Media personalities love to play the prediction game, particularly in January. Where will the S&P 500 wind up at year’s end? What will happen to interest rates? And after Mariah Carey’s infamous New Year’s Eve non-performance, which celebrity will have the next public meltdown?

I enjoy the prognostication pastime as much as any individual. It helps to clarify what matters to me as an investor (as well as what doesn’t). In particular, no matter what happens to the world at large, never allow a big loss to devastate the value of your investment accounts.

For this go-around, rather than predict what will transpire over the next 12 months, I am serving up a twist. Here are three things that WILL NOT occur in 2017:

1. Uncommonly Steep Stock Valuations Continue To Rise Unabated In 2017

Voices in the mainstream may tell you to maintain your bullish optimism. They may tell you that the economy is healthy and that stock assets are reasonably priced.

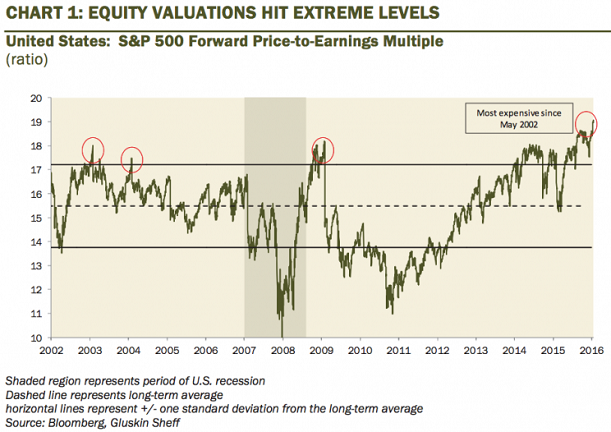

In truth, however, the price an investor pays for the privilege of S&P 500 stock ownership has rarely been as unreasonable as it is right now. Consider Forward P/Es (price-to-earnings ratios). “Guestimates” of corporate earnings 12 months out are not only wildly optimistic, but they are also contributing to valuation levels not seen since the dot-com disaster (3/00-9/02).

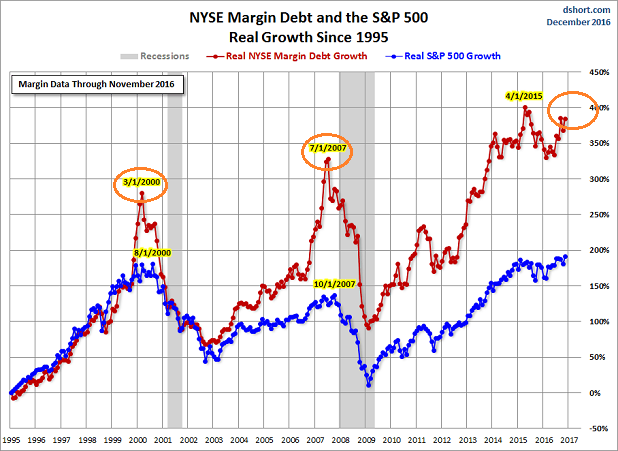

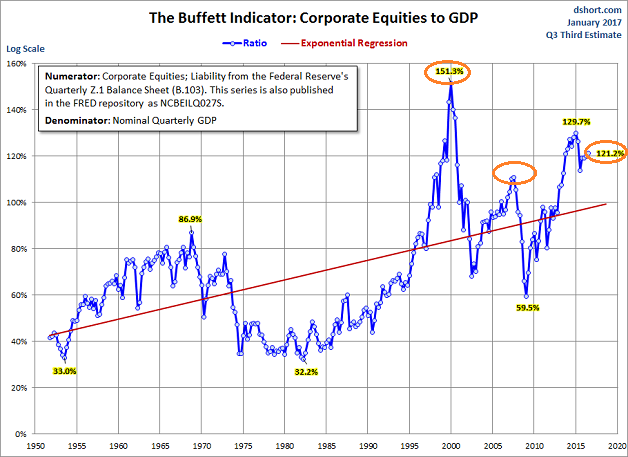

It’s not just Forward P/Es either. Enterprise Value-to-EBITDA is out of whack. Margin debt is near record highs again. Meanwhile, market capitalization-to-GDP (a.k.a. “Warren Buffett Indicator”) is suggesting sharp stock declines are highly likely.

Over the last two years, the idea that ultra-low 10-year yields (a.k.a. “interest rates”) justified escalating prices, even with corporate sales and corporate profits declining for six consecutive quarters. Now that interest rates have been on the rise, it will be up to profits and sales to rebound substantially.

If public companies disappoint? With 10-year yields near 2.5%? Stock prices would be far more likely to stumble than when the 10-year yield sat at 1.5%.

2. The Federal Reserve Hikes Overnight Lending Rates Three Times In 2017 (Unless Yellen Wants To Stick It To Trump)

Every year since the end of the Great Recession (5/09), the central bank of the United States began the year “talking up” rate hikes and/or providing less monetary policy accommodation. And every year, the Federal Reserve failed to deliver.

In some instances, the institution pulled an about-face with the delivery of more monetary stimulus. Consider 2010. They went from the discussion of hiking overnight borrowing costs to serving up more low rate manipulation via a second round of quantitative easing (QE2). In 2011, the Fed shifted from the termination of QE purchases to using proceeds from maturing securities to buy longer-dated bonds to lower intermediate-term borrowing costs.

When the Fed mentioned slowing down QE3 in the summer of 2013, they found themselves waiting until December 18, 2014 before wrapping it up. Four rate hikes in 2015 became one rate hike in December of 2015. Four rate hikes in 2016 became one in December of 2016. And if past is prologue, the Fed has over-promised with three “anticipated” hikes in 2017.

There are those who insist that it will be different now. Specifically, “Trumponomics” will lead to greater wage growth (inflation) and more significant gains in the economy via gross domestic product (GDP). If these gains in wages and GDP do occur, then the Fed will need to raise rates accordingly, reining in the possibility of economic overheating as well as attaining a meaningful distance away from the zero-bound of the last eight years.

It won’t happen.

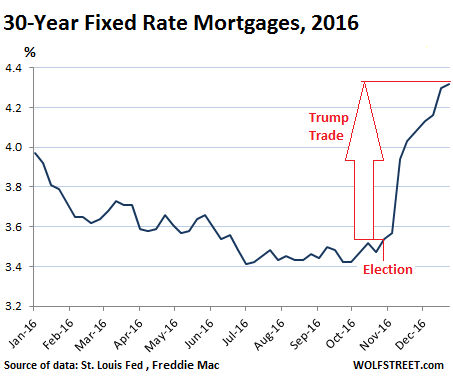

Bear in mind, mortgages have surged nearly 100 basis points already. Wolf Richter at WolfStreet.com accurately identifies the damage to refinancing as well as home sales. Pending home sales are down on a year-over-year basis (November). Other indexes, like Redfin’s Housing Demand Index, recently witnessed the lowest seasonally-adjusted readings in nearly four years (January 2013).

Granted, since Trump became the President-elect, the Yellen-led Fed has sounded more “hawkish” than ever. The shift in tone has been unmistakable. And perhaps central bank leadership genuinely believes it will have to tighten more quickly to offset Trump’s anticipated fiscal stimulus package(s) of tax cuts and infrastructure spending.

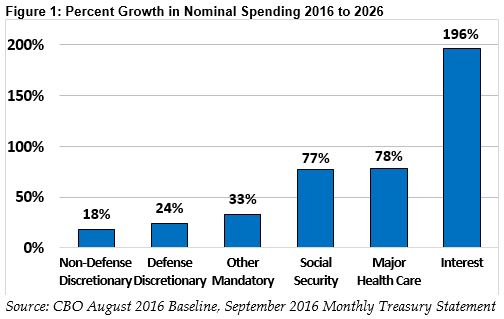

Nevertheless, the Fed is aware of the adverse impact that significantly tighter borrowing costs could have on everything from household consumption to corporate and government debt servicing. Can you imagine just how much more of federal tax revenue will go toward interest on its debt alone?

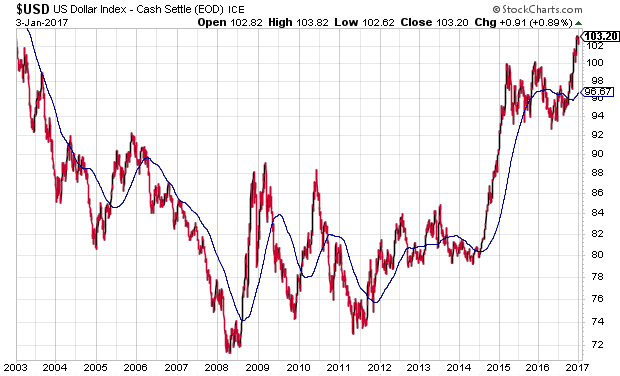

Even if corporate tax rates are lowered substantially, potentially offsetting the drag of higher borrowing costs, the Fed is already running up against 14-year highs for the dollar. Further dollar gains would hurt S&P 500 profits, and potentially erode the wealth effect that the central bank helped to orchestrate through reflated asset prices.

3. “Trumponomics” Propels The Stock Bull Significantly Higher Without Incident In 2017

We know that the elevated dollar is likely to damage S&P 500 corporate profitability. We know that higher interest rates are adversely affecting real estate. And we know that current stock valuations are pricey, if not exorbitant.

In contrast, do we really know what the President-elect will be able to get approved by Congress, or even through executive order? Personally, I am ecstatic about rolling back onerous regulations. Yet I am not naive enough to think that small businesses will be able to shed every shackle that has been promised on a campaign trail.

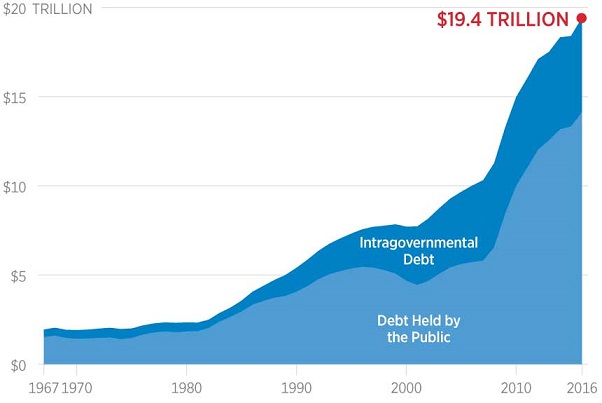

Consider some of the prescribed medicine in the context of a larger picture. For instance, most seem “gaga” over the notion of spending $1 trillion on infrastructure projects. The money has to come from somewhere. Private financing may pick up some of the slack, though these same companies will require tax incentives to engage. Will all of the tax revenue be recovered? Whatever is not picked up by private financing would need to come from government outlays. Without spending a nickel on infrastructure, $1 trillion is already slated to be added to overall federal debt due to existing requirements. Would $1.5 trillion or $2 trillion added to the $20 trillion in existence be problematic in a rising rate environment?

So again, the extremely optimistic take is that infrastructure projects, presumably financed by government deficits as well as some corporate financing, will be a boon for an economy that barely grows at 2% annually. Is it possible that current account imbalances, higher total debt, higher interest servicing and higher interest rates wind up being a headwind for the economy, even as we celebrate the country’s infrastructure enhancements?

The point here is to identify the reality that “Trumponomics” in 2017 does not have the same advantages that “Reaganomics” enjoyed in 1982. Back then, the country was coming out of recession with single-digit P/Es for stocks as well as favorable debt levels. Today, the trailing 12-month GAAP P/E for the S&P 500 is 25.5, government debt-to-GDP is 105% (not 30%), and we are close to eight years into one of the longest equity bull markets ever.

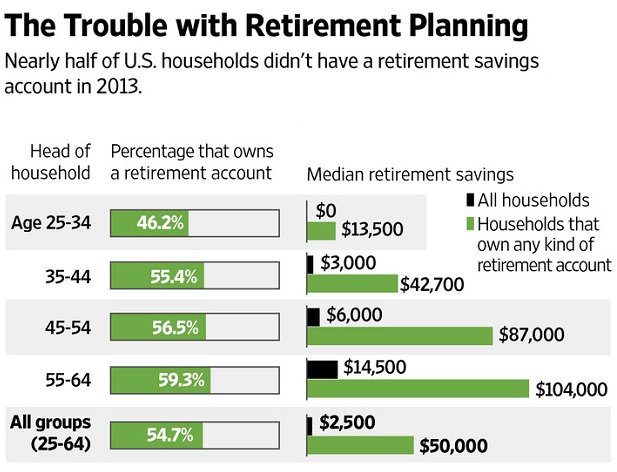

Do I favor tax and regulatory reform? I do. Could cash repatriation from abroad lead to corporations allocating more to capital expenditures as well as human resources? It might. Yet they’re unlikely to address underlying structural headwinds, including global debt, global banking weakness or aging populations in developed economies. The latter looks particularly troubling with respect to investment accounts across the U.S. citizen base.

Want to call me a Nervous Nellie… I’ve been called worse. Regardless, my long-term success as an investor (e.g., stocks, real estate, etc.) is rooted in reducing risk at higher valuations and raising risk at lower valuations. If it turns out that I have missed some of the upside by avoiding an “all-in” performance chase, so be it. I prefer the opportunities that present themselves in severe corrections and average bear market descents (30%).

Disclosure Statement: ETF Expert is a web log (“blog”) that makes the world of ETFs easier to understand. Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc., and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert website. ETF Expert content is created independently of any advertising relationship.