- WTI crude has fallen below $65, signaling further downside toward $50 and $43.

- This drop comes as OPEC+ and the US ramp up supply, tipping the balance.

- With demand still soft and inventories rising, the market leans toward lower prices ahead.

- Looking for more actionable trade ideas to navigate the current market volatility? Subscribe here to unlock access to ProPicks AI winners.

The ongoing tariff war is shaking the markets, and it has its impact on oil prices, too. The value of crude oil is falling quickly, pushing the price of WTI oil below $60 per barrel. Adding to the pressure, OPEC+ has decided to raise oil production by over 411,000 barrels per day as worries grow about supply levels. If nothing changes and the tariffs stay in place, oil prices could keep dropping, possibly reaching as low as $40 per barrel in the long run.

Is the Slide in Oil Prices Just Beginning?

Oil prices are falling as a result of recent actions by the US government under President Donald Trump. The market is reacting to signs of a global economic slowdown. But this drop in oil prices actually works in Trump’s favor.

Republicans have often said they support lower oil prices since it helps American consumers by keeping prices from rising too fast. It also helps lower inflation, which gives the Federal Reserve more reason to cut interest rates—something Trump has been pushing for.

Politically, cheaper oil also puts pressure on Russia, which has shown little interest in ending the current conflict and continues to play for time through diplomatic tactics.

As expected, OPEC+ is also contributing to the downward pressure on oil prices—even though the group usually prefers to keep prices high. Since early in the second quarter, OPEC+ has signaled that it will start easing production cuts and raise output by 411,000 barrels per day beginning in May.

On top of that, the White House has announced plans to increase US crude supply—possibly tripling it starting next month. Together, these moves suggest that supply may soon outweigh demand in the oil market.

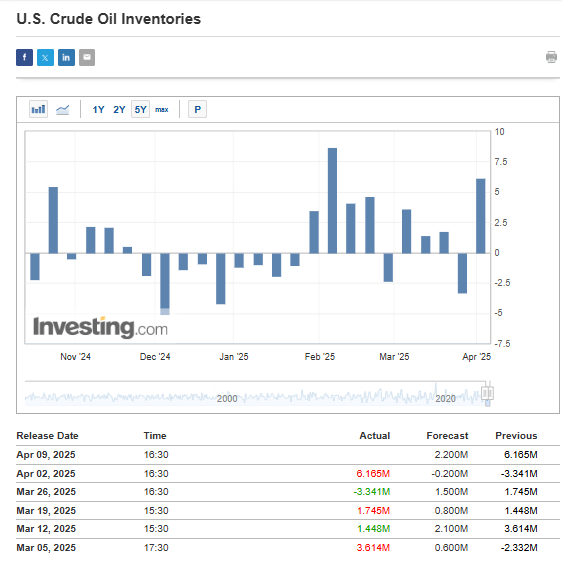

In this situation, it is important to keep an eye on US oil inventory data. The latest report showed a sharp increase in stockpiles compared to previous weeks.

China also remains a key factor. Although demand there had dropped noticeably, recent data shows a slight rebound. Investors are likely to watch this closely in the coming weeks and months.

WTI Crude Breaks Below Key Support Level

Since 2022, WTI crude oil has mostly stayed between $65 and $95 per barrel. But recently, prices have dropped below the lower end of that range. This breakout could be a sign that the downward trend will continue.

From a technical view, the next key support level is near $43 per barrel, with $50 as a natural short-term target. If prices reverse and move back into the previous $65–$95 range, it would signal that the downward trend may be losing strength.

***

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now and instantly unlock access to several market-beating features, including:

- ProPicks AI: AI-selected stock winners with proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.