S&P 500 managed to close right on its 200DMA. However, SVXY retreated from presumed resistance at its 50DMA. The volatility index, the VIX, remains elevated above the 15.35 pivot point.

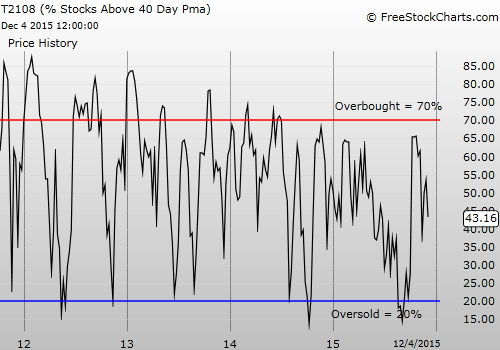

T2108 plunges steeply for 2-month low. The technical damage is clear from this vantage point.

The S&P 500 (SPY) finds relief from support at its 50DMA.

The bounce from the day’s low was swift and ended within 30 minutes.

The bounce in the ProShares Short VIX Short-Term Futures (SVXY) was stymied at 50DMA resistance.

The VIX remains elevated.

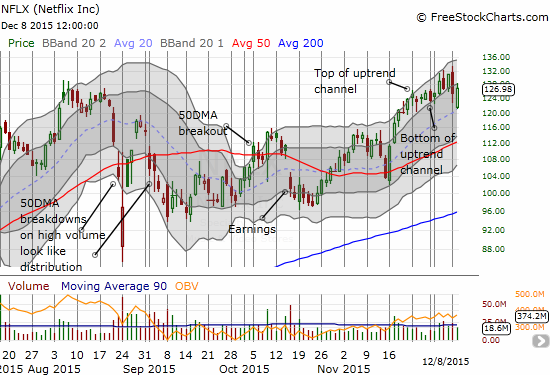

As has become my habit, I also looked at Netflix (O:NFLX) for a potential buy after I concluded odds favored a bounce in the market. The stock happened to be trading just above its uptrending 20DMA. I immediately bought call options as a play on this uptrend support. Fortuitously, NFLX began a slow and then accelerated march higher. I sold as my call options almost doubled in value. I am still holding call options from a purchase on the previous day. On that day, I was playing the previous uptrend channel defined by the upper-Bollinger Bands (BB). This trade worked like a charm on Friday, December 4th.

Netflix (NFLX) falls out of its primry short-term uptrend but finds next support at its uptrending 20DMA

NFLX is part of the small collective of stocks holding up bullish sentiment in the market. The latest technical developments made me even more wary about the underlying health of the market. In the last T2108 Update, I pointed out how the divergence of performance between the S&P 500 and T2108 demonstrated a worrisome lack of breadth in the market. That divergence signaled what has become another two days of selling. This one-two-three punch of trading days is almost a carbon copy of the technical developments that unfolded over December’s first three trading days. THIS time, the difference in performance comes from the exaggerated move in T2108 relative to the S&P 500. The plunge in T2108 suggests that the S&P 500’s relatively mild decline is hiding an expanded range of underlying weakness.

In other words, while odds favor a bounce in the next day or two, the narrow market is not likely going to sustain the momentum.

On the bearish side of the ledger, I closed out a series of put options and shorts after I concluded odds favored a short-term bounce. One of my more important short positions was in Caterpillar (N:CAT). The valiant recovery attempt by CAT since the large post-earnings gap down in October is coming to an end. Today’s gap down below the lower-BB confirms 50DMA as (approximate) resistance. This move is also a bit over-extended, so it made sense to lock in profits here. I am now waiting on the next opportunity to fade my favorite hedge against bullishness.

Caterpillar (CAT) is breaking down again.

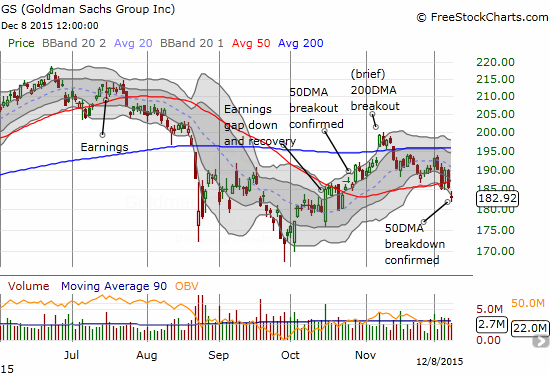

My stubborn short on Goldman Sachs (N:GS) looks ready to pay off. GS made a definitive gap down below its 50DMA support. This selling follows three days of wide churn where GS attempted to hold 50DMA support.

Goldman Sachs (GS) is breaking down.

Until I get a new entry point to short CAT, GS becomes my new hedge against market bullishness.

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Weekly T2108

Be careful out there!

Full disclosure: no positions