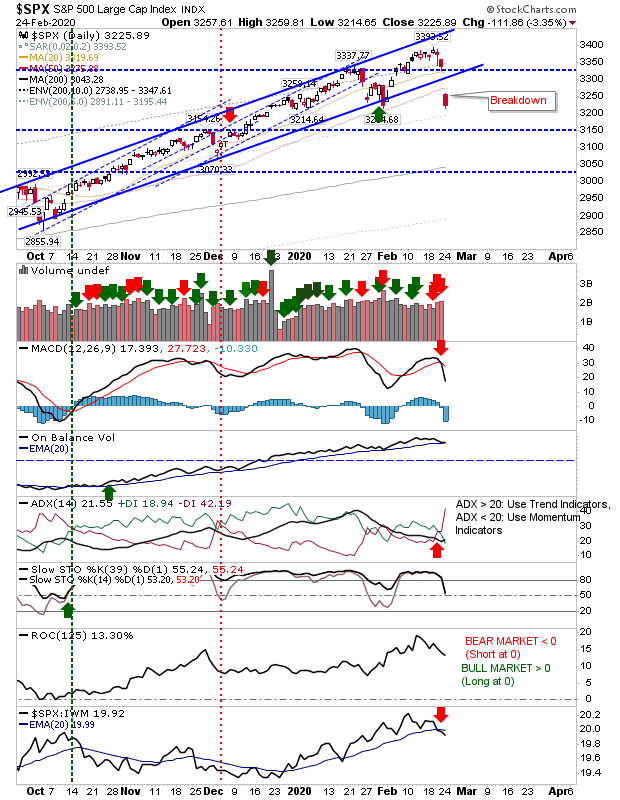

The S&P gapped lower yesterday, out of its rising channel, following the Dow Industrial Average in its channel break on Friday. The gap pushed below 50-day and 20-day MAs, but it hasn't yet triggered a 'sell' signal in On-Balance-Volume on higher volume distribution.

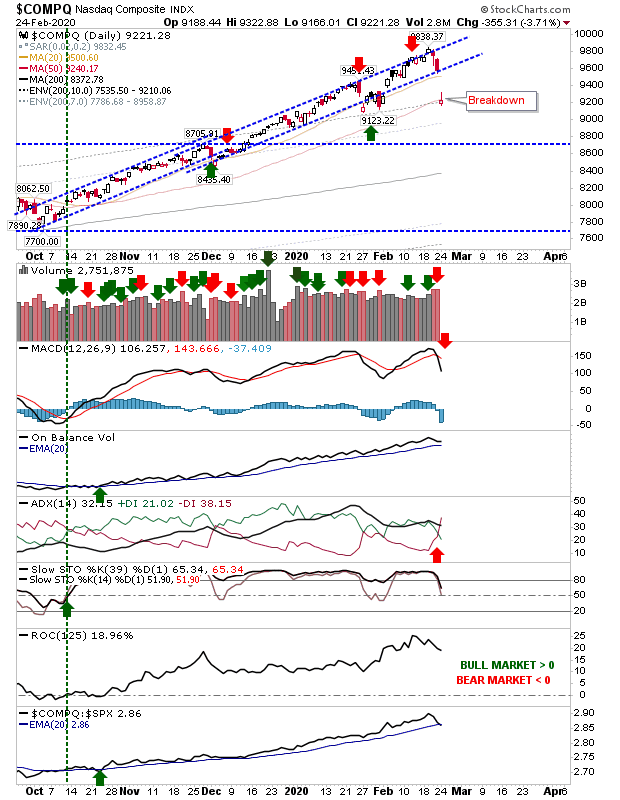

The NASDAQ also gapped out of its channel with a 'sell' MACD trigger; there is also a bearish cross between -DI and +DI, but because of prior strength, both On-Balance-Volume and Stochastics are still bullish.

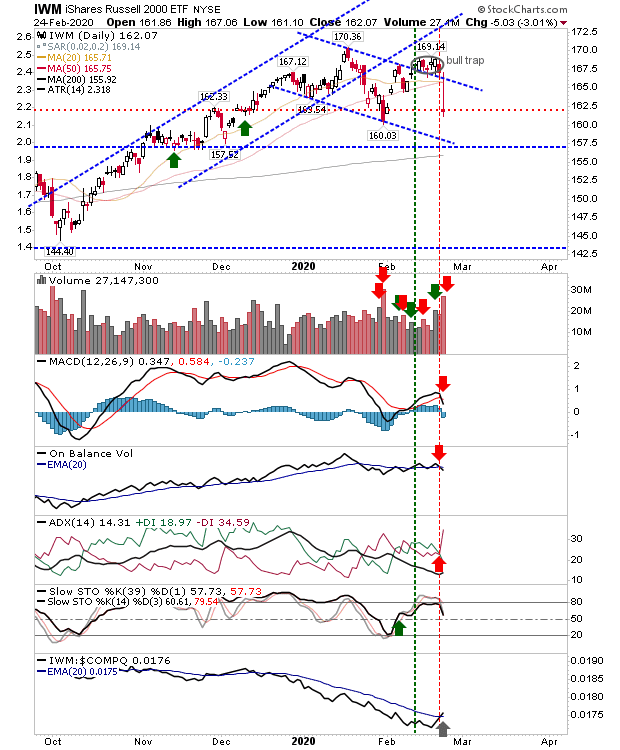

The key to the market could be held by the Russell 2000 (via iShares Russell 2000 ETF (NYSE:IWM)). The index took a big hit, negating its breakout—but left it inside the channel. Because of this, relative performance is improving with a new 'buy' trigger. Other technicals are negative but this might be more of a value opportunity.

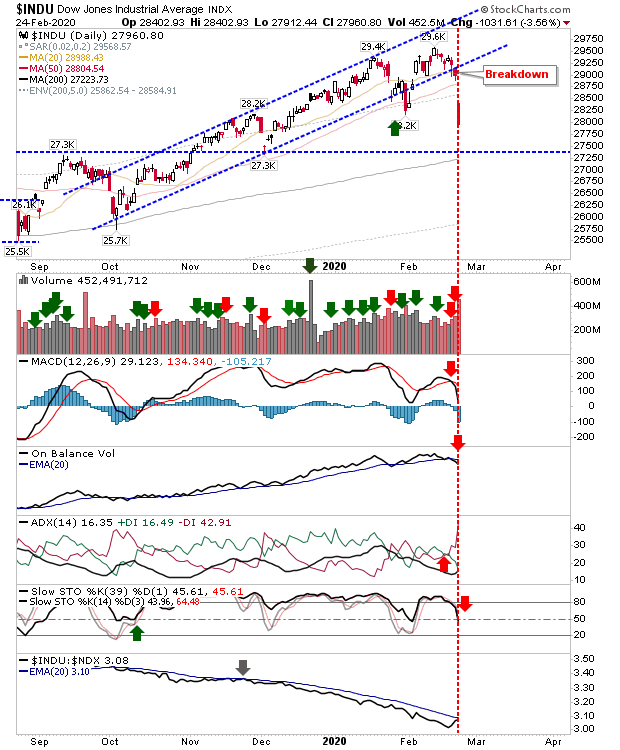

The Dow Jones—the index which broke from the channel on Friday—lost 3.5% on higher volume distribution yesterday. In the process of yesterday's selling it undercut the swing low of January; a portent of what's to come for the NASDAQ, S&P, and maybe the Russell 2000.

With indices gapping lower there is room for a bounce to fill the gap, but if gaps don't close they will mark breakdown gaps and likely lead to more prolonged declines, something which markets have not really experienced since 2018.