Gold must hold above 1316/17 again today (we bottomed exactly here) & beat minor trend line resistance at 1322/23 to retain a bullish outlook targeting 1329/30 then resistance at 1333/35.

Bitcoin has 50% Fibonacci & 6 week trend line resistance at 11577/11665.

Emini S&P bulls dived in using 2755/65 as support & the break above first resistance at 2690/2700 (key to direction) triggered a move towards minor resistance at 2735/37 but we only reached 2727.

AUD/USD dipped to 7723 before a recovery to 7767. We have traded sideways for 3 sessions in oversold conditions. The long tails on the daily candles could signal a recovery is on the cards but we need to beat resistance at 7780/90 for a buy signal.

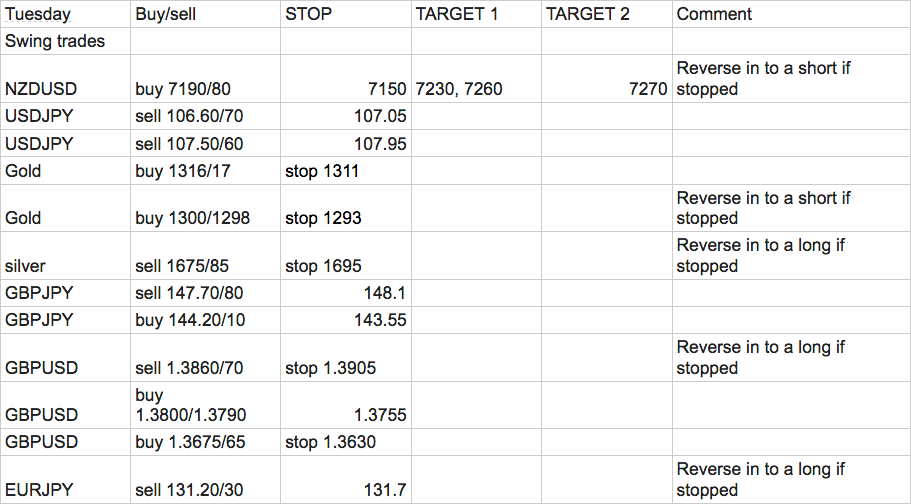

NZD/USD sideways so we wait for a signal. Buy at strong support at 7190/80 or on a break above 7245.

USD/JPY manages a small bounce but I see no buy signal. The recovery meets first resistance at 105.84/88 then 106.25 (now hit) but we could reach as far as stronger resistance at 106.60/70.

EUR/JPY bounce from our buying opportunity at 129.60/50 hit all targets as far 130.80/90 as we look for a test of resistance at 131.20/30 for a selling opportunity today.

USD/CAD tests longer term moving average resistance at 1.2975/85 with a high at 1.3000. If you bought on our buy signal break above 1.2720 you have had a potential 250 pip run on your longs over the past week. Not bad! Now we must take profit & wait for the next signal. It is very possible we will take a tumble but without a solid sell signal shorts are risky at this stage.

EUR/USD I am unsure what happens next so I have to wait for a signal.

GBP/USD topped just 6 pips above our target & expected high for the day at resistance at 1.3860/70.

Dax broke important support at 11900/11890 to hit the next 2 targets of 11860/850 & 11740/720 but we unexpectedly bottomed exactly here...the bullish engulfing candle tells us the bulls have regained control for now.

Euro Stoxx we wrote: best support for today at 3298/88. It is really the only area I would think about trying longs...and guess where the low for the day was?

Outlook for Euro area stock markets at least, is more positive now.