Mixed emotions as the EOS token is live for trading again but has lost a lot of its premium value.

The crypto-market has come down quite significantly since EOS began their switch from the Ethereum network on June 1st. The launch of the EOS Mainnet was supposed to take only a few days but in the end, lasted about three weeks.

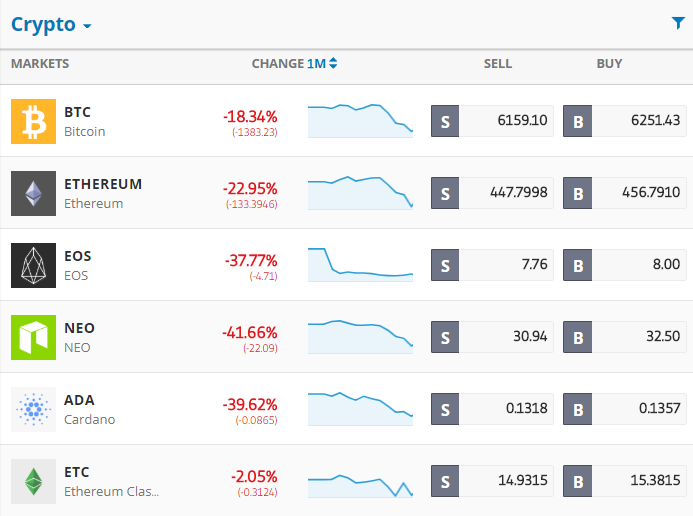

Even though the launch was shaky, the decline in price is actually more or less in line with the rest of the crypto market.

In fact, over the last month, it was the least worst performer of the three tokens that are competing for the title "Ethereum Killer."

For those involved in the crypto space, the price movements are less interesting than the future potential of the technology. The question of which network will come out on top is now prevalent.

Now that EOS is online, its creator Dan Larimer has released a series of tweets disparaging the Ethereum model and explaining why he feels EOS is better than Ether. Of course, Twitter is a rather uphill battle for Mr. Larimer who has only 30,000 followers.

Today's Highlights

Trump's Tech Block

TRY Fly

.

BTC Spike

Please note: All data, figures & graphs are valid as of June 25th. All trading carries risk. Only risk capital you can afford to lose.

Traditional Markets

Trading last week was dominated by relations between the US and China and the so called trade war. This week probably won't be much different.

The latest escalation in the tit-for-tat saga is that President Trump is now considering a block on Chinese investment in American Technology.

This puts an entirely new spin on the broadening negotiations between the world's two largest economies.

Stock markets in Asia are taking a hit this morning as they process the news. Here we can see the China 50, Hong Kong 50, and even the Nikkei 225, declining this morning.

Turkey's Fate

There was no surprise in the elections this weekend. Erdogan the incumbent took a sweeping victory and won another five year term as President.

After winning the nation-wide referendum last year, term limits have now been abolished and Parliament's role has been drastically reduced. In other words, the President is now more powerful than ever. Many believe that his next move is to raise his level of influence with Turkey's central bank.

The bank is rather worried about the high levels of inflation, and rightly so. The President, on the other hand, prefers a strategy that values economic growth over the stability of the Lira.

The Lira did get a bit stronger on the election results, though it's not clear why. Some are calling it a relief rally as some of the uncertainty has been removed. Many traders, on the other hand, are using this as an opportunity to up their Lira shorts.

Here's a long-term chart of the USD/TRY. (Remember, the chart is inverted so a move up means a weaker Lira.) The last candle (circled in purple) is the reaction to the elections. Technical chartists will no doubt point out that the classic pattern formed here is known as a "bullish hammer," especially if it closes the day higher.

Bitcoin's Spike Down

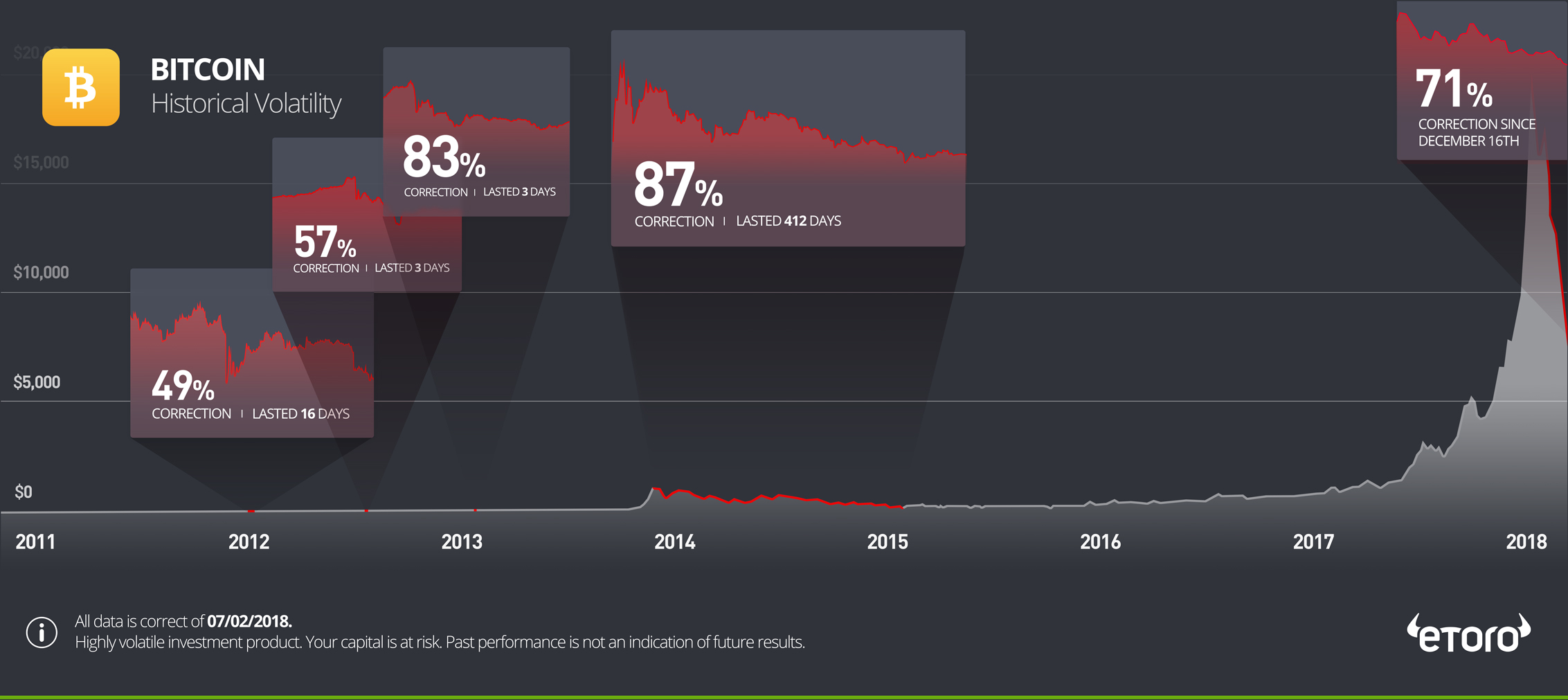

It's been a rough year so far for bitcoin hodlers. The retracement from the peak in December to the lows on February 6th, was the third largest retracement in bitcoin's history in percentage terms.

Here's a technical analysis graphic that we released at that time.

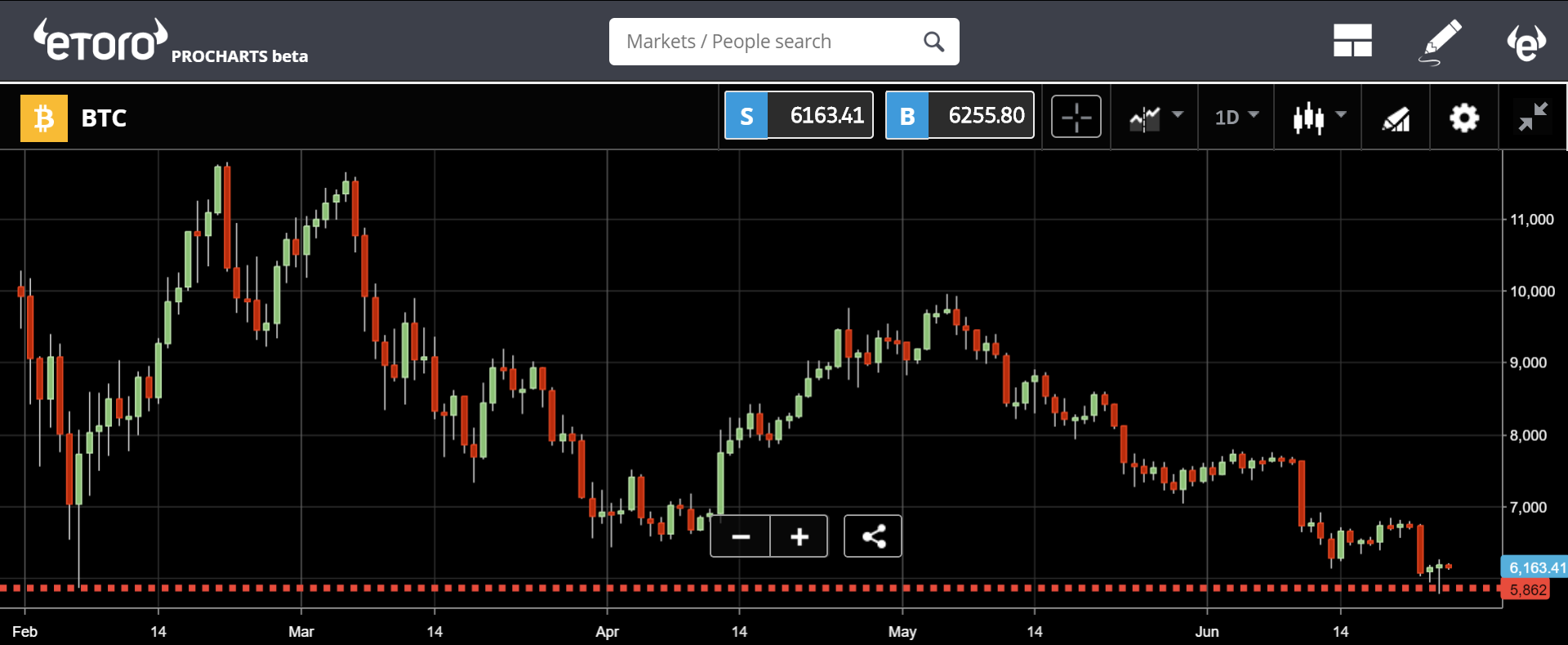

Since then, not much has changed until yesterday when the February 6th lows were taken out with a spike.

For now, the fact that the price bounced back and is now holding above $6,100 is a testament to bitcoin's resilience. Many times when a level of support is broken, the tendency of the market is to carry it lower. Though it is possible for the price to carry lower from here, the bounce back is a clear sign that there are buyers in the market.

Let's keep a watch on it for the next few days and see if it can sustain this level of support, and monitor the volumes which have been rather mellow over the last few weeks.

Wishing you a very mellow mood this week.

eToro, Senior Market Analyst

Disclosure: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital you're prepared to lose.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI