With revenues and earnings projected to grow year over year, we expect T. Rowe Price Group, Inc. (NASDAQ:TROW) to beat earnings expectations when it reports second-quarter 2017 results, before the opening bell on Jul 25.

Why a Likely Positive Surprise?

Our proven model shows that T. Rowe Price is likely to beat on earnings in the second quarter. This is because the company has the combination of two key ingredients for a possible earnings beat – a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), #2 (Buy) or #3 (Hold).

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks ESP: Earnings ESP, which represents the difference between the Most Accurate estimate and the Zacks Consensus Estimate, is currently pegged at +2.38%. This is a very significant and leading indicator of a likely positive earnings surprise for the company.

Zacks Rank: The combination of T. Rowe Price’s Zacks Rank #2 and a positive ESP makes us confident of an earnings beat.

Conversely, we caution against stocks with a Zacks Rank #4 or 5 (Sell rated stocks) going into an earnings announcement.

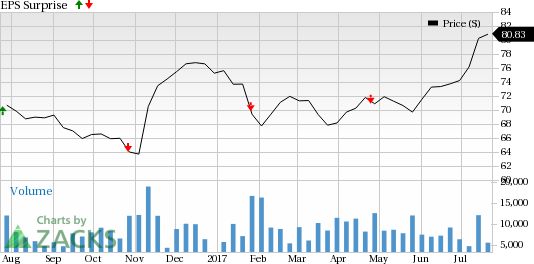

Below is the company’s earnings surprise history as depicted in the chart:

Shares of T. Rowe Price gained 8.9% during the second quarter ended Jun 30, 2017, outperforming the 7.5% rally of the industry it belongs to.

Factors to Influence Q2 Results

Mutual Fund Products Performance: According to Morningstar data, T. Rowe Price witnessed around $5.6 billion of net outflows in U.S. mutual fund products in the to-be-reported quarter.

However, the company is likely to record a rise in assets under management (AUM) as the second quarter experienced decent performance of equity markets. Notably, the S&P 500 index gained 3.1% in the quarter, which is likely to benefit T. Rowe Price, given its equity-heavy asset mix.

Insignificant Fee Waivers: Management believes that with the gradually improving interest-rate environment, fee waivers in its money market mutual funds and trusts would be insignificant.

Revenue Growth: T. Rowe Price’s efforts to improve its operating efficiency, has resulted in year-over-year growth in the top line over the past few years. We believe that the company is well poised to sustain the uptrend, going forward, on the back of several planned initiatives largely tied with launching investment strategies and vehicles, enhancing client engagement capabilities in each distribution channels, strengthening distribution channel in the U.S., EMEA, and the Asia Pacific, and improving its technology platform and deriving long-term cost efficiencies.

Expenses to Escalate: The company did not point out anything related to its cost-control initiatives during the quarter, due to its several planned strategic initiatives. T. Rowe Price projects operating expenses for 2017 at growth rate of 10% (excluding the charge tied with the Dell appraisal rights matter). Notably, T. Rowe Price is anticipating capital expenditures in 2017 to be approximately $200 million, including two-third for technology development.

Notably, this investment manager could not win analysts’ confidence during the quarter. The Zacks Consensus Estimate remained unchanged at $1.26, over the last seven days.

Stocks that Warrant a Look

Here are some stocks you may want to consider, as according to our model they have the right combination of elements to post an earnings beat this quarter.

OM Asset Management PLC (NYSE:OMAM) is scheduled to report second-quarter results on Aug 3. It has an Earnings ESP of +2.63% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Earnings ESP for Och-Ziff Capital Management Group LLC (NYSE:OZM) is +50.00% and it carries a Zacks Rank #1. The company is slated to release second-quarter results on Aug 2.

Franklin Resources, Inc. (NYSE:BEN) has an Earnings ESP of +1.37% and a Zacks Rank #2. It is set to report June quarter-end results on Jul 28.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020. Click here for the 6 trades >>

T. Rowe Price Group, Inc. (TROW): Free Stock Analysis Report

Franklin Resources, Inc. (BEN): Free Stock Analysis Report

OM Asset Management PLC (OMAM): Free Stock Analysis Report

Och-Ziff Capital Management Group LLC (OZM): Free Stock Analysis Report

Original post

Zacks Investment Research